The London Fish Exchange

Data / Market Insight / News

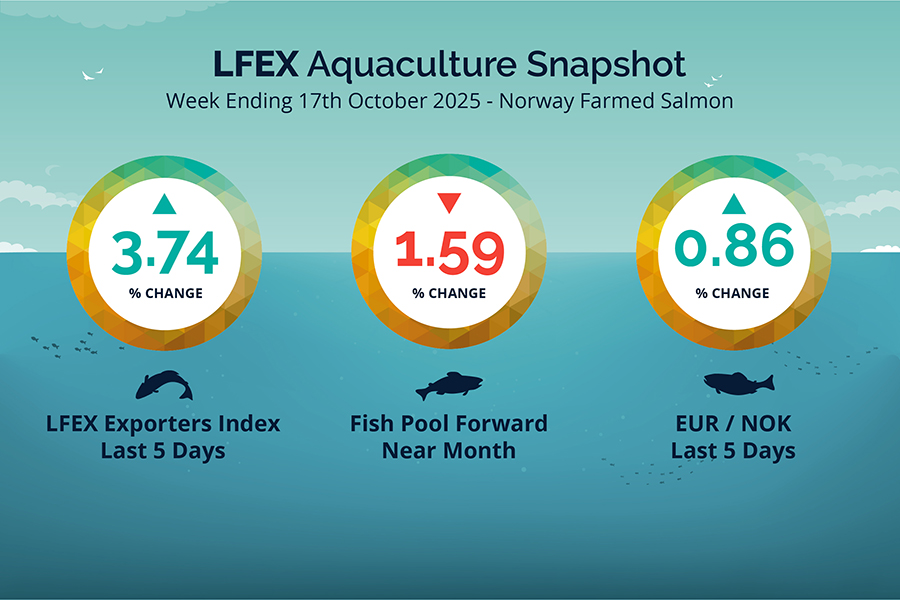

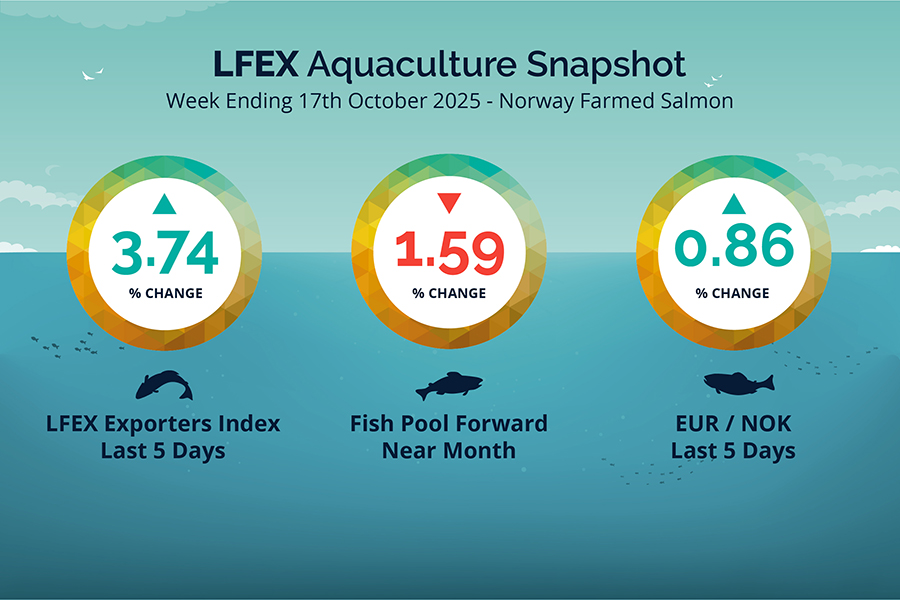

LFEX European Aquaculture Snapshot to 17th October, 2025

|

|

Published: 17th October 2025 This Article was Written by: John Ersser |

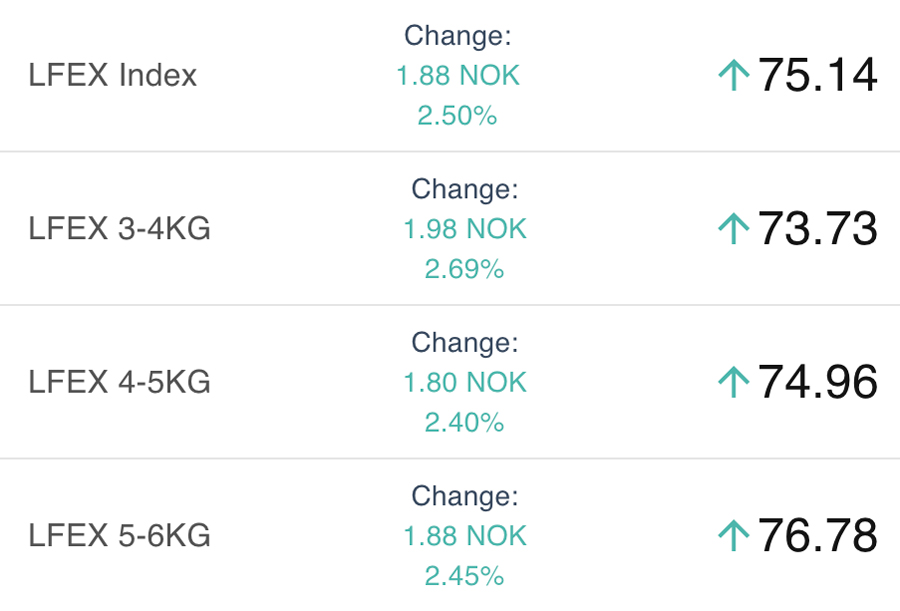

The LFEX Norwegian Exporters Index for Week 42 2025 ended the week UP +2.64 NOK / +3.74% to