The London Fish Exchange

Data / Market Insight / News

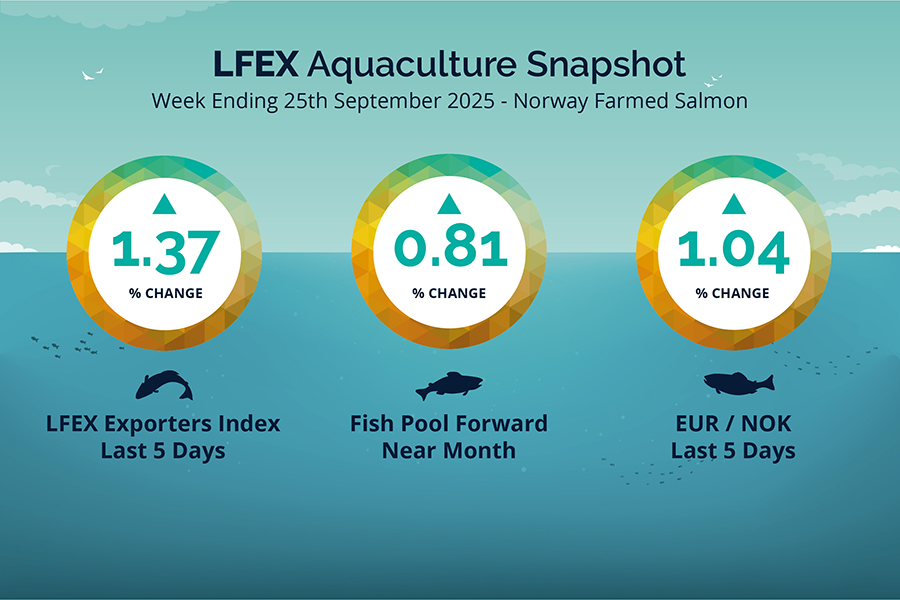

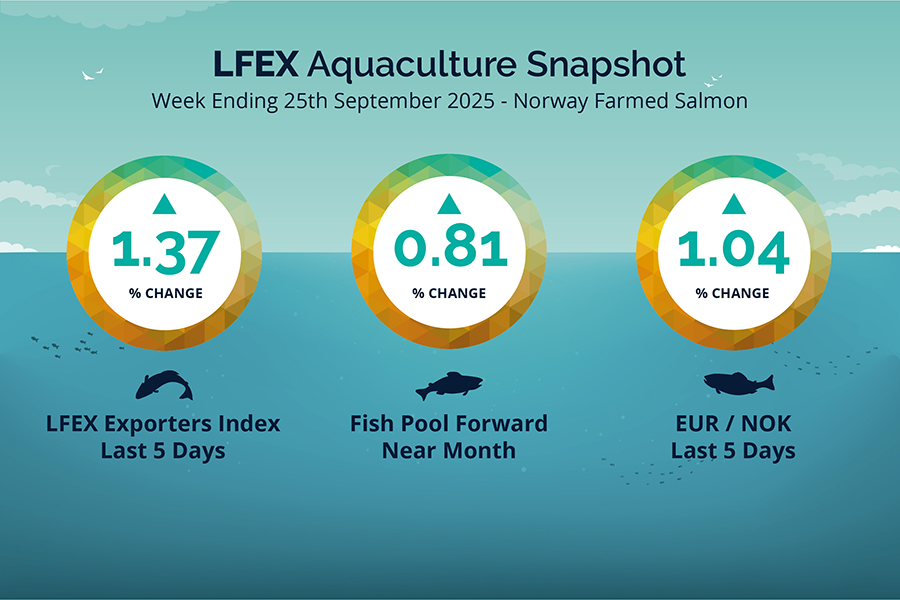

LFEX European Aquaculture Snapshot to 25th September, 2025

|

|

Published: 26th September 2025 This Article was Written by: John Ersser |

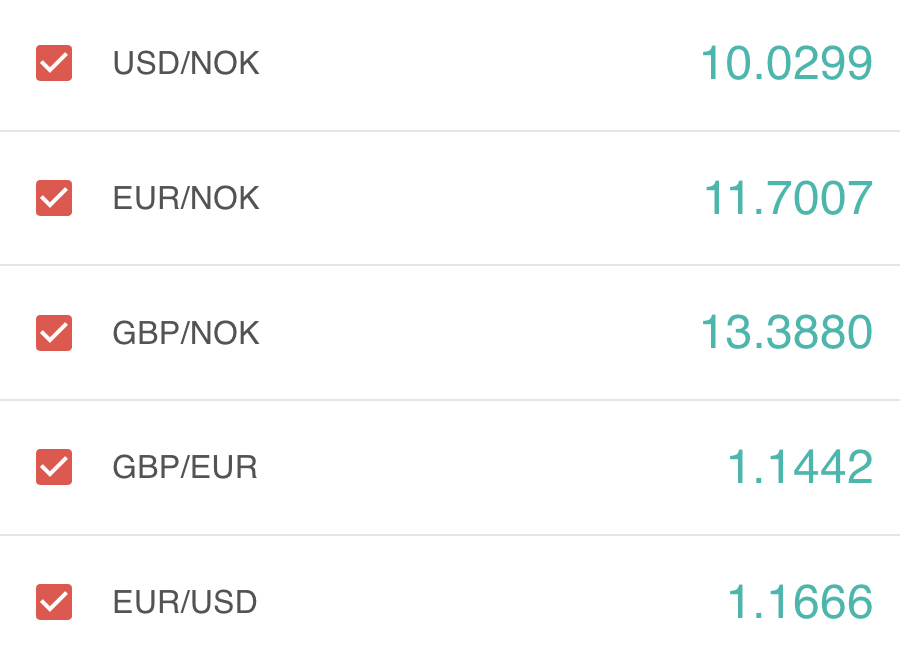

