The London Fish Exchange

Data / Market Insight / News

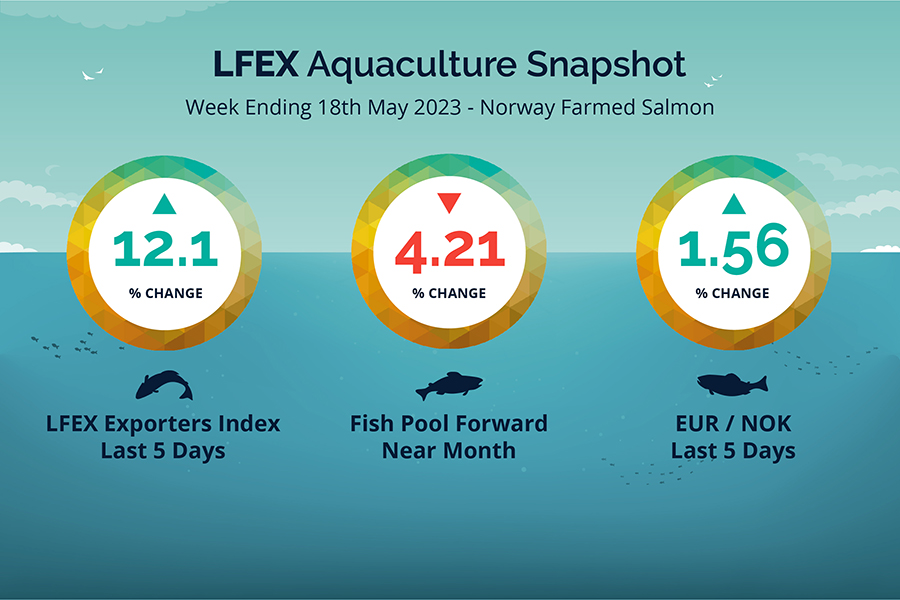

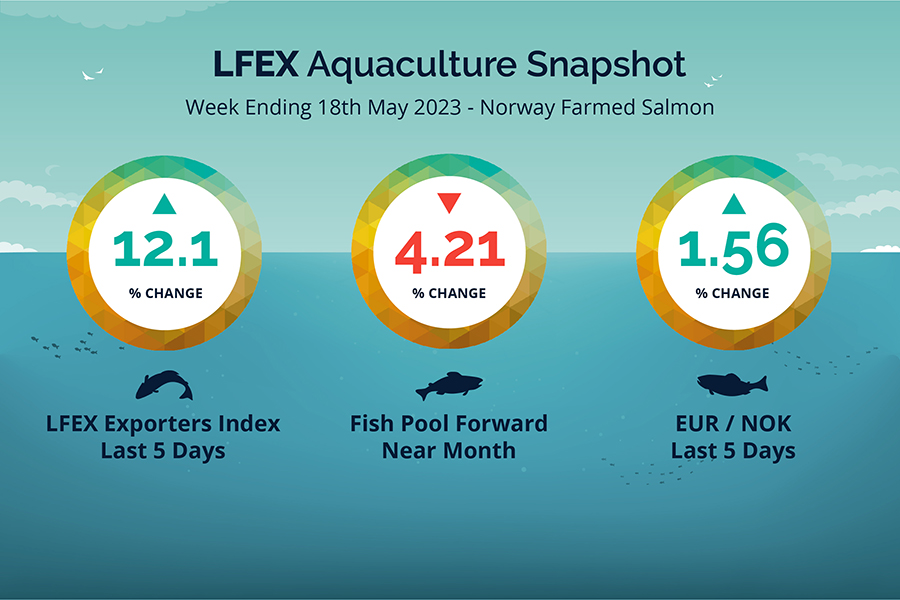

LFEX European Aquaculture Snapshot to 18th May, 2023

|

|

Published: 19th May 2023 This Article was Written by: John Ersser |

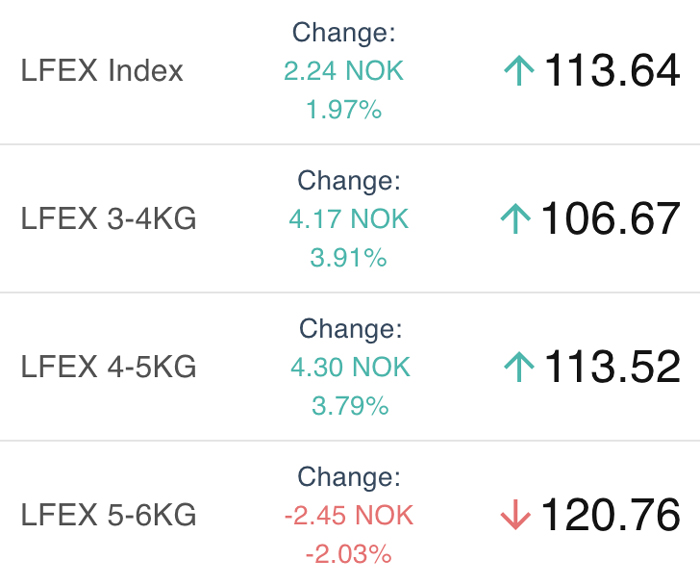

The LFEX Norwegian Exporters Index for Week 20 2023 saw a bounce from the previous