The London Fish Exchange

Data / Market Insight / News

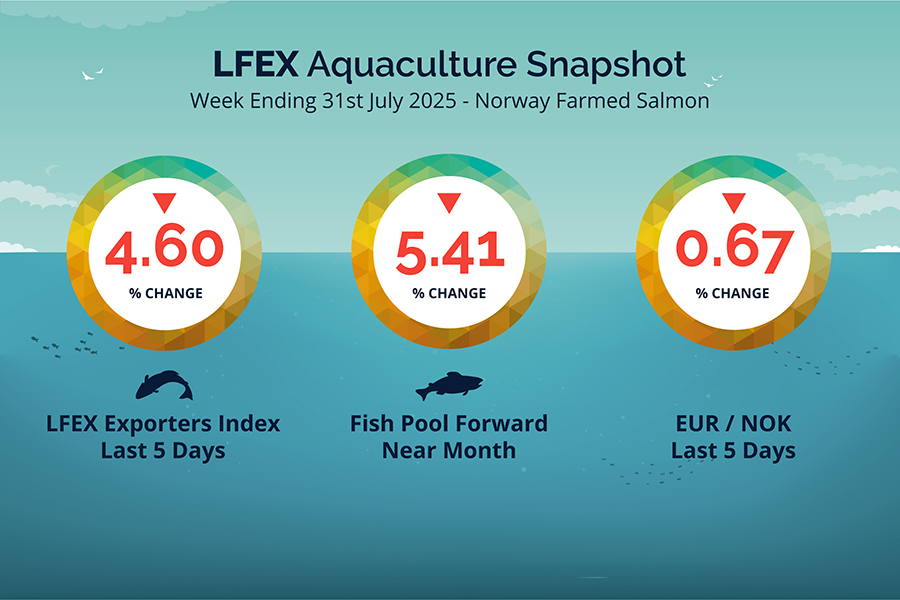

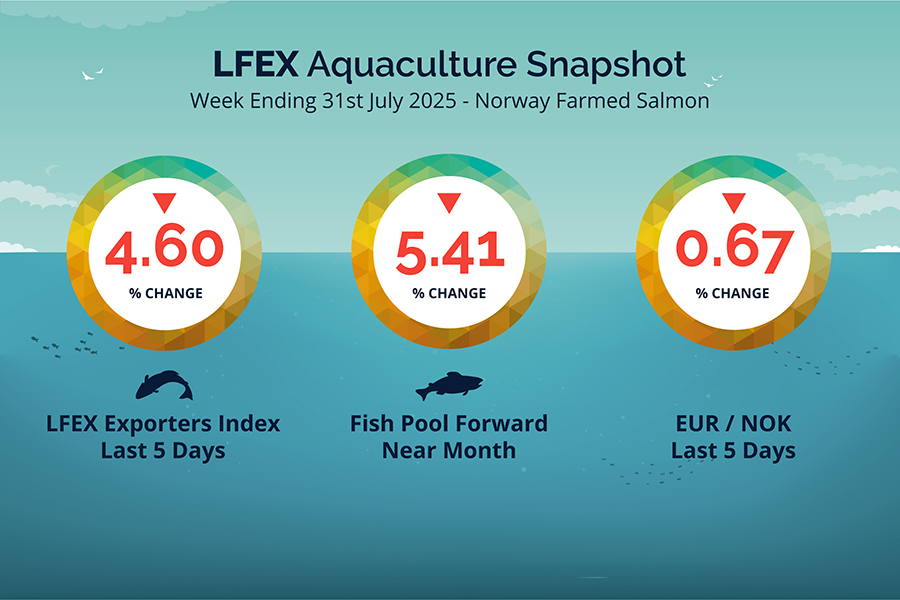

LFEX European Aquaculture Snapshot to 31st July, 2025

|

|

Published: 1st August 2025 This Article was Written by: John Ersser |

