The London Fish Exchange

Data / Market Insight / News

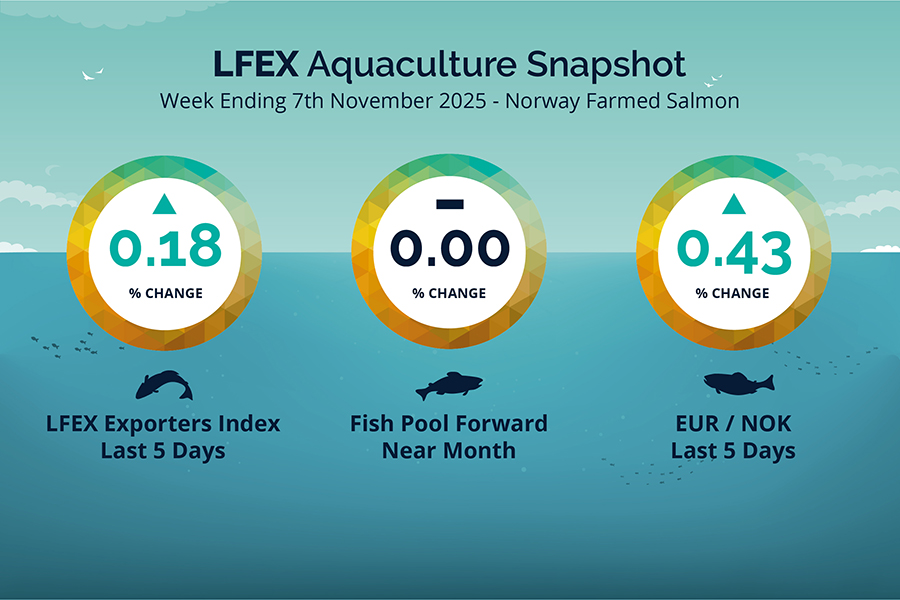

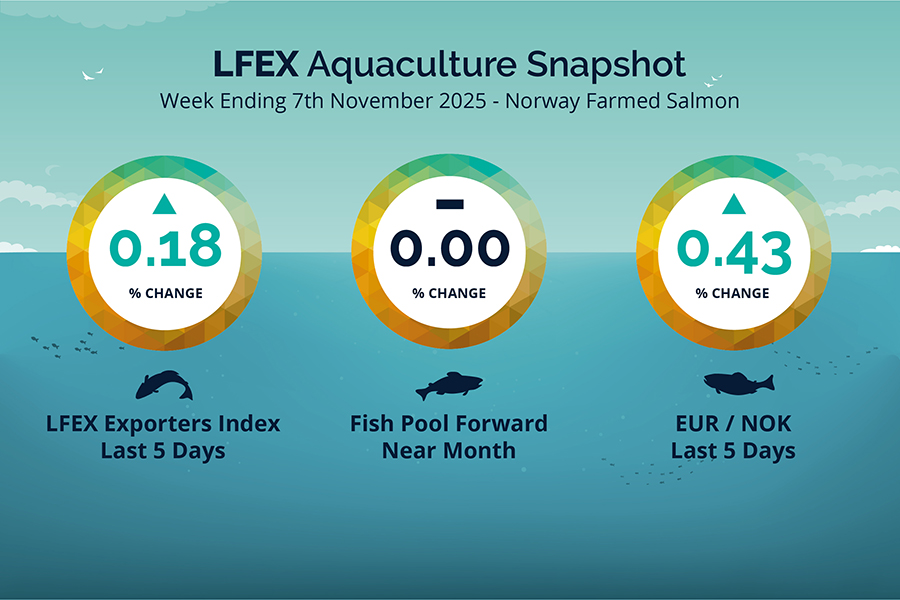

LFEX European Aquaculture Snapshot to 7th November, 2025

|

|

Published: 7th November 2025 This Article was Written by: John Ersser |

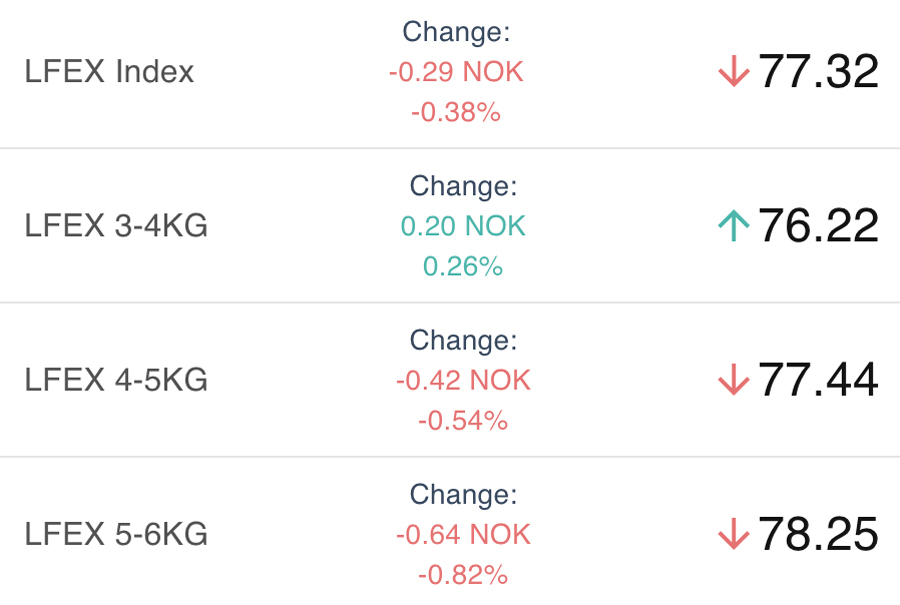

The LFEX Norwegian Exporters Index for Week 45 2025 ended the week UP +0.14 NOK / +0.18% to