Our TOP FAQ’s (Frequently Asked Questions) are listed below.

If you have any particular questions you would like to ask, please contact us at support@lfexchange.com.

What is the purpose of the platform?

Using world-leading technology, we deliver the tools to help increase efficiency in the daily operations of the aquaculture industry. Bringing together communities on a single platform we create immediate connectivity, opportunity, price discovery and secure trading, as well as electronic order capture, documentation and data in a secure, modern and transparent environment, 24 x 7 globally.

How does it help with pricing for buyers?

Using technology as a tool helps stream-line the process to get to the optimal price for buyers. By combining the ability to get immediate pricing from sellers, the ability to compare these prices and ultimately against a market price, buyers will be in a good position to make purchasing decisions knowing that they are trading at the right price – which is good news for everyone in the industry.

I am a global buyer and would like to trade Chilean Salmon on the platform. Is this possible?

In partnership with DataSalmon in Chile and feedback from market participants in Chile, LFEX has implemented the required parameters for trading Chilean sourced products, these include Salmon, Coho and Trout which are now all supported. Our ambition is to provide a global platform for all sources of salmon and trout giving sellers distribution and buyers choice and connectivity globally.

How do I know I’m getting the right price?

At the moment it is hard to judge whether sellers and buyers are getting the right price. The only way a market can truly find the right price is when a sufficient volume of buyers and sellers business collides together and the result of this will deliver the right price. The price will also more accurately reflect the different needs and requirements of the participants that make up the market.

I would like to add some bespoke features for my business needs, can you help?

The LFEX technology platform is the result of a multi-million $ investment and supports a comprehensive range of features and functionality. The system continues to be developed in-line with over-all market requirements. In addition, we can also offer specific and bespoke development for companies and can work with you to deliver the technology and services you need.

I trade whole fish and VAP (value added products) can you help with this?

We have worked hard with both buyers and sellers to ensure that we are in a position to help you sell / buy the products you wish to distribute / purchase in the way you normally do. We also know that different markets have different requirements, and we therefore support whole fish in a large range of presentations, weight classes, certifications etc, as well as multi parameter VAP to ensure you can trade the products you want, in the way you want.

I am concerned about FX – can I track it on your system?

We are conscious that FX can have a significant effect on the sales/purchase prices. We therefore provide real time FX rates on the system for users to look and compare rates and provide visibility of these movements. We also have calculator for you to calculate prices using the real time FX rates, ensuring that you won’t miss currency movements and what it means to your business.

As a seller, can my competitors see my price?

The simple answer is no. Sellers are in complete control of to whom and where they send their prices. Unless requested, the system will not be configured to have other sellers as trading counterparties and therefore they do not connect to competitors. Each price between a seller and buyer is secure and private, and no one else has access to this.

I want to know who I am trading with how does it work?

The good news is that we understand buyers and sellers want to know who they are trading with. Therefore, all prices and offers / request are from disclosed counterparties on the platform. You always know who you are dealing with on the system, which also helps with provenance and credit relationships. However, all your dealings / communications are private and secure. What is published between you and your counterparty remains private between you and your counterparty, and not viewable by other users.

I am new to technology and a bit nervous how can you help?

Firstly, good technology is there to help and assist you in your business. In any piece of technology we use there is an initial investment in time to learn how the new system works, and good technology will be intuitive but also support complexity when needed. A step by step approach to using the system and gaining confidence helps. As we do more trades and get into the more comprehensive features of the system, confidence builds until we become comfortable, and our working practises are now in harmony with the technology…and then the nerves will have been long forgotten.

