The London Fish Exchange

Data / Market Insight / News

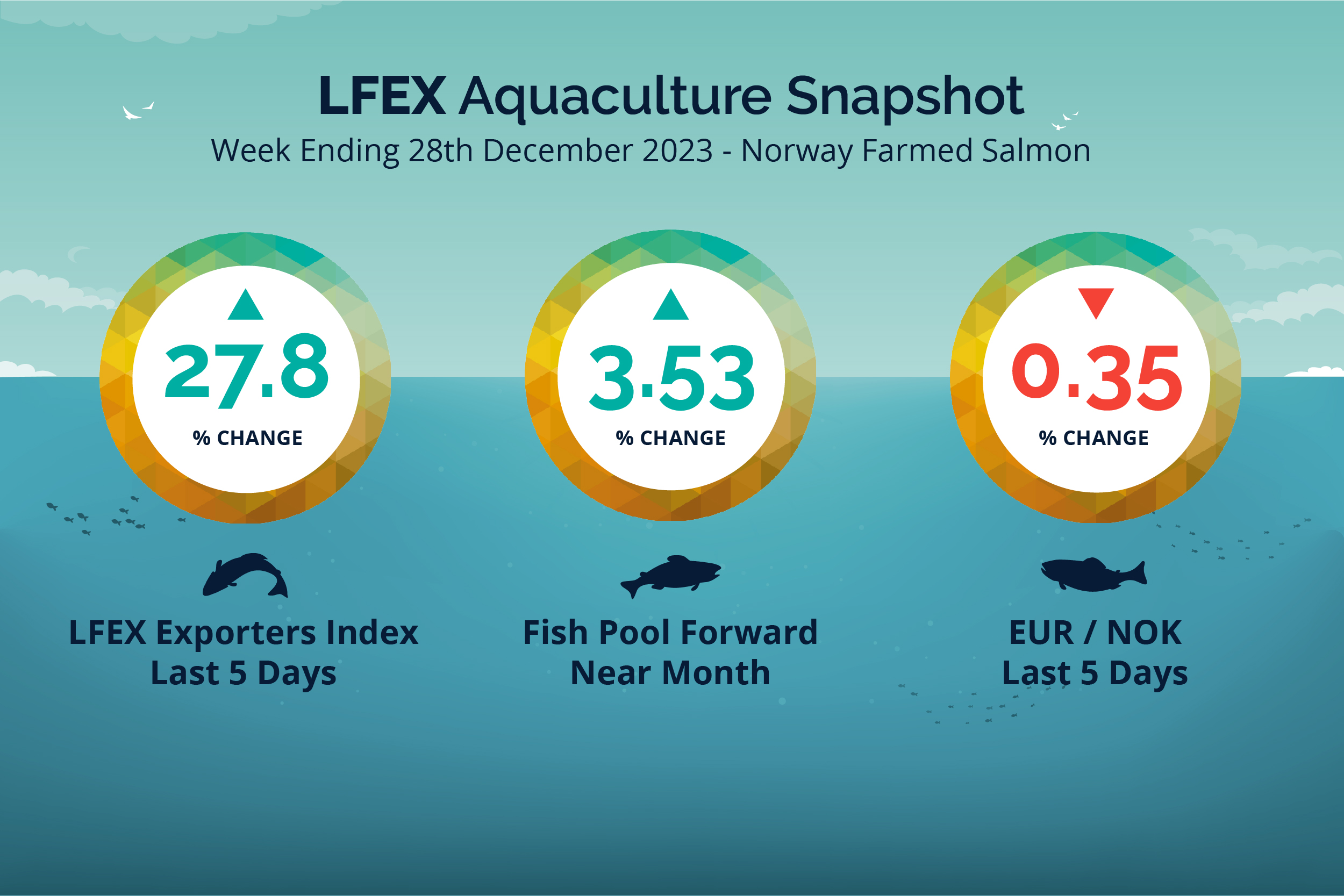

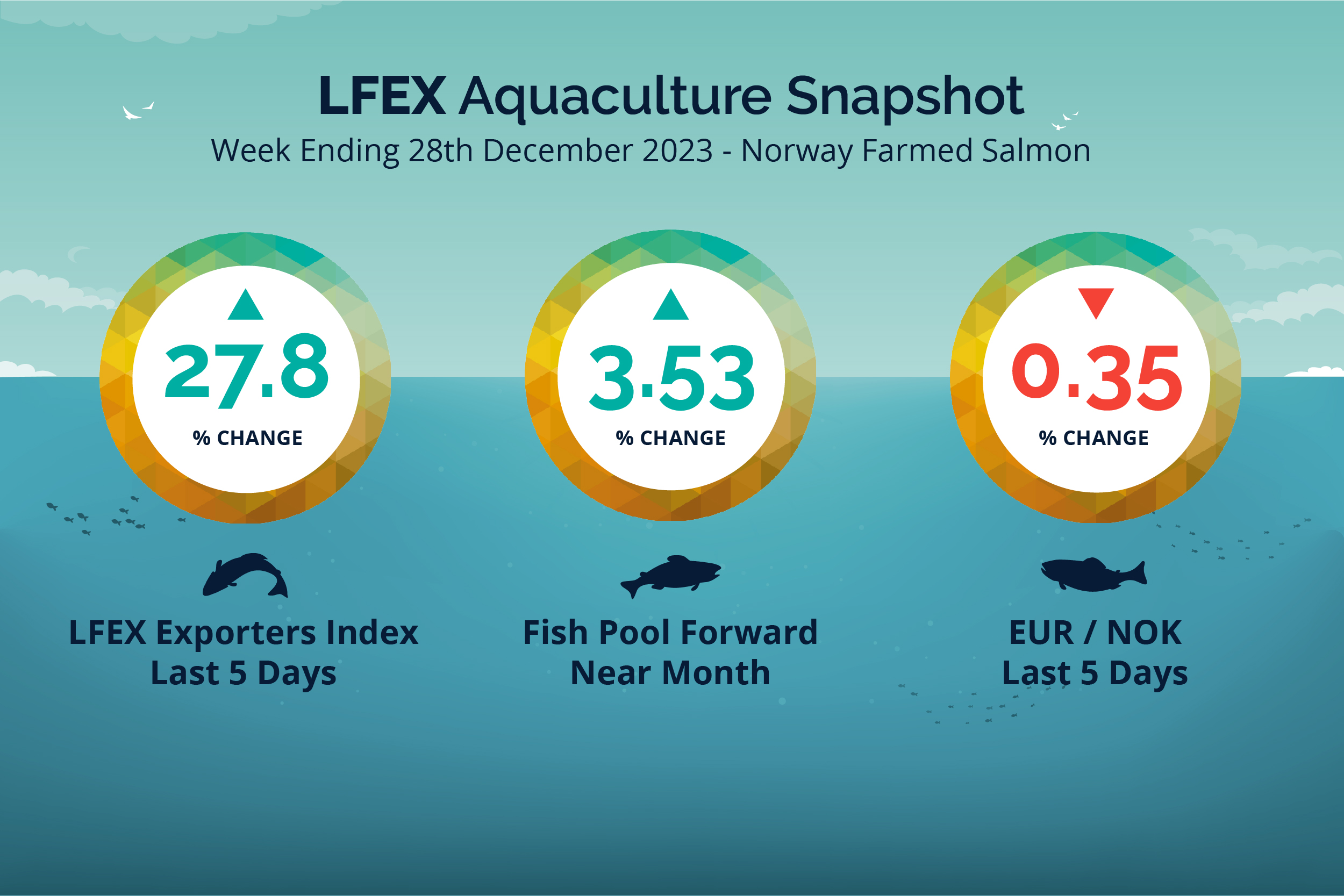

LFEX European Aquaculture Snapshot to 28th December, 2023