weeks drop with the market up + 12.13%, +12.29 NOK to stand at 113.64 NOK FCA Oslo Week ending Tuesday vs previous Thursday.

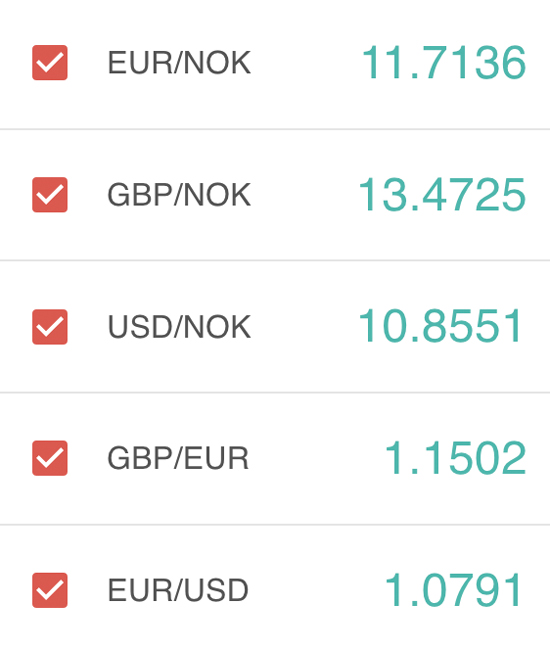

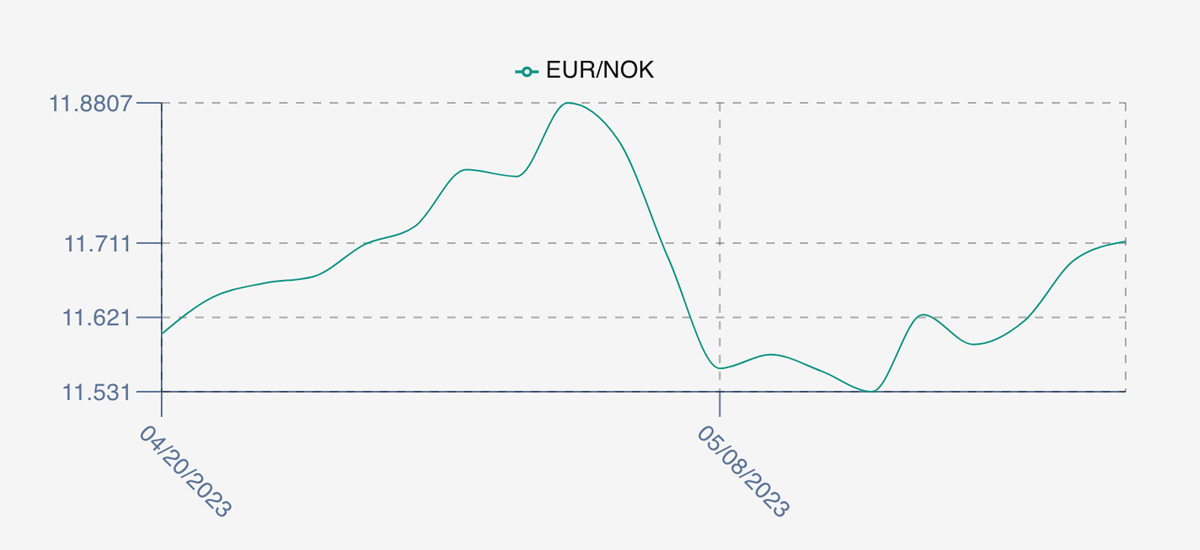

The NOK rate was up at 11.71 to the Euro over the period Thursday to Thursday +0.18 NOK or +1.56%. The Fish Pool future May was reported lower at 102.5 NOK down -4.50 NOK or -4.21%.

