-

9th November 2021LFEX, the Global Electronic Seafood Market, and DataSalmon, the leading provider of data services from the Chilean salmon global market,...

9th November 2021LFEX, the Global Electronic Seafood Market, and DataSalmon, the leading provider of data services from the Chilean salmon global market,... -

5th November 2021LFEX, the Global Electronic Seafood Market, and DataSalmon, the leading provider of data services from the Chilean salmon global market,...

5th November 2021LFEX, the Global Electronic Seafood Market, and DataSalmon, the leading provider of data services from the Chilean salmon global market,... -

23rd April 2021The founders of the London Fish Exchange want to digitise the physical trade of salmon. “We went live last year, in...

23rd April 2021The founders of the London Fish Exchange want to digitise the physical trade of salmon. “We went live last year, in... -

22nd April 2021Electronic trading platform The London Fish Exchange (LFEX) and Chilean fish farm information supplier DataSalmon today launched a joint venture...

22nd April 2021Electronic trading platform The London Fish Exchange (LFEX) and Chilean fish farm information supplier DataSalmon today launched a joint venture... -

22nd April 2021LFEX and Salmon Derivatives, (DataSalmon) are delighted to announce their commercial joint venture for the launch and rollout of trading...

22nd April 2021LFEX and Salmon Derivatives, (DataSalmon) are delighted to announce their commercial joint venture for the launch and rollout of trading... -

12th April 2021Tad Lundborg has joined LFEX the global electronic seafood trading platform in the US and will spearhead activities for the...

12th April 2021Tad Lundborg has joined LFEX the global electronic seafood trading platform in the US and will spearhead activities for the... -

21st February 2021Based on active user feed back, LFEX is pleased to announce the release of Version 4.1 ‘Contracts’ of the company’s...

21st February 2021Based on active user feed back, LFEX is pleased to announce the release of Version 4.1 ‘Contracts’ of the company’s... -

23rd November 2020LFEX is pleased to announce that Dawnfresh Seafoods Ltd., Scotland’s largest Trout farming company, can now be accessed via the...

23rd November 2020LFEX is pleased to announce that Dawnfresh Seafoods Ltd., Scotland’s largest Trout farming company, can now be accessed via the... -

16th November 2020In November 2020 Scottish Trout was launched on the platform with Dawnfresh, the largest producer of Trout in Scotland. Production levels...

16th November 2020In November 2020 Scottish Trout was launched on the platform with Dawnfresh, the largest producer of Trout in Scotland. Production levels... -

6th November 2020LFEX is pleased to announce the release of Version 4.0 of the company’s market leading technology platform over the weekend...

6th November 2020LFEX is pleased to announce the release of Version 4.0 of the company’s market leading technology platform over the weekend... -

14th September 2020Secure electronic platform for pricing and trading of European salmon boasts exclusive distribution rights – Article published on 14th September,...

14th September 2020Secure electronic platform for pricing and trading of European salmon boasts exclusive distribution rights – Article published on 14th September,... -

9th August 2020It is interesting to see the development of land-based salmon farming projects, and we are sure people track progress of...

9th August 2020It is interesting to see the development of land-based salmon farming projects, and we are sure people track progress of... -

4th July 2020LFEX is delighted to announce the release of access to LFEX services on Apple iPad devises. The iPad service has...

4th July 2020LFEX is delighted to announce the release of access to LFEX services on Apple iPad devises. The iPad service has... -

4th July 2020Further to the successful release of the LFEX MobileTrader on Android services LFEX is delighted to announce the release of...

4th July 2020Further to the successful release of the LFEX MobileTrader on Android services LFEX is delighted to announce the release of... -

30th June 2020Every year Mowi provides a wonderfully comprehensive Industry Handbook. The 2020 version is available for downloading at MOWI’s website. At 118...

30th June 2020Every year Mowi provides a wonderfully comprehensive Industry Handbook. The 2020 version is available for downloading at MOWI’s website. At 118... -

24th June 2020LFEX is delighted to announce the release of LFEX MobileTrader for Android. The solution has been designed and built by...

24th June 2020LFEX is delighted to announce the release of LFEX MobileTrader for Android. The solution has been designed and built by... -

14th June 2020NASDAQ Salmon Index pricing has been added to LFEX charting services. The NASDAQ Salmon Index (NQSALMON) is the weighted average of...

