About David Nye

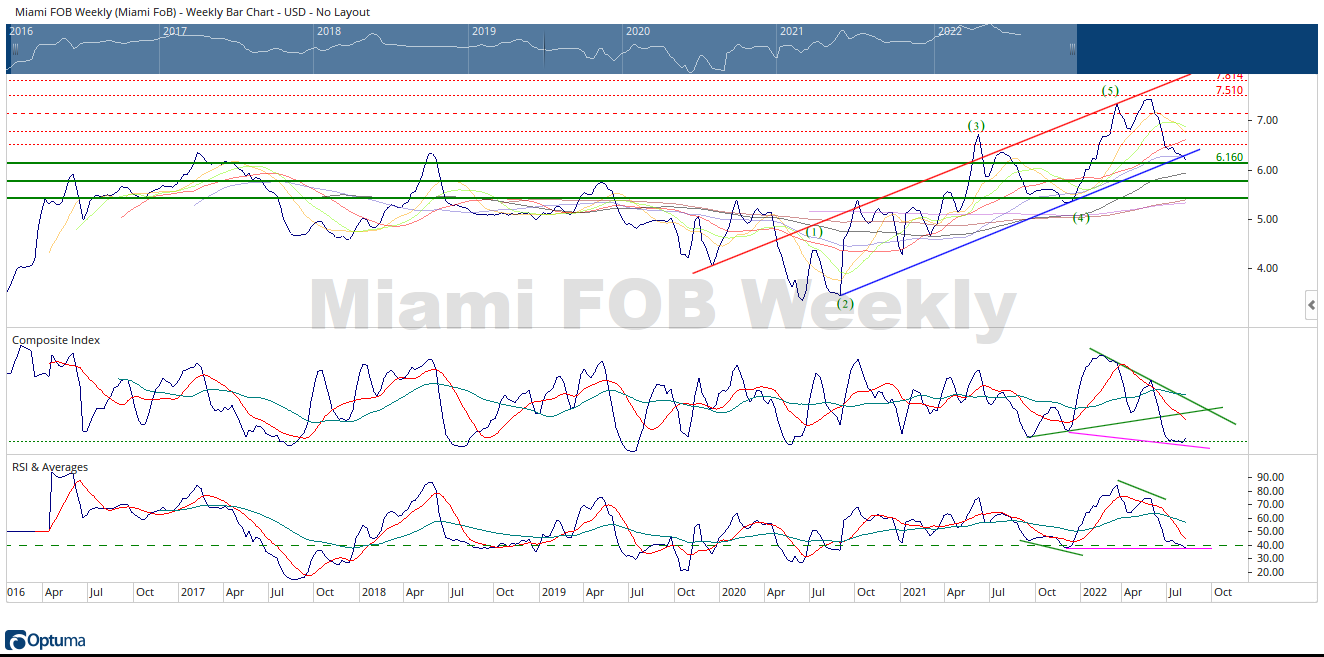

David is a Senior Vice President in investment advisory with over 30 years of experience.Based in Minnesota, USA he has a long history in technical analysis across a range of markets. David brings his experience to provide an independent insight into potential salmon pricing based on LFEX and DataSalmon data.

What is Technical Analysis?

Technical Analysis is used to try and identify price trends in the future. Analysts believe that by using factual past information (trading activity and price changes) it is possible to identify future price movement trends and is quite prevalent in commodity and forex markets but can be applied to any product.

Technical Analysis has been developing for over a century, and there are now hundreds of patterns and signals that have been created. They are often used in conjunction with other forms of research and analysis to help formulate, or support pricing trend opinions.

Purpose of the Analysis?

To provide an independent data-driven view of market pricing trends in the short and medium-term. As a potential tool, for users to access future pricing trends based on LFEX/DataSalmon derived market data.

How Does it Work?

On a regular basis (weekly), David will provide his independent analysis of LFEX and DataSalmon pricing data. The output will be to provide pricing trends based on the most up to date pricing received.

The analysis will show the expected trends and potential (price) levels, as well as other markers – for example, higher or lower price triggers that would affect the analysis of the trend – and what this might mean. It is data-driven, and will not, and does not, account for any other fundamental analysis, or weather or biological events for example. This is the same for any commodity product technical analysis.