The London Fish Exchange

Data / Market Insight / News

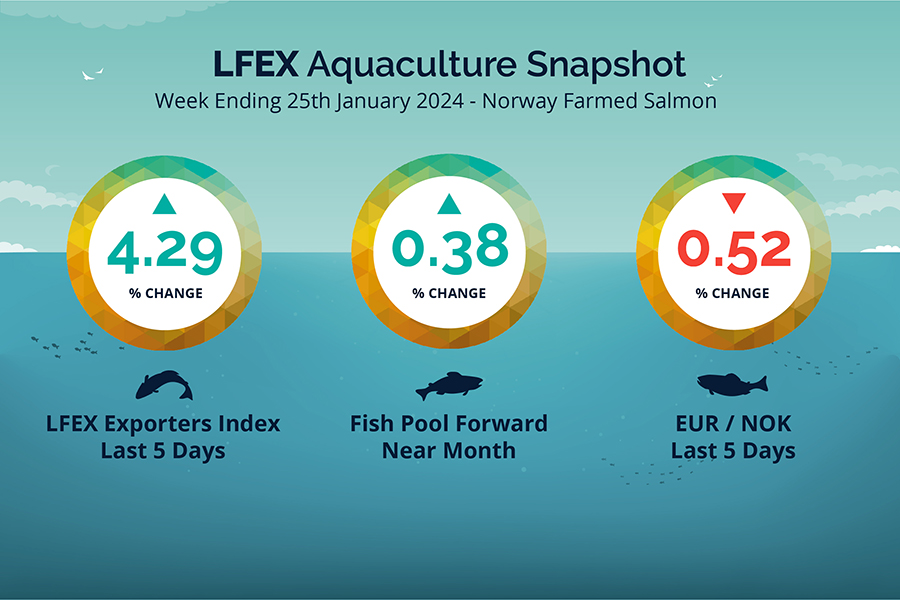

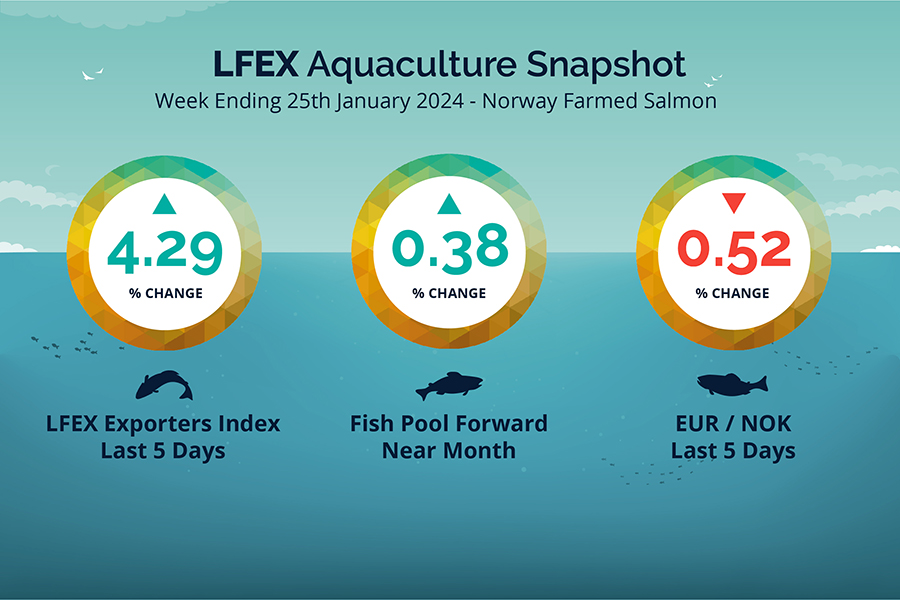

LFEX European Aquaculture Snapshot to 25th January, 2024

|

|

Published: 26th January 2024 This Article was Written by: John Ersser |

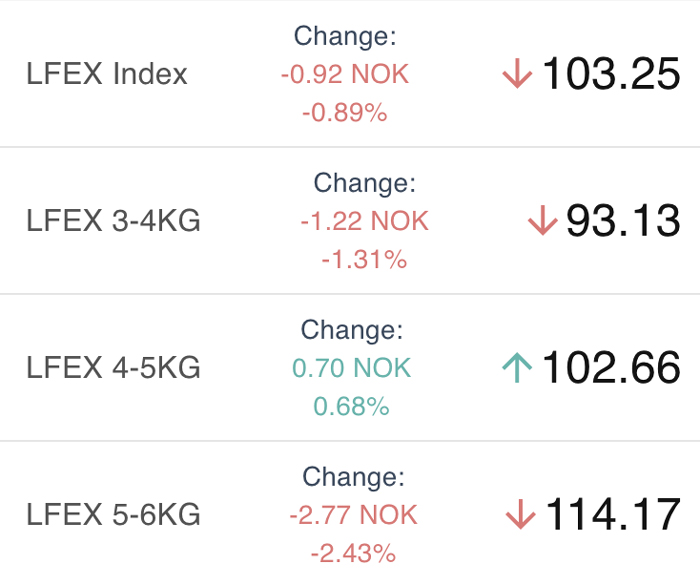

The LFEX Norwegian Exporters Index for Week 4 2024 ended the week up +4.29%, +4.25 NOK to stand at 103.25 NOK (in EUR terms 9.07 / +0.42 / +4.84%) FCA Oslo Week ending Thursday vs previous Thursday.

