The London Fish Exchange

Data / Market Insight / News

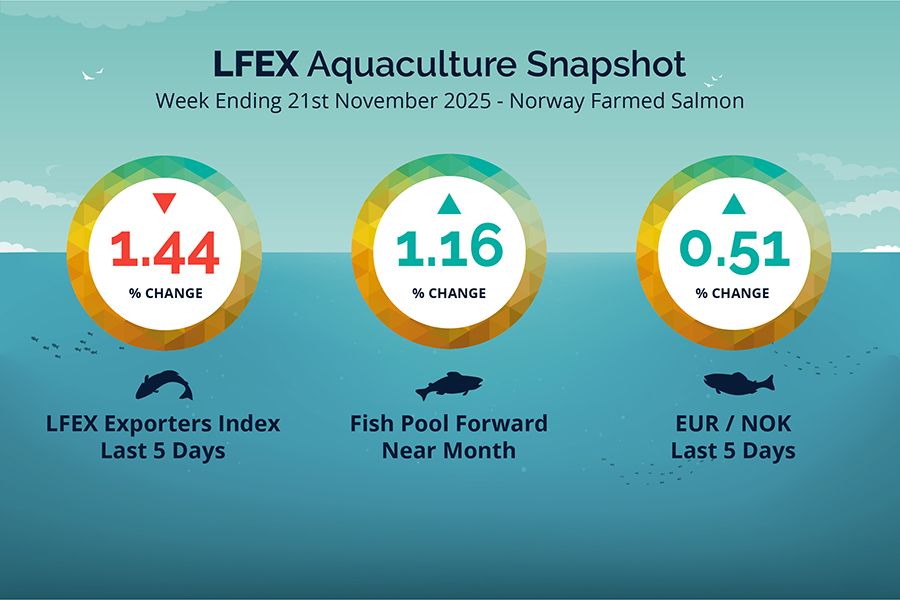

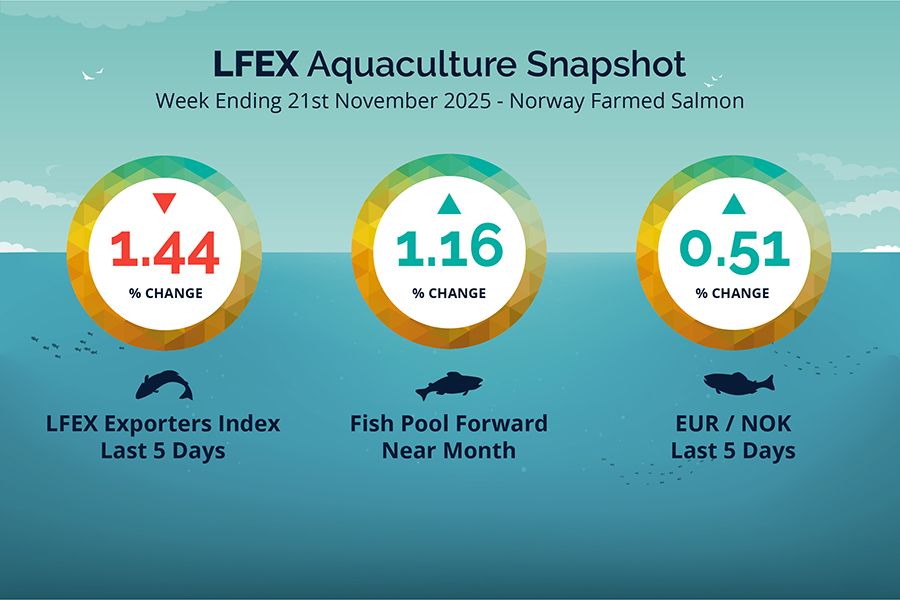

LFEX European Aquaculture Snapshot to 21st November, 2025

|

|

Published: 21st November 2025 This Article was Written by: John Ersser |