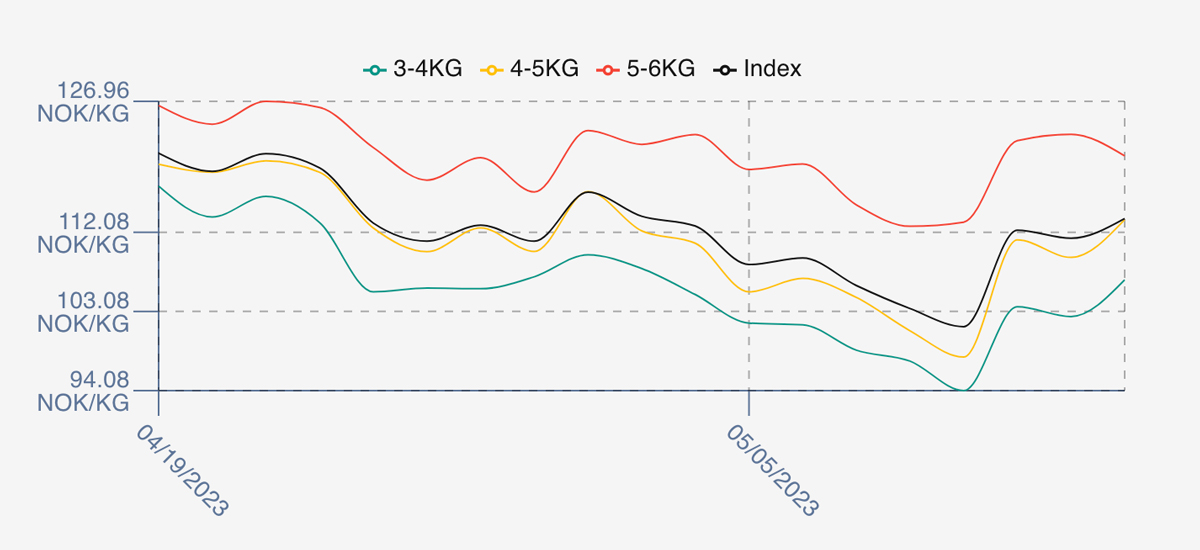

A very short trading week with a two-day holiday in Norway and many northern European markets also closed on the 18th. The compressed week pushed prices significantly higher on the Friday, opening at 112.32 or a 10.82% jump indicating that there wasn’t much inventory over-hang from the prior week. Monday saw pricing hold at 111.40 NOK and Tuesday closed the week out nudging up further at 112.64. The NOK saw weakness again against the EUR reversing last week’s trend. A full harvesting and trading week coming but with markets closed yesterday the market is struggling to getting price discovery at this early stage. Initial suggestions are for a weakness down from these levels, but maybe not back to where week 19 left off… we shall see.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 18th May, 2023 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The London Fish Exchange Norwegian Exporters Index is updated daily to provide the only independent intraweek pricing movement for the Norwegian salmon market.

It has been running for over two years and is based on offered price indications. When tracked back against other weekly pricing we see that on average the index is around 1.2% higher than the traded prices that ultimately go through the market – as would be expected, Further, it tracks the traded weekly price volatility very closely, and more specifically provides depth and colour to intraweek pricing and volatility for an excellent insight into intraweek market dynamics.

FAQ’s

Q. I get confused having to track multiple communication channels, is there a better way?

A. By becoming a central focus point for a market, it is much easier to direct all communications into one channel which is secure, trusted and private. We know that companies often have to juggle 6 or 7 different solutions which becomes unworkable and unreliable as a process. LFEX chat is available 24/7 with all history accessible and auditable on web and mobile with alerts meaning you never miss that important message, order or price or conversation.