14th June 2020NASDAQ Salmon Index pricing has been added to LFEX charting services. The NASDAQ Salmon Index (NQSALMON) is the weighted average of... -

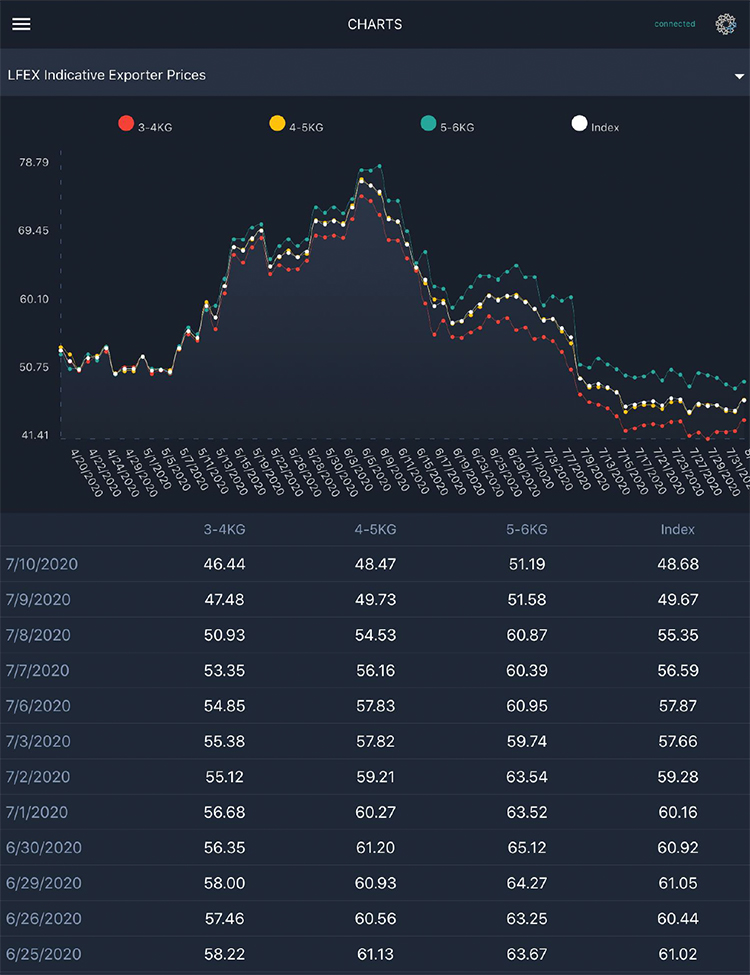

14th June 2020In addition to tradable and indicative prices on the platform sent between sellers and buyers, LFEX now provides composite indicative...

14th June 2020In addition to tradable and indicative prices on the platform sent between sellers and buyers, LFEX now provides composite indicative... -

7th June 2020LFEX today announced that in line with the companies stated policy of continued development of the system based on customer...

7th June 2020LFEX today announced that in line with the companies stated policy of continued development of the system based on customer... -

5th April 2020LFEX today announced that in line with the companies stated policy of continued development of the system based on customer...

5th April 2020LFEX today announced that in line with the companies stated policy of continued development of the system based on customer... -

2nd February 2020LFEX today announced that subsequent to the successful market launch and trading of Norwegian Salmon, the company is pleased to...

2nd February 2020LFEX today announced that subsequent to the successful market launch and trading of Norwegian Salmon, the company is pleased to... -

27th January 2020LFEX today announced that the market launch has been successfully completed with trading of Norwegian Salmon between selected counterparties on...

27th January 2020LFEX today announced that the market launch has been successfully completed with trading of Norwegian Salmon between selected counterparties on... -

3rd September 2019Other species could soon follow salmon onto the London Fish Exchange (LFEX), a buyer-meets-supplier platform (www.lfexchange.com) founded by two business...

3rd September 2019Other species could soon follow salmon onto the London Fish Exchange (LFEX), a buyer-meets-supplier platform (www.lfexchange.com) founded by two business...

The London Fish Exchange

Data / Market Insight / News

A vision for pricing. Farmed Salmon – Where do we want to get to?

|

|

Published: 20th September 2020 This Article was Written by: John Ersser |

Many commodities industries struggle to establish a mechanism to reliably ascertain the true or current price of the physical goods. Without a central market or community, it is near impossible to accurately access the current price of a global commodity at any given time.

In lieu of access to such pricing, post trade reporting can potentially provide an accurate historical picture, albeit of little use in the heat of actual trading, simply confirming at a later date that the product was under or over-priced relative to that market over the period (a week in the case of Salmon) at the time of the transaction. While this may provide some average benchmark it cannot accurately reflect the performance intraday and intraweek for the participants, especially when price volatility is high (15% +/- a week), and nor will it assist in the daily / intraday management of the sales/purchases of these products.

