The London Fish Exchange

Data / Market Insight / News

LFEX European Aquaculture Snapshot to 5th April, 2024

|

|

Published: 5th April 2024 This Article was Written by: John Ersser |

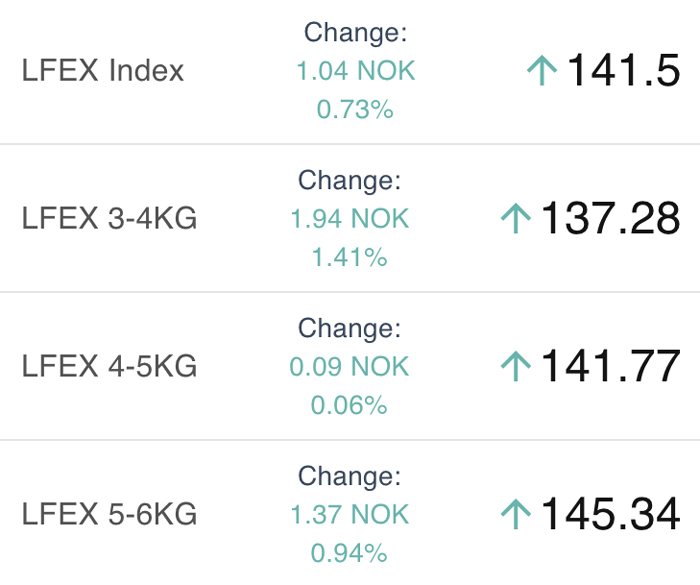

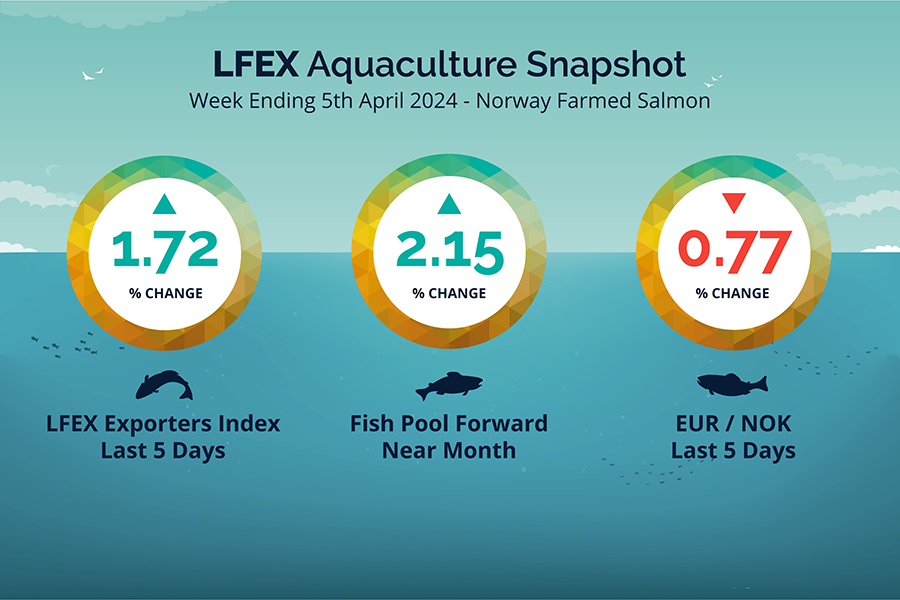

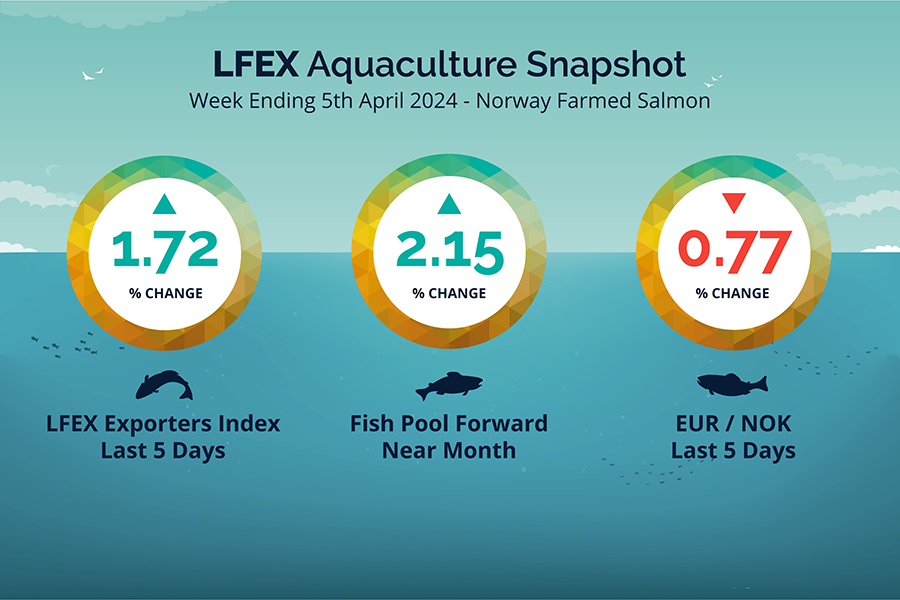

The LFEX Norwegian Exporters Index for Week 14 2024 ended the week up +1.72%, +2.37 