The London Fish Exchange

Data / Market Insight / News

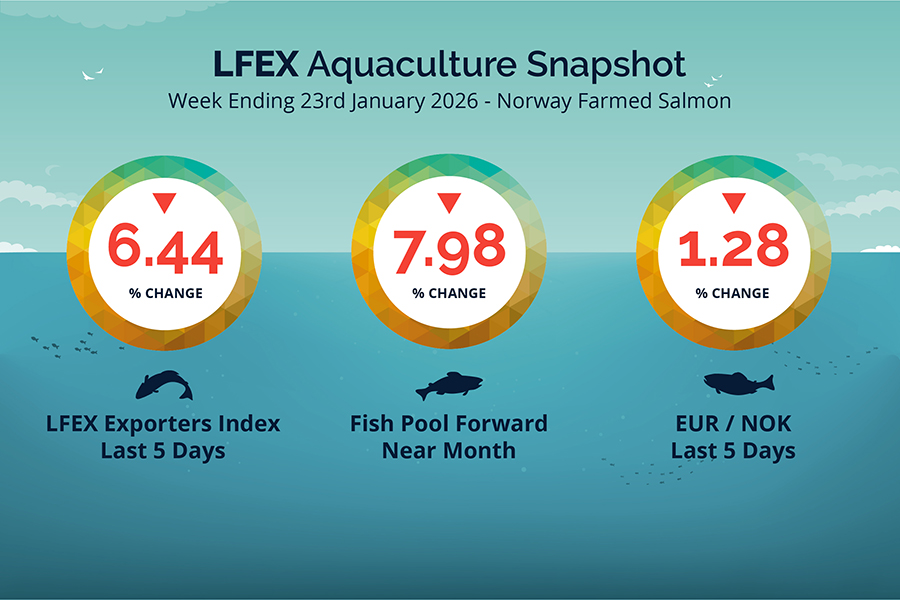

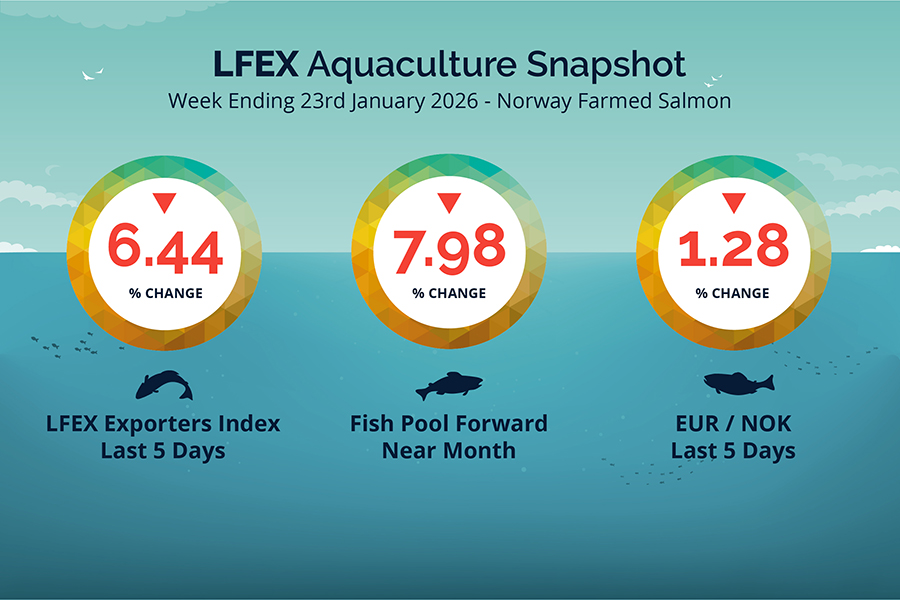

LFEX European Aquaculture Snapshot to 23rd January, 2026

|

|

Published: 23rd January 2026 This Article was Written by: John Ersser |

