The London Fish Exchange

Data / Market Insight / News

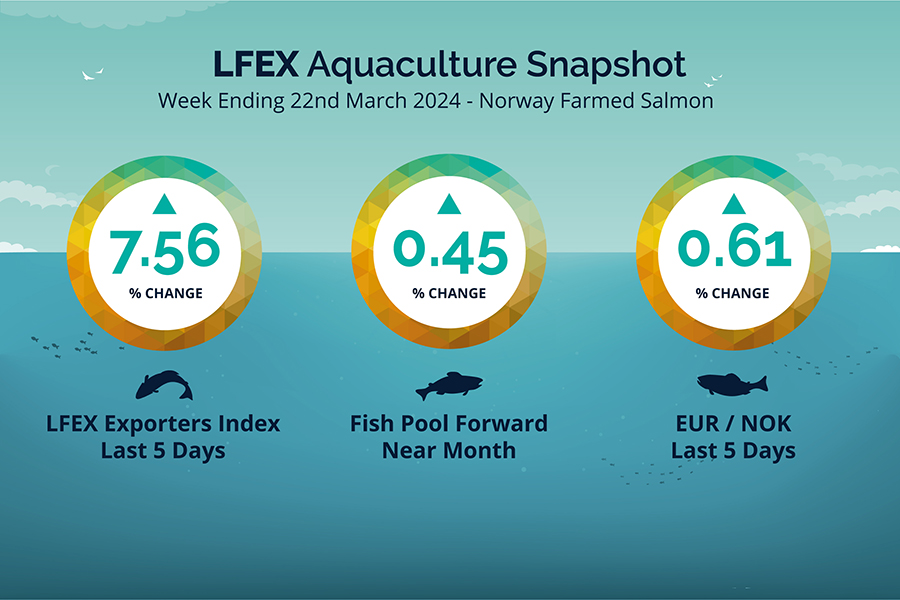

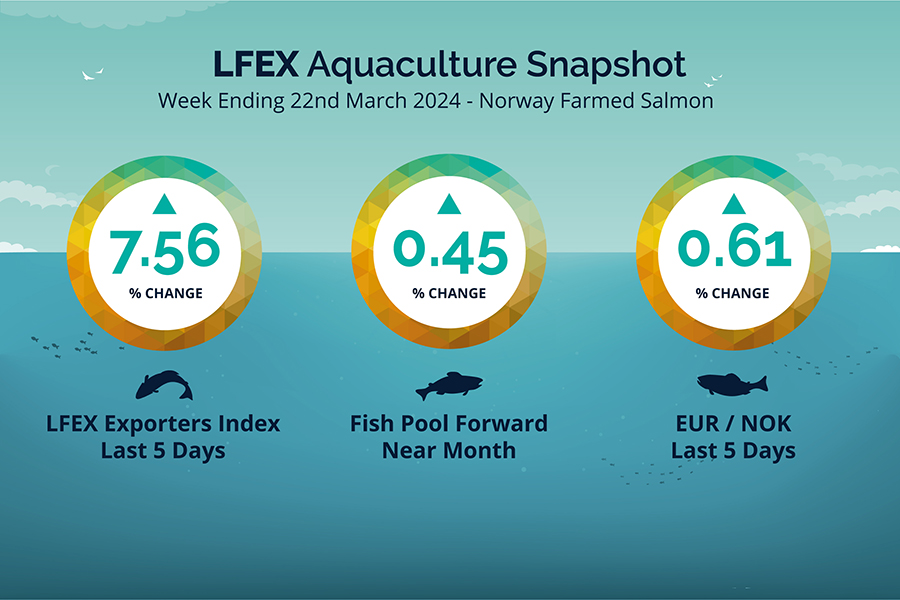

LFEX European Aquaculture Snapshot to 22nd March, 2024

|

|

Published: 22nd March 2024 This Article was Written by: John Ersser |

