The London Fish Exchange

Data / Market Insight / News

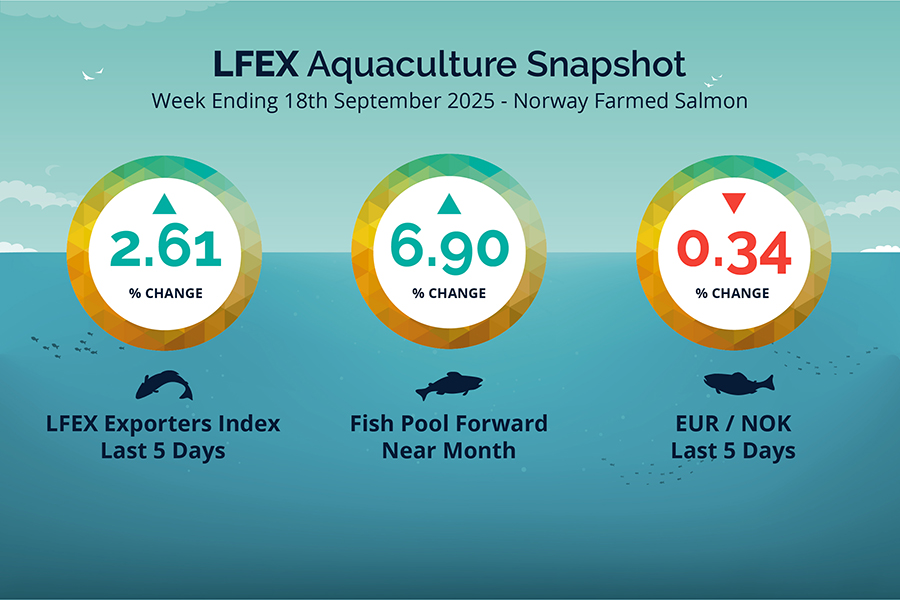

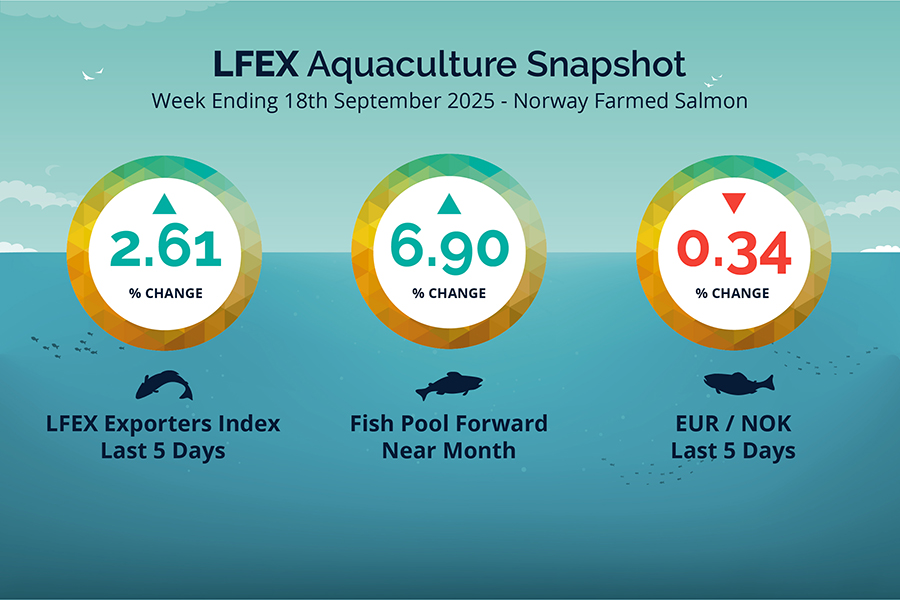

LFEX European Aquaculture Snapshot to 18th September, 2025

|

|

Published: 19th September 2025 This Article was Written by: John Ersser |

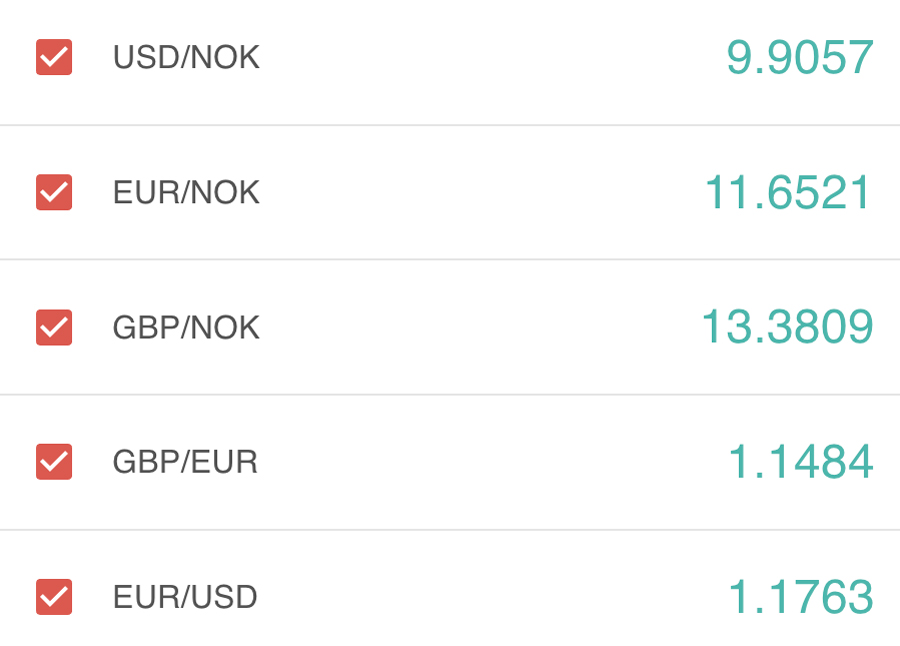