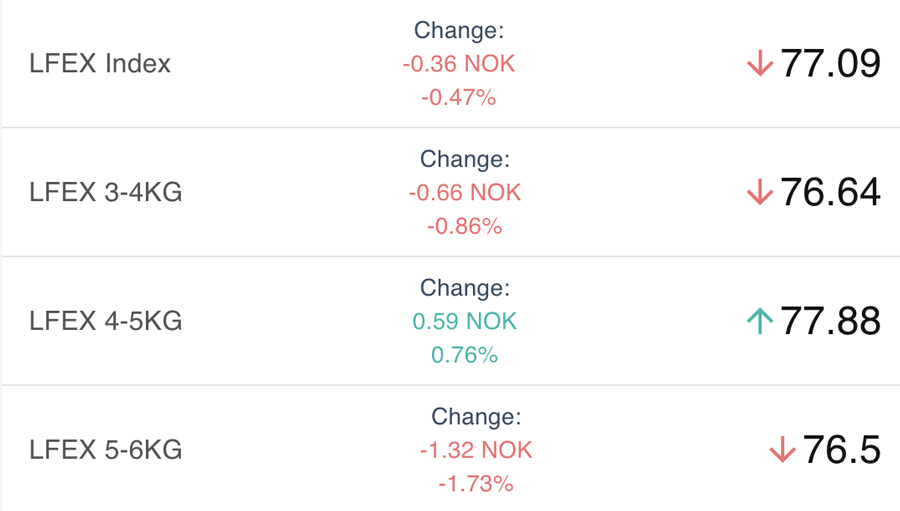

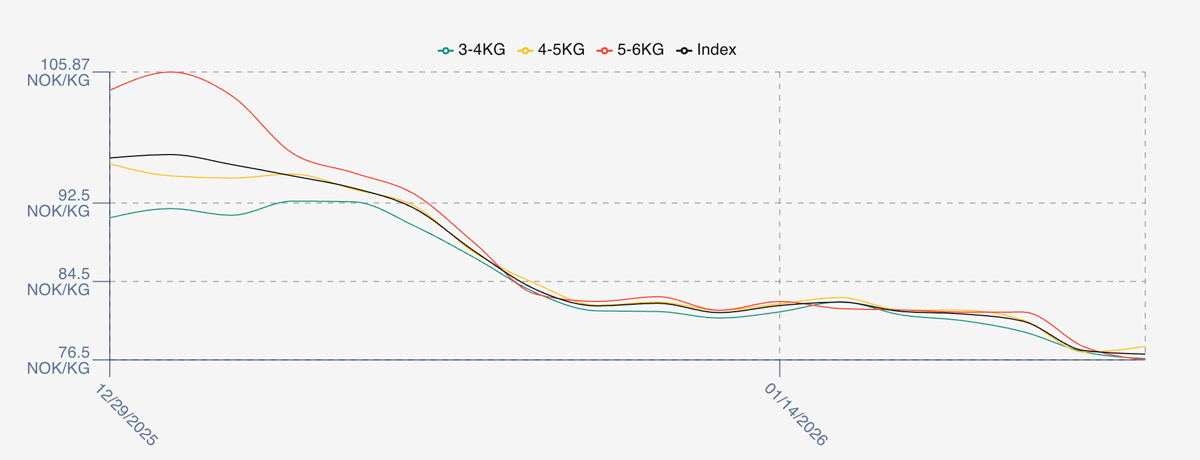

The LFEX Norwegian Exporters Index for Week 4 2026 ended the week DOWN -5.31 NOK / -6.44% to stand at 77.09 NOK (in EUR terms 6.66 / -0.15 / -5.23%) FCA Oslo Week ending Thursday to Thursday (yesterday).

