The London Fish Exchange

Data / Market Insight / News

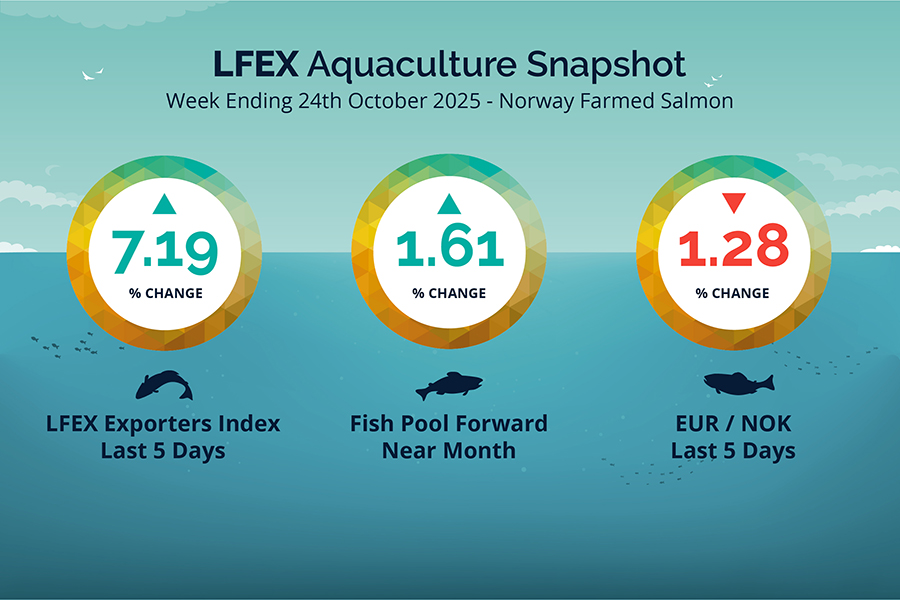

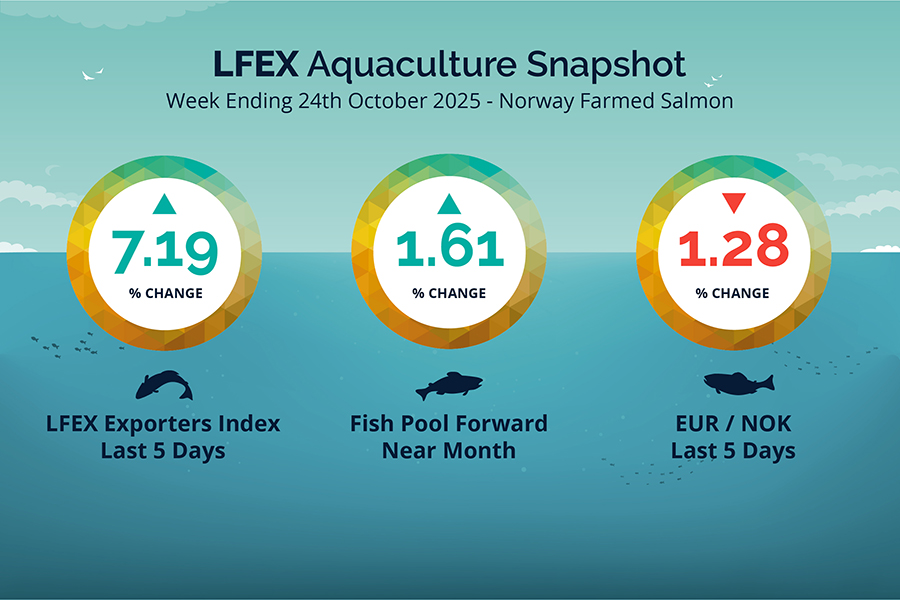

LFEX European Aquaculture Snapshot to 24th October, 2025

|

|

Published: 24th October 2025 This Article was Written by: John Ersser |