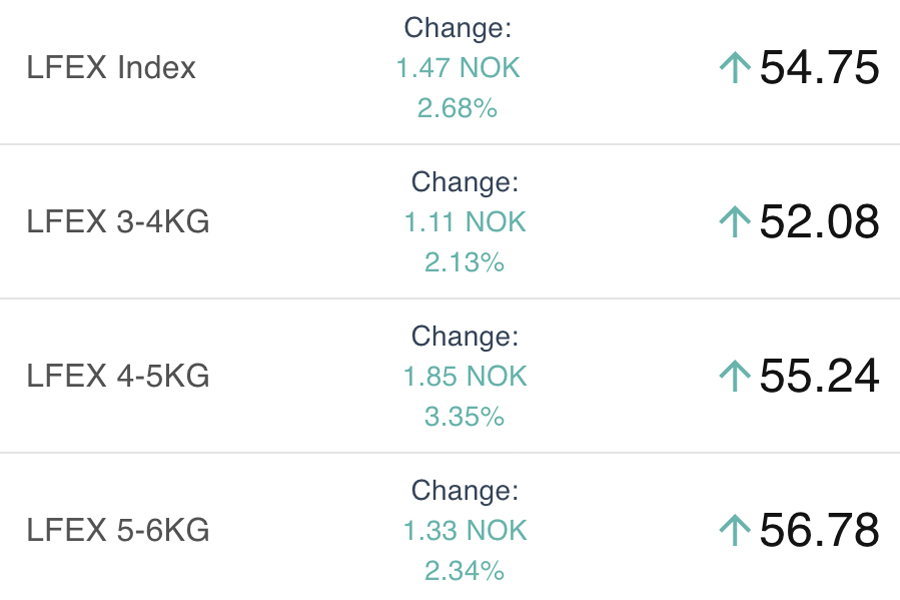

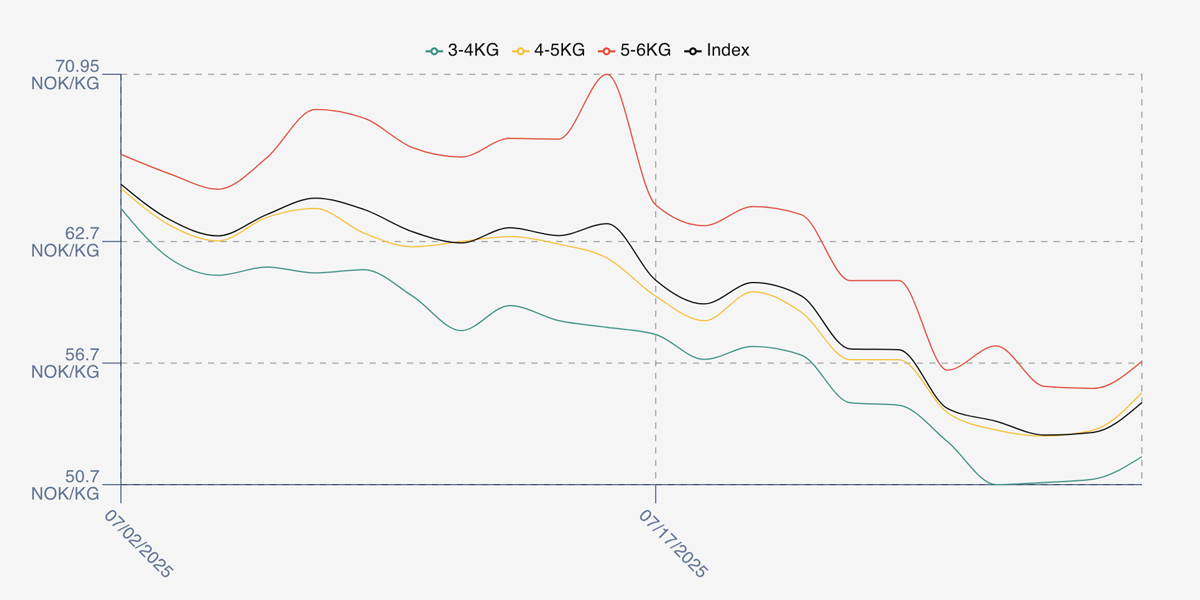

The LFEX Norwegian Exporters Index for Week 31 2025 ended the week DOWN -2.64 NOK / -4.60% to stand at 54.75 NOK (in EUR terms 4.64 / -0.19 / -3.95%) FCA Oslo Week ending Thursday vs previous Thursday.

