The London Fish Exchange

Data / Market Insight / News

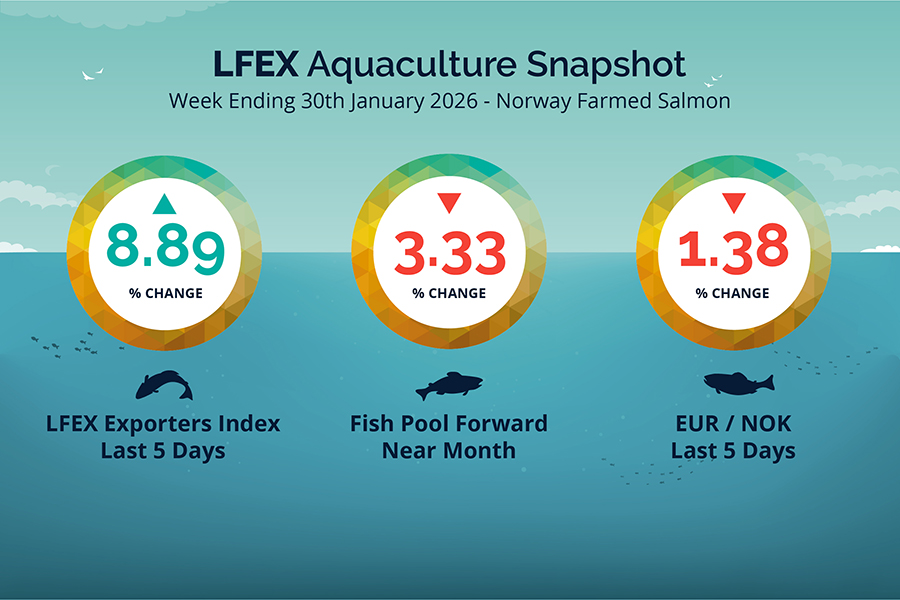

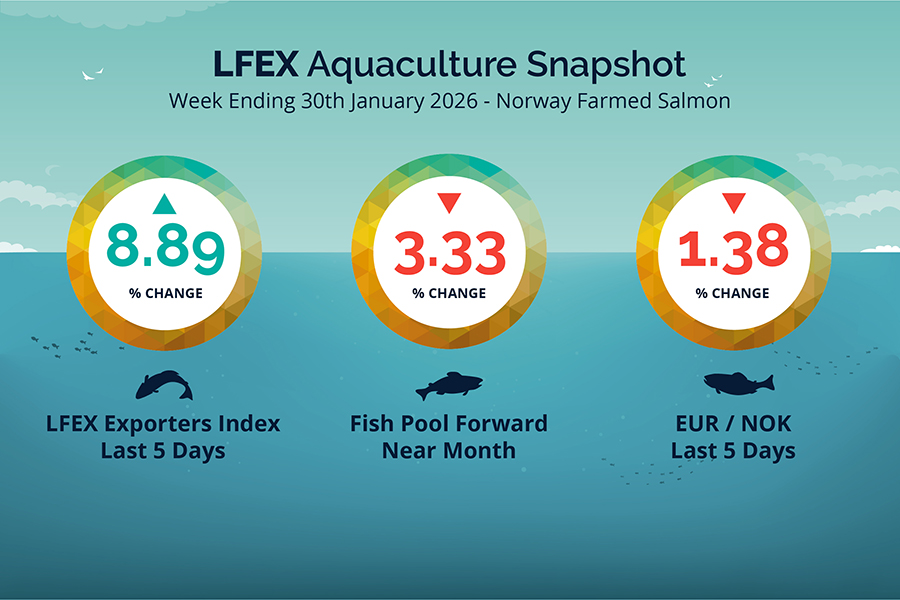

LFEX European Aquaculture Snapshot to 30th January, 2026

|

|

Published: 30th January 2026 This Article was Written by: John Ersser |