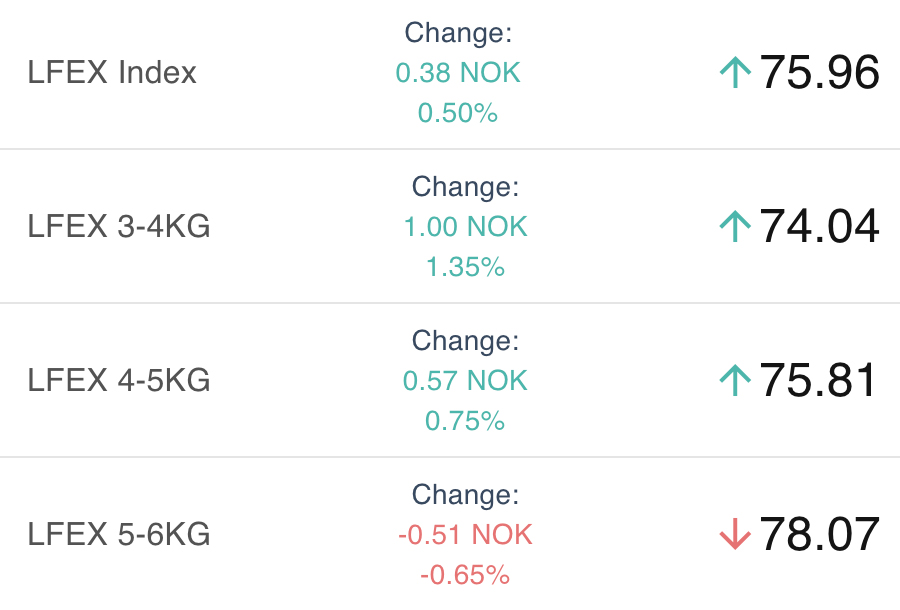

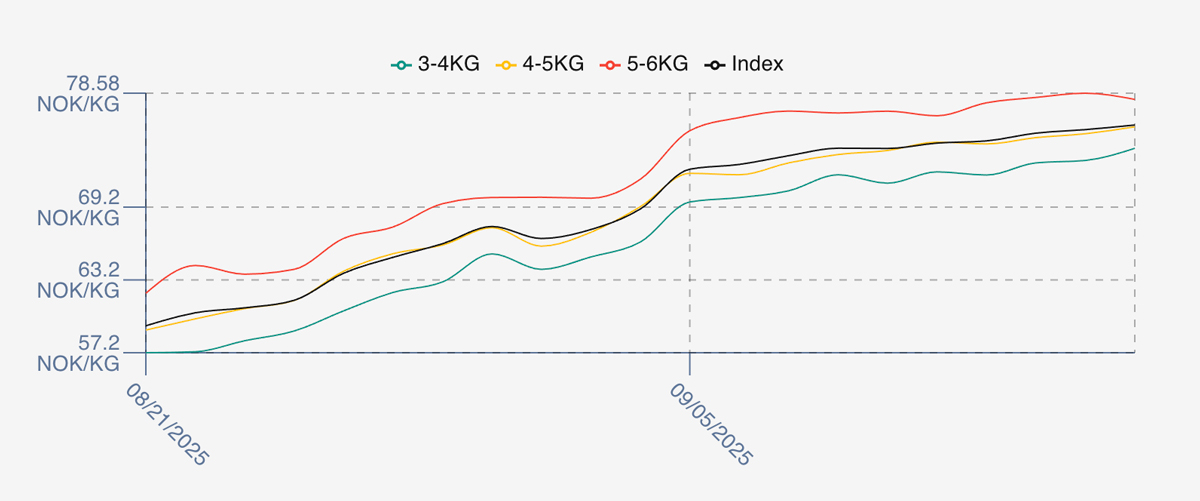

The LFEX Norwegian Exporters Index for Week 38 2025 ended the week UP +1.93 NOK / +2.61% to stand at 75.96 NOK (in EUR terms 6.57 / +0.19 / +2.96%) FCA Oslo Week ending Thursday vs previous Thursday.

