The London Fish Exchange

Data / Market Insight / News

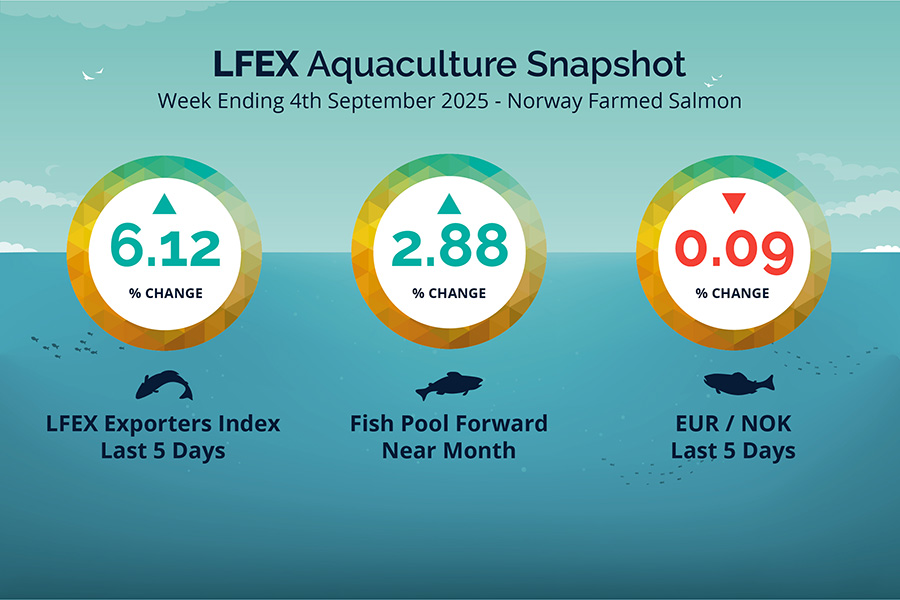

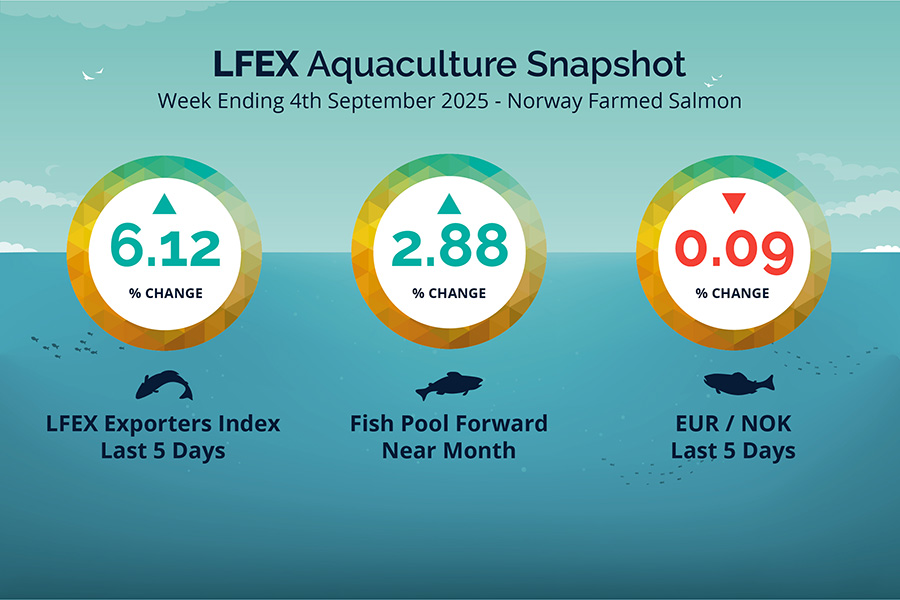

LFEX European Aquaculture Snapshot to 4th September, 2025

|

|

Published: 5th September 2025 This Article was Written by: John Ersser |

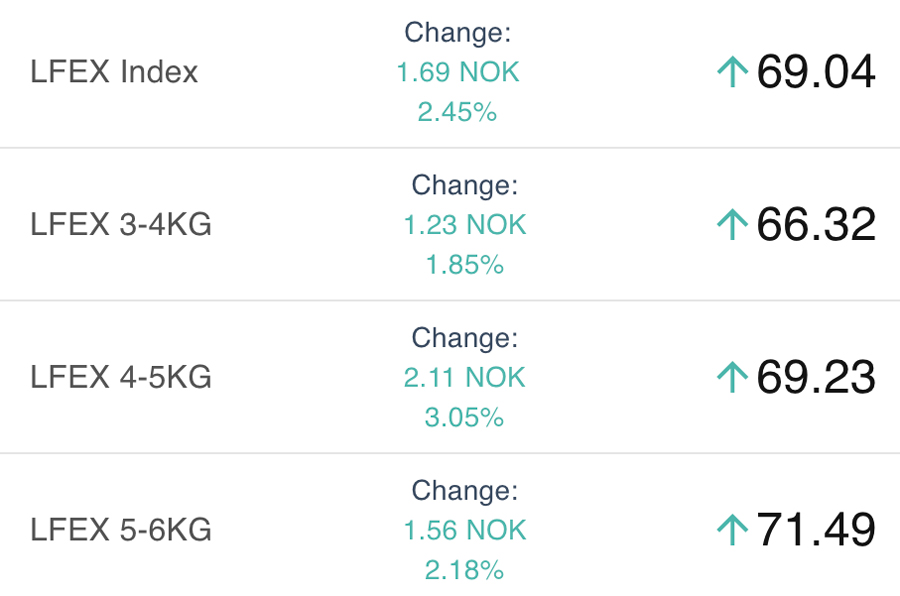

The LFEX Norwegian Exporters Index for Week 35 2025 ended the week UP +3.98 NOK / +6.12% to