The London Fish Exchange

Data / Market Insight / News

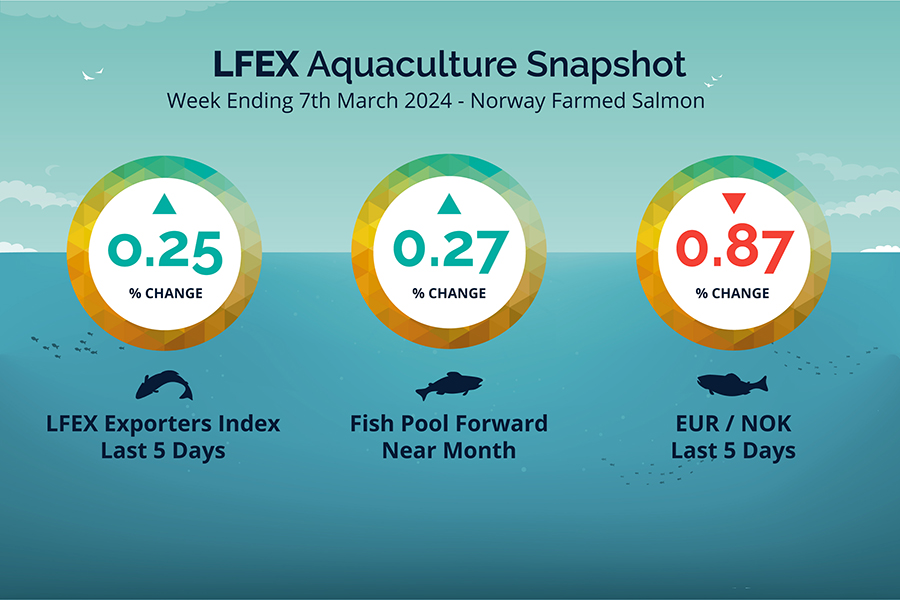

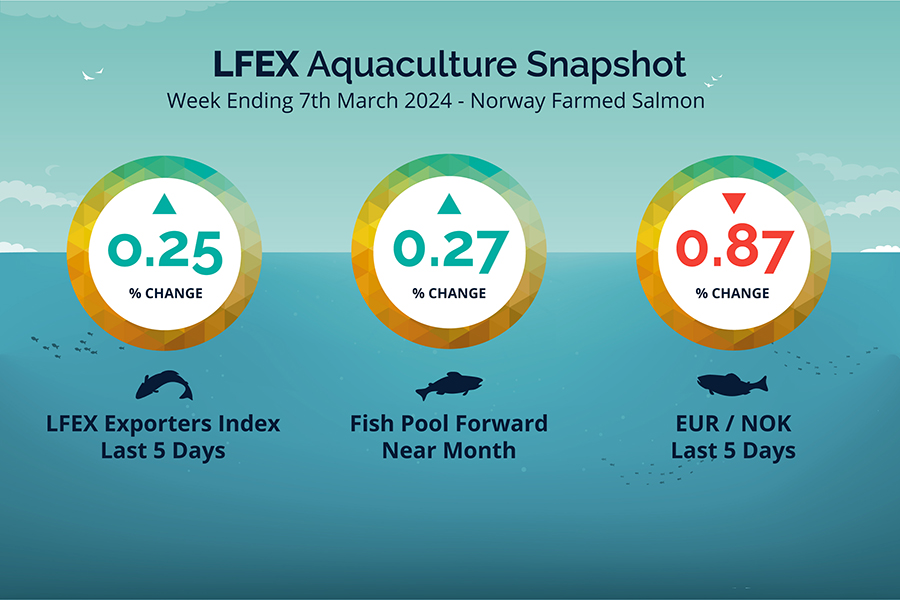

LFEX European Aquaculture Snapshot to 7th March, 2024

|

|

Published: 8th March 2024 This Article was Written by: John Ersser |

