The London Fish Exchange

Data / Market Insight / News

LFEX European Aquaculture Snapshot to 28th August, 2025

|

|

Published: 30th August 2025 This Article was Written by: John Ersser |

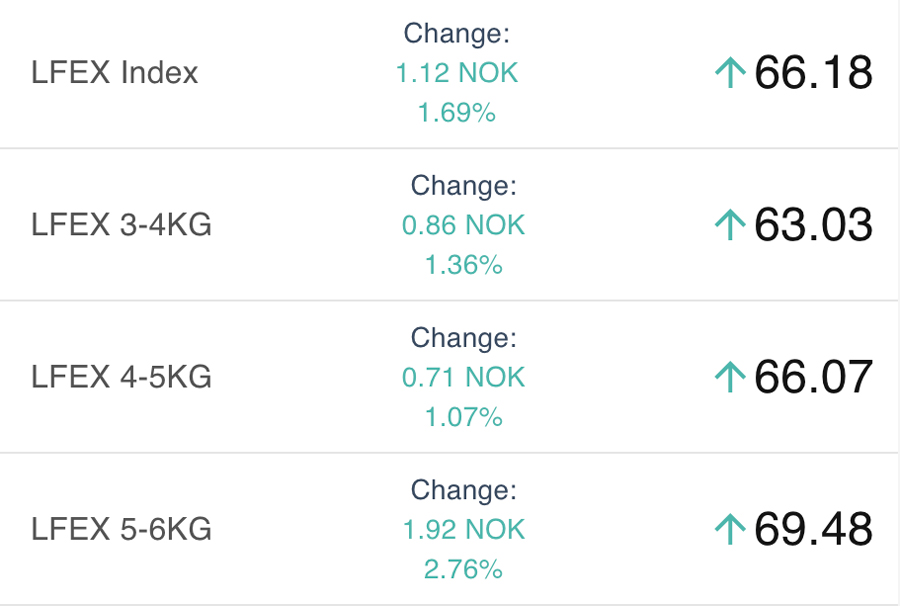

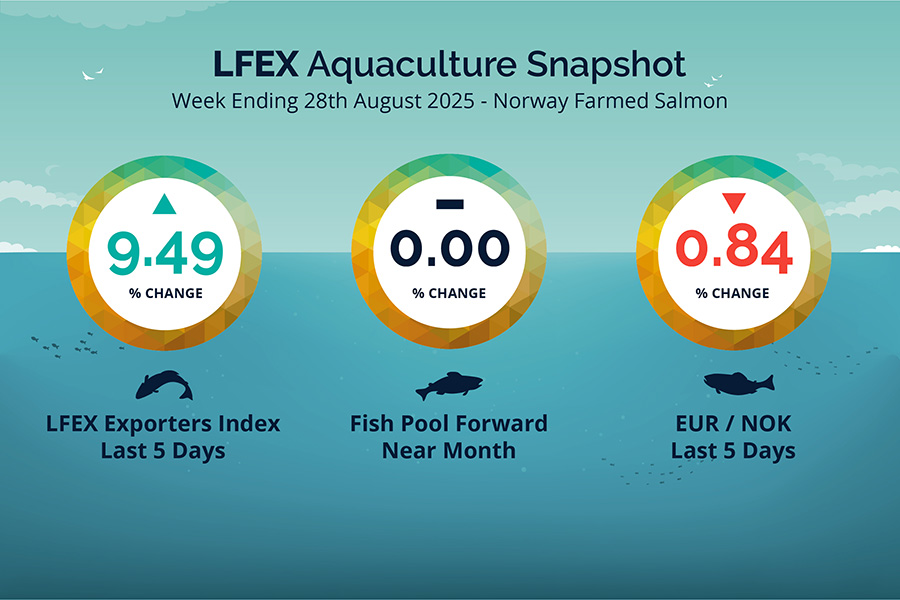

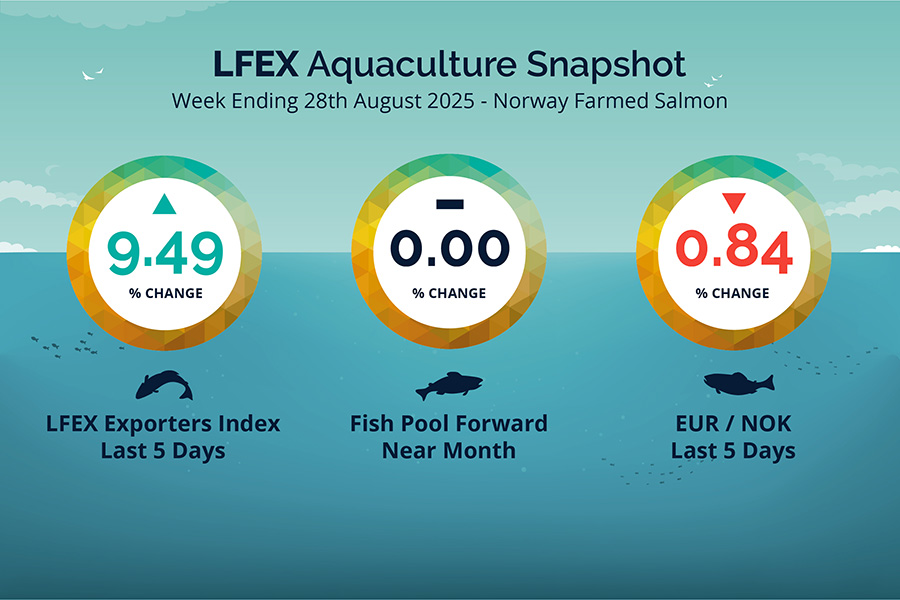

The LFEX Norwegian Exporters Index for Week 35 2025 ended the week UP +5.64 NOK / +9.49% to