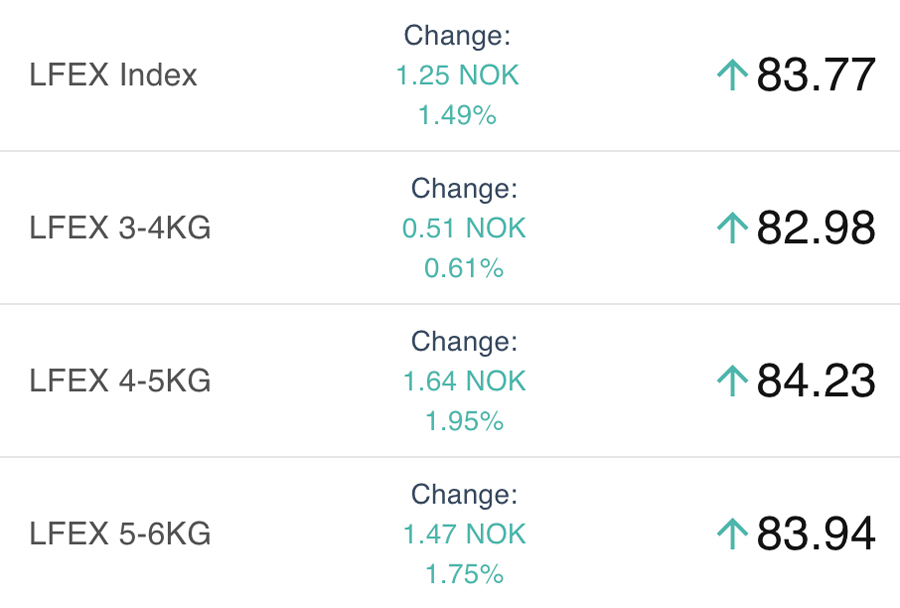

The LFEX Norwegian Exporters Index for Week 5 2026 ended the week UP +6.85 NOK / +8.89% to stand at 83.94 NOK (in EUR terms 7.36 / +0.69 / +10.41%) FCA Oslo Week ending Thursday to Thursday (yesterday).

