The London Fish Exchange

Data / Market Insight / News

LFEX European Aquaculture Snapshot to 22nd May, 2025

|

|

Published: 23rd May 2025 This Article was Written by: John Ersser |

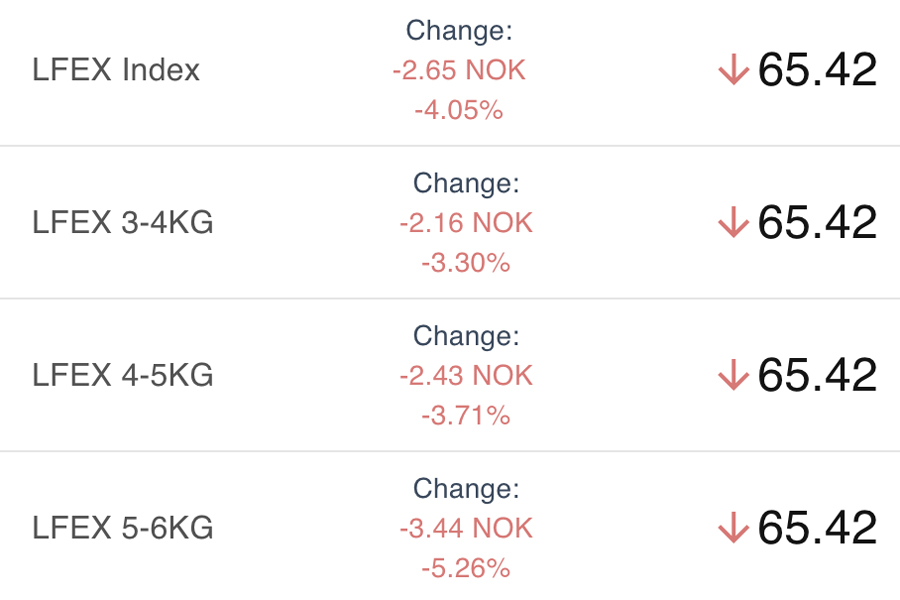

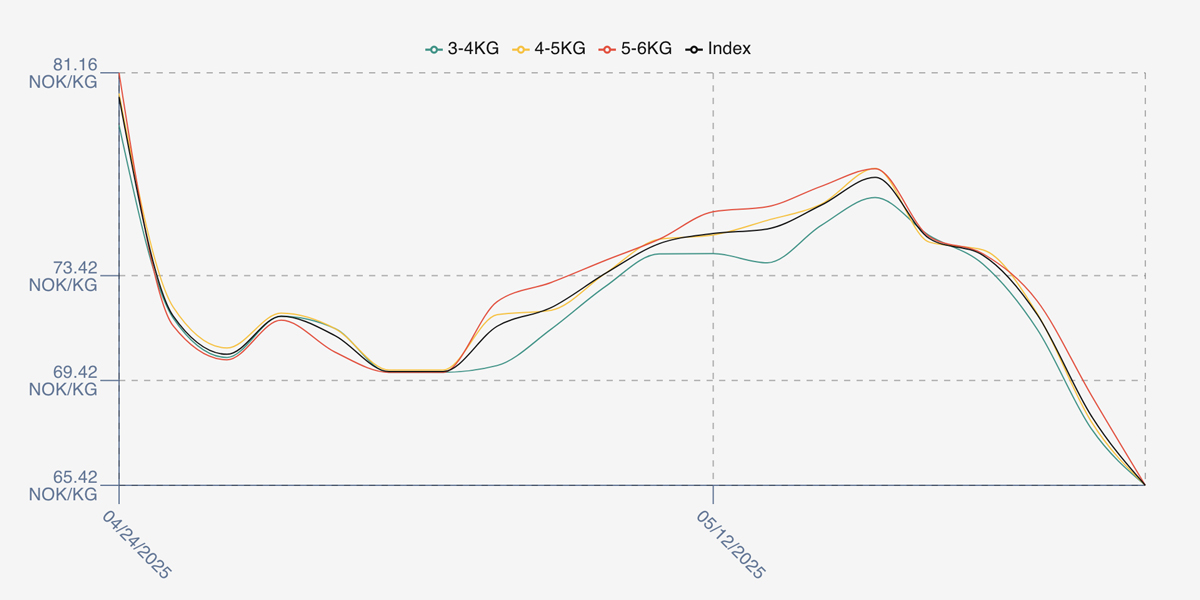

The LFEX Norwegian Exporters Index for Week 21 2025 ended the week DOWN -11.75 NOK / -15.23% to stand at 65.42 NOK (in EUR terms 5.68 / -0.93 / -14.12%) FCA Oslo Week ending Thursday vs previous Thursday.

