The London Fish Exchange

Data / Market Insight / News

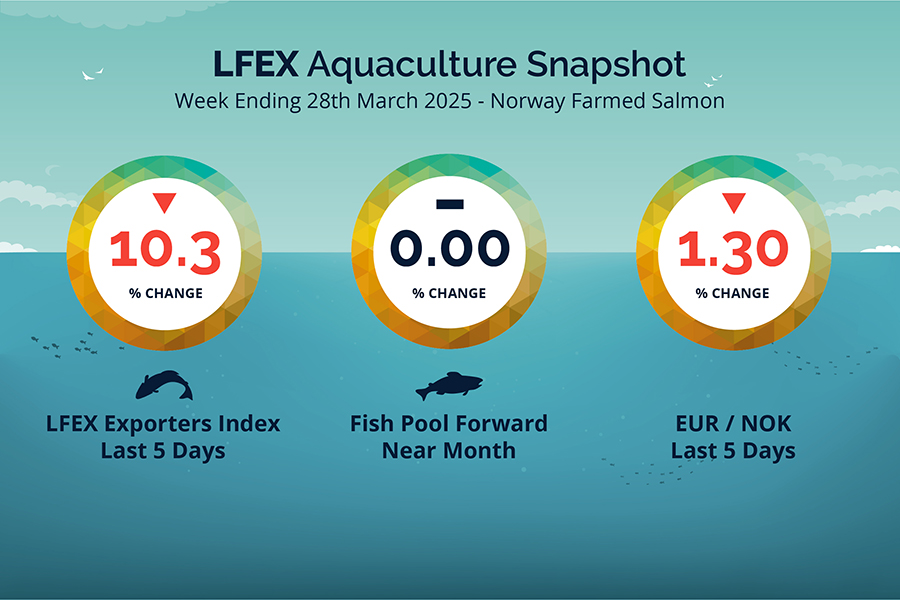

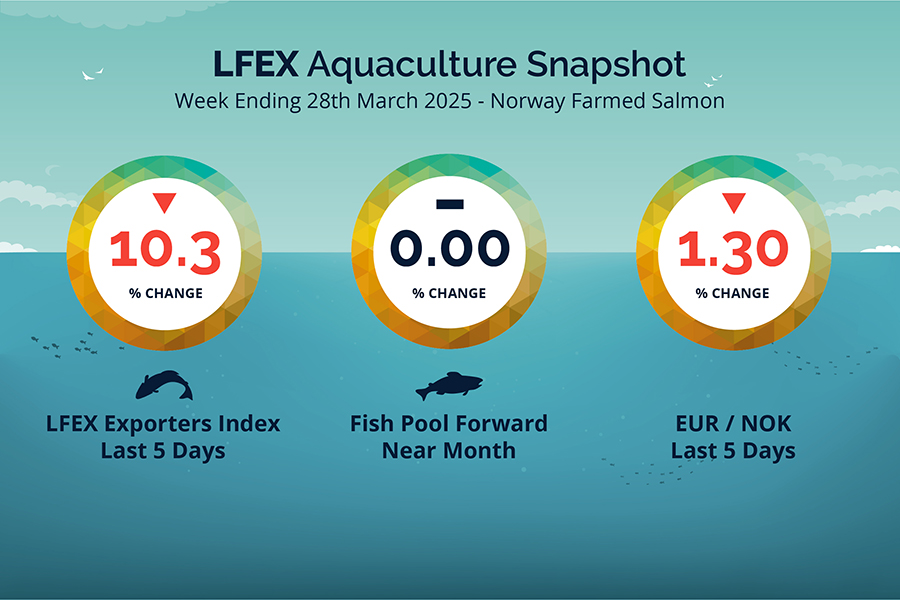

LFEX European Aquaculture Snapshot to 28th March, 2025

|

|

Published: 28th March 2025 This Article was Written by: John Ersser |