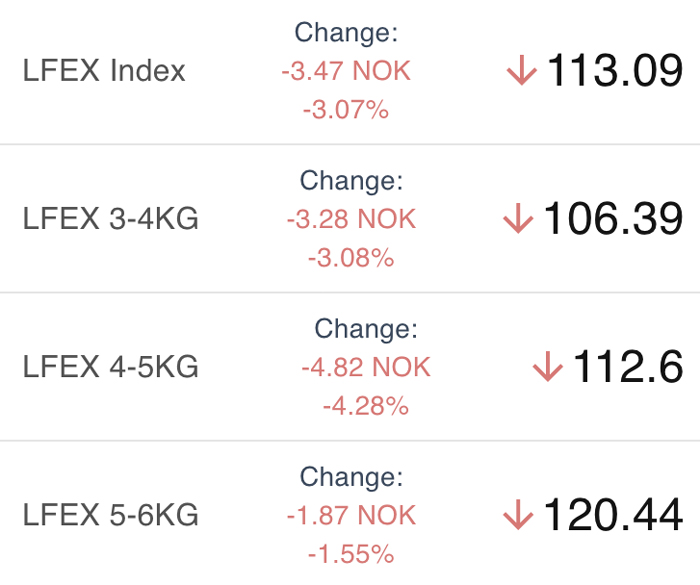

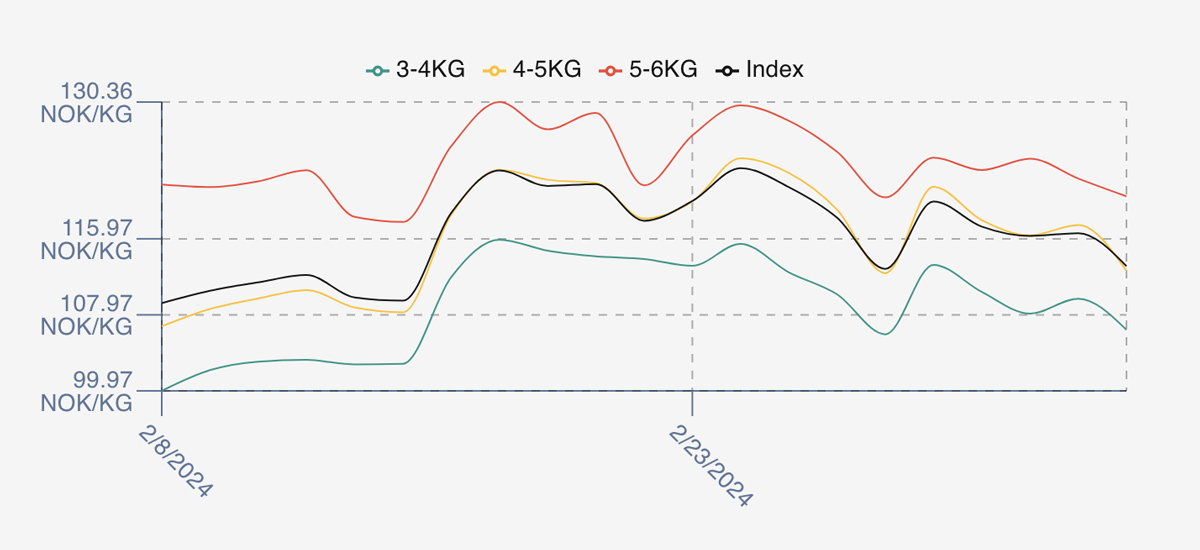

The LFEX Norwegian Exporters Index for Week 10 2024 ended the week up +0.25%, +0.28 NOK to stand at 113.09 NOK (in EUR terms 9.92 / +0.11 / +1.13%) FCA Oslo Week ending Thursday vs previous Thursday.