stand at 73.26 NOK (in EUR terms 6.25 / +0.17 / +2.85%) FCA Oslo Week ending Thursday vs previous Thursday.

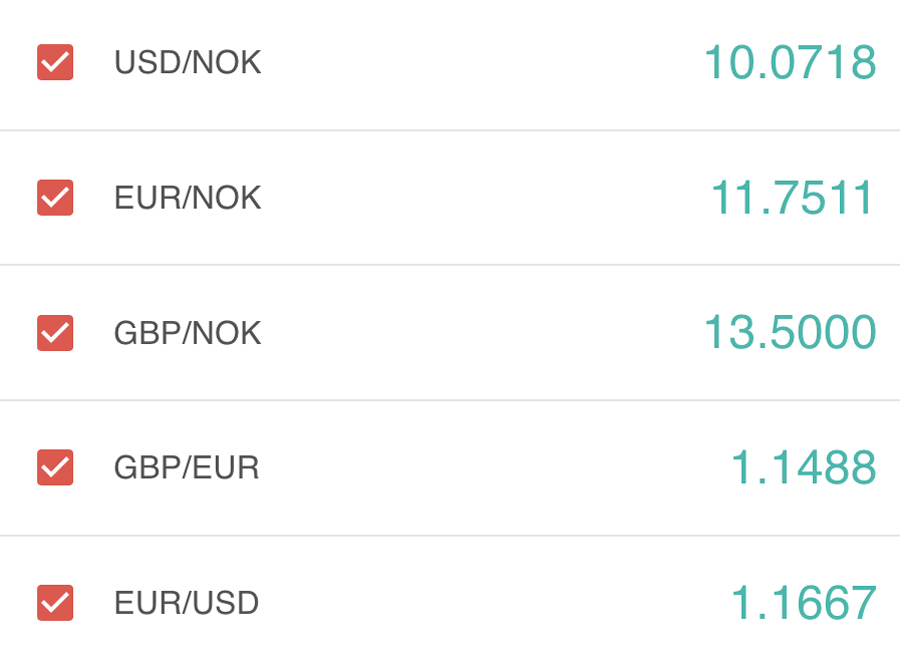

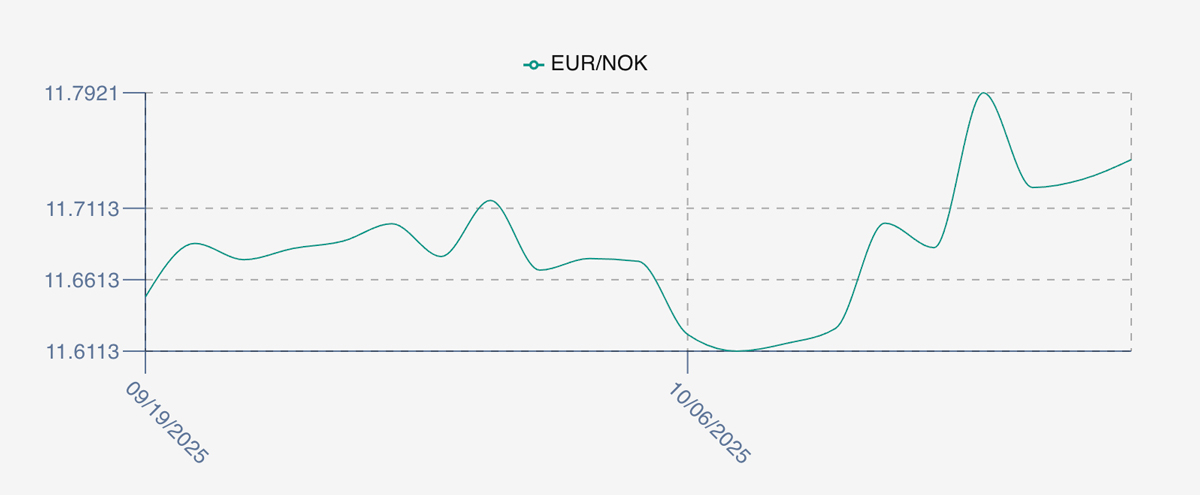

The NOK rate ended UP at 11.73 (+0.10 / +0.86%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future November was reported DOWN Thursday to Thursday at 6.20 EUR, (-0.10 / -1.59%) approximately 72.7 NOK.

