The London Fish Exchange

Data / Market Insight / News

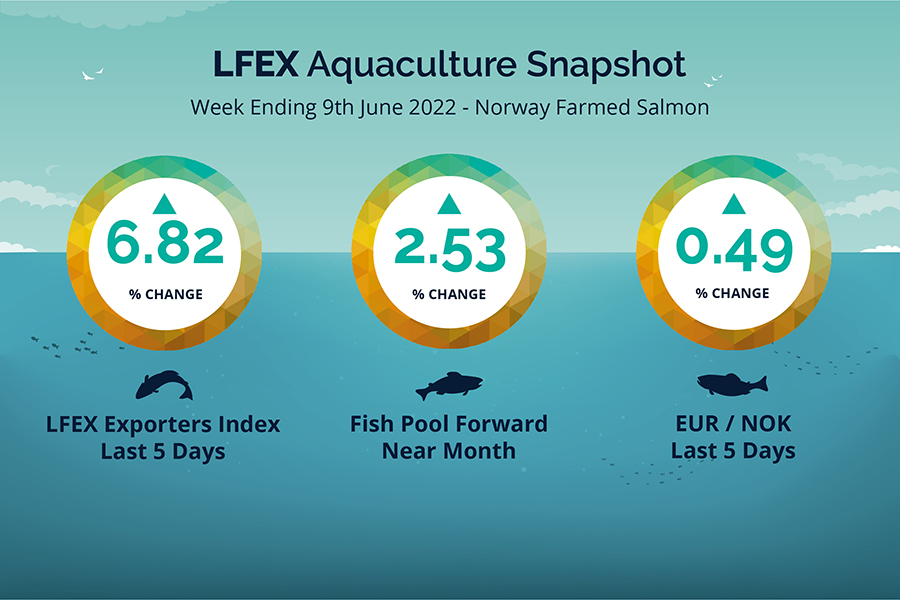

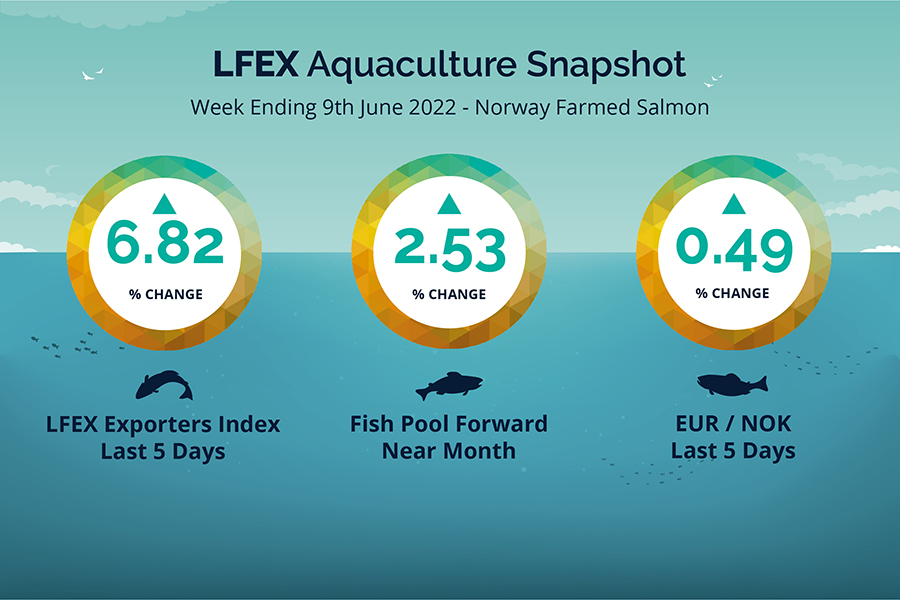

LFEX European Aquaculture Snapshot to 9th June, 2022

|

|

Published: 10th June 2022 This Article was Written by: John Ersser |

