The London Fish Exchange

Data / Market Insight / News

LFEX European Aquaculture Snapshot to 19th December, 2025

|

|

Published: 20th December 2025 This Article was Written by: John Ersser |

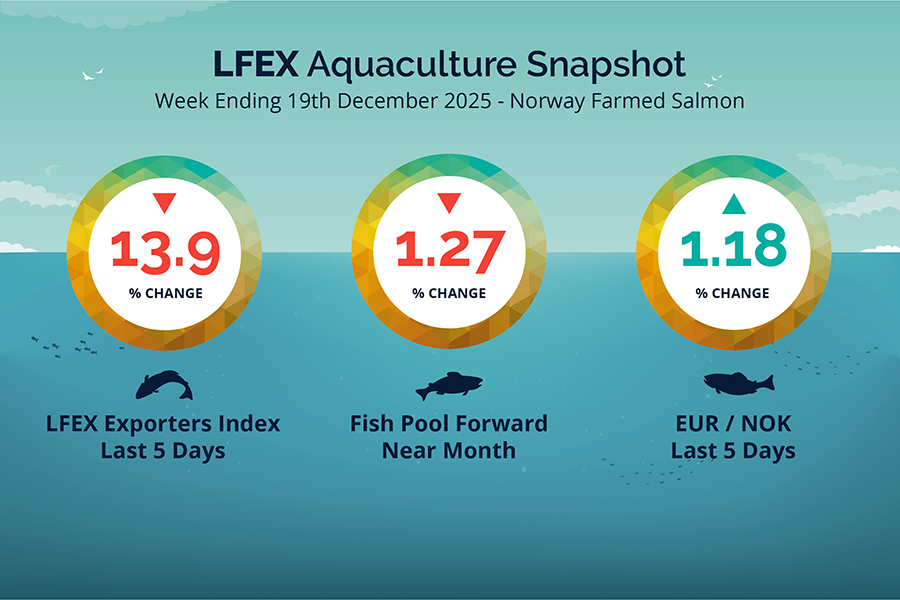

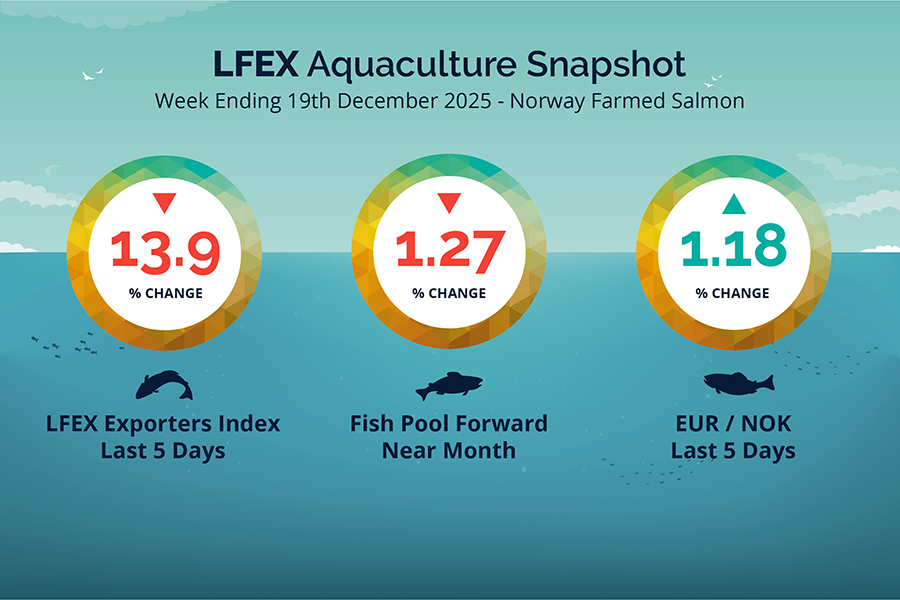

The LFEX Norwegian Exporters Index for Week 51 2025 ended the week DOWN -13.79 NOK / -13.99% to stand at 84.81 NOK (in EUR terms 7.09 / -1.25 / -14.99%) FCA Oslo Week ending Thursday vs previous Thursday.

The NOK rate ended UP at 11.96 (+0.14 / +1.18%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future January was reported DOWN at 7.75 EUR (-0.10 / -1.27%) Thursday to Thursday, approximately 92.69 NOK. February showing 8.32.