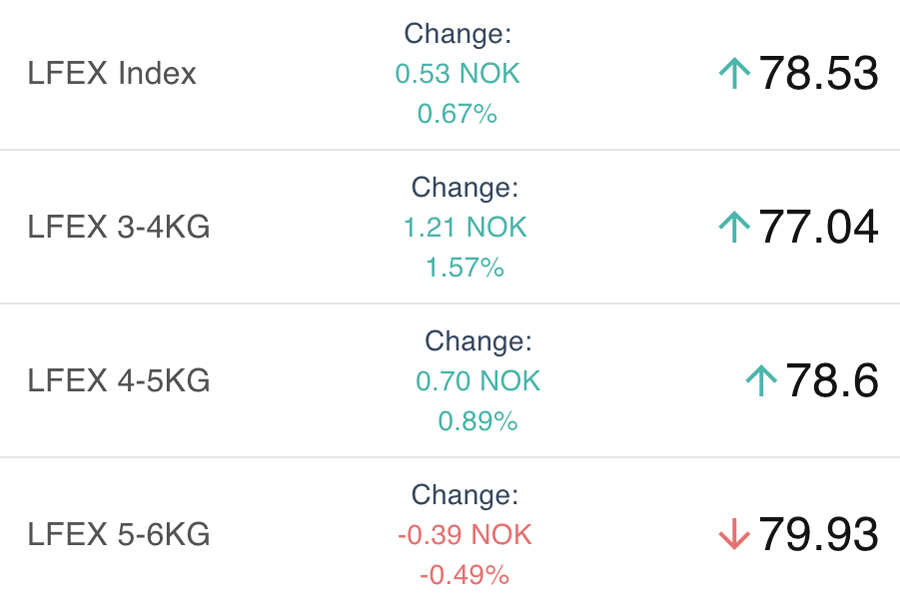

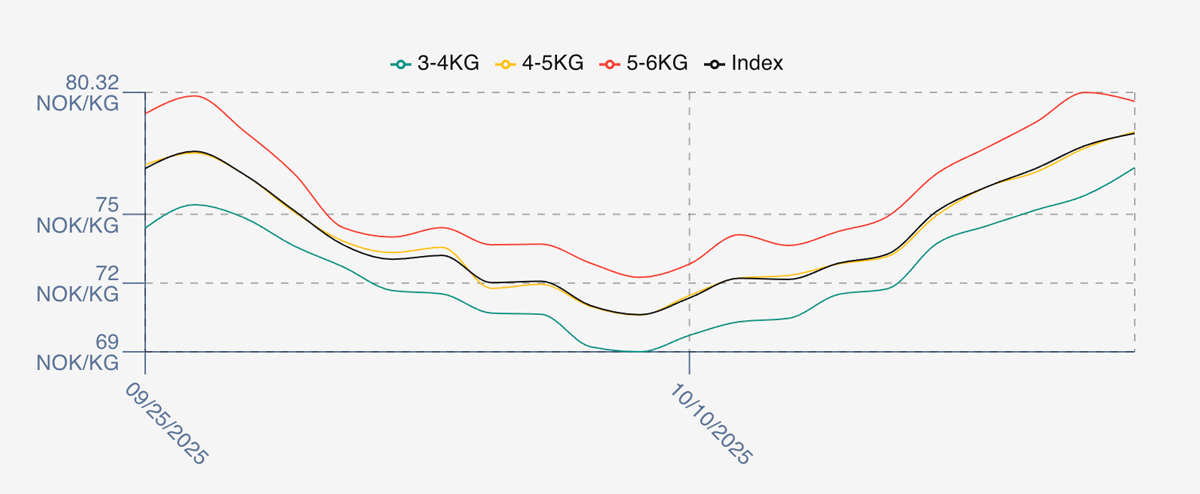

The LFEX Norwegian Exporters Index for Week 43 2025 ended the week UP +5.27 NOK / +7.19% to stand at 78.53 NOK (in EUR terms 6.78 / +0.54 / +8.58%) FCA Oslo Week ending Thursday vs previous Thursday.