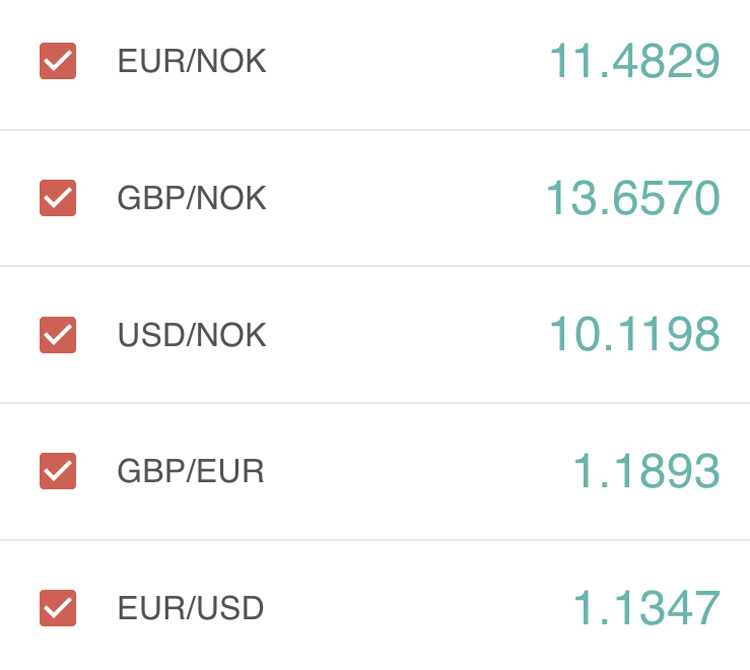

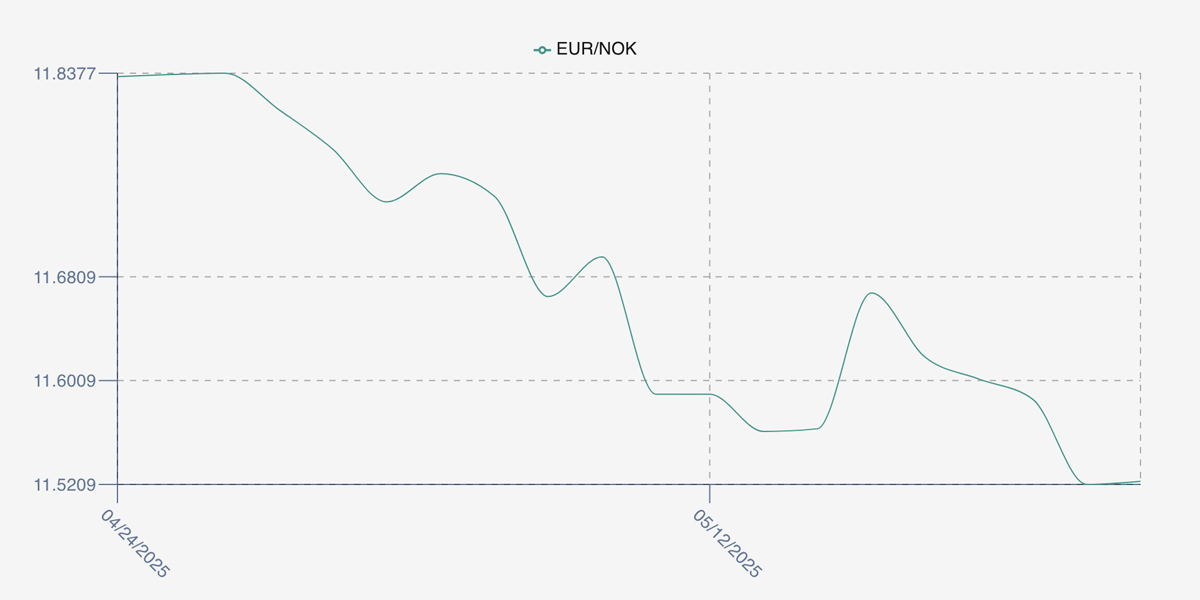

The NOK rate ended DOWN at 11.52 to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future June was reported DOWN Thursday to Thursday -0.20 / -3.13% at 6.20 EUR, approximately 71.42 NOK.

The Last Week

Another difficult week for pricing with a huge swing lower as the week progressed. The index opened offered on Friday at 74.84 off 3% although not much confidence in the pricing, and Monday also held up at the 74 NOK level. Volatility was kicking in by Tuesday as prices started their southwards trajectory at just under 72 offered. While we found the index at 68.07 offered on Wednesday there ]was significant weakness, and the tumble continued into Thursday closing out at just over 65 levels. Poor demand, lots of fish and buyers wanting cheaper pricing.

Spreads compressed to nothing at the close as sellers managed their inventory as best they could with not much transparency.

Next Week

Indications this week see the index opening around 64 NOK level as offered prices come further from Thursday. A now familiar story for 2025 where there is a lot of good qualify volume coming through that needs to find a home, and this is creating tension where each side has a view on how low it should go. Reports of lots of big fish, a continuing algae problem continues to add to the pressure and President Trump announcing further tariff intentions against the EU to add a little external volatility to the mix.

EUR NOK FX rate is off 0.05 at 11.47 this afternoon. This would give an indicative Euro index price around 5.58 on levels later Friday.

Volumes – Fresh Export

Volume figure for week 20 (2025) was 19,523 tons up 7,825 as compared to 11,698 in 2024. Volumes for week 21 and week 22 (2024) were 12,567 and 15,060 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 22 2024 ended the week down -24.46%, -29.23 NOK to stand at 90.28 NOK (in EUR terms 7.91) FCA Oslo. The NOK rate ended down at 11.41. The Fish Pool future May was reported down – 3.00, -2.39% at 122.50 NOK.

David Nye’s technical analysis report will be published on Tuesday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 22nd May, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The LFEX platform is a secure, high performance transactional and data platform?

Built by trader for traders, but also API links into 3rd party systems and a full document suite. It is centrally managed and controlled like a professional financial exchange, meaning no external parties have access to the underlying databases or code. For users it means a genuine real-time, global trading platform, combined with access to your own private data and documentation as well as market data and analysis.

FAQ’s

Q. How can I know where my fish are from?

A. Provenance and specifications documentation are supported order by order.

As provenance and certifications become more important to buyers, it is imperative that the supporting documentation can be made available down to the individual order/trade level. The system supports Fish CV’s, certification documentation and detailed product specifications to ensure that you have all the required documentation and can evidence these materials for counterparty auditing, internal reporting and third-party auditing – all instantly available within your organisation.