The London Fish Exchange

Data / Market Insight / News

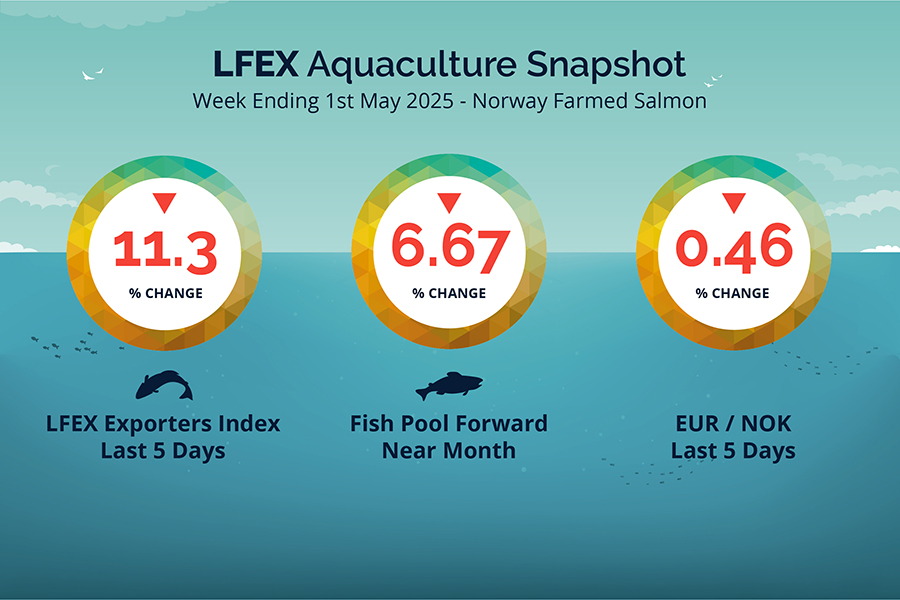

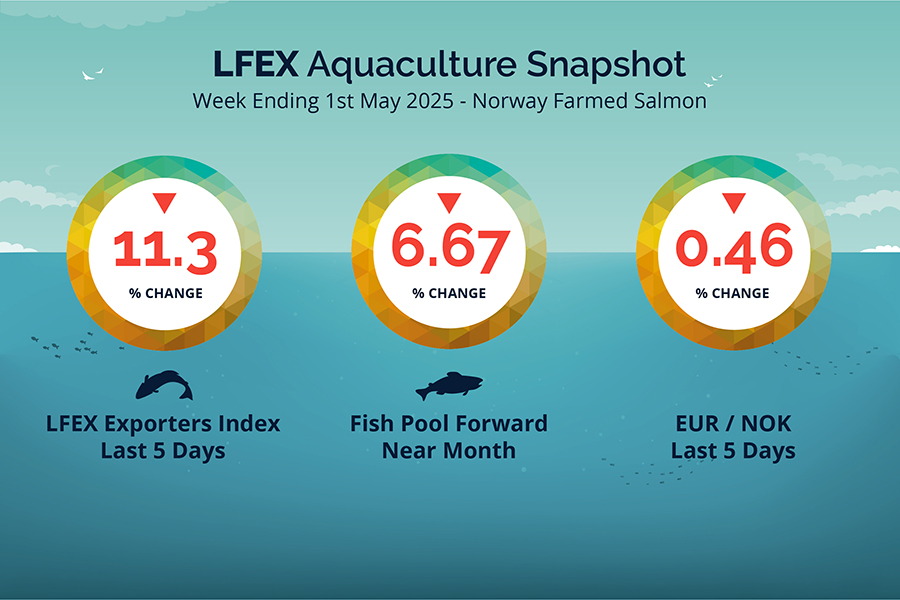

LFEX European Aquaculture Snapshot to 1st May, 2025

|

|

Published: 2nd May 2025 This Article was Written by: John Ersser |