The Last Week

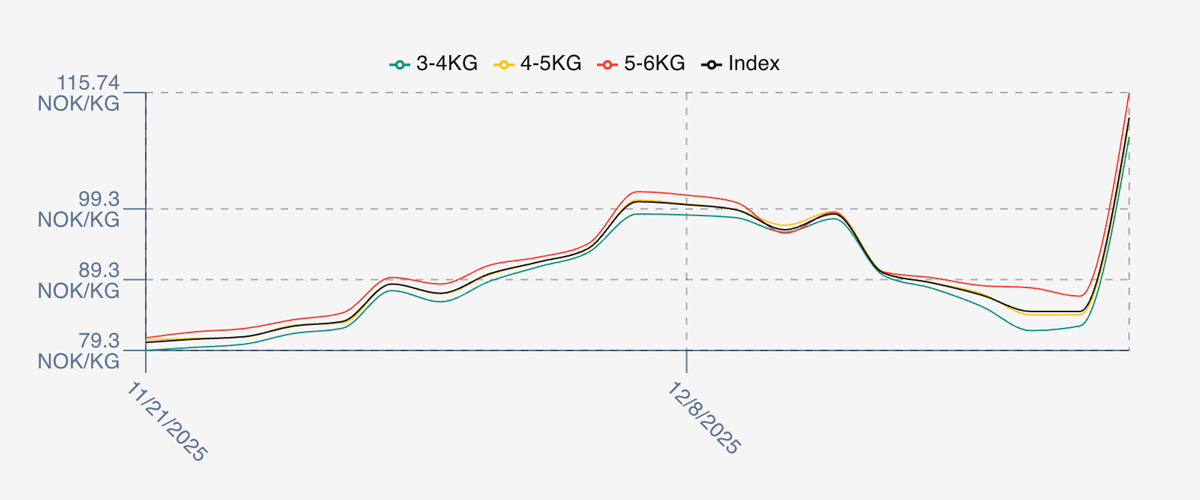

A large falling back in prices. The index gapped down on Friday open last week as prices started dramatically to reverse the prior week gains. The index showed 90.25 on Friday at calculation, in the jaws of a chaotic and falling market with plenty of chat of lower prices still. The drop was 8.35 NOK or nearly 8.5% from Thursday to Friday. More weakness was expected on Monday, and we saw further drops but not dramatic to 88.8 levels, and Tuesday continued to edge lower to 87.13. The last full week before Christmas wasn’t done however, and prices slipped below 85NOK Wednesday and flat Thursday. Pricing has seen a different pattern this year and it will be interesting to see where the year ends and 2026 levels begin.

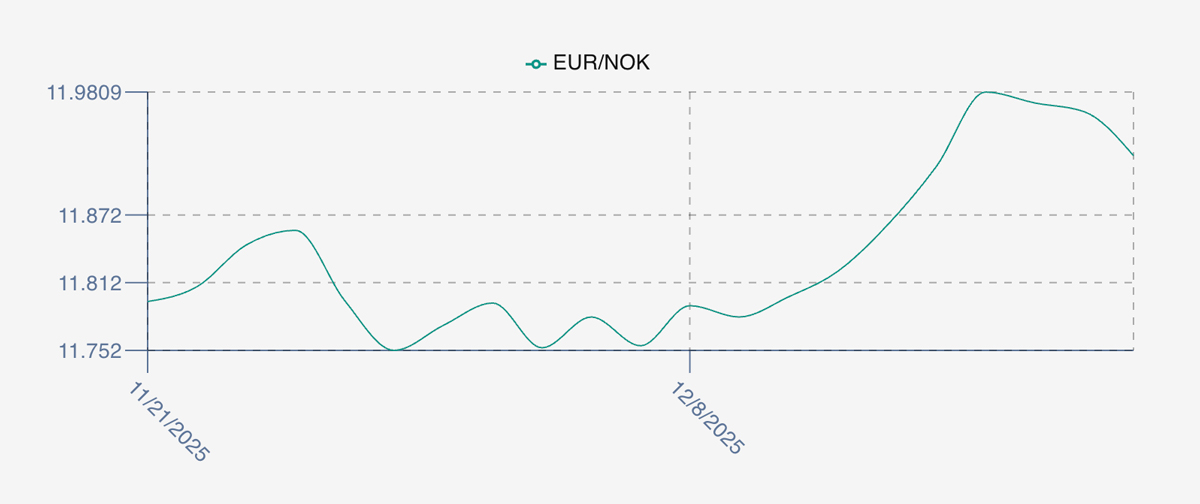

FX rate continued it’s ascent this week with and overall rise of 1.18%. The week opened at 11.85 and climbed 0.06 over the day, peaked at just over 12.00 on the 16th and 18th intraweek and closed out slightly lower at 11.96.