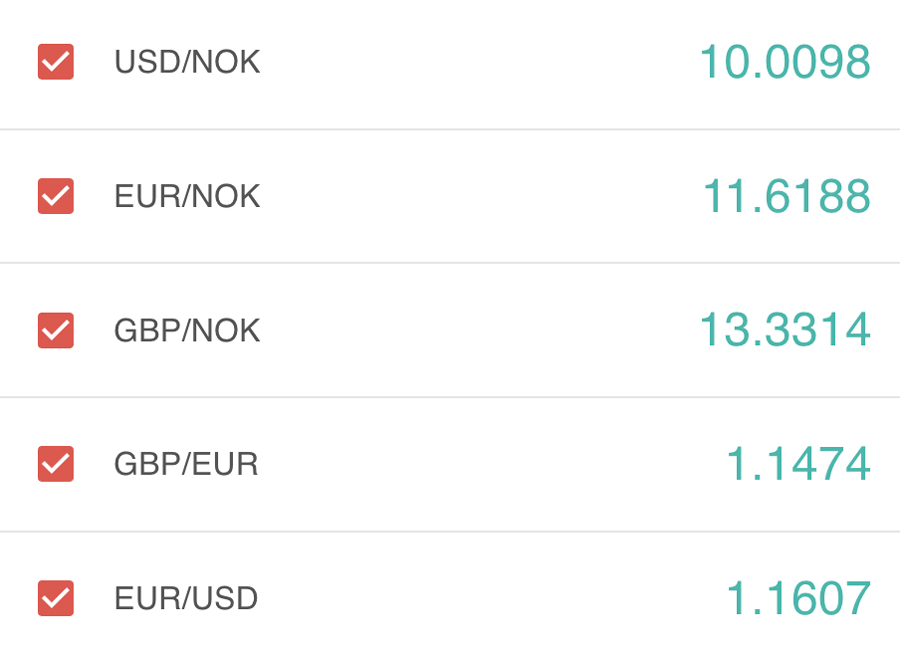

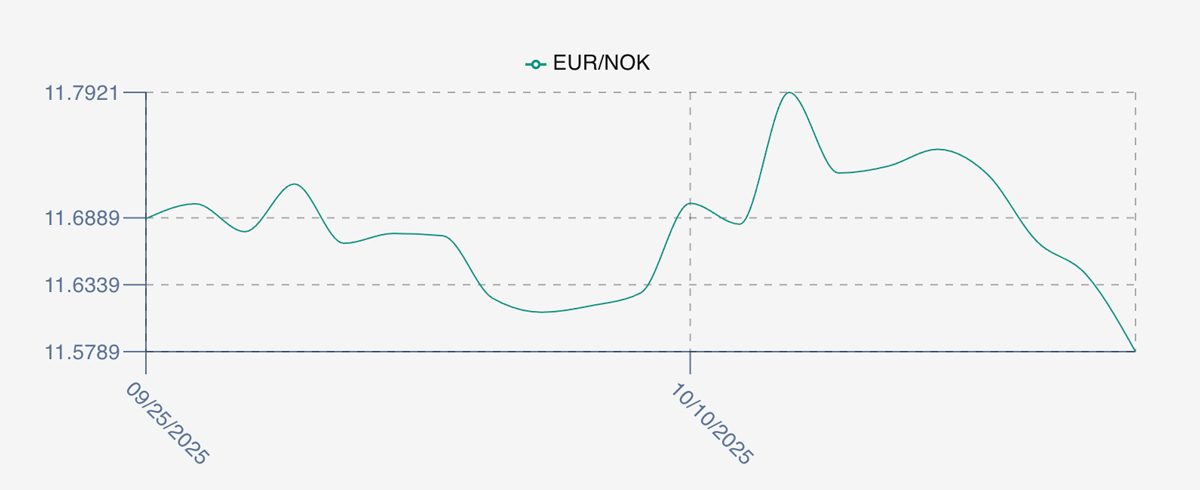

The NOK rate ended DOWN at 11.58 (-0.15 / -1.28%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future November was reported UP Thursday to Thursday at 6.30 EUR, (+0.10 / +1.61%) approximately 72.95 NOK, with December showing 6.87 Euro.

The Last Week

A more expensive week as prices continue to climb. One way traffic this week as prices across the 3-6 range increased. Friday prices were pushed up 2.5% from the prior weeks close to open at 75.14 and broadly the market added approximately 1 NOK for each day through to Wednesday at 78. While Thursday did see the continued rise it was held back a little as the larger fish 5-6s dipped marginally on Thursday and gave us a closing level of 78.53. Prices are at or around similar levels to both 2024 and 2023 by way of comparison.

FX rate was more volatile this week as we saw the EURNOK rate fall with a stronger NOK this week. Opening at 11.745 on Friday the rate fell across the week to bottom at 11.58 which would have made buying in Euro 1.4% more expensive by the end of the week.

Spreads on the index have remain around the 3 NOK between 3-4 and 5-6 evenly spread.

Next Week

Pricing for next week doesn’t appear to be volatile. Early indications around the 79ish NOK level for the index which would put it just ahead of Thursdays close. No major potential issues to report on Friday afternoon. Talk of 6+ size being plentiful.

Spreads between 3/4s to 5/6s remain at / around the 3 NOK level currently.

EUR NOK FX rate is this afternoon around the 11.62 level, and off the recent bottom of 11.58. This would give an indicative Euro index price around 6.80 on offered levels later Friday – an increase of 0.42 Euro versus this time last week.

Volumes – Fresh Export

Volume figure for week 42 (2025) was 26,448 tons UP 887 as compared to 25,561 in 2024 some 3.47 % HIGHER. Volumes for week 43 and week 44 (2024) were 24,910 and 25,749 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 44 2024 ended the week down -4.41 NOK / +0.81% to stand at 71.16 NOK (in EUR terms 5.96 / + 0.44 / +6.82%) FCA Oslo. The NOK rate ended up at 11.93 to the Euro. The Fish Pool future November was reported at -2.00 NOK / -2.47% at 79.0 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 24th October, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

You can find historical weekly reports and data from LFEX going back over 5 years.

We collect manage and maintain all data to allow the market the ability to use and interpret information they find useful. With 5 years of unique high quality daily data it is the only place you can access pricing trends at such a granular level.

FAQ’s

Q. As a seller how can I manage my inventory as efficiently as possible?

A. You can set-up an offer and send it to multiple counterparties at the same time. You can negotiate and manage this volume between the counterparties and sell full or part of this inventory. Importantly the system won’t let you over-sell inventory you don’t want to offer / don’t have. At times of stress it helps to be showing volume to as many customers a possible to get orders.