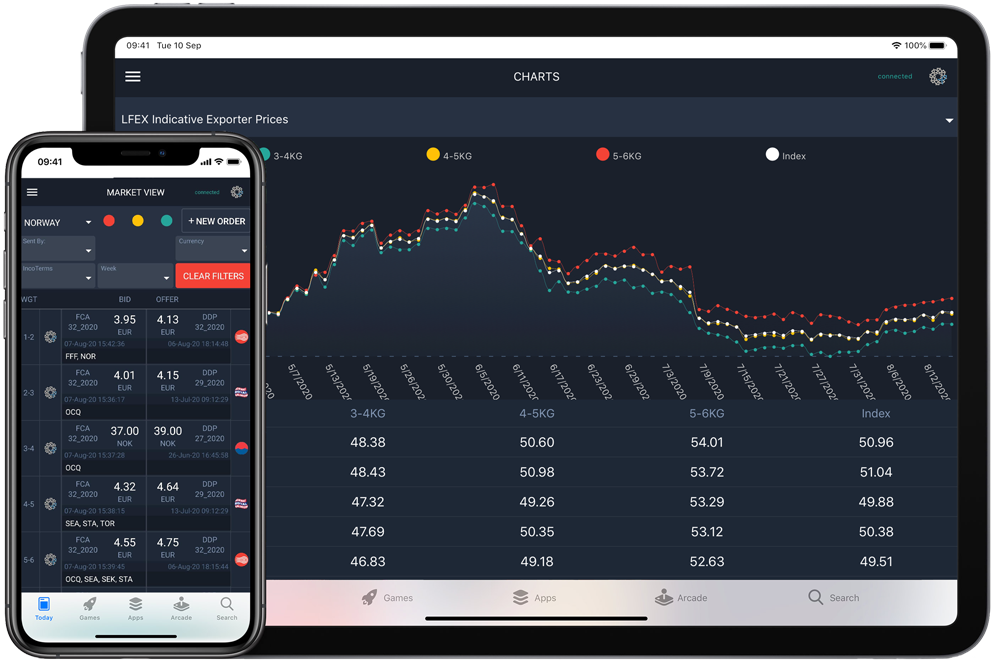

Can I see the overall market price?

LFEX has develop a world leading technology for the aquaculture market, partly based on our groups’ collective experiences in different financial and commodity markets and trading technology. We support you with both a choice of real-time prices from sellers as well as LFEX provided, independent pricing, to benchmark your markets. This is helpful for both buyers and sellers when gauging the current market price.

I trade a range of specifications – how can you support this?

LFEX spent over a year working very closely with both buyers and sellers in the salmon and trout market to develop the platform to capture the different activities of all the participants in the market. As a consequence of this we are able to offer an unlimited range of possibilities and specifications for both sellers and buyers. We have completed transactions with a wide range of parameters and complexity – easily, quickly and simply – one of the great benefits of our technology.

I spend a lot of time on different communications technology and it can get confusing, can you help?

This was an excellent question and really drives home one of the key purposes of using the LFEX platform – connectivity. We know that companies have to use multiple solutions to communicate with each other, sometimes 6 or 7 including text, WhatsApp, Skype, email, WeChat, Telegram etc. LFEX Chat allows users to replicate this communication but in one centralised, secure location. However, the platform also offers the benefits of sending, receiving and managing prices, orders and trades in the same place as well, but much more efficiently.

How can I find an average market price on LFEX?

LFEX publishes it’s Norwegian Exporters indicative prices on a daily basis. This is an independent index and pricing created by LFEX to provide an indication of pricing and also volatility, and is the world’s first daily index for the industry. It is helpful to track the market movement and sentiment intraweek. Looking back traded prices would tend to go through at slightly lower level than the exporters index as you would expect.

There is a particular buyer / seller I want to connect with – how do I do this?

LFEX configures trading counterparties according to the users market, product and preferences. We are continually adding new counterparties to the platform. If you have a specific request for a particular user and you can’t see them on the platform please drop an email to suport@lfexchange.com and we will look to arrange connectivity for you. There will be the usual take-on requirements between counterparties when connecting.

Does is cost to register and use the platform?

There is no cost to register and try out the platform. Buyers and Sellers can register for free. Once registered users receive their secure logins and can access and start using the platform. We encourage users to access the platform and look at the data and offers that are available and use the services on the system. We only make a small charge if you successfully complete a trade.

For some customers English is not the preferred language, can you help?

By using the templates on the system, it is very easy for buyers or sellers to send offers or orders to counterparties anywhere. The chat service supports multilanguage / characters meaning as long as users have the necessary input keyboard they can communicate in any language they chose – even emojis.

How can LFEX help me in volatile markets?

In weeks like we have just experienced it can be hard for buyers to manage. We know from experience that one of the best ways to handle upward price volatility is to get connected to as many sellers as possible, as quickly as possible, and give yourself the optimal chance to secure a price and inventory. If you have to trade, it will get you the best price at the time you can secure.

Why does your Index price differ from NASDAQ?

Our index as described above seeks to capture the daily price movements and give participants an accurate read of the actual market prices for the most actively traded weight classes. The NASDAQ Index accounts for all weight classes and is based on traded prices from the previous week and is a weighted averaged. Therefore, as happened in Week 49, the average traded prices were around 65 because a lot of the volume was traded early in week when prices were lower and is entirely correct.