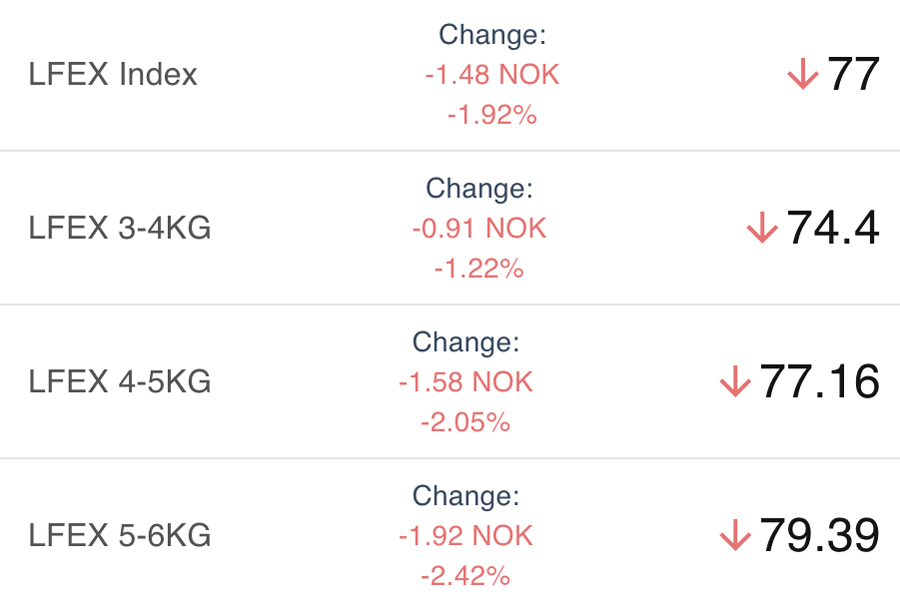

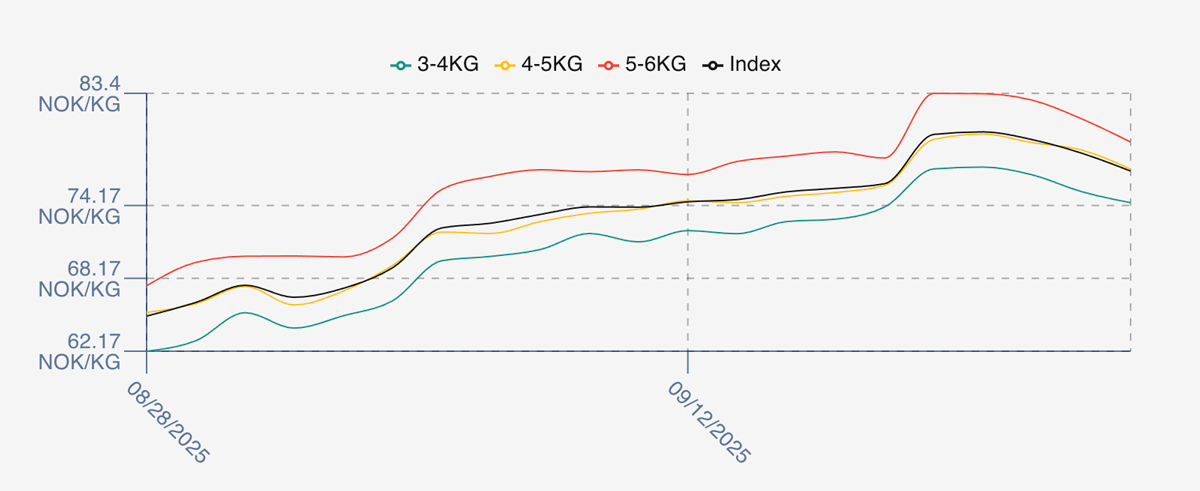

The LFEX Norwegian Exporters Index for Week 39 2025 ended the week UP +1.04 NOK / +1.37% to stand at 77.00 NOK (in EUR terms 6.59 / +0.02 / +0.33%) FCA Oslo Week ending Thursday vs previous Thursday.

