The London Fish Exchange

Data / Market Insight / News

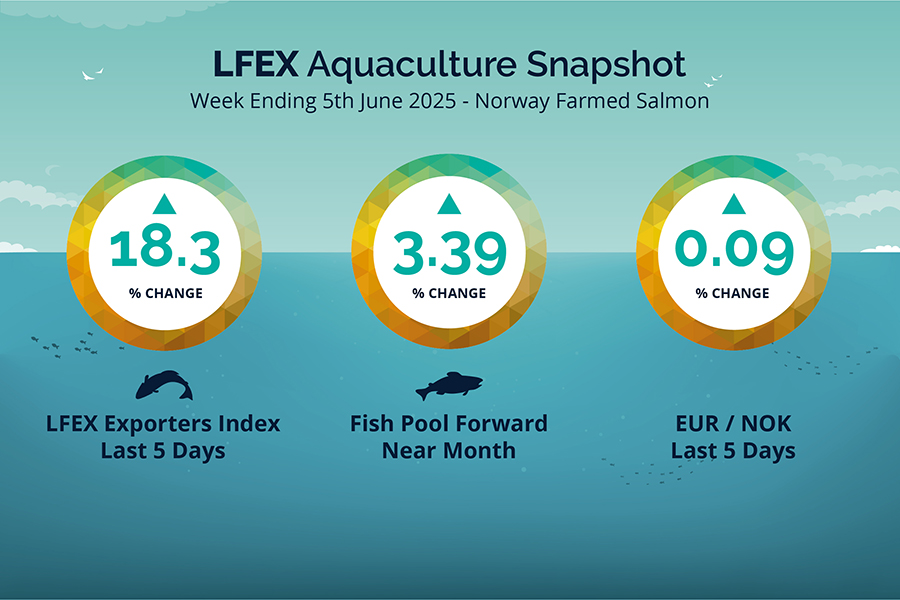

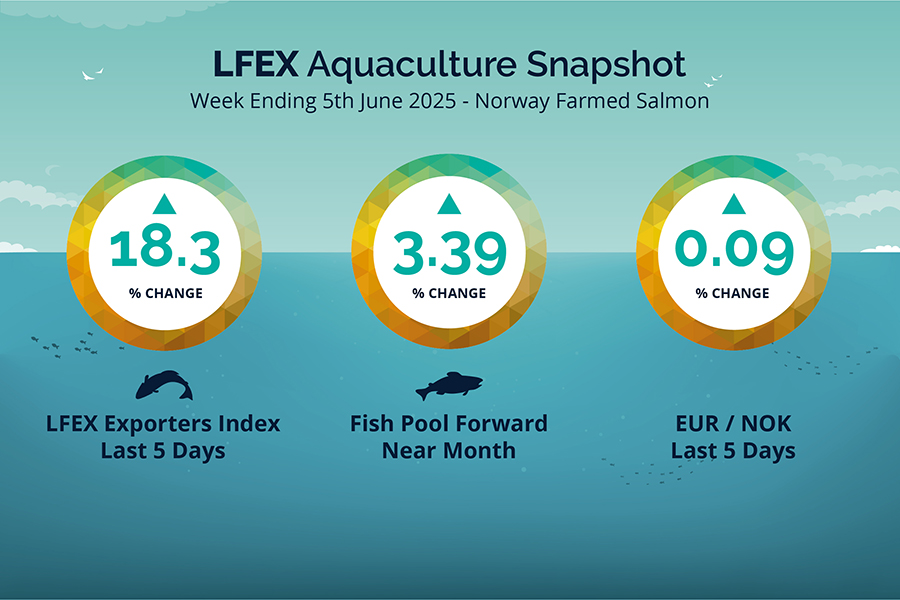

LFEX European Aquaculture Snapshot to 5th June, 2025

|

|

Published: 6th June 2025 This Article was Written by: John Ersser |

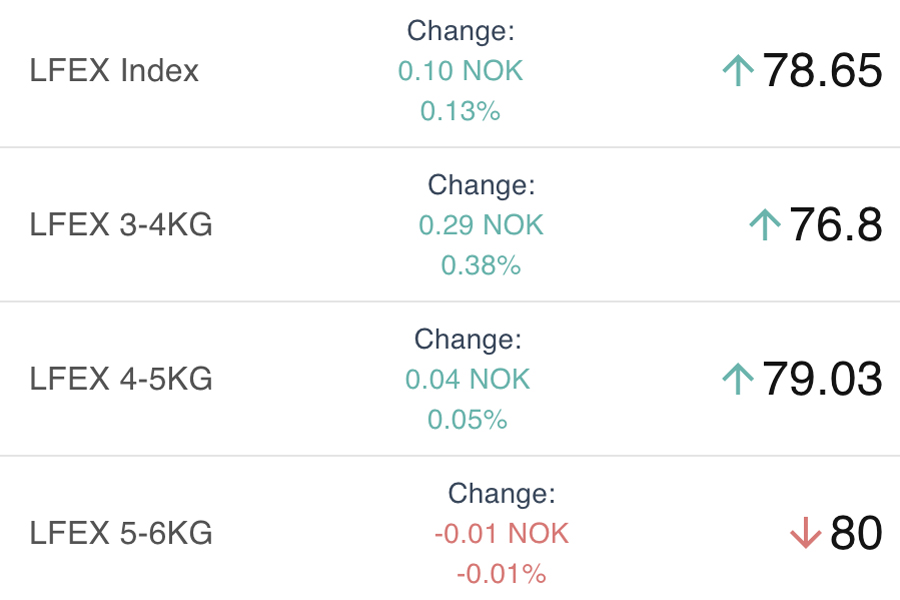

The LFEX Norwegian Exporters Index for Week 23 2025 ended the week UP +12.19 NOK / +18.34% to