NOK to stand at 140.46 NOK (in EUR terms 12.12 / +0.30 / + 2.51%) FCA Oslo Week ending Thursday vs previous WEDNESDAY.

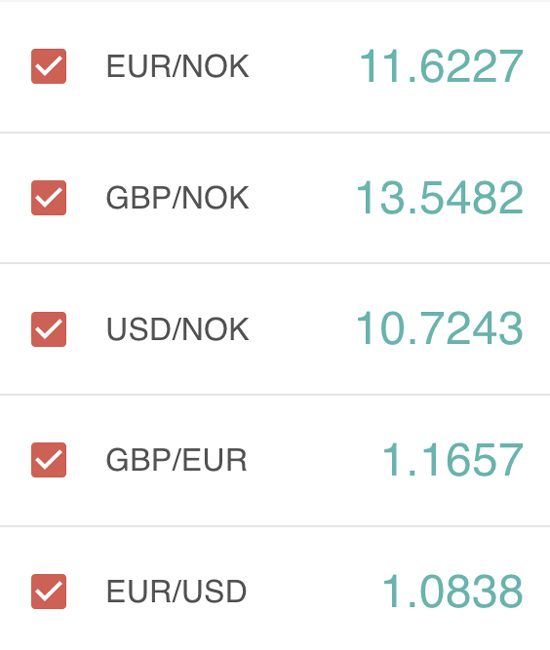

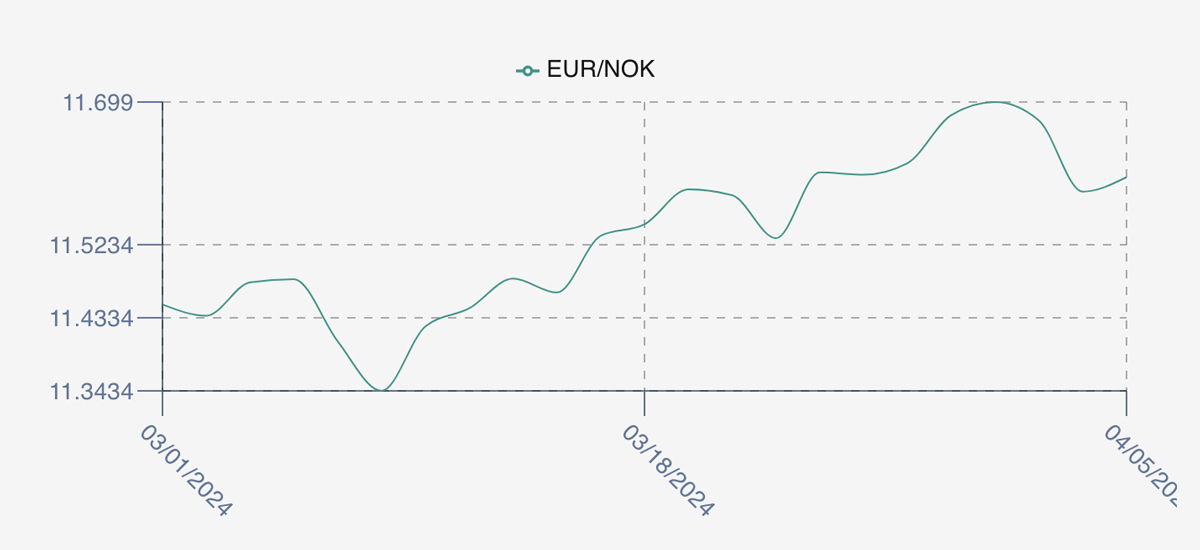

The NOK rate ended down at 11.59 to the Euro over the period Thursday to WEDNESDAY -0.09 NOK or -0.77%. The Fish Pool future April was reported up +2.50 NOK, +2.15% at 119.0 NOK.