stand at 69.04 NOK (in EUR terms 5.88 / +0.34 / +6.21%) FCA Oslo Week ending Thursday vs previous Thursday.

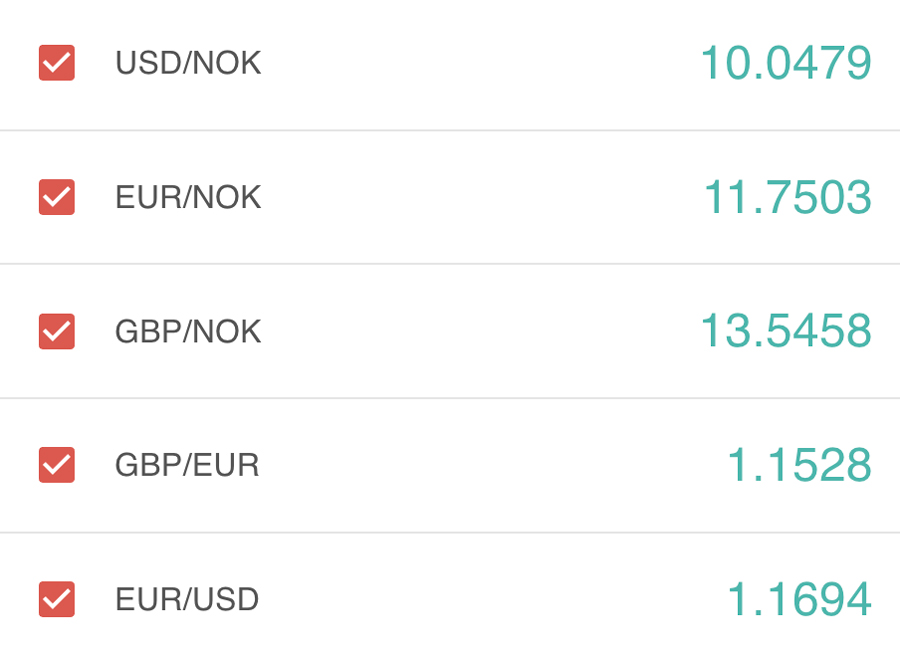

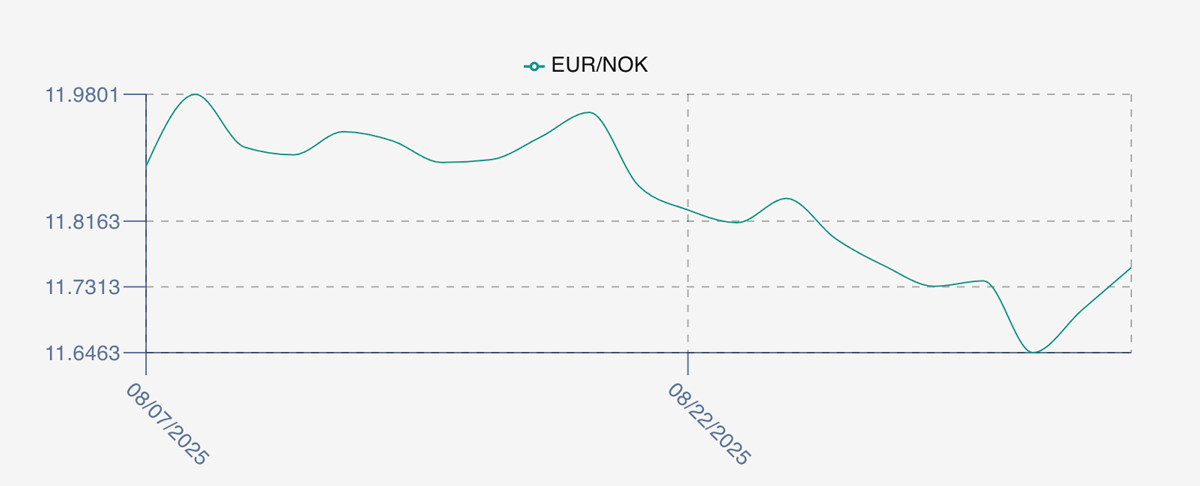

The NOK rate ended DOWN at 11.75 (-0.01 / -0.09%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future October was reported UP Thursday to Thursday at 5.350 EUR, (+0.15 / 2.88%) approximately 62.86 NOK.