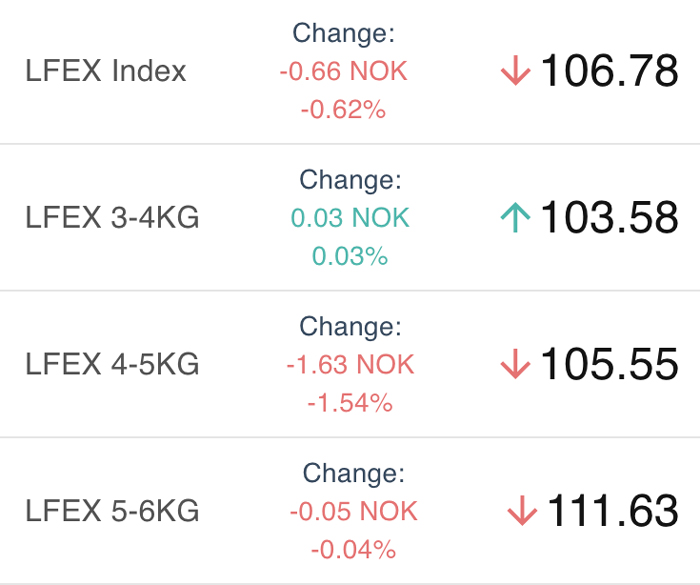

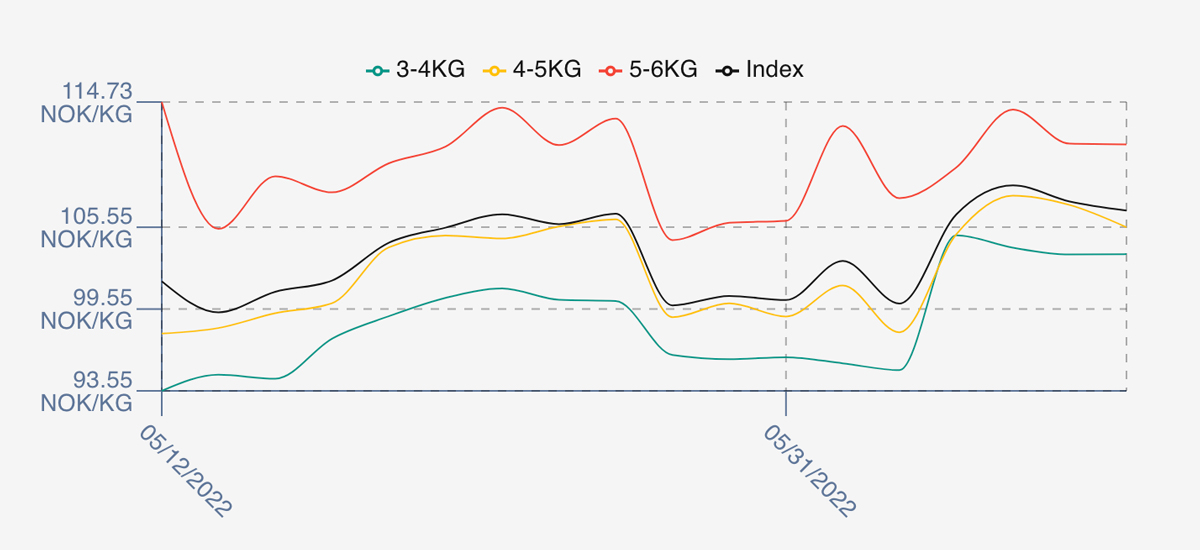

A partial trading week this week. The LFEX Norwegian Exporters index was up +6.8%, +6.82 NOK to stand at 106.78 NOK FCA Oslo Week ending Thursday vs previous Thursday.