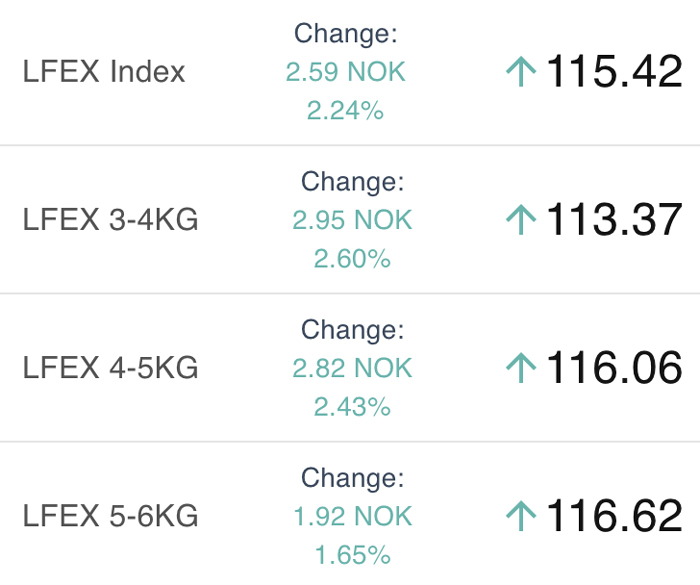

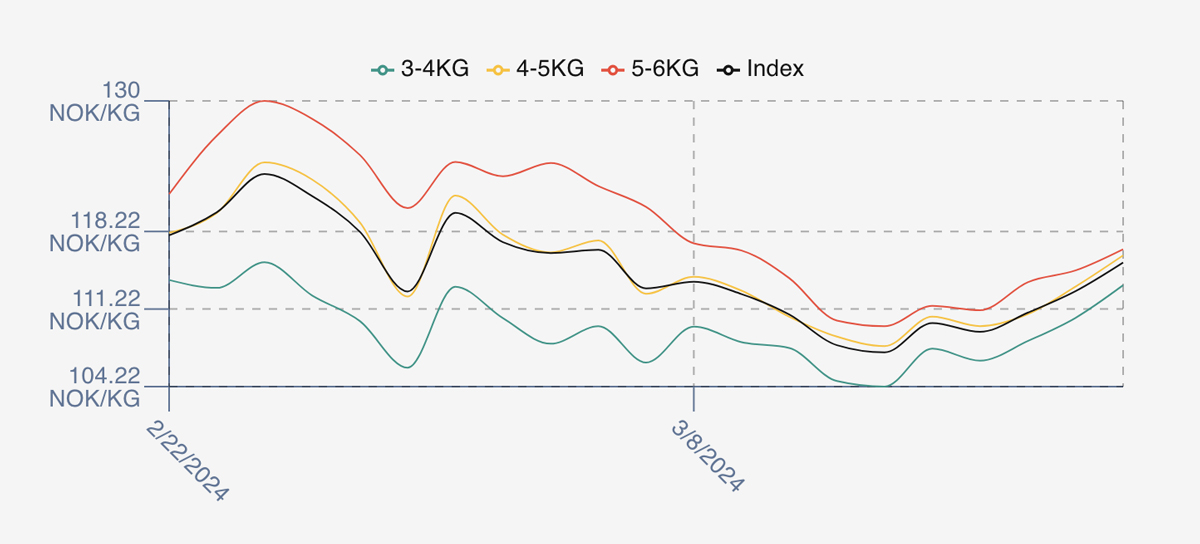

The LFEX Norwegian Exporters Index for Week 12 2024 ended the week up + 7.56%, +8.11 NOK to stand at 115.42 NOK (in EUR terms 10.01 / +0.65 / + 6.9%) FCA Oslo Week ending Thursday vs previous Thursday.