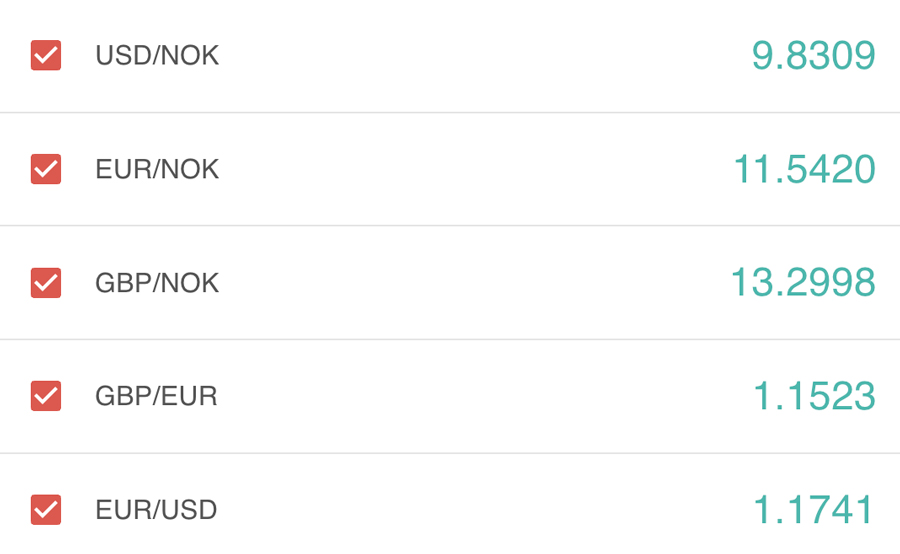

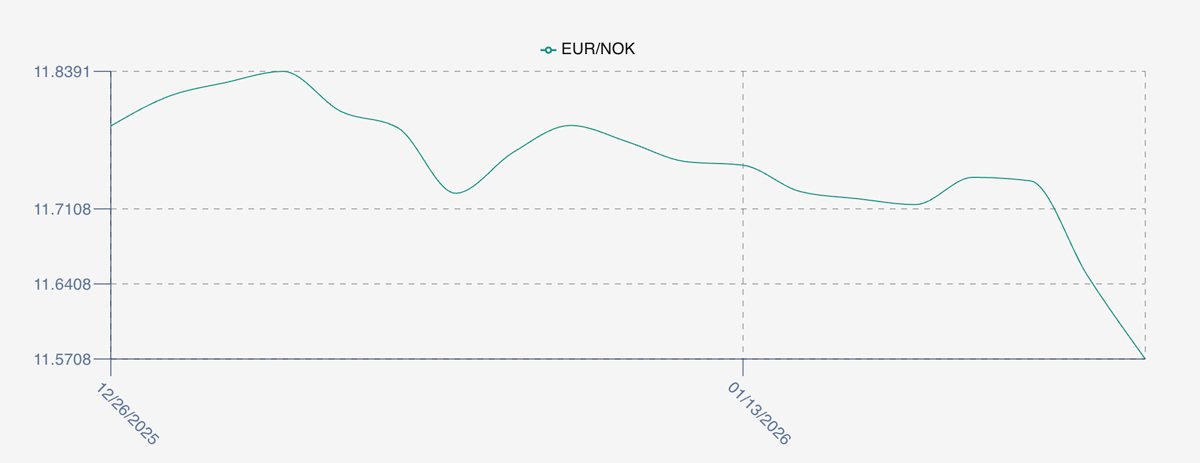

The NOK rate ended DOWN at 11.57 (-0.15 / -1.28%) to the Euro over the same period. The Fish Pool Euronext future February was reported DOWN at 7.50 EUR (-7.98% / -0.65) for the same period for comparison.

The Last Week

Prices continue to drop. Week 4 saw prices dip across all trading days as overall offered prices notched up a near 6.5% fall over the trading week. Friday opened at 81.44 / -1.17% off the prior week close. Monday was lower small and held at 81.19 as Tuesday notched down to 80.4. The damage was done this week on Wednesday as price fell 3 NOK on the day to 77.45 and would have held there if the larger sizes again hadn’t pushed the index down as the 5/6s came in cheaper than the 3/4s and 4/5s. Last report we noted strong volumes, more large fish and demand not pushing prices. Throw into the mix more tariff threats mid-week, geopolitical threats and prices come down.

The FX rate dropped this week, flat to Tuesday and tanked Wednesday / Thursday from 11.74 down to 11.57 as tariff threats were announced.

Spreads have remained around 1 NOK on close. 5/6s have been cheaper much of the week and closed the week at levels less than 3/4s.

Next Week

Early indications showing prices around the 75 NOK level for the index as we head into the new week. That puts us down 2.00 NOK from Week 4 close yesterday of 77.09. Prices are falling. Lots of fish, bigger fish and not many committed buyers all applying pressure.

Spreads are sitting around 0.5 NOK 3-5s, with 5-6s similar pricing to 3-4s.

The EUR NOK FX rate is this afternoon hovering around the 11.545 level and has been volatile up to 11.58 levels. This would give an indicative Euro index price around 6.50 EURO on offered levels Friday.

Volumes – Fresh Export

Volume figure for week 3 (2026) was 22,239 tons UP 4,914 tons as compared to 17,325 in 2025 some 28.36 % HIGHER. Volumes for week 4 and week 5 (2025) 15,564 and 16,370 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 5 2025 ended the week down -5.1 NOK / -5.50% to stand at 87.67NOK (in EUR terms 7.45) FCA Oslo. The NOK rate ended up +0.02 NOK /+0.17% at 11.76. The Fish Pool Euronext future February was reported at 8.97 EUR which equates to approximately 105.48 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 23rd January, 2026 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The LFEX platform has been designed to allow you to manage your business in real-time from a single application.

It means not only is key information available at your fingertips to allow you to make the trading decisions you need to make, it allows you to act on those decisions effectively and efficiently. As a tool it matches systems found in financial markets where time and money are critical.

FAQ’s

Q. Who can see my prices?

A. The answer is you can choose, it’s 100% in your control. Although you can connect to different counterparties simultaneously, the system maintains a 1-2-1 relationship between you and the seller / buyer you connected with. It securely brings your relationships onto the platform and you decide who can see your prices and offers / requests and all actions and activity are secure and private.