stand at 77.32 NOK (DOWN in EUR terms 6.60 / -0.02 / -0.25%) FCA Oslo Week ending Thursday vs previous Thursday.

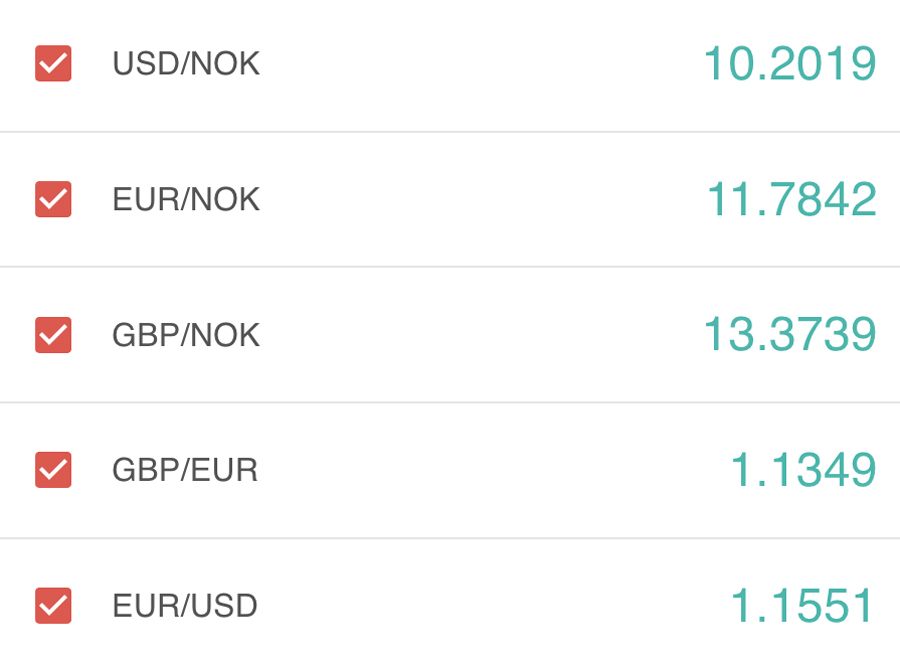

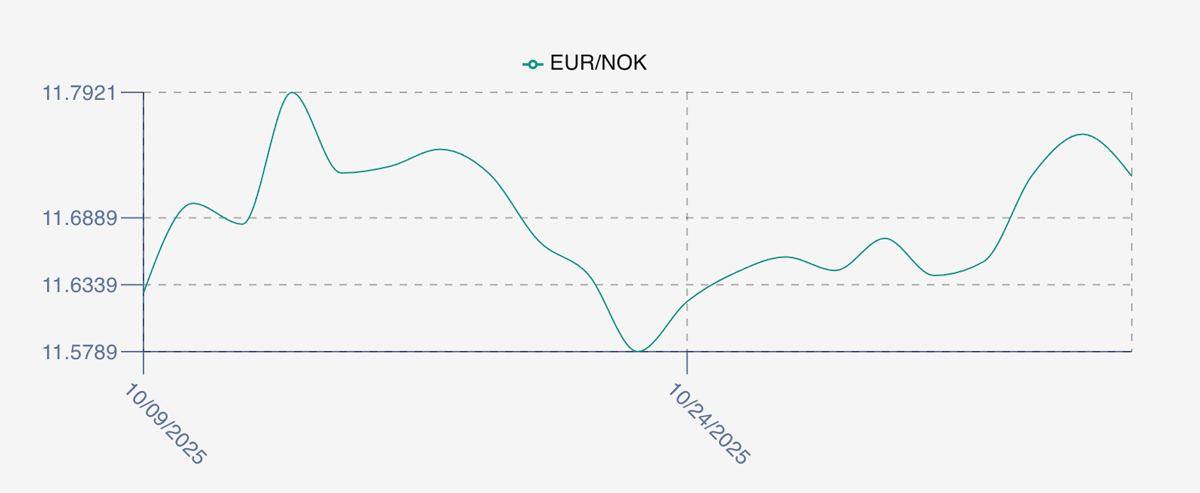

The NOK rate ended UP at 11.72 (+0.05 / +0.43%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future December was reported FLAT again Thursday to Thursday at 6.87 EUR, (0.00 / +0.00%) approximately 80.51 NOK.