stand at 65.06 NOK (in EUR terms 5.53 / +0.52 / +10.42%) FCA Oslo Week ending Thursday vs previous Thursday.

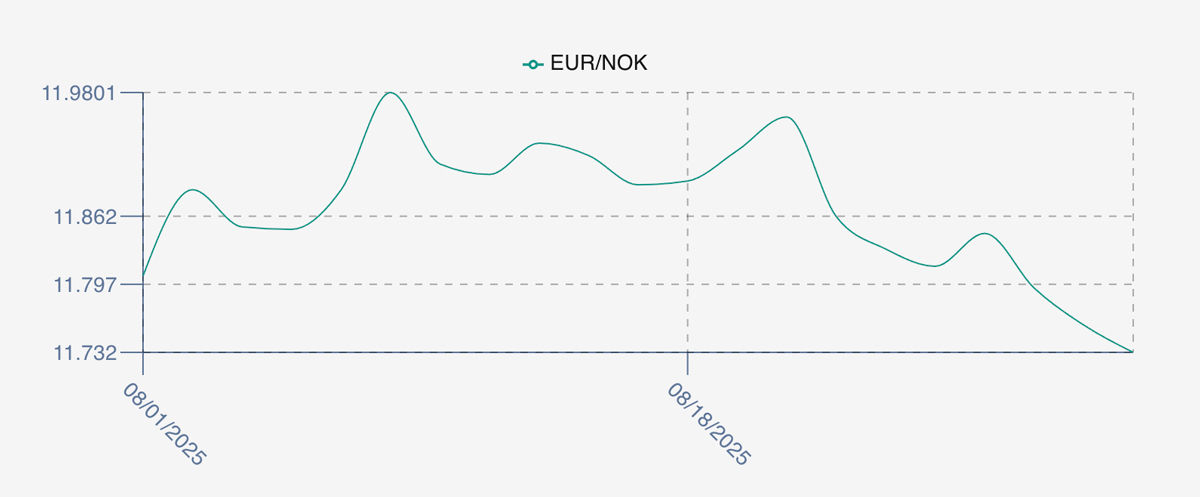

The NOK rate ended DOWN at 11.76 (-0.10 / -0.84%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future September was reported FLAT Thursday to Thursday at 4.90 EUR, (0.00 / 0.00%) approximately 57.62 NOK with October showing 5.20 also flat.

