The London Fish Exchange

Data / Market Insight / News

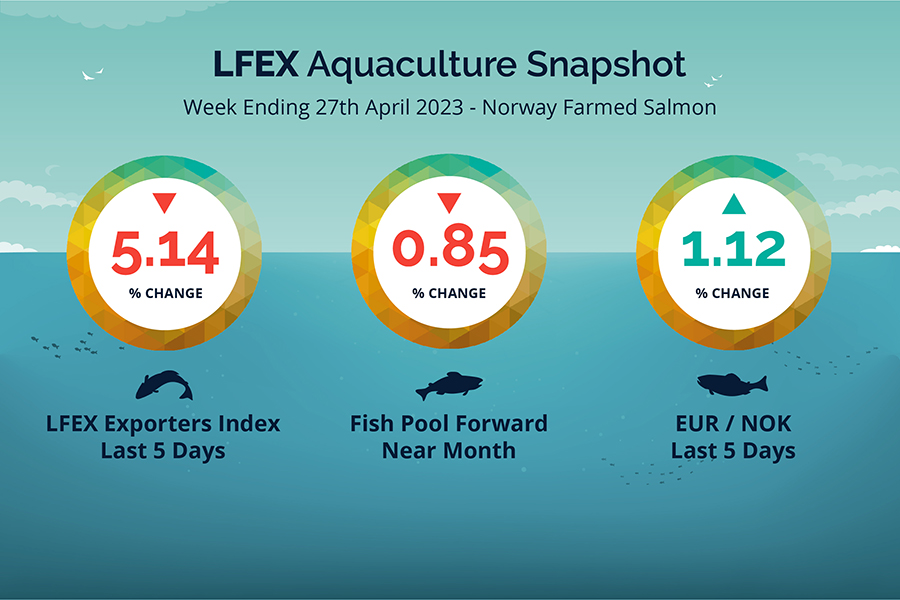

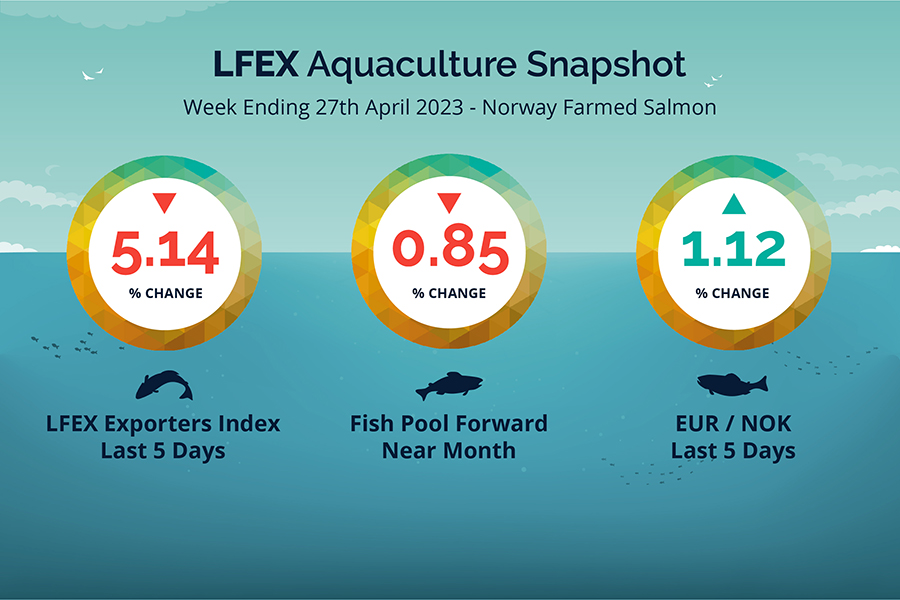

LFEX European Aquaculture Snapshot to 27th April, 2023

|

|

Published: 28th April 2023 This Article was Written by: John Ersser |