Sellers and buyers need to be able to access accurate current pricing to form an opinion on the trades they want to undertake. The data should be both long term historical to identify longer-term market trends (24+ months), with shorter term histories to establish recent trading patterns and recent price development and of course the current market price. The data must be as accurate and reliable as possible and the source independent and trusted, to give confidence to the market participants.

Our Vision

What if the market had access to both current indicative prices, and also last traded prices? The guess work of the current market price would all but disappear. Access to the latest traded prices in the last few minutes would allow the market to track prices and market direction in real-time. The benefits of this are phenomenal for everyone; imagine that instead of making tens or hundreds of phone calls a day, all day, every day to access and evaluate a ‘price’ that may or may not be accurate, participants can simply view the last traded prices, and look at a chart to see the direction of the market, and know where the market price is.

More London Fish Exchange Articles...

Imagine the huge amount of time saved in the price discovery process each week, confidence in price levels when making prices (no under selling and leaving profit on the table, and no over pricing and missing the market, and also being aware of short term pricing trends – volatility – that has such a dramatic impact on participants profit and loss).

Armed with the knowledge of accurate current pricing, farmers and exporting organisations can focus on what is important to them; their brand, their product, quality, certification, provenance, supply factors etc This ensures that farmers and exporters can continue to focus on their differentiating factors, as well as relationship building, greater distribution, growth and margin management. Importantly it provides buyers confidence when purchasing, and provides a better, more transparent and more granular price to work with.

How did we get to this?

The historical look back might tell a story of a perfect sales week for the seller securing premium over the average pricing during the week, or the reverse, but it can’t tell you what really happened, where the opportunities were won or lost, or how to manage daily volatility.

Markets evolve this way simply because there has been no other alternative available to them. With little infrastructure or service that can support the needs of the market, people have to find a way, however time consuming and inconsistent, and this becomes custom and common practise.

We can observe that both buy and sell side struggle to establish pricing, and this is made harder with the volatility around pricing today. Both sales and purchaser institutions spend vast amounts of time during the week, every week without fail, speaking to their counterparts seeking to get a ‘feel’ for where the market is, getting market feedback and gossip, picking up rumours, and discounting less reliable sources or those with an agenda to mark prices higher or lower.

Evolutionary

Our approach is not revolutionary but tried and tested in varying forms for different types of markets. In 1987 the London Stock Exchange went through the ‘Big Bang’, the move from manual trading of shares on the floor of the exchange to using technology to deliver market prices to sellers and buyers, and the advent of electronic trading for the UK, as an example.

Much has happened in the intervening period and the acceptance of the internet and newer technology has helped improve and transform many industries. Using our experiences, expertise and technology we can establish better functioning and more efficient price discovery mechanisms and trading solutions for participants in the aquaculture industry.

We know that in the future there will be a greater demand for healthier foods, and specifically this includes fish and aquaculture. We also know that in future the potential supply of these resources will also increase as production technology and methods evolve and mature, with some estimates for potential global supply increases of over 1m tons for farmed salmon over the next 4-5 years. We also know that growth will be geographically diverse from both a supply and demand perspective and this will make it even more important to have efficient and effective technology in place for communication, pricing, distribution and trading.

How Can We Help?

Within LFEX we have significant experience and expertise in markets and data, we also have a phenomenal technology platform that will allow us to capture trades and prices and develop these into professional pricing services, offering a transparent, unbiased and independent reference source for intraday price discovery, as well as short term trends and long term historical analysis.

We already produce a daily indicative price for Norwegian salmon to registered users accessed via our LFEX Webtrader or LFEX Mobiletrader, and continue to build out services and technology to make the business of wholesale (or institutional level) buying and selling fish more efficient, accessible, transparent and effective.

Working with Technology

Working with good technology makes our lives easier. Once implemented and running it does the heavy lifting, manages the complex tasks, the boring tasks and the time critical tasks making us more efficient in our daily processes. The data it delivers allows us to manage our businesses better, to identify and optimise opportunity, revenue and margins, to service our customers better, and give us more choices. It provides scalability in institutions, allows companies to evolve, increase product lines, customers, volumes and grow whilst efficiently managing resources.

This is our vision for the future too. To increase internal efficiencies, to improve access to counterparties, to increase efficiency of distribution, and to capture and manage customer flows from a growing and diverse customer base. We want to reflect the changes in the industry, recognise the importance of aquaculture, support fisheries, the diversification of products, farming methods and consumers globally, and ensure we are positioned to successfully support a global community with our platform and services.