The London Fish Exchange

Data / Market Insight / News

LFEX European Aquaculture Snapshot to 3rd July, 2025

|

|

Published: 5th July 2025 This Article was Written by: John Ersser |

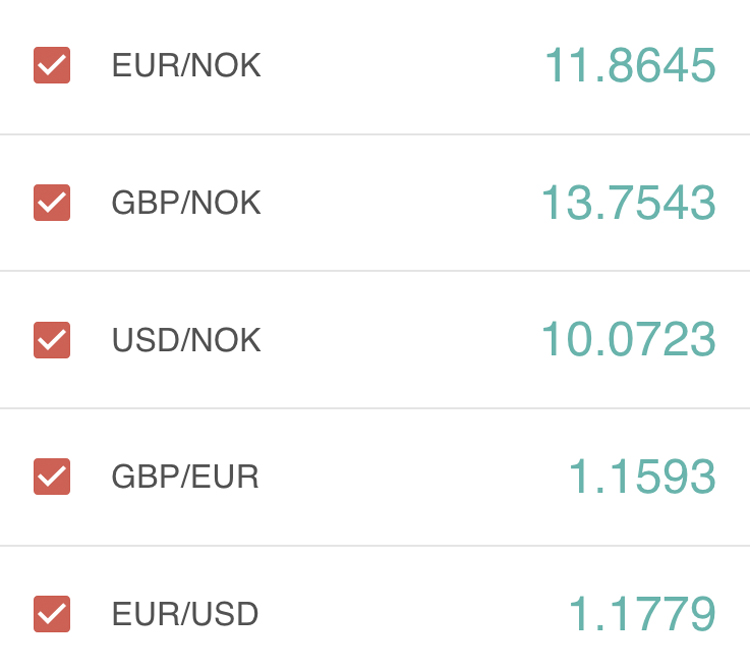

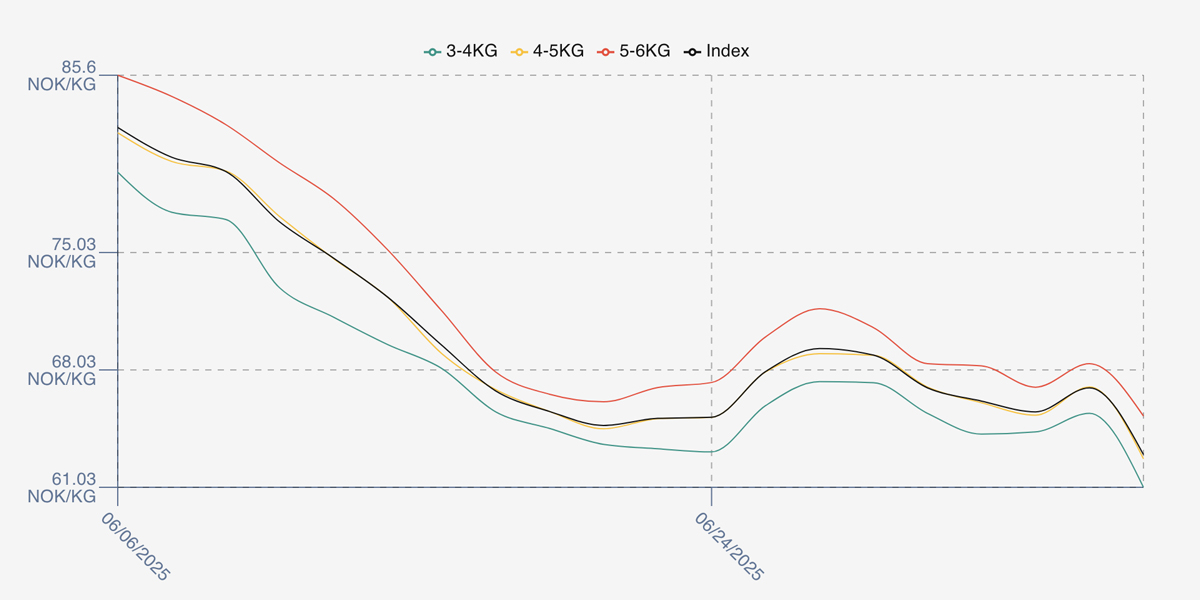