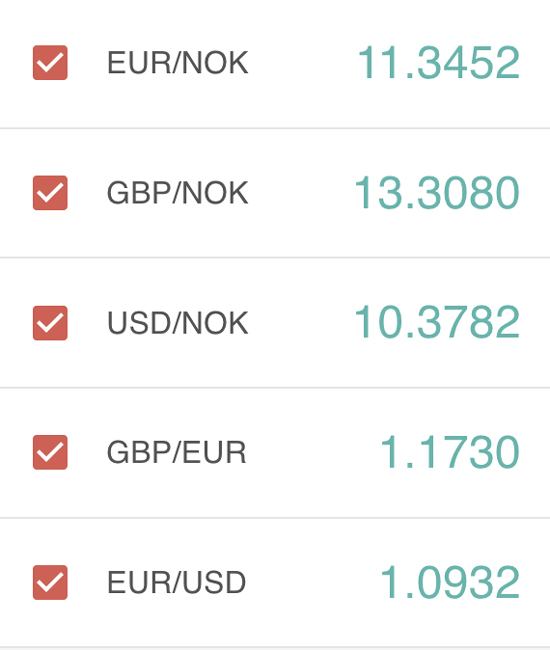

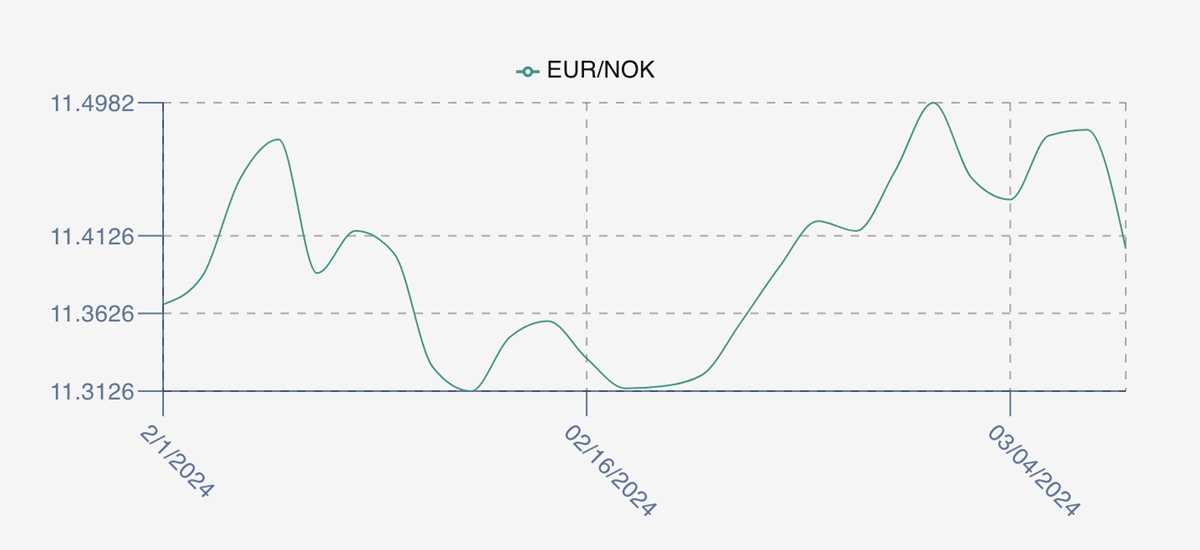

The NOK rate ended down at 11.40 to the Euro over the period Thursday to Thursday up -0.10 NOK or -0.87%. The Fish Pool future March was reported up +0.30 NOK, +0.27% at 113.00 NOK.

The index opened stronger at 119.90 compared to the prior weeks close (112.81), a significant rise of over 7 NOK, and bang-on where it started week 9 before dropping off. Much the same can be said of this week as prices intra-week again fell, although this week Friday was the peak, and the market was generally a little softer. Monday saw 117.25, Tuesday 116.27, flat Wednesday 116.56 and the ‘usual’ drop off on Thursday.

What’s the story – high prices for low volume superior fish, low prices for higher volume production fillets, unsold high value fish gets sold off a little cheaper as the week progresses. Next week looks like things are moving a little, still a lot of production fish distorting the market, but the spread in prices by size starting to come in especially on 5+ fish. Pricing looks to follow the similar pattern as last week – depending on where it starts. Looking around the 113.5 NOK levels at the moment as we go into the week. With Easter approaching there will be more fish coming through and buyers will be starting to think about this.

By comparison for next week – trading in week 11 2023 was up +0.95 at 125.74 NOK – and a new intraweek peak was achieved at 135.70 reduced volumes hit the market….phew.

David Nye’s technical analysis report will be published later next week.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 7th March, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

You can track the business you do with each specific counterparty?

The system saves all your and your counterparties activity on the system. We give you the tools to then sort and manage this data yourself. If you want to find trades with just one counterparty this is easily achieved, as well as any pricing/data, or documentation against these trades. It’s a super flexible real-time system to get you the information and data you need, when you need it.

FAQ’s

Q. How do I know I’m getting the best price?

A. A good question. The best price might be described better as the right price, taking into account your volumes, delivery dates and specifications. The only clear way to achieve this is to have offers from as many companies as possible and co-ordinate this, to build up the price development picture and lastly to have a refence or benchmark price to provide guidance on the current market prices and activity. It’s called a market or an exchange and it is the only independent way you can secure and evidence the right price when you trade.