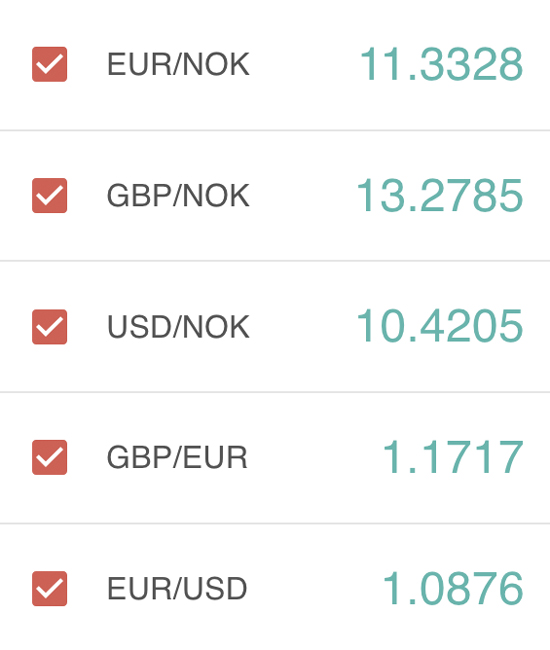

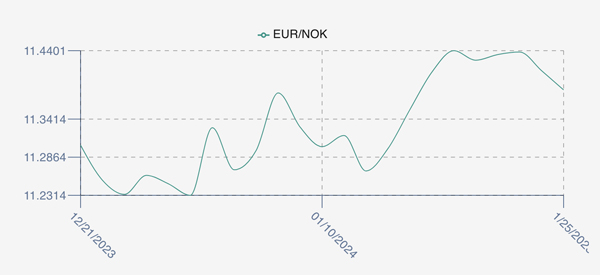

The NOK rate ended down at 11.38 to the Euro over the period Thursday to Thursday -0.06 NOK or -0.52%. The Fish Pool future January was reported up +0.40 NOK, +0.38% at 106.5 NOK.

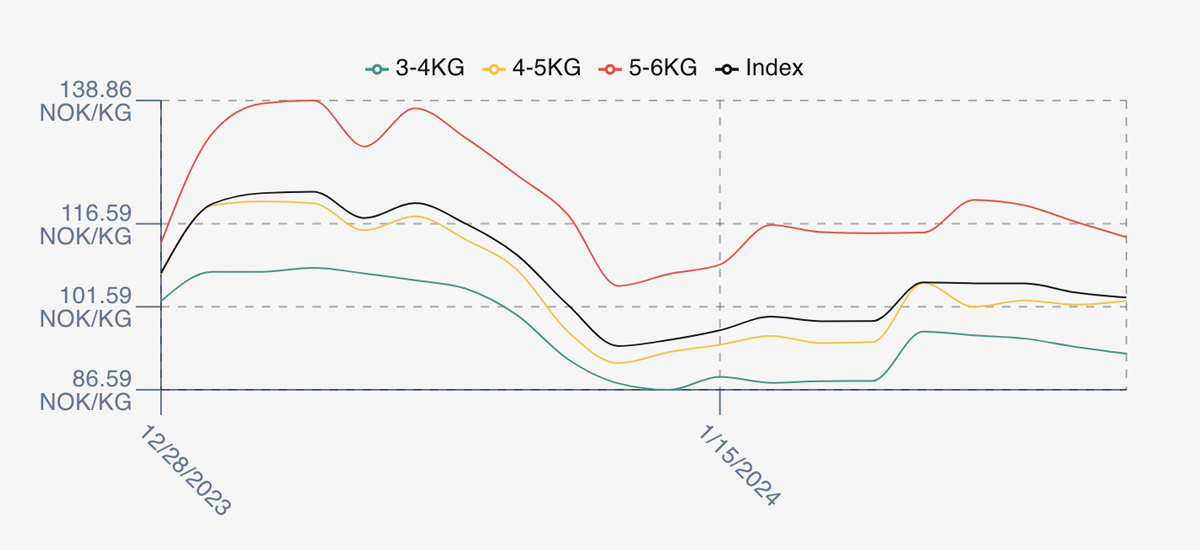

The index jumped up 6.6% on open at a level of 105.99 as the market tried to find some equilibrium after the recent weeks volatility. Friday was the high and prices were held flat Monday and Tuesday at 105.83 and 105.81, with a slight retracement to end the week. Prices in the last 4 weeks have ranged from 122 Nok to 94 Nok and heading up again, the volatility making it very difficult to accurately get a level on the market for both sellers and buyers – so a calm week was helpful.

We have observed that Price discovery is getting later in the day on Friday. If you would like to contribute or be involved in price discovery please contact Andy (mailto:a.rowell@lfexchange.com) – it’s your market and the more inputs the more representational the pricing.

Next week prices are set to increase. Lower volume availability is predicted, still a high proportion of production grade fish in the mix and the Chinese New Year which will put a further demand on bigger fish. Early estimates for the index around 109 Nok being dragged up with a 14 Nok premium between 4/5’s and 5/6s.

Volumes for week 3 ‘24 were significantly down 14,622 vs 16,564 in ‘23. Pricing for week 5 last year started at 92.81 but ended down at 87.42. There was only spot trading, Chinese New Year was already over and once the buying was done there was surplus stock in the system depressing prices that week.

David Nye’s technical analysis report will be published later next week.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 25th January, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

David Nyes report last week discussed the positive pricing momentum from both the ‘Composite Index’ and the ‘RSI’ (both technical indicators) and a bullish overview generally.

He noted that there may be some shorter term hurdles to overcome (and indicated levels that, if hit, could indicate a reverse in pricing). All worth keeping an eye on.

FAQ’s

Q. How independent are you?

A. We are based in London and have a range of different and diverse shareholders and affiliates in Europe and the US, from ex investment bankers, commodity brokers, technologists and data and market experts. LFEX is set-up to run like a regulated financial market to ensure confidence in what we do, and our technology is globally recognised as best in class.