The London Fish Exchange

Data / Market Insight / News

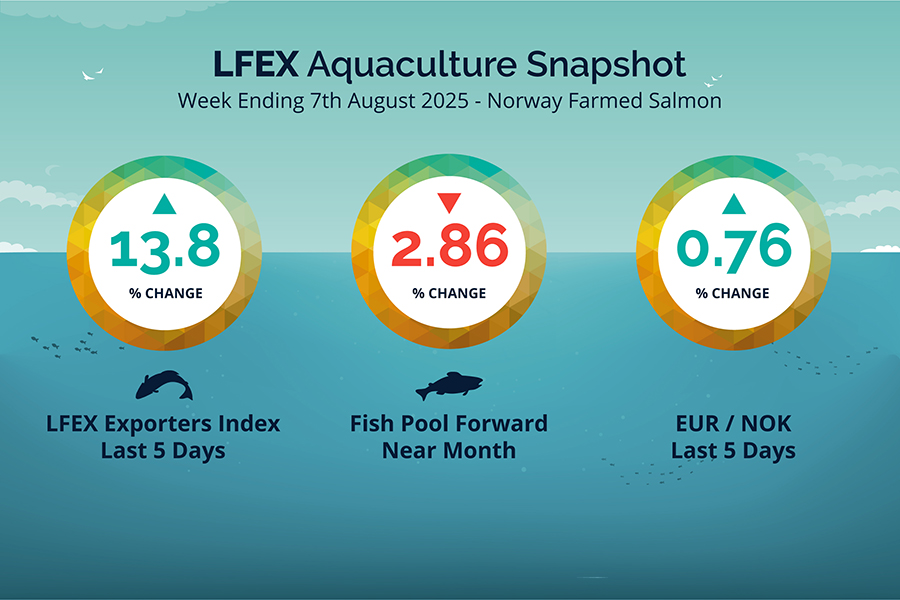

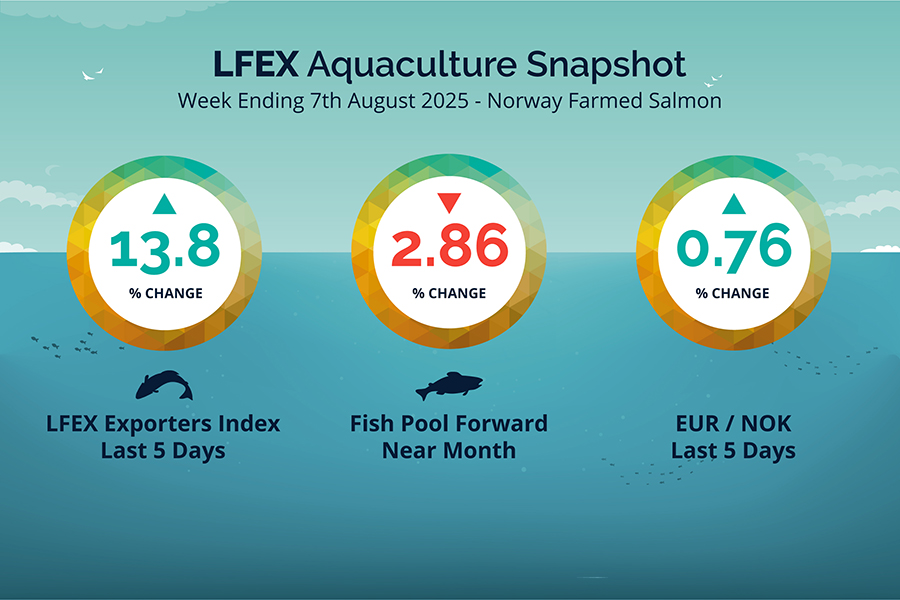

LFEX European Aquaculture Snapshot to 7th August, 2025

|

|

Published: 8th August 2025 This Article was Written by: John Ersser |

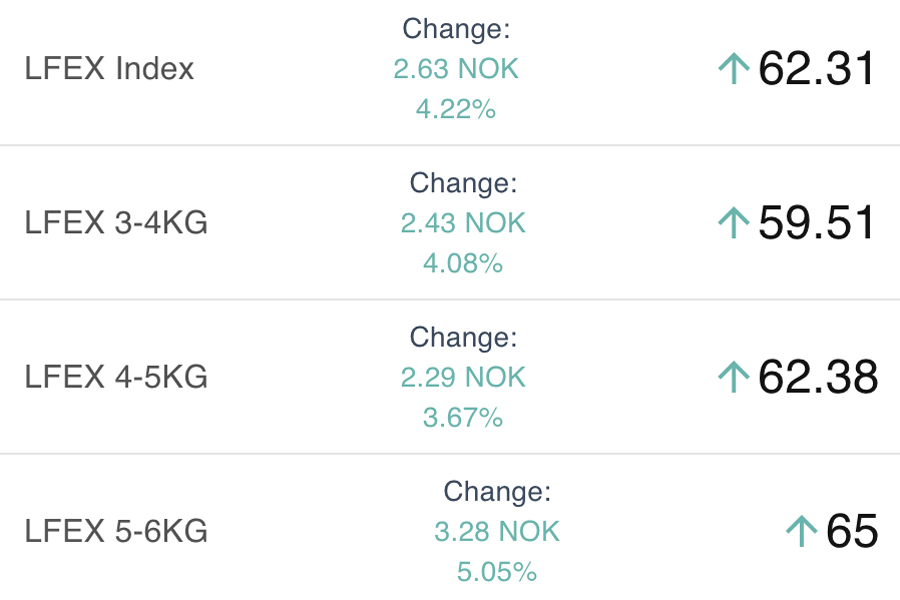

The LFEX Norwegian Exporters Index for Week 32 2025 ended the week UP +7.56 NOK / +13.81% to