The London Fish Exchange

Data / Market Insight / News

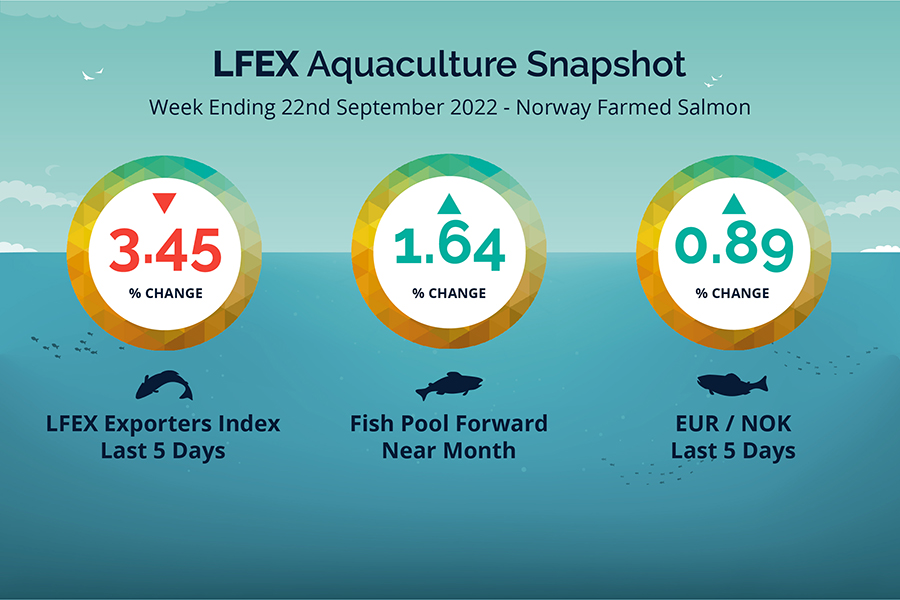

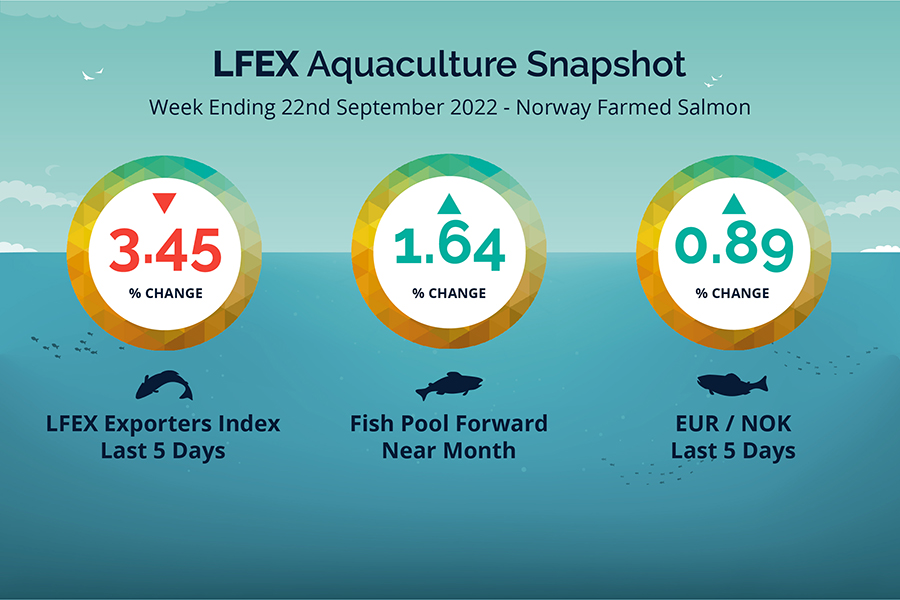

LFEX European Aquaculture Snapshot to 22nd September, 2022

|

|

Published: 23rd September 2022 This Article was Written by: John Ersser |

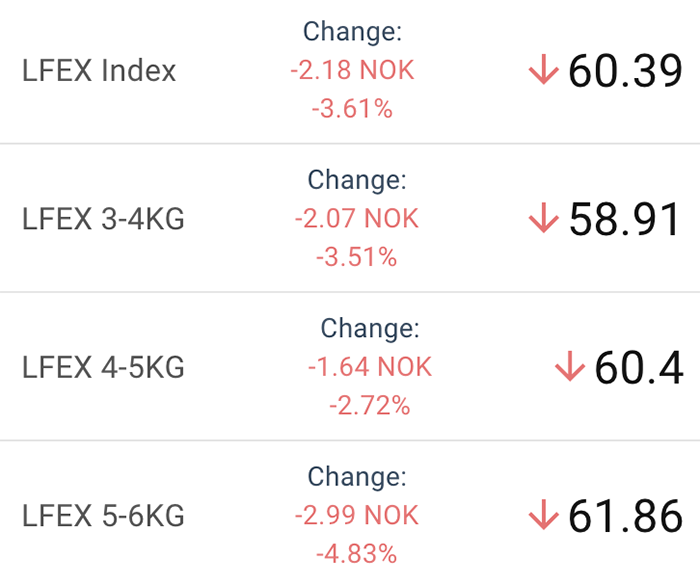