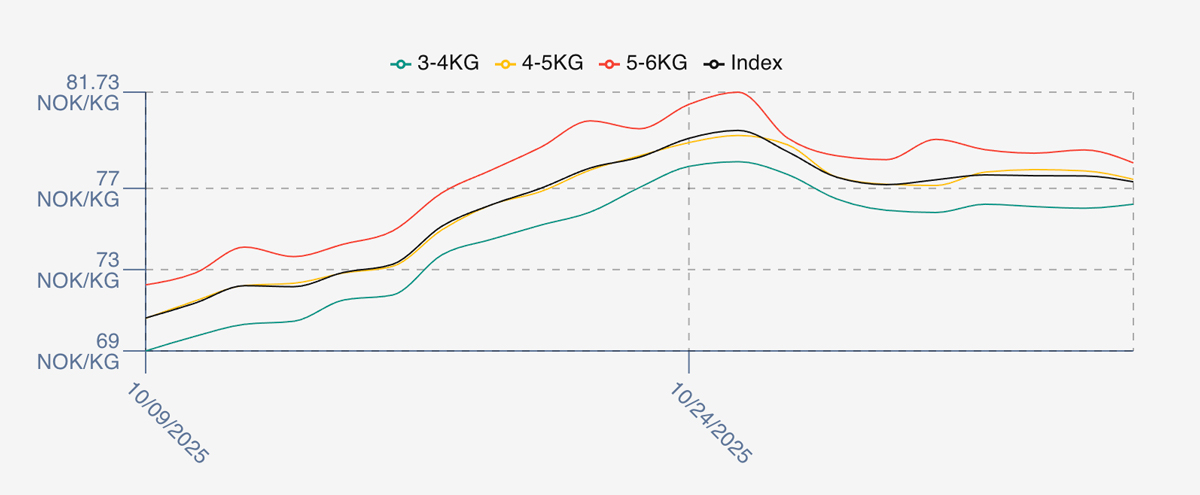

The Last Week

The chart this week is (almost) mill pond flat. We haven’t seen a week as flat this for…a long time. A complete contrast to the volatility this year. Friday saw a tiny push on prices as always, opening at 77.42 and registering a gain of 0.24 of a NOK or 0.31% mainly from the 5/6s. Monday’s average was up at 77.66 although the 5/6s came back a little. Tuesday and Wednesday flat 77.62 and 77.61 and Thursday a tiny drop off to 77.32. Overall, a small increase over the prior week close as demand and supply coalesced around the 77.50 NOK level.

FX rate saw a little more movement as the EURNOK rate picked up from the 11.64 levels at the start the week to a high of 11.76 on Wednesday and settled at 11.72. Unusually this meant that the EURO prices dropped over the week -0.02 / -0.25% to 6.60, whereas the NOK price (marginally) increased.

Spreads on the index were around 2.5 – 3 NOK and compressed to 2 NOK to finish the week.

Next Week

Early indications around the offered indicative level of 77.1 NOK for the index which would put it just below Thursdays close. Fish remained widely available from last week, but it looks like there will be less fish to sell this week. The market is definitely quieter this Friday. Larger fish 6+ size being plentiful.

Spreads between 3/4s to 5/6s have remained tight at 2 NOK the same as last week’s closing spread.

After peaking at 11.79 the EUR NOK FX rate is this afternoon around the 11.77 level. This would give an indicative Euro index price around 6.55 EURO on offered levels later Friday – a decrease of 0.09 Euro versus this time last week.

Volumes – Fresh Export

Volume figure for week 44 (2025) was 24,875 tons DOWN 874 as compared to 25,749 in 2024 some 3.40 % LOWER. Volumes for week 45 and week 46 (2024) were 23,871 and 22,825 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 46 2024 ended the week up +6.45 NOK / +8.60% to stand at 81.44 NOK (in EUR terms 6.93 / + 0.54 / +8.51%) FCA Oslo. The NOK rate ended flat/up at 11.76 to the Euro. The Fish Pool future November was reported up 1.00 NOK / +1.32% at 77.0 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 7th November, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The LFEX system is secure and private? Whether you are a buyer or seller putting up prices you are in complete control of to whom and where you send your prices.

The system is configured to the counterparties you are prepared to see prices / offers from and within this you can configure who sees what price, all manageable and updateable in real-time. Each price between a seller and buyer is secure and private, and no one else has access to this.

FAQ’s

Q. I tend to trade the same order specifications each week, how can I do this efficiently?

A. No problem. The RFQ is configurable and saved by user. This means that you can set it up perfectly for what you want to trade with your own parameters and at a single click have your own fully populated orders ready to go week in week out. We understand that different users have different requirements, and the system has been designed to cater for everyone’s different choices. We also allow users to configure their LFEX Web workspaces to reflect how they want to operate and use the platform with bespoke and default layouts.