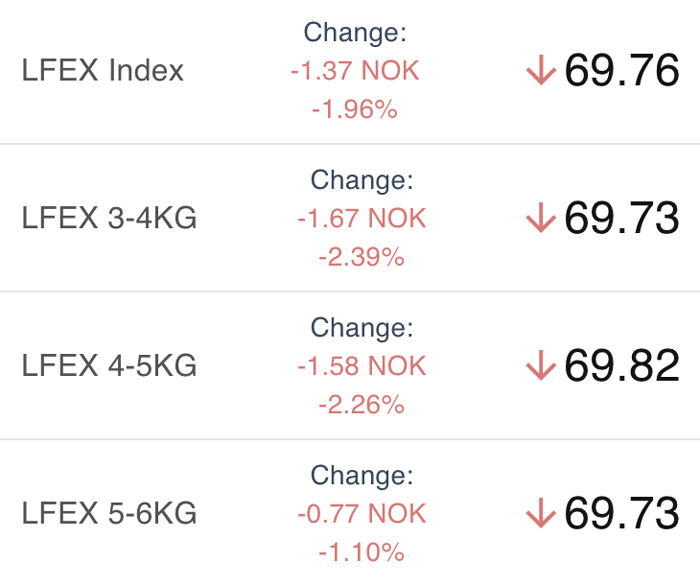

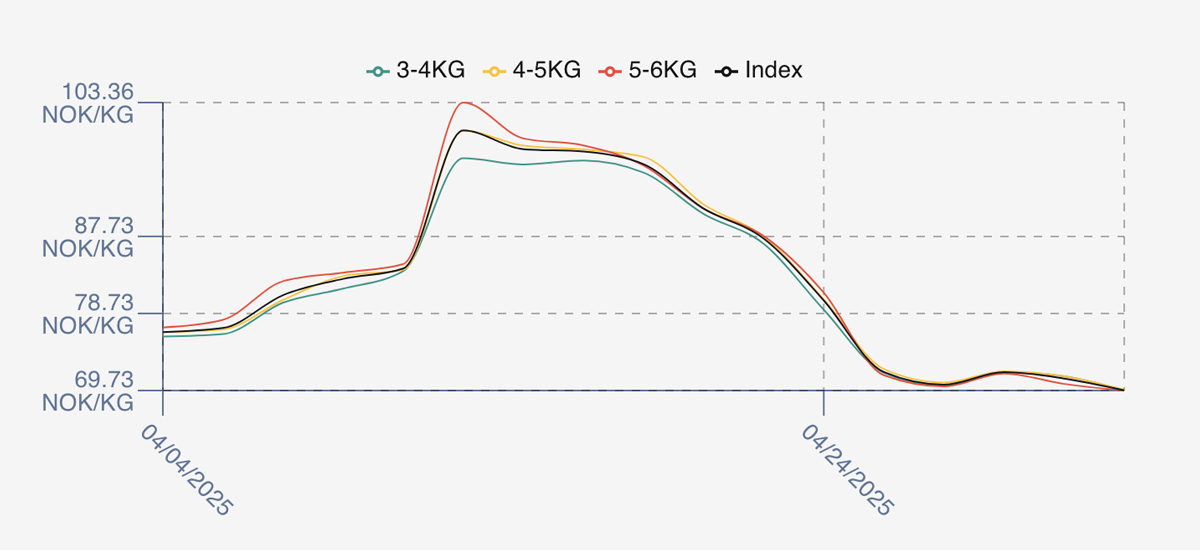

The LFEX Norwegian Exporters Index for Week 18 2025 ended the week DOWN -9.11 NOK / -11.35% to stand at 71.13 NOK (in EUR terms 6.04 / -0.74 / -10.94%) FCA Oslo Week ending Wednesday vs previous Thursday.