stand at 62.31 NOK (in EUR terms 5.24 / +0.60 / +12.95%) FCA Oslo Week ending Thursday vs previous Thursday.

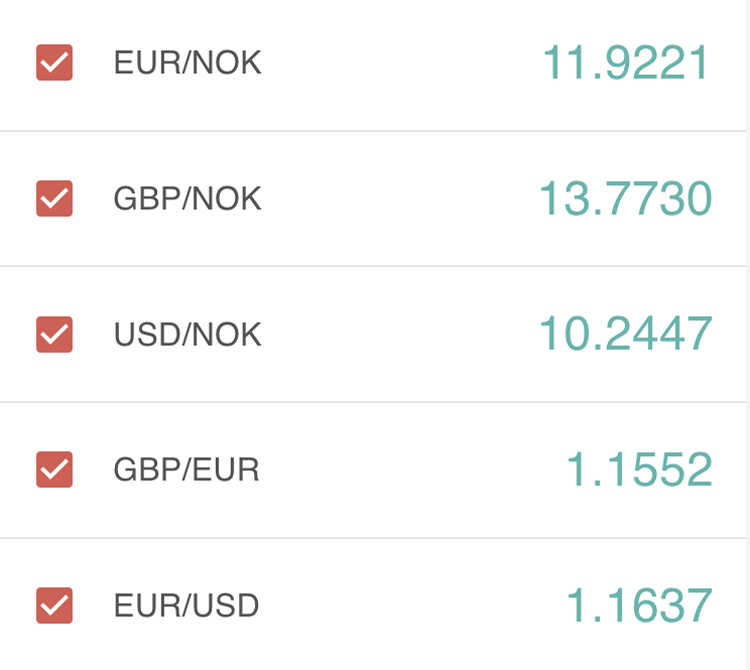

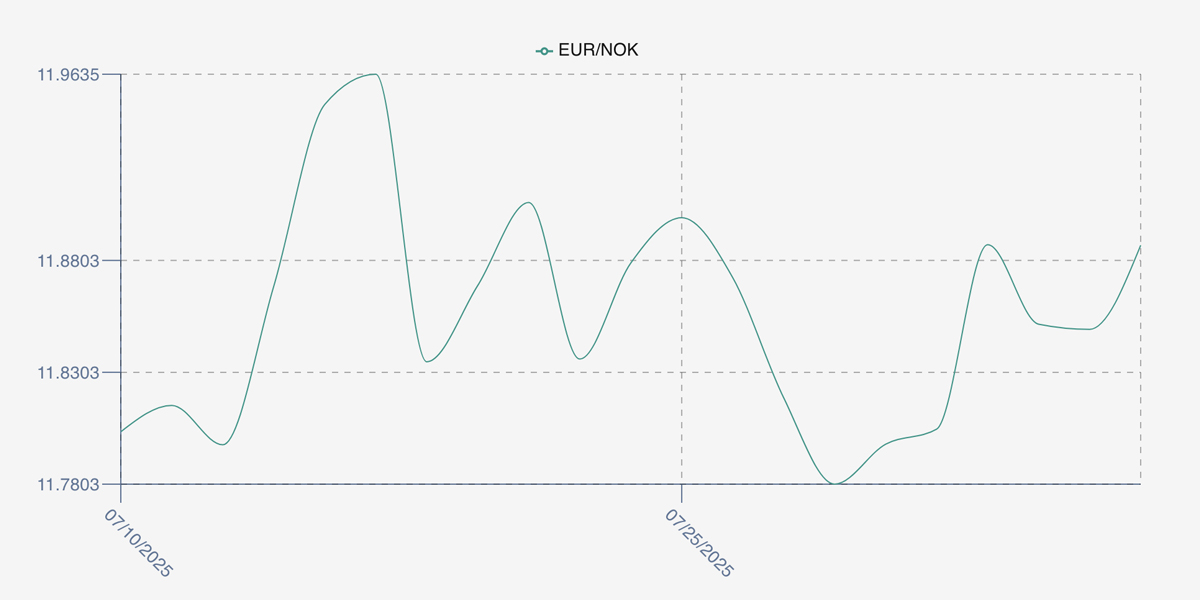

The NOK rate ended UP at 11.89 (+0.09 / +0.76%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future September was reported DOWN Thursday to Thursday at 5.10 EUR, (-0.15 / -2.86%) approximately 60.64 NOK.