stand at 78.65 NOK (in EUR terms 6.83 / +1.05 / +18.24%) FCA Oslo Week ending Thursday vs previous Thursday.

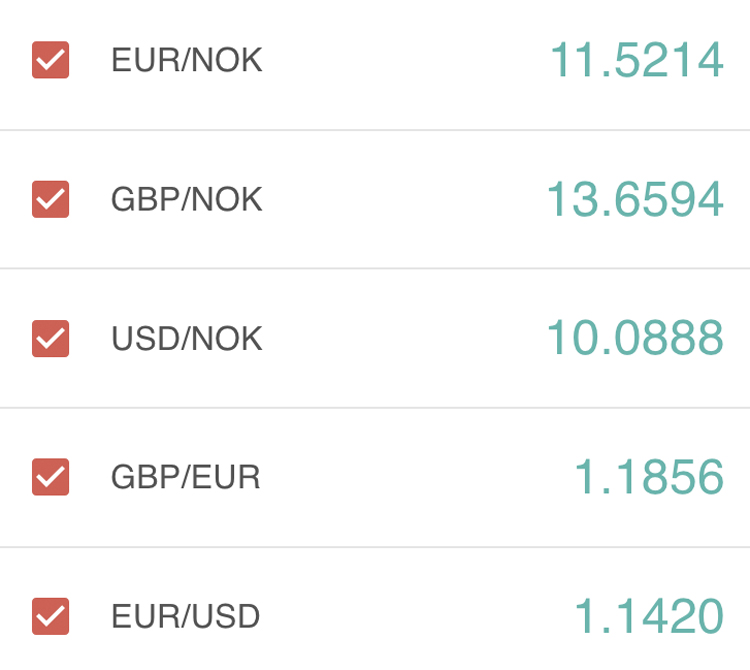

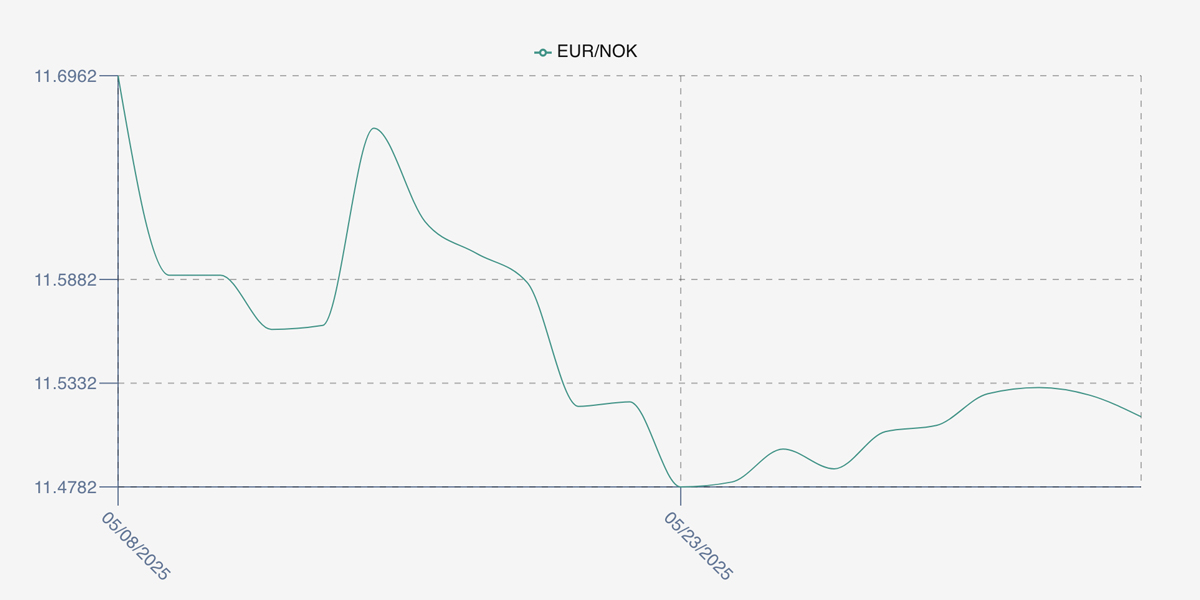

The NOK rate ended FLAT at 11.51 (+0.01 / +0.09%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future July was reported UP Thursday to Thursday +0.20 / -3.39% at 6.10 EUR, approximately 70.21 NOK.