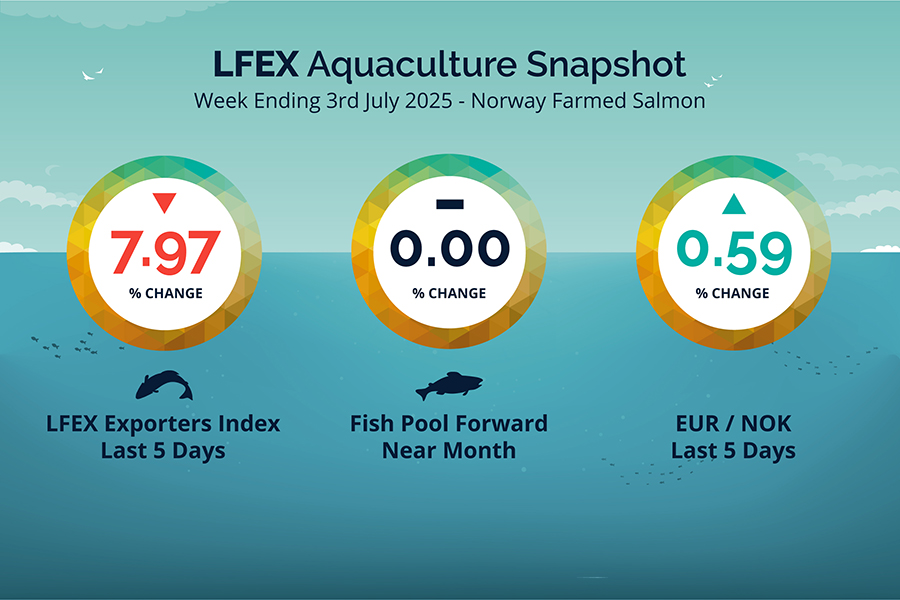

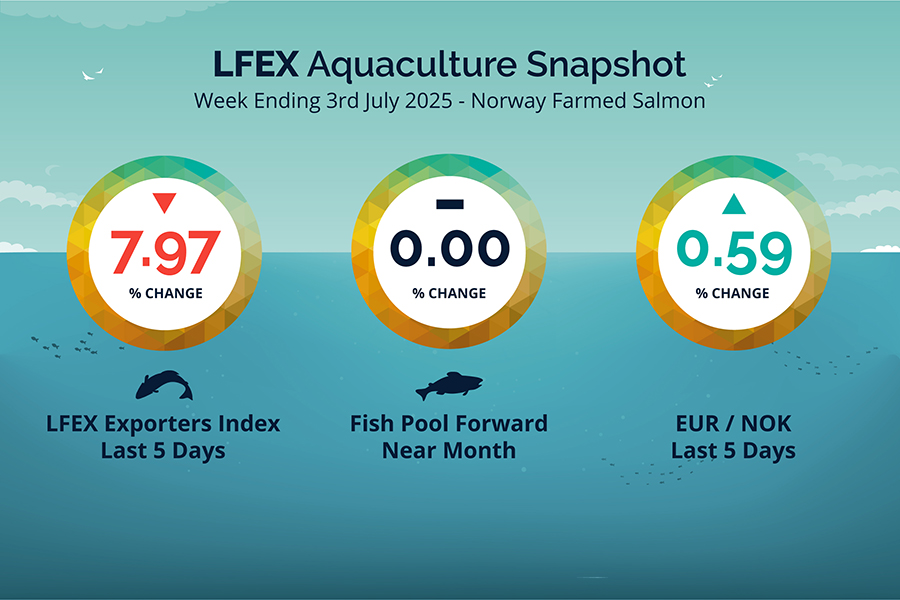

The LFEX Norwegian Exporters Index for Week 27 2025 ended the week DOWN -5.52 NOK / -7.97% to stand at 63.78 NOK (in EUR terms 5.37 / -0.50 / -8.51%) FCA Oslo Week ending Thursday vs previous Thursday.