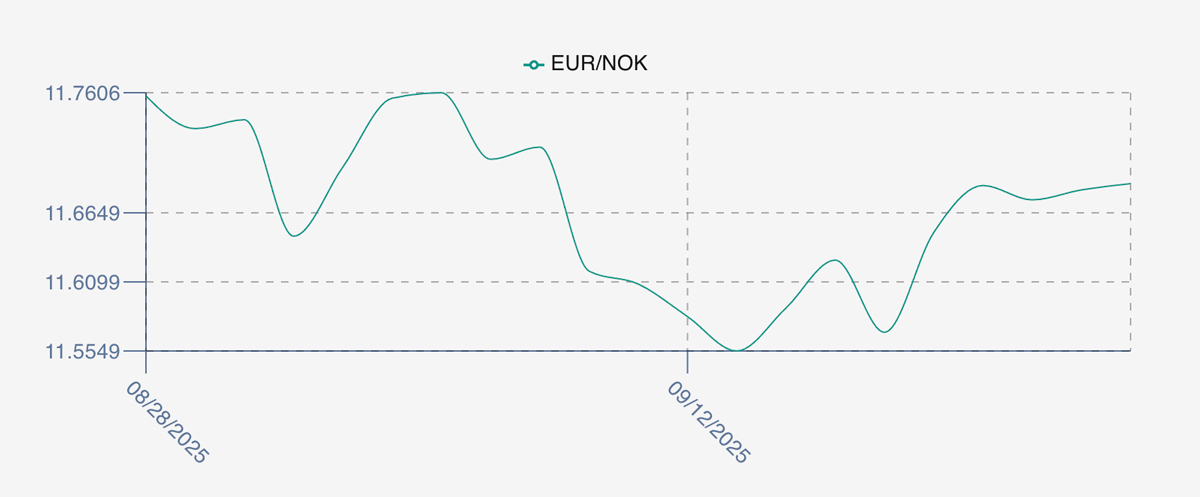

The NOK rate ended UP at 11.69 (+0.12 / +1.04%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future October was reported UP Thursday to Thursday at 6.25 EUR, (+0.05 / 0.81%) approximately 73.06 NOK, with November showing 6.45.

The Last Week

The headline rates don’t tell the story of the week. On Friday we saw the index jump up to 80.02 as prices were pushed up, a jump of 4 NOK or 5.35% from the prior week close – itself the high of a gently trading up week. Monday saw prices not only hold but edge up a further 0.22 of a NOK based on lower availability in the market. Strong prices for the time of year didn’t hold, and Tuesday gave back small at 79.5, another 1 NOK on Wednesday and fizzled lower Thursday to close the week out at 77 flat. The FX rate climbing reduced some of the impact on rising prices for Euro buyers depending on when you bought in the week – but a tough week for buyers to navigate.

FX rate opened at 11.65 on the Friday, up from 11.57 as we entered the week, and headed higher Monday to 11.69 where it sat approximately for the week.

Spreads on the index relaxing slightly this week coming in at 5 NOK.

Next Week

Initial early indications this week see the that indicative prices are pretty flat going into week 40 with the index showing around 77.75 NOK a small increase over Thursday, however, price discovery is difficult today and is one of those weeks where there isn’t a consensus and we wait to what will happen as the week progresses.

Spreads between 3/4s to 5/6s are sitting at around the 4.5 NOK level currently.

EUR NOK FX rate is flat this afternoon with rates around 11.69 after a significant rise to 11.73 in the morning. This would give an indicative Euro index price around 6.65 on offered levels later Friday.

Volumes – Fresh Export

Volume figure for week 38 (2025) was 24,495 tons DOWN 4,178 as compared to 28,673 in 2024 some 14.5% LOWER. Volumes for week 39 and week 40 (2024) were 29,238 and 26,543 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 40 2024 ended the week up +0.10 NOK / +0.14% to stand at 69.31 NOK (in EUR terms 5.91 / + 0.03 / +0.57%) FCA Oslo. The NOK rate ended lower at 11.72. The Fish Pool future October was reported down Wednesday to Thursday -1.50 NOK / -2.09% at 70.2 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 25th September, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The LFEX stores all your previous orders and transactions for immediate access to all your activity on the platform.

It also saves previous orders so that you can quickly and accurately input new orders / RFQ’s without having to constantly key in new order information and allows constant updating of these orders (price / volume etc) as the market develops, until you trade or end the RFQ.

FAQ’s

Q. Can I manage a sub-set of my client list to show prices or specific requests for prices?

A. Yes the LFEX system flexibility allows users to show interest to one counterpart, all counterparties or a specific group of counterparties that you chose. The system is built to be as flexible as possible, replicating real world processes, but automating them making it much more efficient. So, if you want to quote/target a sub-set of users because of geography / currency / inco terms etc it is easy to do.