The Last Week

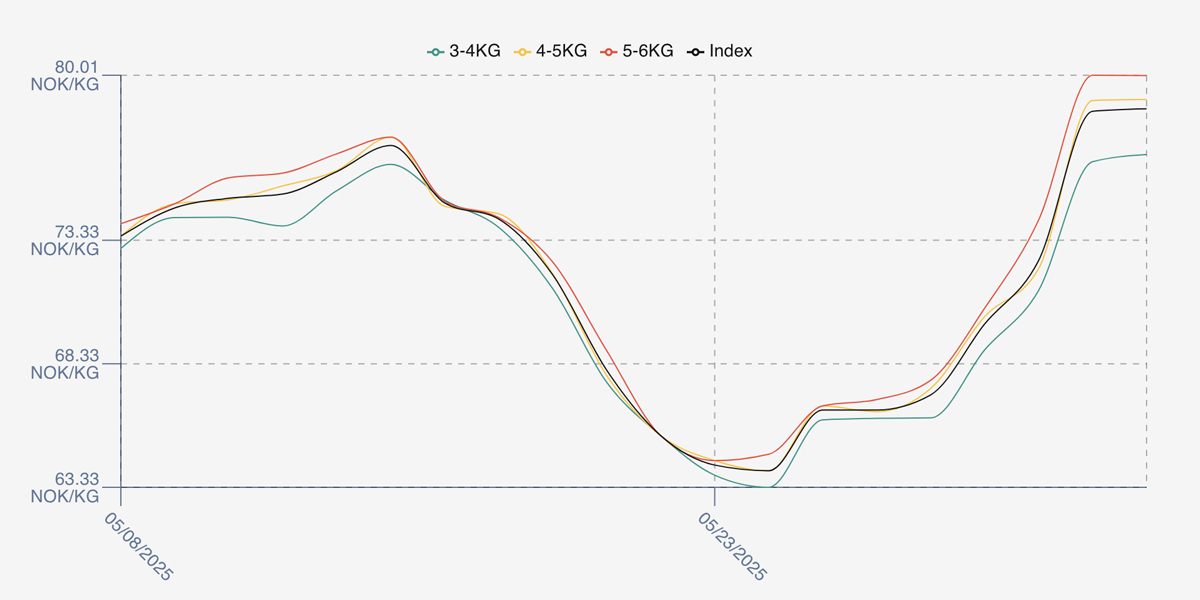

A full week of trading, and a significant and unexpected jump in pricing. Friday opened the week marginally stronger, up around 1% or just over 0.6 of a NOK at 67. We then saw pricing start to take off with a rise in offered levels around 3 NOK on Monday and a further 2.5 NOK on Tuesday. However, the week was not done as pricing jumped a further 6 NOK offered on Wednesday at 78.55 and closed out at 78.65 offered, the rise catching out early sellers. Volumes remain good, although perhaps a little softer in the south and buyers need to pay up before the Whitsun Monday bank holiday.

Spreads have widened a little to 3 NOK between 3-6s. With a NOK between 4-5s and 5-6s.

Next Week

Indications this week see the index opening around 82.5 NOK level as offered prices continue their Whitsun 4 day week climb. Volumes remain good at the beginning of the trading week as sellers push prices, and there is a significant spread of prices in the market currently. Concerns that the price has risen too quickly, which could come undone, especially if the bigger players don’t play.

EUR NOK FX rate is higher 0.01 at 11.52 this afternoon having peaked early doors today at 11.535 and trending slightly downwards. This would give an indicative Euro index price around 7.16 on levels later Friday.

Volumes – Fresh Export

Volume figure for week 22 (2025) was 18,223 tons up 3,163 as compared to 15,060 in 2024. Volumes for week 23 and week 24 (2024) were 16,605 and 16,797 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 24 2024 ended the week down -0.38%, -0.31 NOK to stand at 81.42 NOK (in EUR terms 7.127) FCA Oslo. The NOK rate ended down at 11.43. The Fish Pool future June was reported down – 12.00, -12.50% at 84.00 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 5th June, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

You can manage sales inventory to target customers.

If you know how much you want to move, at what price and which potential customers you want to sell it to – you can configure this in seconds on the system. You can then manage this in real-time, chip away at the orders but always in control of where you are at. You can use the chat facility to engage with and encourage customers around your offer.

FAQ’s

Q. Can I communicate in a different language on the platform?

A. The good news is that the chat service supports multilanguage / characters meaning as long as users have the necessary input keyboard, they can communicate in any language they choose. This includes Chinese characters – for which you can use Google translate to …translate, as well as the ever-helpful emojis.