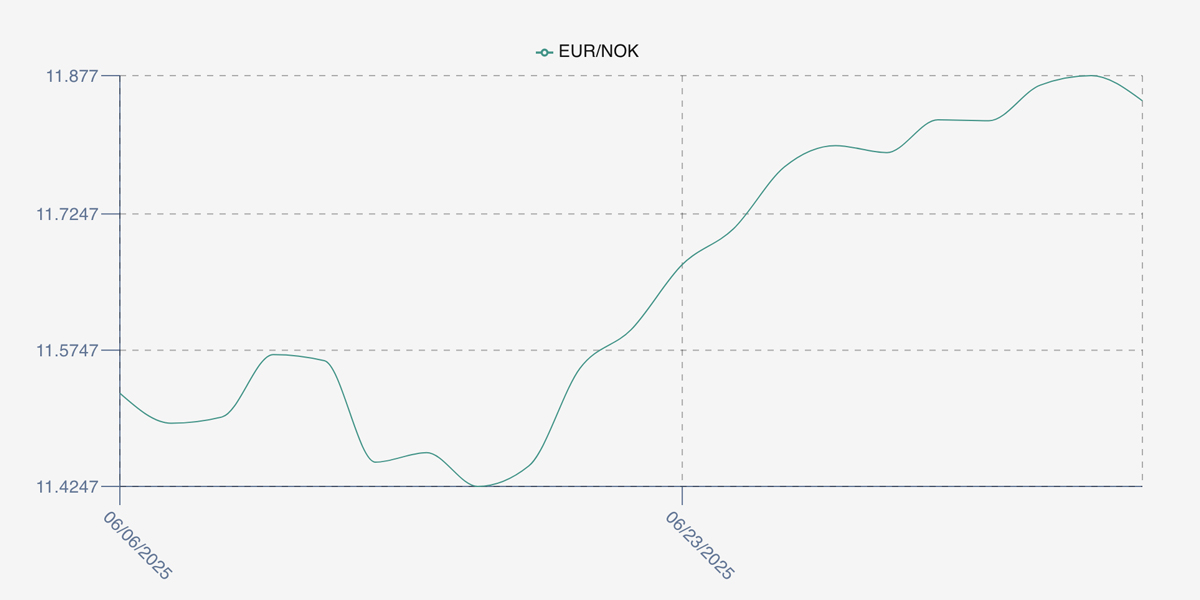

The NOK rate ended UP at 11.87 (+0.07 / +0.59%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future August was reported FLAT Thursday to Thursday at 5.90 EUR, approximately 70.03 NOK.

The Last Week

The uncertainty around last week’s open levels was reflected in the performance of the market this week and reflected in the index levels. Despite poor sentiment prices opened at just off last week’s closing levels at 68.91 offered (after prices had climbed at the end of week 26). We were 2 NOK off on Monday, another 1 NOK on Tuesday and another half by Wednesday to 65.5NOK. Thursday saw a minor capitulation to 63.78 as unsold stock went through. Top to bottom a 5.13 NOK intra week fall.

FX rate opened up at 11.80 and was one way traffic all week closing out at the high of 11.87.

Spreads stayed around the 4 NOK between 3-6s with 5/6s 2.5 NOK over 4/5s.

Next Week

Indications this week see the index opening around the 62.9 NOK level which is down around a NOK from Thursday closing levels. Mood music isn’t strong for pricing. A lot of small fish available and European demand is softer. Bigger sizes seem less available. Smaller spreads between 3/4s to 4/5s (1.5 NOK) versus 2.5NOK for 4/5s-5/6s.

EUR NOK FX rate is flat from yesterday at 11.87 this afternoon retaining its recent peak. This would give an indicative Euro index price around 5.30 on offered levels later Friday.

Volumes – Fresh Export

Volume figure for week 26 (2025) was 21,712 tons up 4,335 as compared to 17,377 in 2024. Volumes for week 27 and week 28 (2024) were 19,201 and 18.421 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 28 2024 ended the week up +6.01%, +4.40 NOK to stand at 77.64 NOK (in EUR terms 6.65) FCA Oslo.

The NOK rate ended up, at 11.67. The Fish Pool future July was reported down – 2.25, -2.81% at 77.9 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 3rd July, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

LFEX has significant experience in building and running internal trading, middle and back-office systems as well as data solutions?

This means our experience and systems used to run and operate markets, also provides the basis for internal technology solutions for producers / sales organisations and also buyside companies. We know in many industries companies fail to prioritise internal / supply chain technology which can provide multiple efficiencies within an organisation and further deliver high quality data that can be used to further improve operational activity. Feel free to contact us to discuss your internal technology requirements and how it can be a bespoke and unique solution for your local and global business operations and needs.

FAQ’s

Q. What other views can I get on pricing?

A. We publish technical analysis every week from David Nye – the only company to do so using daily pricing data. It provides a further view on pricing trends and helps add colour to the short-term pricing picture. Last week’s analysis concluded: ‘In summary, the Oslo FoB Index could be rolling over to retest the 64.46 NOK support zone. The large move in the Composite Index without a corresponding move in the Oslo FoB Index is concerning for the bulls. The RSI has used its current displacement as recent displacement highs. These are some reasons to have a bearish viewpoint.