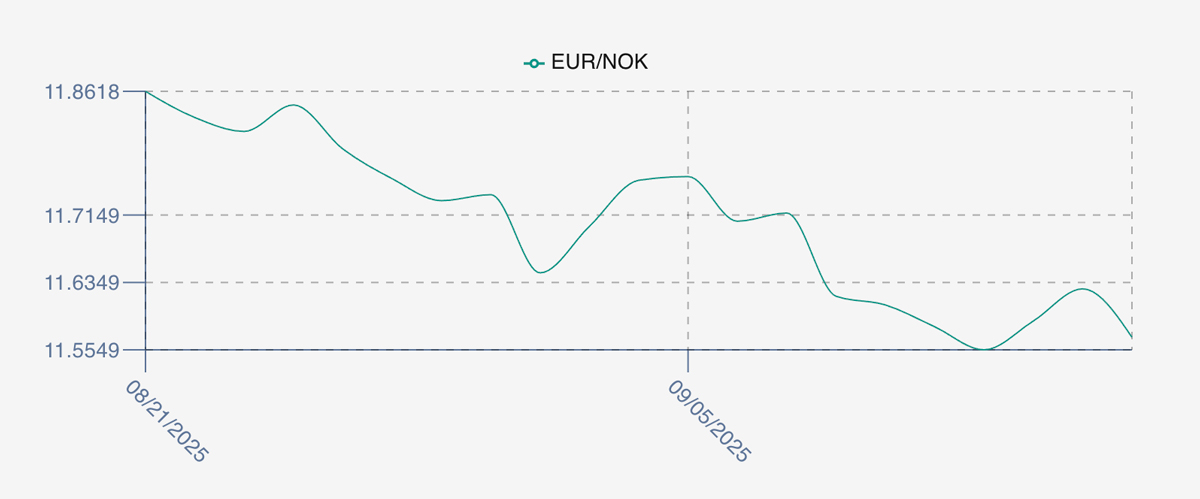

The NOK rate ended DOWN at 11.57 (-0.04 / -0.34%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future October was reported UP Thursday to Thursday at 6.20 EUR, (+0.40 / 6.90%) approximately 71.72 NOK.

The Last Week

Another consistent week with gently increasing prices. On Friday we saw the index pushed up from the open at 74.47 NOK levels up around 0.44 NOK increase on the prior week close. Trading then really just inched up small every day, no drama, swings or volatility. The index finished at 75.96 levels which may not have been the expectation of buyers at the beginning of the week. It’s worth noting that volumes in week 37 (for which we have numbers) were lower than the corresponding week last year.

FX rate opened at 11.58 on the Friday, so pretty flat (vs 11.57) as we entered the week, and with a bit of volatility intraweek ended up where we started at 11.57.

Spreads on the index tightening this week coming in at 4 NOK evenly spread.

Next Week

Indications this week see the that indicative prices are up significantly, with the index potentially hitting the 80 NOK level. This would give us a 4/5 NOK increase on the Thursday close. The volume of fish has now dropped as compared to last year, at least in week 37 and seems week 38, which has enabled sellers to push prices.

Spreads between 3/4s to 5/6s have widened again this Friday with the level around 6 to 6.5 NOK with the larger 5/6s pulling ahead over the 4/5s.

EUR NOK FX rate is higher again this afternoon with rates around 11.68 vs 11.57 yesterday. This would give an indicative Euro index price around 6.85 on offered levels later Friday.

Volumes – Fresh Export

Volume figure for week 37 (2025) was 24,791 tons DOWN 4,008 as compared to 28,799 in 2024 some 14% LOWER. Volumes for week 38 and week 39 (2024) were 28,673 and 29,238 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 39 2024 ended the week down -2.32 NOK / -3.24% to stand at 69.21 NOK (in EUR terms 5.88 / – 0.24 / -3.90%) FCA Oslo. The NOK rate ended higher at 11.77 to the Euro. The Fish Pool future September was reported down -0.24 NOK / -0.70% at 70.25 NOK with October showing 70.71.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 18th September, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

Odd Lots – what does it mean, and can I trade them?

Odd Lots, or smaller orders and unusual one-off transactions are often the result of a surprise demand that needs to be facilitated by a buyer, or a smaller excess inventory from a seller. The use of a platform is ideal in this scenario allowing both sides to broadcast their Odd Lot requirement to multiple counterparties quickly and easily, and to source and mop up the requirement. It means the system can take the strain as opposed to chasing around for ultimately a low volume order.

FAQ’s

Q. If I use your chat service can anyone else see my messages?

A. LFEX Chat is available on both web and mobile devices and allows users to communicate in real-time with specific named individuals. Every user on the system is uniquely identified and this offers a secure, robust and private service. It is free to use as part of the LFEX service and puts all your business communications in one place, and your private data remains just that… private. It won’t keep glitching like other services and won’t frustratingly reinvent words as your mobile ‘auto-corrects’ to the wrong words.