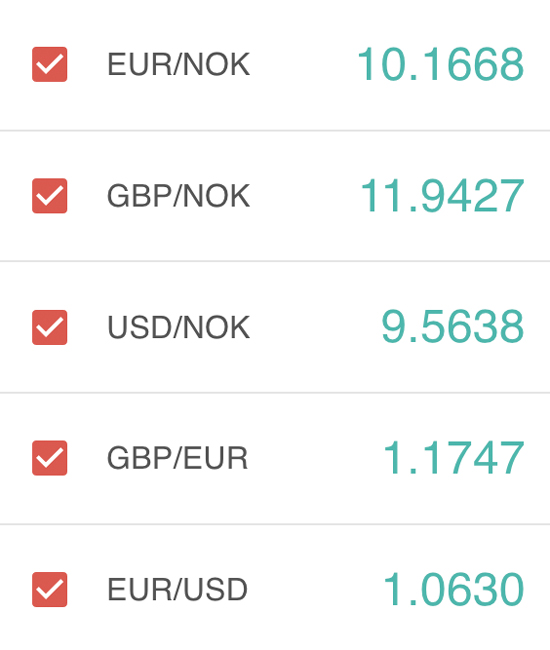

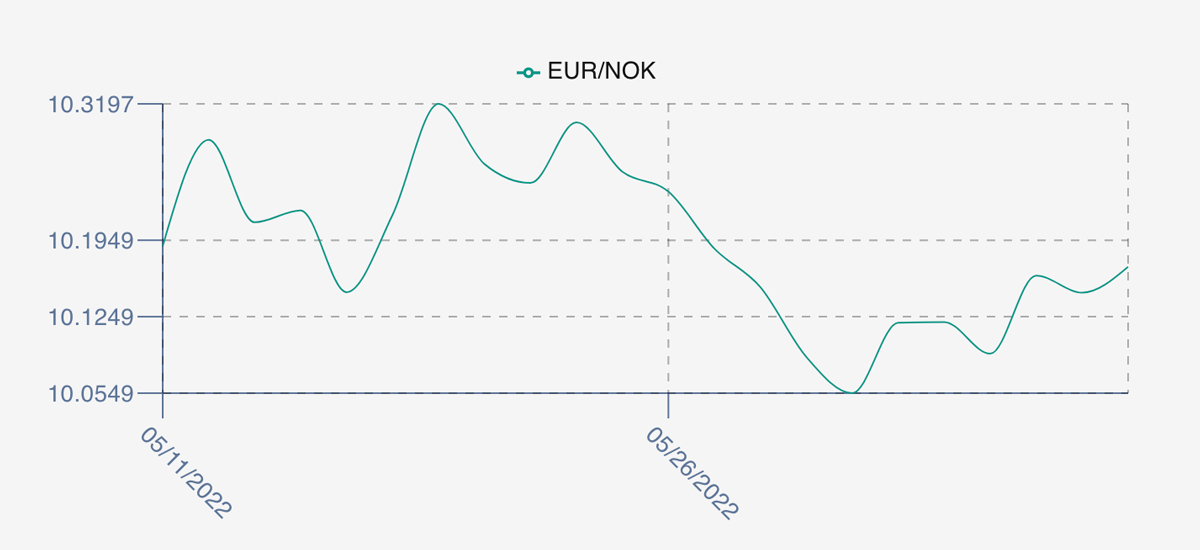

The NOK was slightly weaker at 10.17 to the Euro over the period Thursday to Thursday +0.05 or 0.49%. The Fish Pool future June made +2.50 NOK to 101.5, +2.53% over the same period.

Not a full trading week with Monday off. Friday pricing saw a (slightly unexpected?) leap up from 99.96 NOK to 106.48 NOK or over 6%. Trading resumed on Tuesday pushing to the week high at 108.62, before settling back 107.44 Wednesday and 106.78 on Thursday. Harvest levels remained low this week keeping prices up. Kontali indicated in their view that actual available spot volumes in Q1 were actually down 18% and nearer 20% down in Q2 all factors considered, which would give some explanation to recent prices. This leads us to next week (week 24) which will be about harvesting levels. There is an expectation of some more fish availability which might naturally put some pressure on pricing… but we’ll see.

David Nye’s analysis for a Technical viewpoint will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 9th June, 2022 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

In 1999 Barrons publishes an article predicting Amazon would go bankrupt – they called Amazon “just another middleman…”.

The collision of buyers and sellers on one quality platform created transparency, volume, liquidity, market information, feedback and efficient price discovery. The rest is history.

FAQ’s

Q. I want to use the platform more, how can I get my counterparties more involved?

A. As with most change, some need a gentle nudge. Make sure your buyers/sellers know you are using the platform and that you are set-up with them as valid trading partners to see your bids/offers/RFQ’s/chat. Get your orders on the platform early and respond to inquiries in a timely manner. Let them know you intend to manage your orders more through the platform and it will give them a competitive advantage with you and your firm to do the same. In the beginning work to get transactions done.