|

|

Published: 29th December 2023 This Article was Written by: John Ersser |

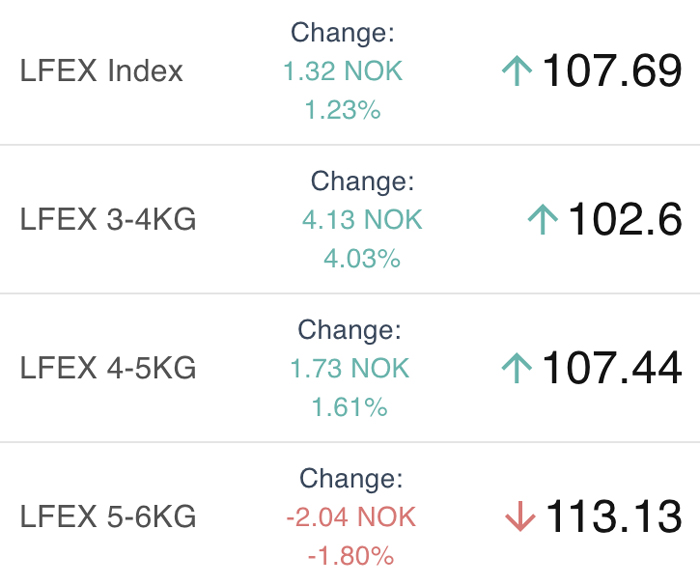

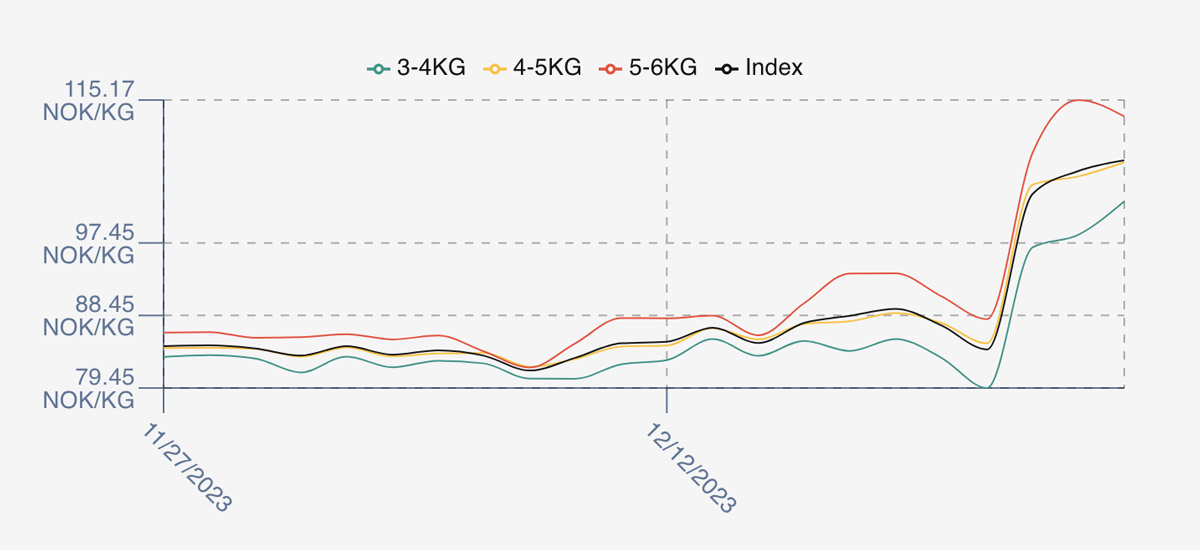

The LFEX Norwegian Exporters Index for Week 52 2023 ended the week up +27.85%, +23.46 NOK to stand at 107.69 NOK (in EUR terms 9.56 / +2.11/ + 28.31%) FCA Oslo Week ending Thursday vs previous Thursday.