The Last Week

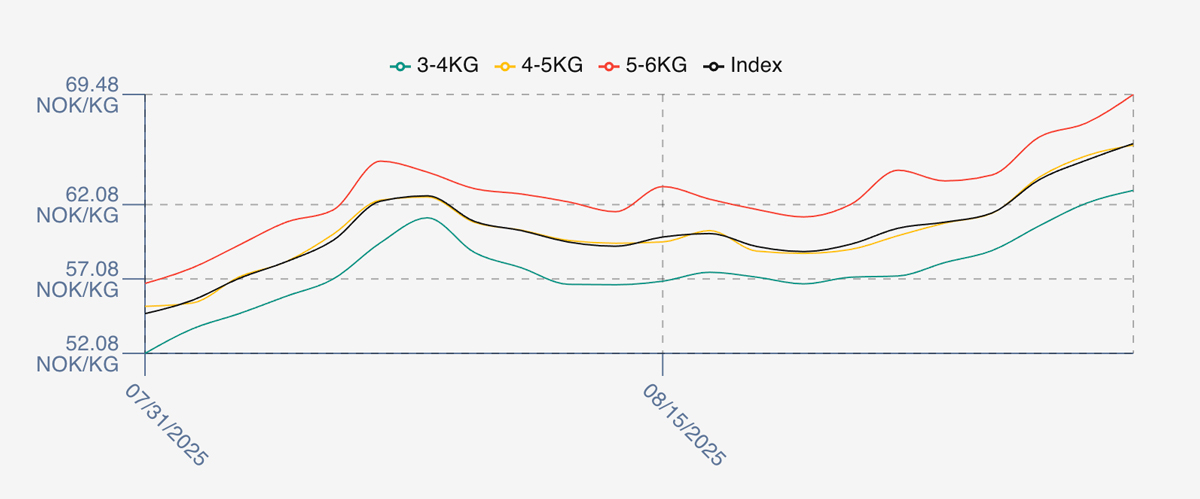

A rising market. Despite the large volumes going through this week the market was a one direction market heading north. Prices opened nearly a NOK stronger from the previous close at around 6.5 NOK or nearly 2%. Monday and Tuesday edged up a collective 1 NOK further 61.52, and we really saw the market kick off Wednesday and Thursday 63.75 and 65.06 respectively for a one-way traffic week.

Readers might want to re-view David’s technical analysis report from last week which contained some interesting views based on the signals from the analysis.

FX rate opened at 11.83 on the Friday a fall of 0.06 as we entered the week, and apart from a blip on Tuesday to 11.84 the rate tracked down to close out at 11.76, approximately 1% top to bottom.

Spreads on the index again have averaged 5 NOK over the week 5-6s slightly higher.

Next Week

Indications this week see the index will be a little further up from last weeks close with an indication of indicative offered levels around 66 NOK. Bigger sizes continue to have more strength. Lots of volume going through and buyers have been using the low prices to freeze inventory. To be seen how this continues as prices have risen in the last 3 days of trading.

Spreads between 3/4s to 5/6s have increased to sit around 6.5 NOK weighted in favour of the larger 5/6s.

EUR NOK FX rate is softer again this afternoon with rates around 11.735. This would give an indicative Euro index price around 5.62 on offered levels later Friday.

Volumes – Fresh Export

Volume figure for week 34 (2025) was 28,180 tons up 3,938 as compared to 24,242 in 2024 some 16% higher. Volumes for week 35 and week 36 (2024) were 25,506 and 26,416 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 36 2024 ended the week up +1.41 NOK / +1.99% to stand at 72.41 NOK (in EUR terms 6.145 / + 0.04 / -0.69%) FCA Oslo. The NOK rate ended higher at 11.78 to the Euro. The Fish Pool future September was reported down -1.10 NOK / – 1.54% at 70.4 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 21st August, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The LFEX RFQ allows users to make offers and requests for forward orders not just the current week?

If a customer has a specific need for inventory at a specific day / week in the near future this request can be put up – for example a short-term campaign. Likewise, if a seller wants to secure some early sales (especially in a falling market) they can put up offers for that date / following week. The system also offers contracts trading for multi-leg orders.

FAQ’s

Q. After I have bought on the platform do I get a confirmation?

A. When executing on the platform you and your counterparty both receive an instantaneous confirmation of the transaction between you. The system creates a fully electronic documented record of your transaction with all associated details contained in this. These same details are immediately available in real-time to both parties and can be accessed whenever required. All history is maintained within the system and can be searched by any parameter of the trade.