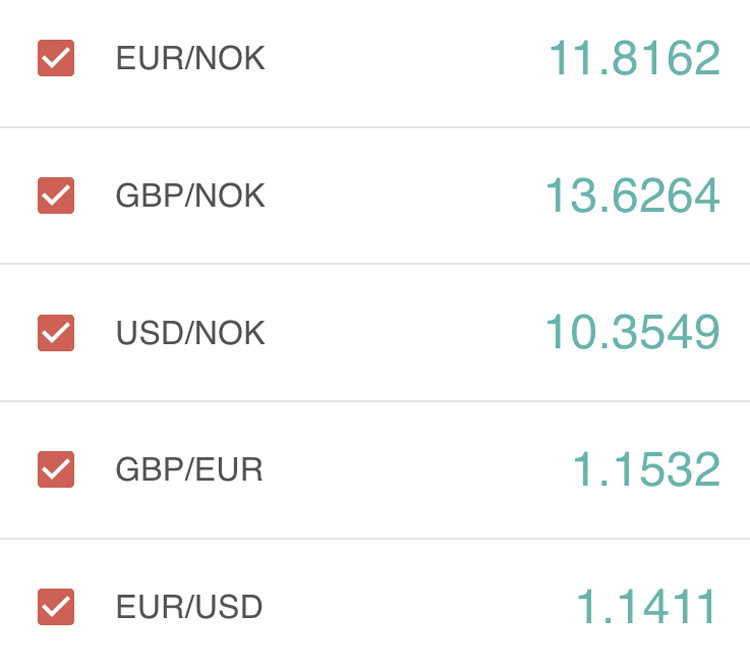

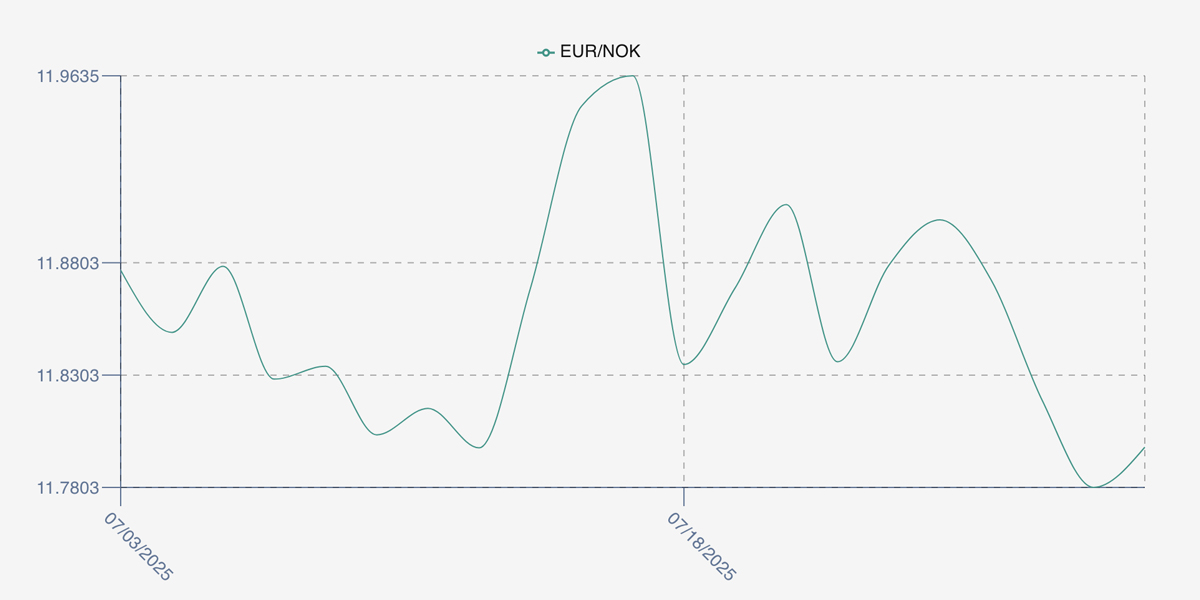

The NOK rate ended DOWN at 11.80 (-0.08 / -0.67%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future September was reported DOWN Thursday to Thursday at 5.25 EUR, (-0.30 / -5.41%) approximately 61.95 NOK.

The Last Week

A low priced week, the lowest the index has priced since September 2021. After a weak week in week 30, the offered index opened down last Friday at 54.46 a drop of over 5% on the day for week 31 deliveries. Monday didn’t see any respite lower again at 53.83, and an index low was found on Tuesday at 53.15. In reality Wednesday was flat – 53.28 only up small based on 4-5s edging a little higher. Relief came on Thursday as all weight classes (3-6), and the index closed up, 1.5 NOK at 54.75, but still an overall loss for the week of nearly 5%. Lots of fish, not much demand from a hot Europe on holiday.

FX rate opened at 11.90 a small rise on the prior day and then gave back the prior week’s gains, back down to 11.78 on Wednesday before steadying to close at 11.80.

Spreads on the index have pulled in slightly to 4.5 NOK with 3-4s showing a low of 50 NOK during.

Next Week

Indications this week see the index holding and showing a small increase from where we left off last week with the week opening indicative offered around the 55.5 NOK level Oslo FCA. Strong volumes coming through for this time of year in the build up to the usual summer peaks. Same story with Europe – hot and holidays. Additional US tariff is noted as disappointing.

Spreads between 3/4s to 5/6s continue to sit around 4 NOK.

EUR NOK FX rate popped up after lunch by 0.05 from yesterday at 11.85 this afternoon. This would give an indicative Euro index price around 4.68 on offered levels later Friday.

Volumes – Fresh Export

Volume figure for week 30 (2025) was 26,055 tons up 4,069 as compared to 21,986 in 2024. Volumes for week 31 and week 32 (2024) were 22,624 and 20,669 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 32 2024 ended the week FLAT with no change to stand at 74.22 NOK (in EUR terms 6.26 / + 0.03 / +0.51%) FCA Oslo. The NOK rate ended down, at 11.85 to the Euro. The Fish Pool future August was reported down – 3.50, -4.49% at 74.50 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 31st July, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

If you have a certain amount of inventory and want to sell at a target price you can manage this on the system.

If you know how much you want to move, at what price and which potential customers you want to sell it to – you can configure this in seconds on the system. You can then manage this in real-time, chip away at the orders but always in control of where you are at. You can use the chat facility to engage with and encourage customers around your offer.

FAQ’s

Q. Does salmon trade like other commodities?

A. The salmon market trades fundamentally like every other commodity market. We have seen and continue to see significant volatility in many agricultural commodities.

Markets and platforms help both buyers and sellers, in periods of high or low volumes find price levels and trading partners, and provide the mechanism to connect, engage, and execute. Because markets are fluid and supply and demand ebb and flow it pays to be connected, present and involved. The more activity placed on an electronic market, the better and more useful data can be produced, with improved and accessible transparency helping you and your business.