The Last Week

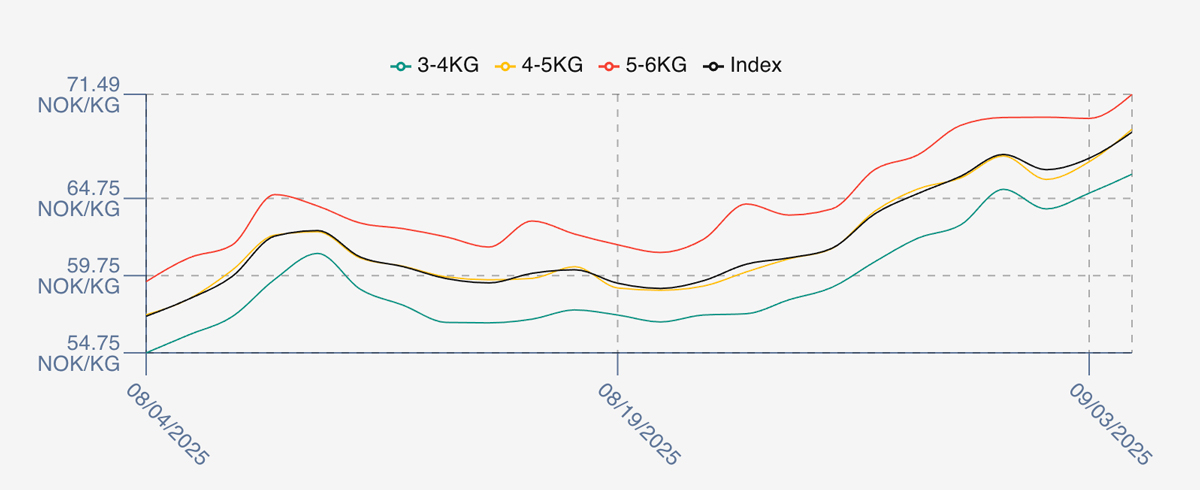

Continued pick-up in prices. Friday index opened at 65.06 NOK levels a further 1 NOK to the good on the prior week close. Monday saw further strength to 67.66, and then the market caught its breath a little as price edged lower on Tuesday at 66.61 average. However, it seems logistics issues may have started to come in to play as Wednesday rebounded to 67.35 and the week rounded off on a high at 69.04.

FX rate opened at 11.73 on the Friday a fall of 0.025 as we entered the week, dropped to 11.64 by Tuesday before resetting back to the 11.75 level and little change for the week.

Spreads on the index again have averaged 6 NOK over the week evenly spread.

Next Week

Indications this week see the index will be pushed up further up from last weeks close with a clear increase of around 3 NOK indicative offered levels around 72 NOK. Some debate around volumes, logistics, and appetite for freezing clouding the picture at the moment.

Spreads between 3/4s to 5/6s have continue to sit around 6 NOK weighted in favour of the larger 5/6s.

EUR NOK FX rate is marginally stronger this afternoon with rates around 11.77. This would give an indicative Euro index price around 6.11 on offered levels later Friday.

Volumes – Fresh Export

Volume figure for week 35 (2025) was 27,726 tons up 2,221 as compared to 25,506 in 2024 some 9% higher. Volumes for week 36 and week 37 (2024) were 26,416 and 28,799 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 37 2024 ended the week up +1.20 NOK / +1.66% to stand at 73.61 NOK (in EUR terms 6.17 / + 0.02 / +0.38%) FCA Oslo. The NOK rate ended higher at 11.93 to the Euro. The Fish Pool future September was reported up +1.30 NOK / +1.85% at 71.7 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 21st August, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The LFEX platform helps sellers manage and distribute multiple prices to different customers in real-time on the system.

Customers are different and have different demands, whether it is sizes, classifications, certifications, currencies or INCO terms. The platform allows sellers to manage this process, getting bespoke pricing out to a universe of customers quickly and easily allowing buyers more immediate access to offers to see and react to.

FAQ’s

Q. How does your weekly pricing change work?

A. The index is a useful tool for overall pricing as well as tracking intra week volatility and we calculate and publish the index every day. We report the weekly change based on the change from the previous Thursday – effectively that week’s close to the Thursday of that following week. This gives an accurate measure of the actual change week on week, especially useful when pricing has gapped between the Thursday close and Friday pricing. The index will show how it changed during that week, capturing the opening levels as prices and sales are pushed at the start of the week and where it ends up, and is a useful indication of intra week sentiment.