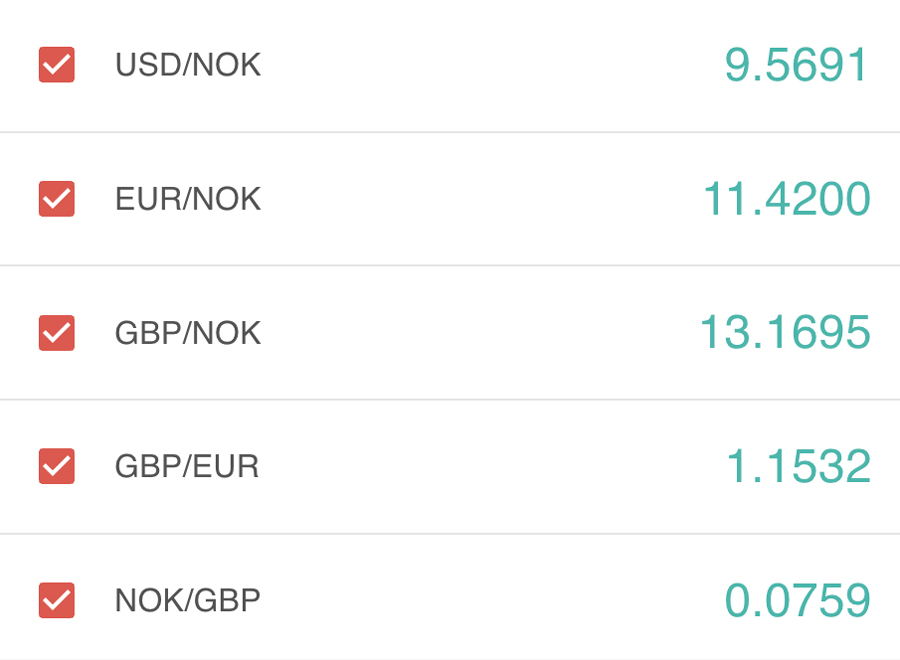

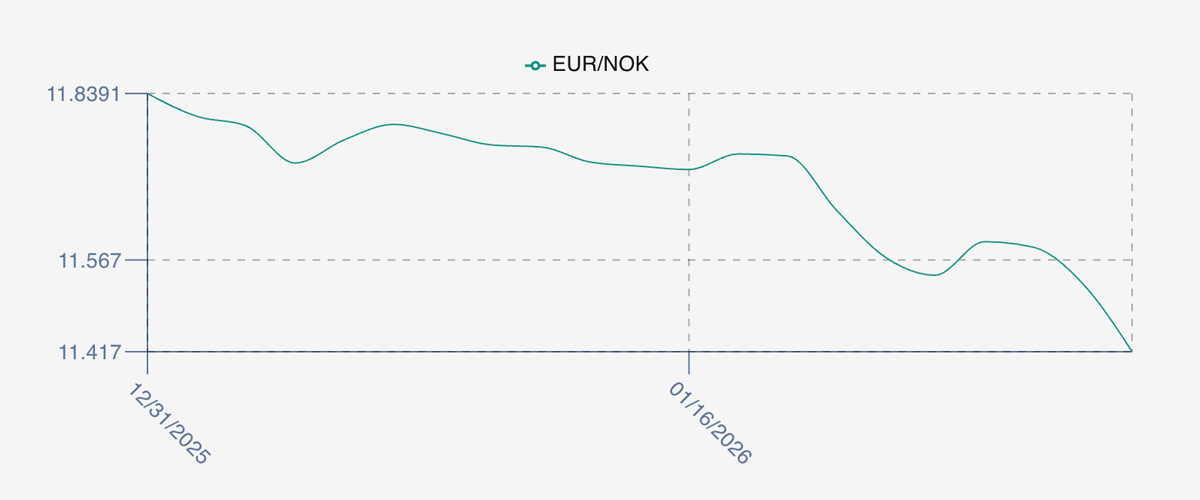

The NOK rate ended DOWN at 11.41 (-0.16 / -1.38%) to the Euro over the same period. The Fish Pool Euronext future February was reported DOWN at 7.25 EUR (-3.33% / -0.25) for the same period for comparison with March showing 8.35.