The LFEX Norwegian Exporters Index week 38 was down -3.45%, -2.16 NOK to stand at 60.39 NOK FCA Oslo Week ending Thursday vs previous Thursday.

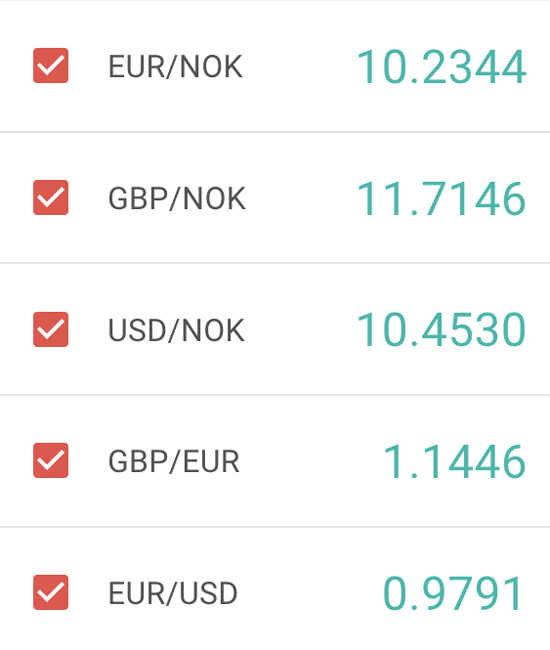

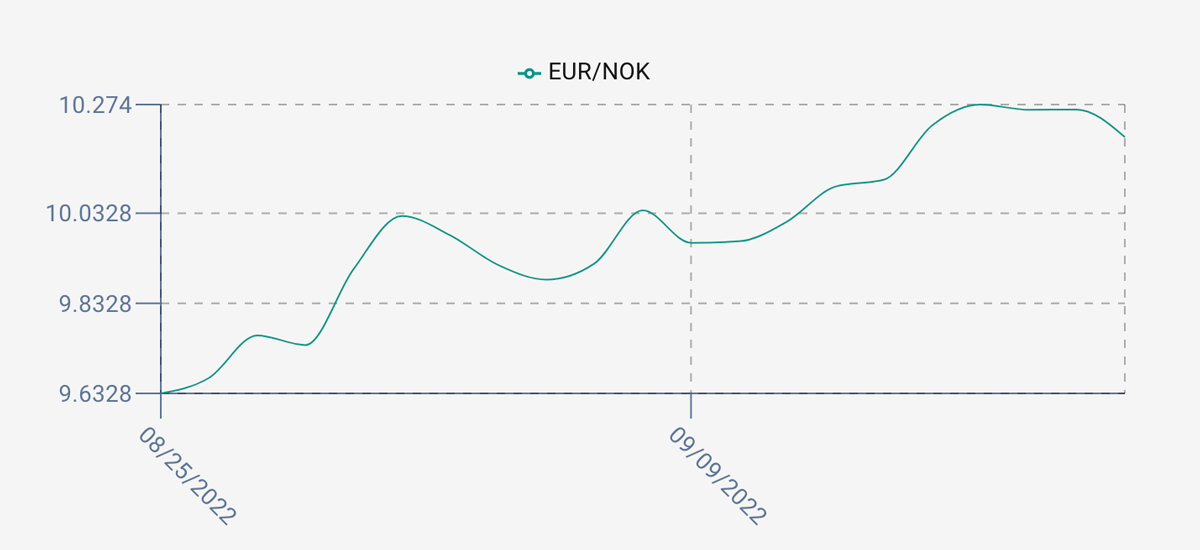

The NOK was up ending at 10.20 to the Euro over the period Thursday to Thursday +0.09 NOK or +0.89 %. The Fish Pool future September was up +1.00 NOK at 61.00 NOK.