Spreads started increasing over the week, particularly over 17th and 18th as smaller and midsized fish dropped faster than 5/6s. We saw a 6 NOK spread Wednesday which came back to around 4 for Thursday at the end of the trading week.

Next Week

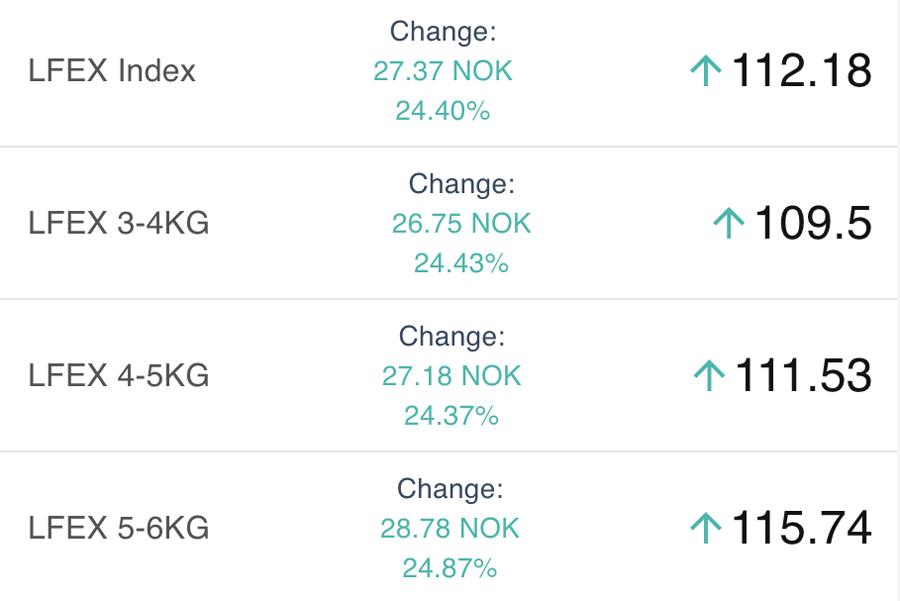

Early indications showing prices jumping for the last 2 days before Christmas. Index level around 112.5 NOK as volumes drop off. Fresh only sales pre-Christmas and week 52 is known for this jump in price.

Spreads between 3/4s to 5/6s widen significantly 109.5 / 111.5 / 115.5 approximately.

The EUR NOK FX rate is this afternoon around the 11.91 level down 0.05 since yesterday. This would give an indicative Euro index price around 9.40 EURO on offered levels Friday.

We wish everyone a very Happy Christmas and compliments of the season.

Volumes – Fresh Export

Volume figure for week 50 (2025) was 25,596 tons DOWN 62 tons as compared to 25,658 in 2024 some 0.24 % LOWER. Volumes for week 51 and week 52 (2024) were 22,450 and 9,134 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 52 2024 ended the week up +40.83 NOK / +49.12% to stand at 123.96 NOK (in EUR terms 10.47 / +3.44 / +48.99%) FCA Oslo. The NOK rate ended up +0.01 NOK / +0.08% at 11.84. The Fish Pool future December was reported at 89.00 NOK which equates to 7.52 Euro with January showing 7.70 Euro.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 19th December, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

After you have executed transactions on the platform you can access documentation from this order?

By executing on the platform, you have a confirmed transaction between you and your counterparty – a fully electronically documented record of your transaction with all associated details contained in this. These details are immediately available in real-time to both parties and can be accessed whenever required. All history is maintained within the system. Further, a full suite of documentation can then be attached to these records whether it is invoices, specifications, logistics etc making all relevant trade documentation available to both parties the instant they are uploaded / updated.

FAQ’s

Q. When is LFEX open?

A. Like the city, the platform never sleeps. It is available for use 24 x 7 x 365. The nature of aquaculture trading is global with sellers and buyers from all corners of the planet. It is the perfect tool to manage orders 24 hours a day. It allows users to put up offers and requests when counterparties are asleep, knowing when they wake up and are available the system will have notified them of any new offers or orders they need to react to. Or perhaps just a morning chat or end of day round-up to keep building that relationship.