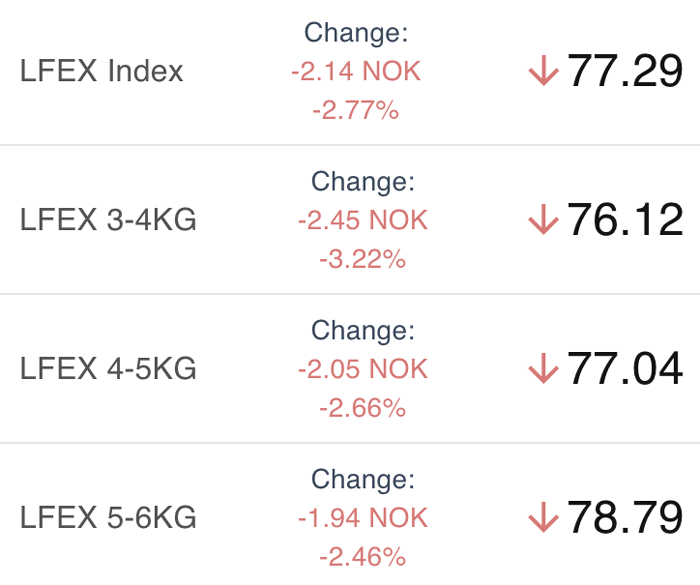

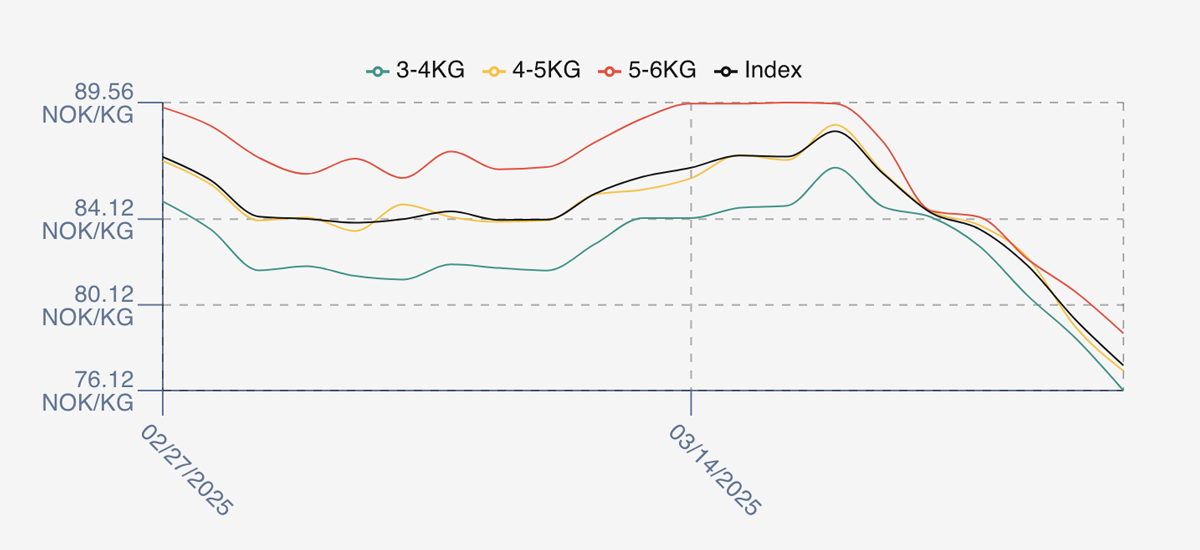

The LFEX Norwegian Exporters Index for Week 13 2025 ended the week DOWN -8.95 NOK / -10.38% to stand at 77.29 NOK (in EUR terms 6.80 / -0.69 / -9.19%) FCA Oslo Week ending Thursday vs previous Thursday.