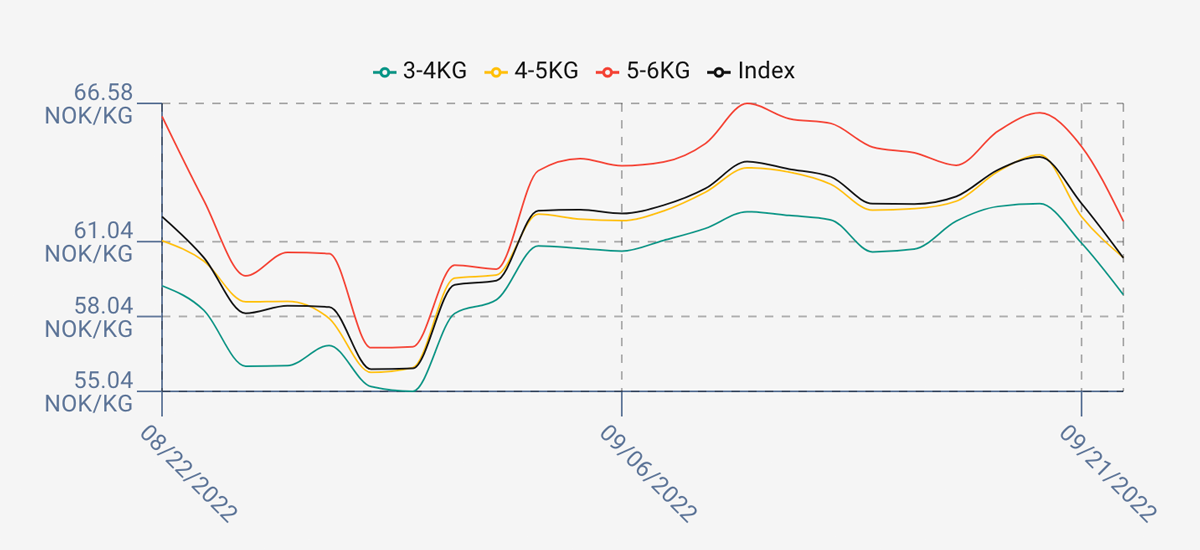

The expectation for pricing around the 62 NOK level proved correct although there was some volatility intra week to get to the close at 60.39. The market opened flat on Friday last at 62.85 NOK up 0.3 NOK or 0.48% with pricing then pushing up to 63.92 NOK after the weekend and peaking at 64.43 NOK for the week on Tuesday. We then saw a reversal on pricing on Wednesday at 62.57 NOK down -1.86 NOK and a further decline of -2.18 NOK to see the week out. A total fall of over 6% as the week ran off. Volumes for week 37 were 25.8k tons. No explanation for the reversal mid-week but as of Thursday prices have been tightening as we go in week 39. Expect therefore prices around these closing levels for next week. As usual we will see…

David Nye’s analysis for a Technical viewpoint will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 22nd September, 2022 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The LFEX platform helps sellers manage and distribute multiple prices to different customers in real-time on the system.

Customers are different and have different demands, whether it is sizes, classifications, certifications, currencies or INCO terms. The platform allows sellers to manage this process, getting bespoke pricing out to a universe of customers quickly and easily allowing buyers more immediate access to offers to see and react to.

FAQ’s

Q. Can my competitors see my price?

A. The simple answer is no. Whether you are a buyer or seller putting up prices you are in complete control of to whom and where you send your prices. The system is configured to the counterparties you are prepared to see prices / offers from and within this you can configure who sees what price, all manageable in real-time. Each price between a seller and buyer is secure and private, and no one else has access to this.