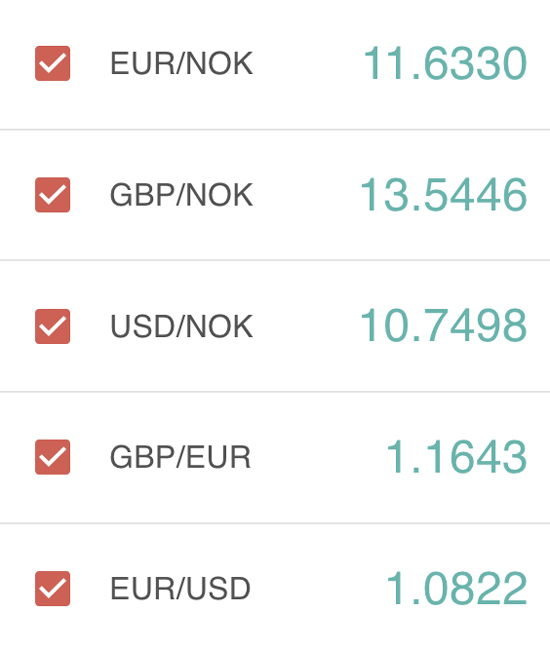

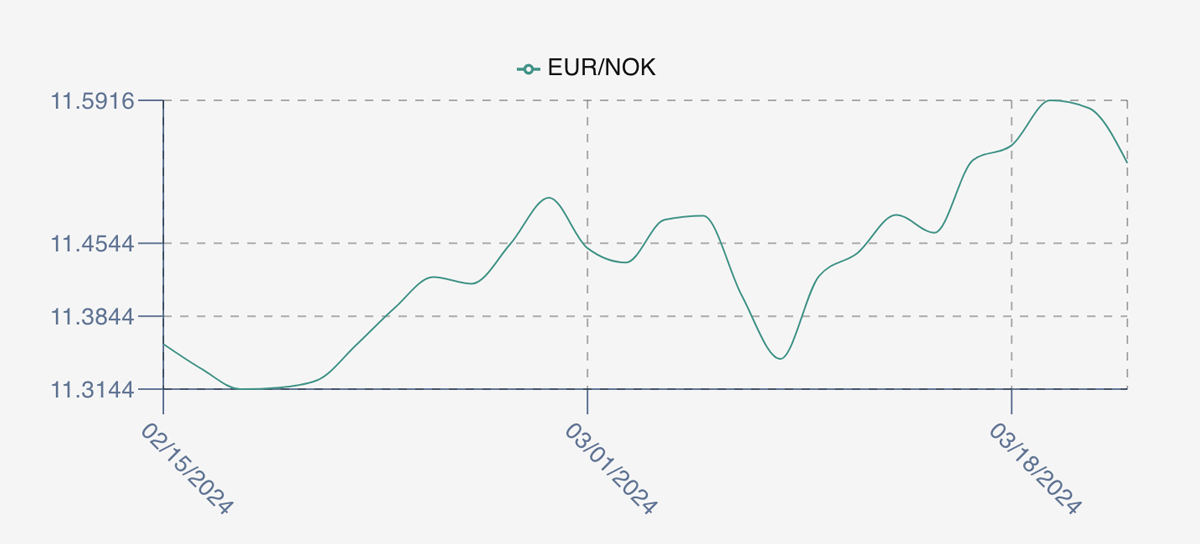

The NOK rate ended up at 11.53 to the Euro over the period Thursday to Thursday up +0.07 NOK or +0.61%. The Fish Pool future March was reported up +0.50 NOK, +0.45% at 111.0 NOK.

Last week (12) the index opened up small at 109.96 compared to the prior weeks close (107.31). Pricing was balanced on Monday at 109.17 and little change into Tuesday at 110.89. However, pricing started to build Wednesday at 112.83 and closed out at 115.42 and the high for the week as Easter started to approach. Lack of superior fish still causing a problem and squeezing the market higher.

Next week will be all about Easter, and prices are expected to jump – why? There is absolute consistency of message, next week is a 3 day harvest week before Easter, the following week is limited to 4 days. There is limited supply of superior fish. Easter demand is good with strong continental demand showing. As a consequence, prices are set to jump up, with indicative levels for the index 126 – 127 NOK as buyers source their requirements. More telling is the message that week 14 will continue to be high, and some respite might be found by week 15. NOK remains week versus EURO, but hardly compensating for the jump.

By comparison week 14 2023 was the Easter trading week (week 13 this year), and prices ended at 120.68 NOK. The EURONOK rates was 11.39.

David Nye’s technical analysis report will be published later next week.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 22nd March, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

You and your company can work multiple orders on the platform simultaneously.

For example, you can work to transact on this weeks’ needs for usual supply of fish, as well as any surplus requirements you may have for the week, while at the same time using the RFQ’s to start getting pricing and offers for the following week(s) business. You can also have constantly updated prices on these requests from sellers (when the market is rising or falling) track price development and decide when is optimal to buy. This is particularly useful in the weekly market where we see both intraweek volatility and also trading patterns emerging.

FAQ’s

Q. How can I find orders and trades on the system?

A. The system captures all pricing, orders and trading activity in real-time for users. You have immediate access to all your pricing and trade data, and the ability to search and sort this data by any data item(s). Further users can add post trade information within the same environment, meaning sales staff, management, logistics and finance staff can all view, use and manage business activity, as well as start to analyse their own data at a very granular level.