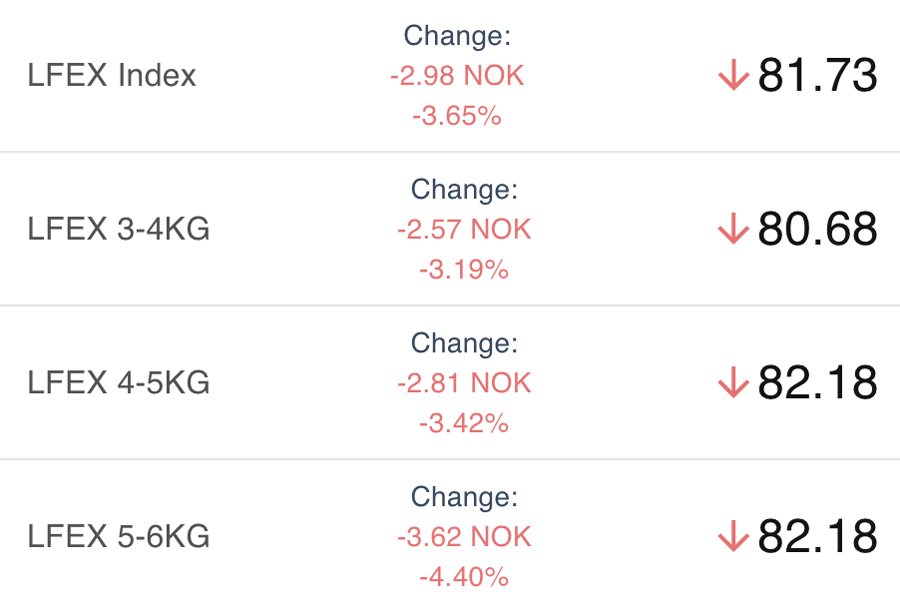

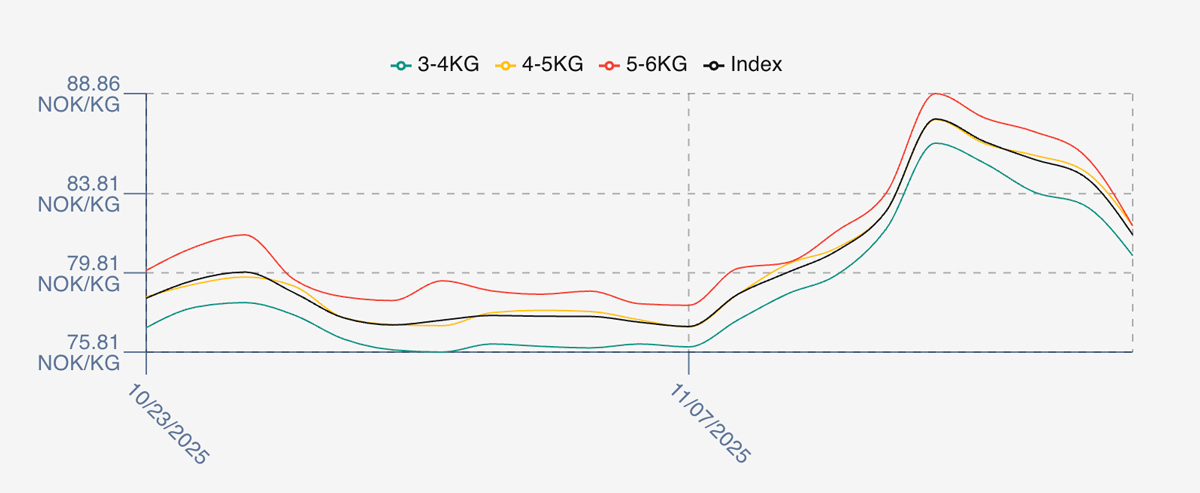

The LFEX Norwegian Exporters Index for Week 47 2025 ended the week DOWN -1.19 NOK / -1.44% to stand at 81.73 NOK (in EUR terms 6.97/ -0.14 / -1.94%) FCA Oslo Week ending Thursday vs previous Thursday.