Can I as a buyer enter a price that I am prepared to trade on?

100% yes. Buyers can not only make specific requests based on their own requirements, they can also add a price to the request that they are prepared to buy at. Sellers can accept this price and trade with you, or counter with their own price(s). Buyers can amend their prices, or withdraw them at any time, and are in complete control of the prices they want to show and to whom they want to show them.

This is a great way of building an understanding of a market where there are both sellers prices and buyers prices are visible.

Can I trade different markets from the one system?

The answer 100% yes. We want to bring as many sellers and buyers from as many different markets as possible onto the platform. Many buyers focus on a single market for geographic reasons, while others have choices of Norwegian, Icelandic, Chilean, Scottish, Canadian etc. Prices vary by market according to raw material and logistics costs, fresh / frozen and more choice gives users more opportunity.

How can I benefit from technical analysis?

If it were possible to track salmon prices – the more frequent the better – then an independent professional Technical Analyst could provide an insight (based on historical data) into future price trends for the salmon market. This could potentially be a very useful tool for both sellers and buyers to help identify trading patterns over the short or medium term and improve trading performance. For more information on this please contact support@lfexchange.com.

As a buyer how can I benefit from putting up prices onto the platform?

There are many benefits for buyers to put up prices on the platform. We think this is a key component of price discovery as well as opportunity creation for buyers. Instead of being a price taker buyers can show the price they are prepared to trade at (and this can be amended during the life of the order). If the price is for example 3% below the market you might not get filled, but you might, or you might get a better counter-offer as a consequence. The best thing is, it doesn’t hurt you or cost you to have a go, it only creates an opportunity for you. The worst that can happen is you don’t get any takers, in which case you can react accordingly.

How flexible is the system if my needs / products aren’t represented?

This is a great question, and the answer is infinitely flexible. Every week we get feedback from users and every week we add new features or parameters to the system to ensure that users demands are met. The system also offers multiple ways of communicating in addition to the core order/trading functions, including order commentary and chat to ensure that you can communicate effectively with each other.

I need to buy urgently in the market, what can I do?

This week was pretty tough with the volume squeeze making it difficult for buyers to secure fish as the prices moved up. There are two main elements to this; the first is being prepared for this type of eventuality in the first place, by having as many counterparties set up as possible to source potential inventory quickly along with a good working practice on the system, the second is to proactively put requests with prices (bids) into the market and to work these. Waiting to be offered prices when someone finally picks up a phone isn’t the answer, if you are there and engaged people have an opportunity to react to you and help to get you filled.

I need to benchmark Chilean salmon for a contract can you help?

The LFEX DataSalmon Indices are the best sources of pricing for Chilean salmon products. The DS Miami D Trim and FoB PMC whole fish index for Brazil are two of the most popular. DS uses the underlying trading data from up to 80% of the market in any given week to produce independent, comprehensive and auditable index benchmark pricing for the industry. This can be used to compare trading performance or physical contract settlement for parties who want a floating market-based settlement rate.

I am concerned about beginning the transition from manual to electronic transacting. Is it acceptable to do both?

The short answer is of course yes. In fact we recommend that this is how people start. By dipping your toes you learn about the system, what you see and what to expect. You can then build confidence and proactively use the system to get the maximum benefit from it. You can download the orders from the system if you need to into a CSV file, or input data into your existing system in the same way you do a manual trade.

Can I trade with multiple counterparties on one order?

This is happily supported in the system and means that a buyer can make a request to several counterparties and trade part of the order with one company (who may have the best price but not the total volume required) and the balance with a second or third seller. Sellers on the other hand can put up an offer with an inventory level in any amount and work this with multiple customers. The system will allow the seller to see and manage each separate negotiation with the buyers, and most importantly the system won’t let sellers over-trade – i.e. sell inventory they don’t have.

I have specific provenance and quality levels – can you help?

The platform creates a 1 to 1 transactional relationship, and you therefore know exactly who you are trading with. Buyers can define a huge range of specifications on the system from quality levels e.g. premium / grade 1 / Industrials, and certifications where the system supports any number of definitions including ASC, MSC, G-GAP, Kosher, BAP, BRC etc to ensure that you can clearly define your own very specific purchasing needs, and the evidential documentation to support this.