The Last Week

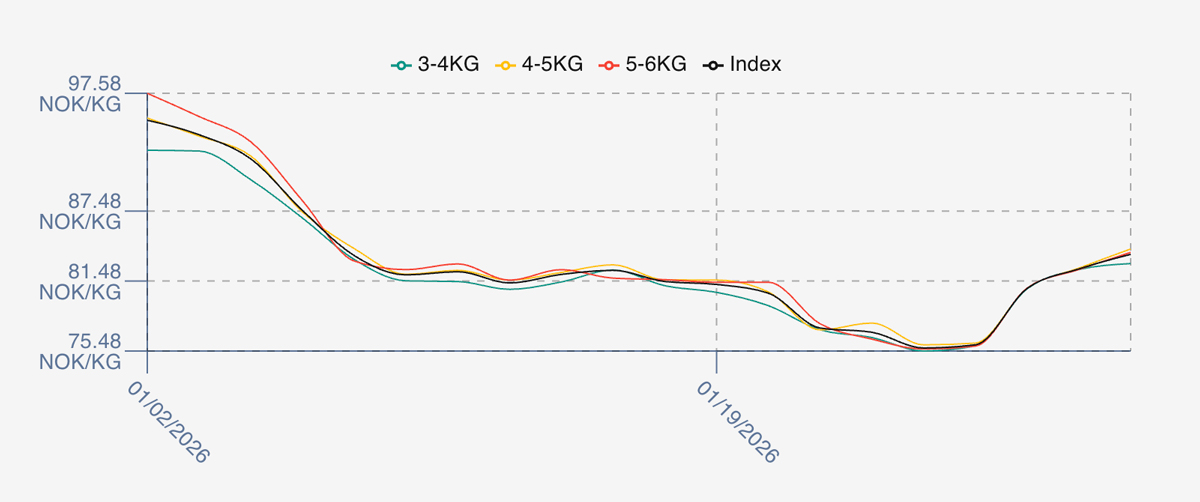

A change in direction. Week 5 saw prices recover, bouncing off of the lows created last Friday of 75.74 offered. Last Friday open was 1.35 NOK lower than the prior week close and that coming off of a downward pricing week. Monday held on as we saw the graph plateau. Anyone buying early in the week did well. Tuesday saw a strong bounce up nearly 5 NOK to 80.85, Wednesday 82.52 and the week closed on the high at 83.94. Bottom to top 8.2 NOK up or 10.8% as prices corrected. Less volume available second half on the week pushed up prices, linked to concerns over the weather reducing supply, and impending demand from Asia.

The FX rate saw a lot of volatility this week, ranging from 11.61 and bottoming at 11.37. The end of week rate we took at 11.41 on Thursday, but the EURO weakness overall has been evident.

Spreads have remained super tight, with nothing really between the 3 classes, save that 5/6’s have still been coming in cheaper than the 4/5’s.

Next Week

Early indications showing prices around the 90.9 NOK level for the index as we head into the new week. That puts us UP 6.5 NOK from Week 5 close yesterday of 83.94, and a significant 15 NOK since this time last Friday. Prices are up on the strength of the upcoming Chinese New Year with good volumes heading East, large fish being sold in that direction which has helped, and potential concerns of cooler waters reducing fish growth. Currency weakness is making fish more expensive in Euro and Dollar terms reducing US demand, which is also dealing with the impact of tariffs.

Spreads are sitting small around 0.75 NOK 3-6s, with 5-6s now higher again.

The EUR NOK FX rate is this afternoon hovering around the 11.39 level and has been volatile, but sentiment has weakening. This would give an indicative Euro index price around 7.98 EURO on offered levels Friday.

Volumes – Fresh Export

Volume figure for week 4 (2026) was 20,924 tons UP 5,360 tons as compared to 15,564 in 2025 some 34.4 % HIGHER. Volumes for week 5 and week 6 (2025) 16,370 and 15,184 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 5 2025 ended the week down -5.1 NOK / -5.50% to stand at 87.67NOK (in EUR terms 7.45 / -0.45 / -5.66%) FCA Oslo. The NOK rate ended up +0.02 NOK /+0.17% at 11.76. The Fish Pool Euronext future February was reported down Thursday at 8.97 EUR, March showing 9.20 Euro.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 30th January, 2026 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

Even when you are not in the office you can keeping a proper track on everything you do?

The system is designed to be there for you 24 x 7, no matter where you are or what time zone you are in you will be able to access the platform and communicate, place orders or make offers or execute trades. You can log in remotely and securely from any location, see the most recent data and offers.

The system has been designed to ensure you never miss an opportunity and sends notifications to users (SMS and Email) of events affecting you even when not logged in. We also provide access to the LFEX Mobile APP should you not have access to a computer or WiFi, and real-time LFEX Chat services. Whether you are away from the desk, office or country, at an Expo or on holiday you will always have everything you need to optimise your business.

FAQ’s

Q. After I have executed transactions on the platform can I access documentation from this order?

A. By executing on the platform you have a confirmed transaction between you and your counterparty – a fully electronically documented record of your transaction with all associated details contained in this. These details are immediately available in real-time to both parties and can be accessed whenever required.

All history is maintained within the system. Further, a full suite of documentation can then be attached to these records whether it is invoices, specifications, logistics etc making all relevant trade documentation available to both parties the instant they are uploaded / updated.