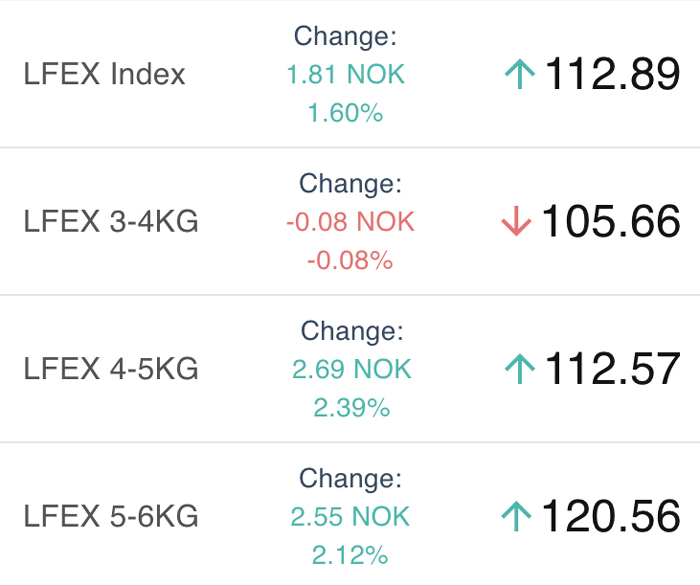

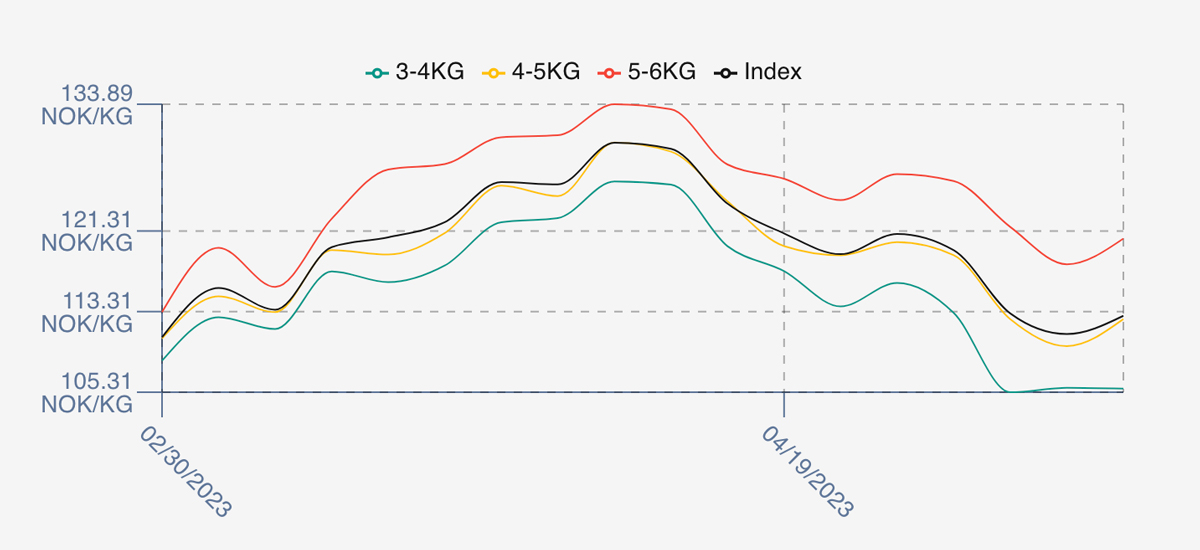

The LFEX Norwegian Exporters Index for Week 17 2023 was overall down -5.14%, -6.12 NOK to stand at 112.89 NOK FCA Oslo Week ending Thursday vs previous Thursday.