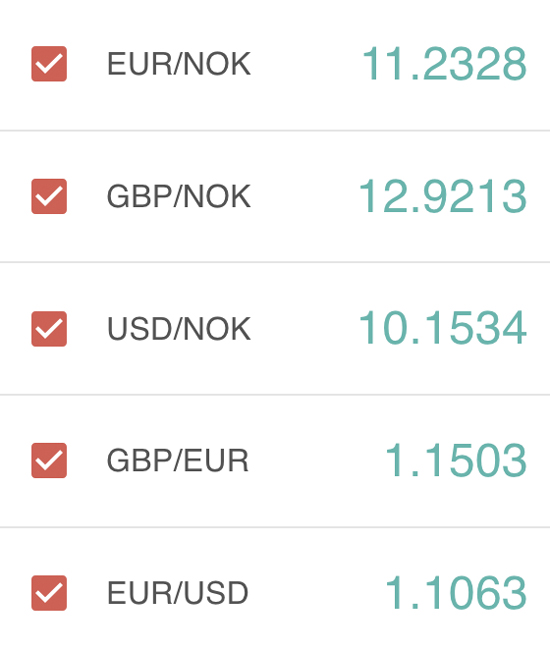

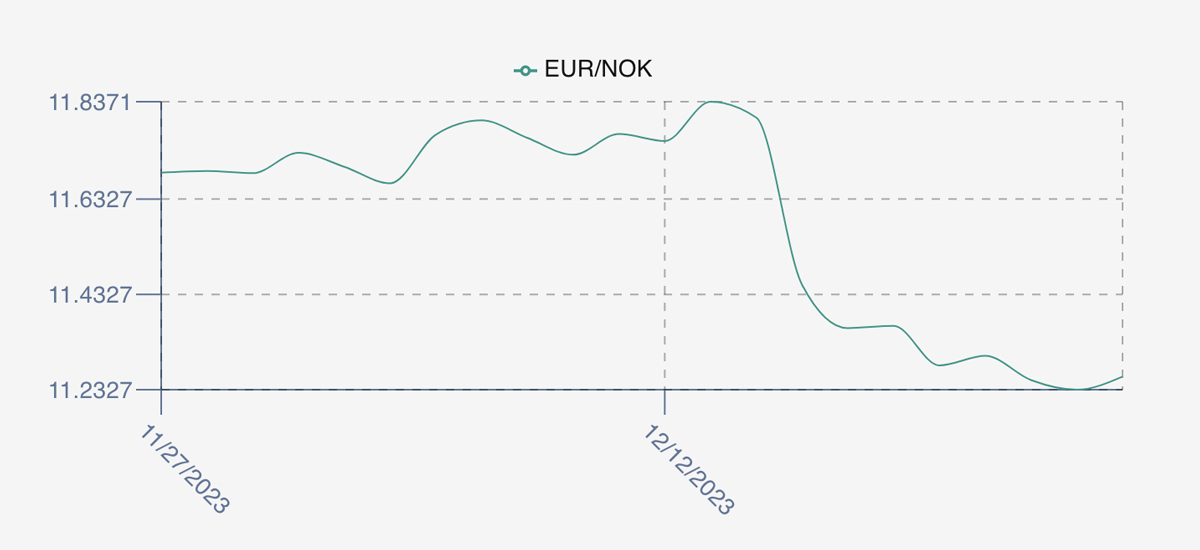

The NOK rate ended down at 11.26 to the Euro over the period Thursday to Thursday -0.04 NOK or -0.35%. The Fish Pool future December was reported up + 3.00 NOK, +3.53% at 88.0 NOK with January showing 105.2.

The index price opened on Friday at 103.55 NOK / +18.66 %, +19.32 NOK one of the biggest 1 day percentage and absolute gains Thurs to Friday we have ever seen as prices were pushed up through Friday trading – we indicated up 15 NOK by midday. A short Christmas week saw prices continuing to move up with Wednesday 27th at 106.37 and Thursday at 106.69. A reduction of harvest days combined with demand provided the backdrop. Currency was flattish over the week, but still added to a further strengthening in EUR terms to a +28.3% rise on the week. Pricing didn’t necessarily follow through during the week at least in the UK (although there is of course some lag) with retail buyers able to purchase whole salmon at £6 /kg discounted by 50% for smaller fish. Next week lower harvests – however there has been emergency packing of smaller fish due to jellyfish. It maybe a week of two halves, but it looks like it will start high around the 120 NOK levels. Pricing will be published later today.

As a comparison week 1 ’24 – last year – saw the price close at 89.92 a 3.62% rise that week, at a NOK rate at 10.7. The FP future for January 24 was showing 89.8. David Nye’s technical analysis report will be published later next week.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 28th December, 2023 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

We wish everyone a happy, healthy and successful 2024.

We look forward to working with you to further digitise the markets, offer more services and deliver more data to make 2024 the best yet for pricing access and transparency and efficiency of process to users globally. With best wishes from the team at LFEX.

FAQ’s

Q. What happened to the Composite Index last week based on the gains last Friday?

A. The Composite Index displacement didn’t change much with a 18.3% rally from last Friday’s close. The Composite Index did break above the purple down sloping trendline that the Composite Index has been using as resistance for a few weeks. The Composite Index does not have much history at its current displacement but there is history of making turns at slightly higher displacement levels. The good news for the bulls is the Composite Index has plenty of room to move to higher displacements. I still believe the Olso FoB Index is going to higher prices (…and it did). The Oslo FoB Index was up 23.9% on Friday. That’s a big move and the Oslo FoB Index could take some time digesting its gains in price or time or both.