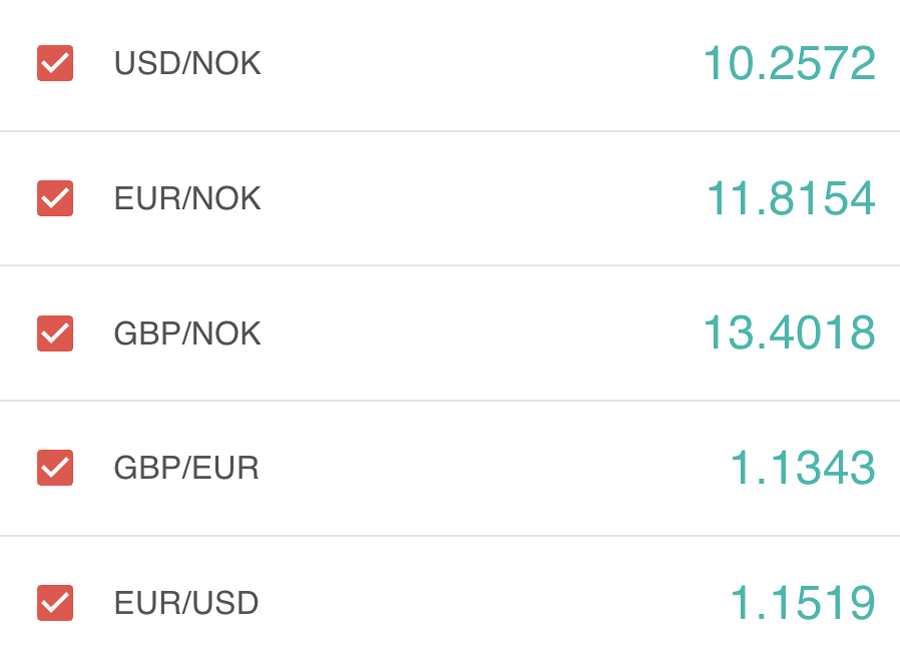

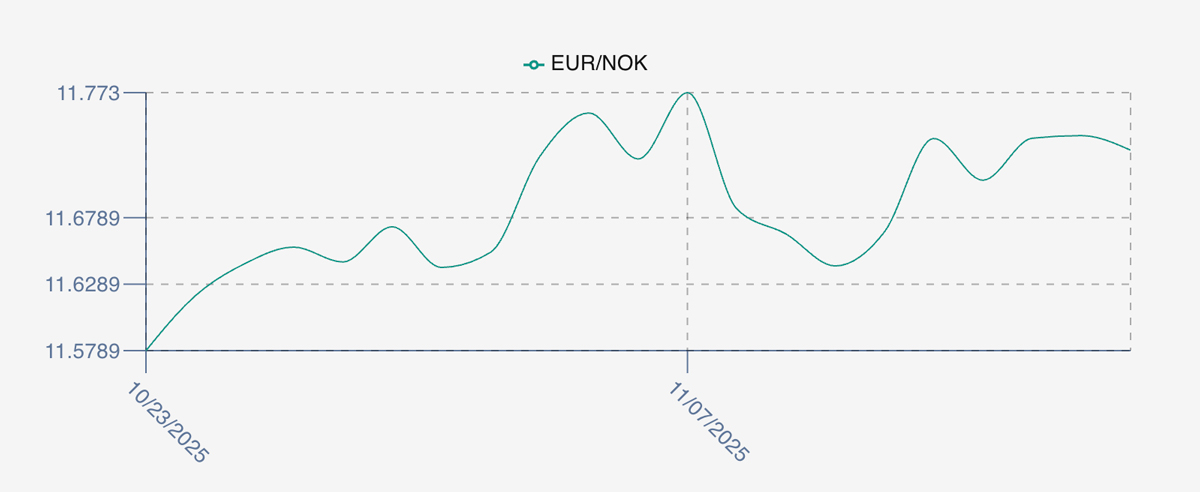

The NOK rate ended UP at 11.73 (+0.06 / +0.51%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future December was reported 6.95 EUR (+0.08 / +1.16%) Thursday to Thursday, approximately 81.52 NOK. January showing 7.65.

The Last Week

A pricing reversal. Momentum from week 46 pushed prices up strongly on the open on the basis of reduced inventory coming through this week. The index jumped 5.62% on opening or 4.66 NOK to 87.58. It didn’t last. The beauty of the index is that we can track the market across the week and get a good sense of direction of travel for prices. Monday came off a NOK to 86.43, Tuesday and Wednesday a similar story as prices tracked down. Thursday was a bit of a capitulation losing 3 NOK on the last trading day as the week recorded an overall and unexpected fall to close at 81.73. Top to bottom intraweek fall of 5.85 NOK / 7.16%. Too many / more than expected larger fish came through which had the effect of pushing the larger fish prices down, with 4/5s and 5/6s pricing the same by the end of the week and fish left over. Possible buyers couldn’t get to grips with such a quick price escalation.

FX rate saw over movement as the reverse of the prior week EURNOK rate picked up from the 11.67 close prior week to close out at 11.72. In reality the rate was pushed to 11.73 by Friday and was there or there abouts all week.

Spreads on the index compressed to 1.5 NOK on Friday as 4/5s and 5/6s combined, and reflection of bigger fish being priced down.

Next Week

Early indications around the offered indicative level of 80.4 NOK for the index which would put it continuing its downward trend and off a further 1.25 / 1.5 NOK from Thursday. A lot of unsold fish available today which is having an effect of complicating pricing for next week.

Spreads between 3/4s to 5/6s are around the 1.8 NOK level, with very little between 4/5s and 5/6s.

After claiming significantly over the past 12 hrs and hitting a peak of 11.85 the EUR NOK FX rate is this afternoon around the 11.825 level. This would give an indicative Euro index price around 6.80 EURO on offered levels later Friday – a decrease of 0.66 Euro versus this time last week.

Volumes – Fresh Export

Volume figure for week 46 (2025) was 23,488 tons UP 663 tons as compared to 22,825 in 2024 some 2.90 % HIGHER. Volumes for week 47 and week 48 (2024) were 23,333 and 25,376 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 48 2024 ended the week down -1.15 NOK / -1.32% to stand at 86.13 NOK (in EUR terms 7.39 / -0.14 / -1.83%) FCA Oslo. The NOK rate ended up at 11.66 to the Euro. The Fish Pool future November was reported up Thursday to Thursday 0.50 NOK / +0.63% at 80.5 NOK with Dec showing 86.50 up 2.5 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 21st November, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The London Fish Exchange works 365 days, 24/7!

Let the LFEX work for you. It never needs an afternoon off, or a day off, or holiday (although you can access it on your vacation). It can help your company buy or sell efficiently and in a cost effective manner. Make offers or requests 24 hours a day. Let the LFEX be a key member of your team.

FAQ’s

Q. How can I know where my fish are from?

A. Provenance and specifications documentation are supported order by order.

As provenance and certifications become more important to buyers, it is imperative that the supporting documentation can be made available down to the individual order/trade level. The system supports Fish CV’s, certification documentation and detailed product specifications to ensure that you have all the required documentation and can evidence these materials for counterparty auditing, internal reporting and third-party auditing – all instantly available within your organisation.