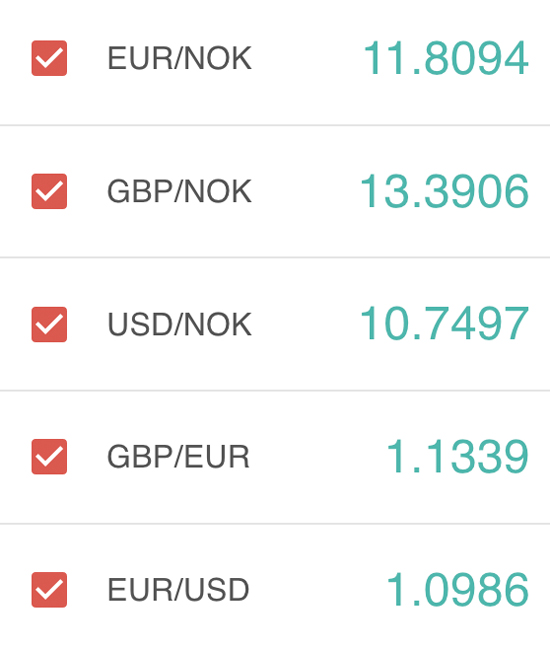

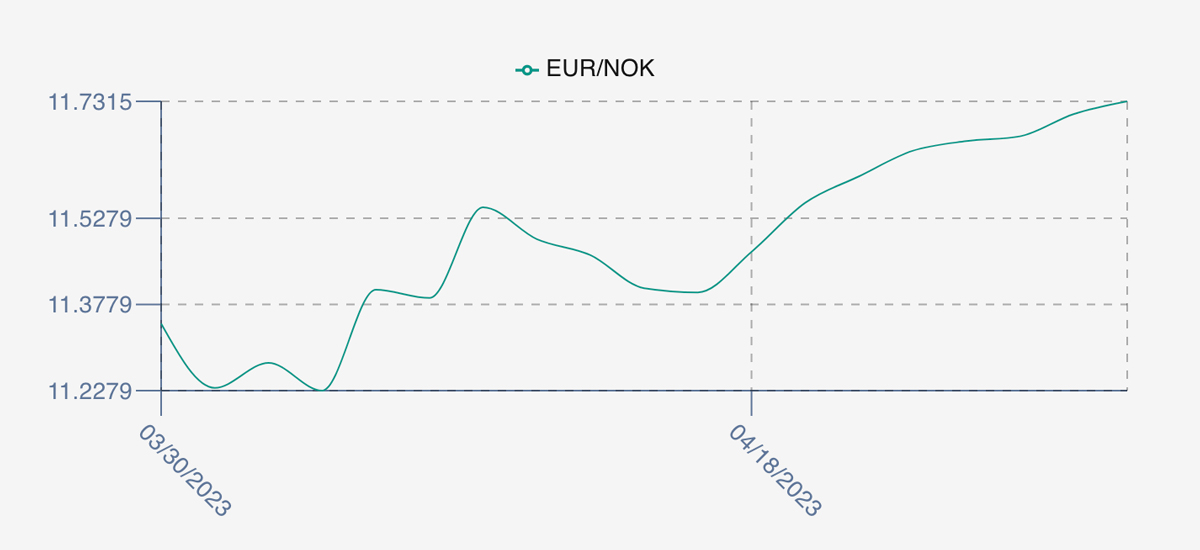

The NOK rate was up at 11.73 to the Euro over the period Thursday to Thursday +0.13 NOK or +1.12%. The Fish Pool future April was reported lower at 117.0 NOK down -1.00 NOK or -0.85%, with May showing 112 NOK.

The market opened in positive territory +2.01 NOK stronger at 121.02NOK last Friday to start WK17 pricing. Monday saw this given back at 119.4, and prices then found weakness at 113.12 on Tuesday and 111.08 on Wednesday before holding firmer to close out the week at 112.89 NOK. A slightly complicated week with more volume and Barcelona Expo. NOK weakness continues which makes buying in EUR cheaper. Good availability of smaller fish, but 5-6’s have developed a life of their own. The spread between 2/3 and 5/6 is around a not insignificant 15 NOK (105 – 120). The market is seeing big price spreads between different sellers and pricing volatility at the moment which is causing some angst at the lack of transparency. Next week is a shorter May bank holiday week and also Constitution day in Poland. There will less fish available next week which seems to be indicating pricing remaining around the current levels.

It was great to see people this week in Barcelona, although we could have done with a lot more time. Looking forward to catching up on all the good thoughts and conversations.

David Nye’s technical analysis report will be published on Tuesday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 27th April, 2023 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

Electronic platforms perform many roles for markets and market participants.

By bringing a community together you get a much better view of available inventory (liquidity), access to more participants, more opportunity for price discovery, ability to track market pricing electronically in real-time, pre-trade checking and secure and robust confirmations between parties. They throw off mountains of data that can be used to analyse pricing, trading patterns, counterparty performance etc.

Further, they can provide a single point of connectivity for settlement and documentation and an independent and verified record of truth. They provide huge efficiencies in process, less errors, automation of orders / trading / settlement processes. They give participants the ability to access the right price for any given market condition, and free up staff time to focus on optimising business and relationships.

FAQ’s

Q. How can I optimise my sales in weeks where there may be a reduction in buyers volume?

A. Active engagement with as many counterparties as possible will help with distribution. Widening global reach would also help with this, especially if the softness is within a particular market, and funnel volume elsewhere. Proactive updating of pricing and offers will create a sense of movement in the market and spur activity, as well as targeted pricing by clients or geography. Encourage engagement with dialogue on chat and market updates and even get buyers to put up bids to you help build a better market picture.