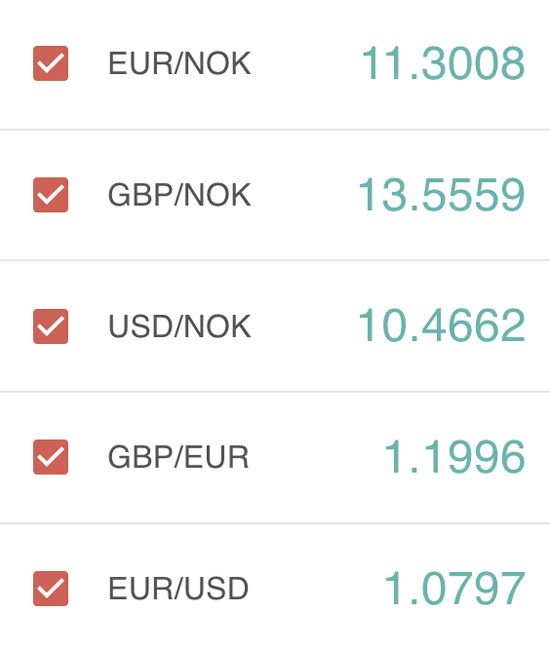

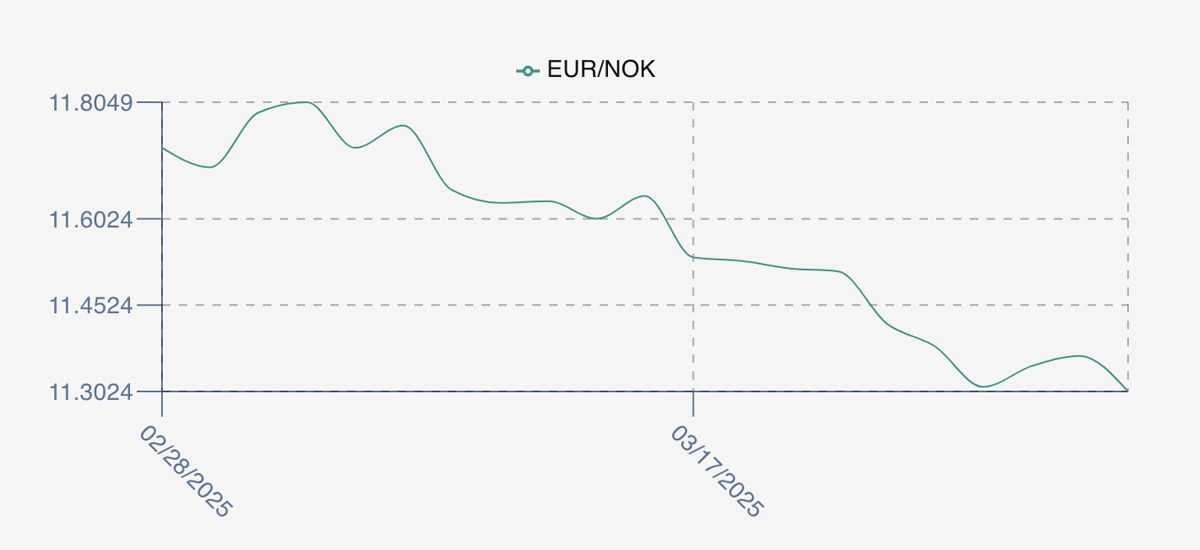

The NOK rate ended down -0.15 NOK / -1.30% at 11.36 to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future April was reported flat Thursday to Thursday at 7.15 EUR approximately 81.22 NOK, with May showing 7.80 down 0.30 approximately 88.60 NOK.

The Last Week

Pricing opened softer last week as a continuation of weaker prices. The cancellation of flights from Heathrow weighed on prices but ultimately availability of fish brought prices down. The week kicked off down around 2 NOK at 84.41 and Monday tickled down offered at 83.66. Weakness continued showing Tuesday at 81.96 and then it was downhill. 5 NOKs were lost over Wednesday and Thursday as the market closed out on the low of the week at 77.29 and crashing through the 84.03 support level.

Total spreads between sizes 3/4s and 5/6s were crushed on Friday with little difference between the sizes. This has opened up to 2.5 NOK by the end of the week.

The EURNOK FX rate also saw one directional movement as the rate dropped from 11.41 on Friday to 11.36 on Thursday.

Next Week

Early pricing indications from exporters for next week are coming around the 73.2 NOK level offered for the index. This is down over 5 NOKs from Thursdays close. A massive turnaround from last year when prices were at the 140 levels – and it’s all about volume – there is a lot of it coming through and a lot of big fish (6+). Hopes for an Easter bounce look unlikely at the moment as the market struggles to deal with the (unplanned) volumes.

Spreads are showing around 2.5 NOK currently going in to the new week.

EUR NOK FX rate has continued to fall showing 11.32 this afternoon. This would give an indicative Euro index price around 6.46 on levels later Friday.

Volumes – Fresh Export

Volume figure for week 12 (2025) was 18,272 tons up 4,833 as compared to 13,493 in 2024. Volumes for week 13 and week 14 (2024) were 9,512 and 11,675 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 14 2024 ended the week up +1.72%, +2.37 NOK to stand at 140.46 NOK (in EUR terms 12.12) FCA Oslo. The NOK rate ended down at 11.59 to the Euro. The Fish Pool future April was reported up +2.50 NOK, +2.15% at 119.0 NOK.

David Nye’s technical analysis report will be published this Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 28th March, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The London Fish Exchange works 365 days, 24/7!

Let the LFEX work for you. It never needs an afternoon off, or a day off, or holiday (although you can access it on your vacation). It can help your company buy or sell efficiently and in a cost effective manner. Make offers or requests 24 hours a day. Let the LFEX be a key member of your team.

FAQ’s

Q. How can I know where my fish are from?

A. Provenance and specifications documentation are supported order by order.

As provenance and certifications become more important to buyers, it is imperative that the supporting documentation can be made available down to the individual order/trade level. The system supports Fish CV’s, certification documentation and detailed product specifications to ensure that you have all the required documentation and can evidence these materials for counterparty auditing, internal reporting and third-party auditing – all instantly available within your organisation.