The Last Week

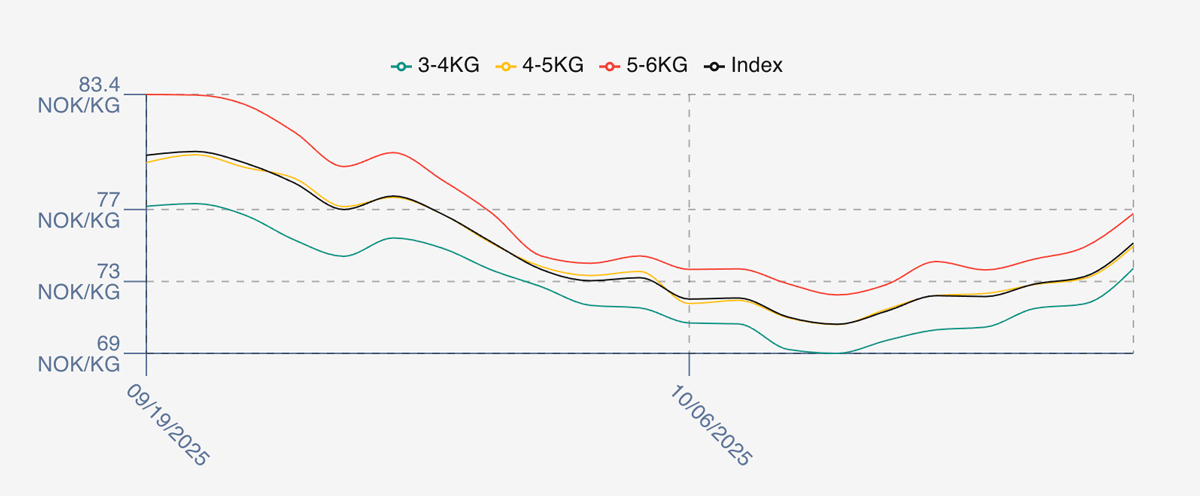

As you were. The pricing trend this week was roughly the mirror opposite of last week. Which makes a nice smile on a chart. Friday opened up +0.73 NOK on the prior week at 71.35 – the prior Thursday being the low of the recent pattern at 70.62. Monday was pretty flat at 71.21, while Tuesday added a NOK at 72.16 followed by to half NOK rises 72.8 and 73.26 ending the week on the high, a level close to last year at this time (74.96). Traders found pricing a little challenging on Friday but actually there was good consistency at the indicated levels after the prior week falls.

FX rate was stronger this week, opening at 11.71 a pick-up from Thursday, and continued to peak at 11.79 before settling back to 11.73 on the Thursday.

Spreads on the index have remain around the 3 NOK between 3-4 and 5-6 evenly spread.

Next Week

Pricing for next week again looking stable. Prices are up small with early indications around the 75 NOK level for the index, with no major potential issues to report on Friday afternoon.

Spreads between 3/4s to 5/6s remain at / around the 3 NOK level currently.

EUR NOK FX rate is this afternoon around the 11.75, up 0.02 from Thursday, but it has been higher at 11.82 this morning and then dropped. This would give an indicative Euro index price around 6.38 on offered levels later Friday – an increase of 0.30 Euro versus this time last week.

Volumes – Fresh Export

Volume figure for week 41 (2025) was 26,112 tons UP 932 as compared to 25,180 in 2024 some 3.57 % HIGHER. Volumes for week 42 and week 43 (2024) were 25,561 and 24,910 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 43 2024 ended the week up +0.61 NOK / +0.81% to stand at 75.57 NOK (in EUR terms 6.40 / + 0.09 / +1.41%) FCA Oslo. The NOK rate ended lower at 11.805 to the Euro. The Fish Pool future October was 73.0 NOK with November showing 81 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 17th October, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

LFEX delivers secure and trusted connectivity with counterparties globally for order routing, price discovery and transactions.

If you have a group of customers in Asia, you are a processor in northern Europe or a retailer in the US, we provide real-time, seamlessly integrated technology platform including pre and post trade services and data to support industry operations.

FAQ’s

Q. With Trump’s tariffs in place and other geopolitical issues, how can you help?

A. It’s about optimising your resources to get the maximum distribution for your business. If the US is more difficult to navigate, then switching flow to other markets maybe the way to go. Using a platform that has global connections to trusted counterparties that allows you to efficiently broaden your scope, connect, price and trade is a sensible initiative.