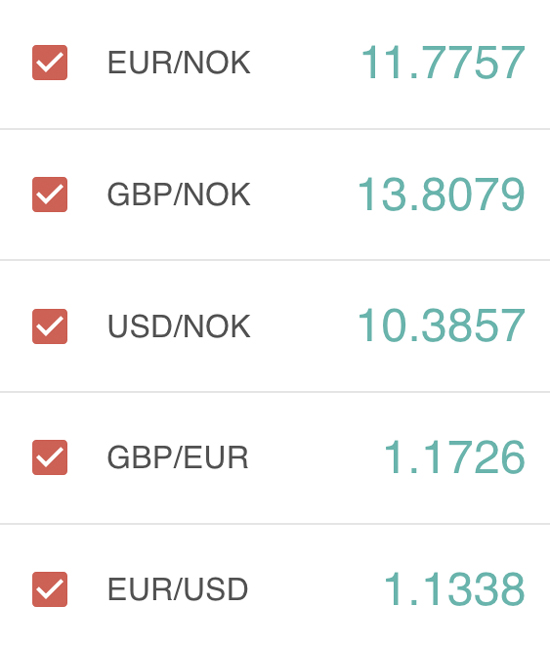

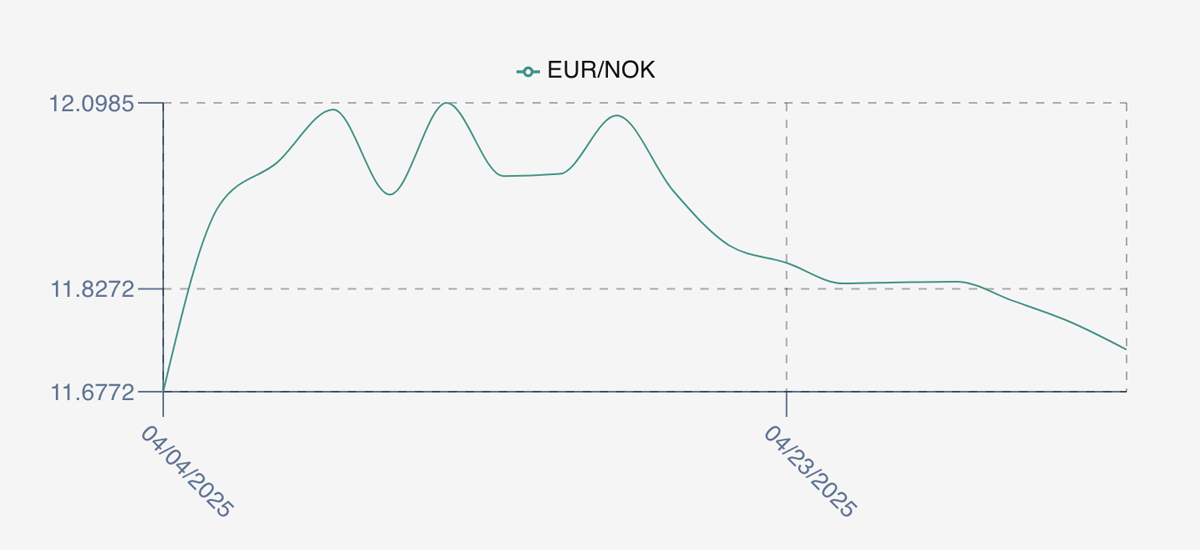

The NOK rate ended DOWN at 11.78 to the Euro over the period Thursday to Wednesday. The Fish Pool Euronext future June was reported DOWN Thursday to Wednesday -0.50 / -6.67% at 7.00 EUR, approximately 82.46 NOK with June showing 7.50.

The Last Week

Another shorter trading week with the market closed on Thursday 1st May. Prices were falling heavily the prior week, closing 80.24 last Thursday and pricing was further crunched as week 18 opened offered at 71.89 down a further 10.4%. Pricing was volatile as traders tried to find levels and then business. The falls continued into Monday as prices were offered at 70.42 – which transpired to be the low of the week. A little stability on Tuesday at 71.87, followed by a close of week Wednesday at 71.13 as traders managed their books for the bank holiday. Lots of fish, good biomass growth and good quality (superior) fish has brought the drop again this week. The significant volumes of larger fish has meant that the 5/6’s have traded at a discount to the smaller sizes all week.

Total spreads sit around the zero between 3/4s and 4/5s while the 5/6’s a discount of 1 NOK.

Next Week

Indications this week see the index opening around 69.5 NOK as offered prices come down another couple of NOK since yesterday and spreads remain tight. There continues to be a lot of quality fish coming through. US tariffs have meant and a refocus to business into Europe and Asia. Algae has meant additional slaughter from a couple of farms in the north adding to volumes…and Barcelona expo starts next week…so a complicated picture to juggle.

EUR NOK FX rate remains flat at 11.76. This would give an indicative Euro index price around 5.86 on levels later Friday.

Volumes – Fresh Export

Volume figure for week 17 (2025) was 18,343 tons up 5.420 as compared to 12,923 in 2024. Volumes for week 18 and week 19 (2024) were 11,511 and 10,617 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 19 2024 ended the week up +2.61%, +3.30 NOK to stand at 129.77 NOK (in EUR terms 11.08) FCA Oslo. The NOK rate ended down at 11.71. The Fish Pool future May was reported up +4.25, +3.56% at 123.50 NOK.

David Nye’s technical analysis report will be published on Tuesday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 1st May, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

Built by traders for traders.

For sophisticated users LFEX provides the ultimate in flexibility in setting up your screens the way you want to, to drive the system. People work differently and have different priorities in terms of functions or data. The system allows you to set-up as many of your own workspaces as you need, as well as spread over multiple monitors – ensuing you can track offers, orders and pricing quickly and easily.

FAQ’s

Q. How can I know where my fish are from?

A. Provenance and specifications documentation are supported order by order.

As provenance and certifications become more important to buyers, it is imperative that the supporting documentation can be made available down to the individual order/trade level. The system supports Fish CV’s, certification documentation and detailed product specifications to ensure that you have all the required documentation and can evidence these materials for counterparty auditing, internal reporting and third-party auditing – all instantly available within your organisation.