The Last Week

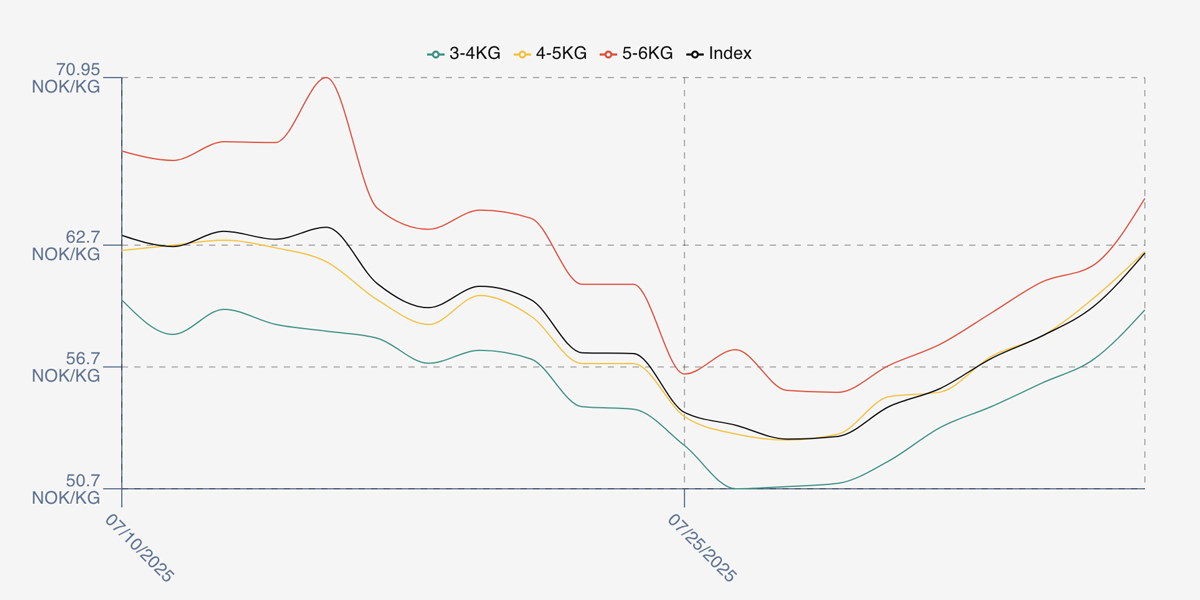

An UP Week! After the significant drops of the prior weeks the market bounced back in week 32. It started as a gentle rise on market open Friday up 1.63% / 0.89 of a NOK at 55.64 and found more strength on Monday at 57.12. In fact, it was all one-way traffic as Tuesday saw 58.24 and the chart was pretty linear hitting 59.68 offered on the Wednesday. Clearly not done Thursday accelerated the increase with an offered 62.31 to close out and big week for pricing and a level not seen since mid-July. Why? Combination of supply squeeze from Tuesday, some logistics issues and a few holidays in Europe meant that prices were forced in an upwards direction.

FX rate opened at 11.80 0n the Friday and over all saw a small rise to the 11.89 closing levels.

Spreads on the index have averaged 5.5 NOK over the week and as all classes (3-6s) increased in unison.

Next Week

Indications this week see the index flat or tiny increase from where we left off last week with the week opening indicative offered around the 62.5 NOK level Oslo FCA. Pricing seems to have found some strength with larger fish pricing stronger. No strong views of where the market is headed.

Spreads between 3/4s to 5/6s compressed to sit around 3 NOK.

EUR NOK FX rate has seen a significant move upwards today. This afternoon rates are around 11.975. This would give an indicative Euro index price around 5.22 on offered levels later Friday.

Volumes – Fresh Export

Volume figure for week 31 (2025) was 25,317 tons up 2,693 as compared to 22,624 in 2024. Volumes for week 32 and week 33 (2024) were 20,669 and 21,367 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 33 2024 ended the week down -1.71 NOK / 2.30% to stand at 72.51 NOK (in EUR terms 6.17 / + 0.10 / +1.56%) FCA Oslo. The NOK rate ended down, at 11.76 to the Euro -0.09 NOK or -0.76%. The Fish Pool future August was reported down – 0.75, -1.01% at 73.75 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 7th August, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

You can place orders / make offers (or RFQ’s) on the system for any period you want.

So if you want to make an offer for a limited period, or offer a firm price you are prepared to buy at over a short period you can do that. In fact, you can define any time period you want from minutes to weeks, allowing you to match your orders with your business demands.

It also means you can for example put out offers for available frozen inventory, and update prices as often as you want against this without having to constantly resend offers – brilliant.

FAQ’s

Q. I get confused having to track multiple communication channels, is there a better way?

A. Poor habits make for hard work for everyone, errors and inefficiency. It is much easier to direct all communications into one channel which is secure, trusted and private. We know that companies often have to juggle 5 or 6 different solutions which becomes unworkable and unreliable as a process. LFEX chat is available 24/7 with all history accessible and auditable on web and mobile with alerts meaning you never miss that important message, order or price or conversation.