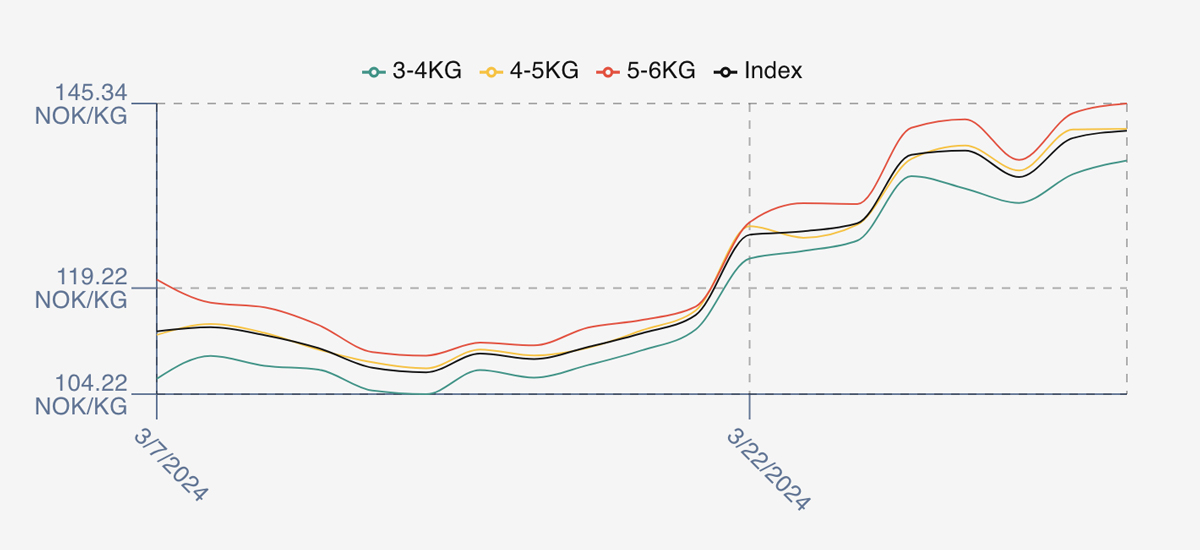

A short but record-breaking week. Last week (w14) the index opened on Friday up 0.85 NOK / 0.61% at 138.94 after the huge gap up on the prior days price – setting a price level for the short easter week. Pricing as expected was strong in this week. Tuesday opened at 138.94, a small drop on Wednesday at 134.94 before climbing to new record index price recorded by LFEX at 140.46 NOK on Thursday (yesterday).

Whilst we await the volume figures for week 14, it is worth noting week 13 exported 9,512 tons of fresh premium salmon as compared to 17,460 tons in week 13 2023. The NOK was slightly stronger this week, making Euro prices that touch more expensive versus last week. NOK was weaker at this stage last year, but we are getting close to comparable NOK levels from a year ago.

A chronic shortage of superior grade fish continues, not that buyers are chasing at these prices. Prices are at record levels and look to continue as we enter week 15 with even a slight increase over the closing rates (140.46). The usual ambitious early pricing is settling, and pricing going into week 15 is looking at an index level of 141/142 NOK. Not much fish around, even production fish are expensive. Farmers are also happy to grow out fish which adds to the pricing pressure. The cure for high prices is usually high prices, but a bit more volume would help.

By comparison week 15 2023 prices ended at 125.93 NOK. The EURONOK rates was 11.39 – remember that Easter was a week later last year.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 5th April, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

Electronic platforms perform many roles for markets and market participants.

By bringing a community together you get a much better view of available inventory (liquidity), access to more participants, more opportunity for price discovery, ability to track market pricing electronically in real-time, pre-trade checking and secure and robust confirmations between parties. They throw off mountains of data that can be used to analyse pricing, trading patterns, counterparty performance etc.

Further, they can provide a single point of connectivity for settlement and documentation and an independent and verified record of truth. They provide huge efficiencies in process, less errors, automation of orders / trading / settlement processes. They give participants the ability to access the right price for any given market condition, and free up staff time to focus on optimising business and relationships.

FAQ’s

Q. Accessing products is really difficult at the moment and I understand why. However, with more volume coming through in Q3, how can I plan to access this easily and quickly?

A. The best chance of accessing more pricing and inventory is to build up a roster of many different relationships to give you as much choice and exposure as possible. By building these relationships on the platform you can quickly and easily manage accessing more pricing and offers. We know that there is often a big pricing spread even in the same weight class between sellers and the platform will provide you with the tools to access these.