The London Fish Exchange

Data / Market Insight / News

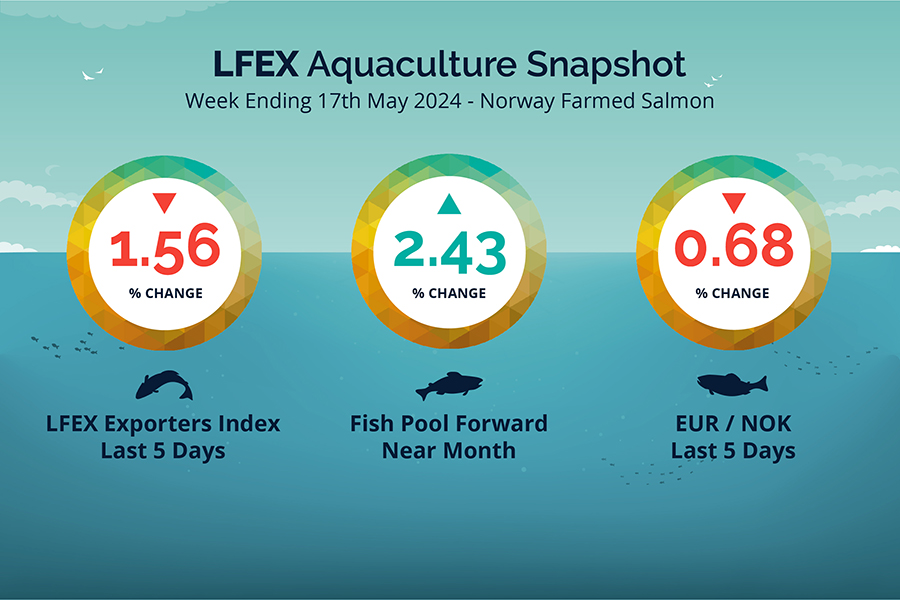

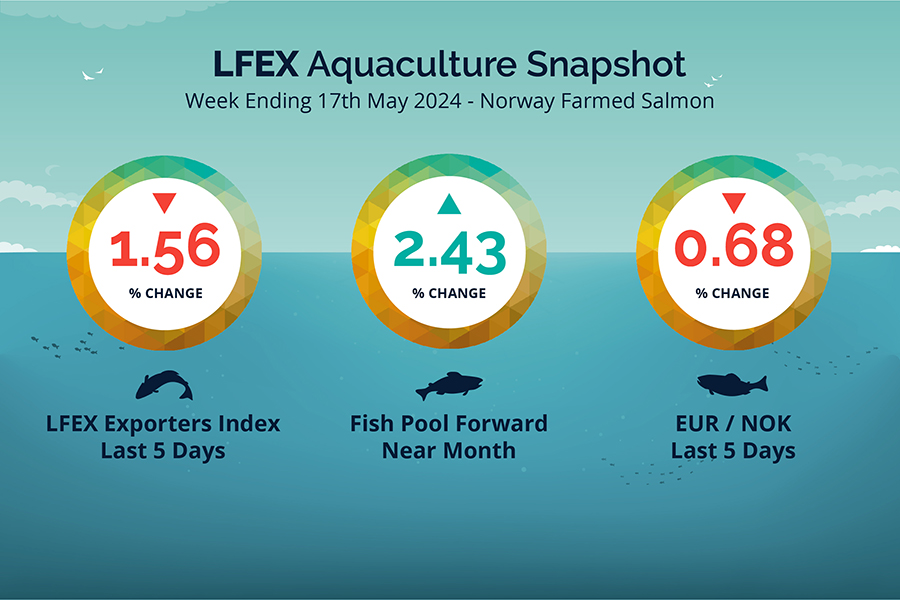

LFEX European Aquaculture Snapshot to 17th May, 2024

|

|

Published: 17th May 2024 This Article was Written by: John Ersser |

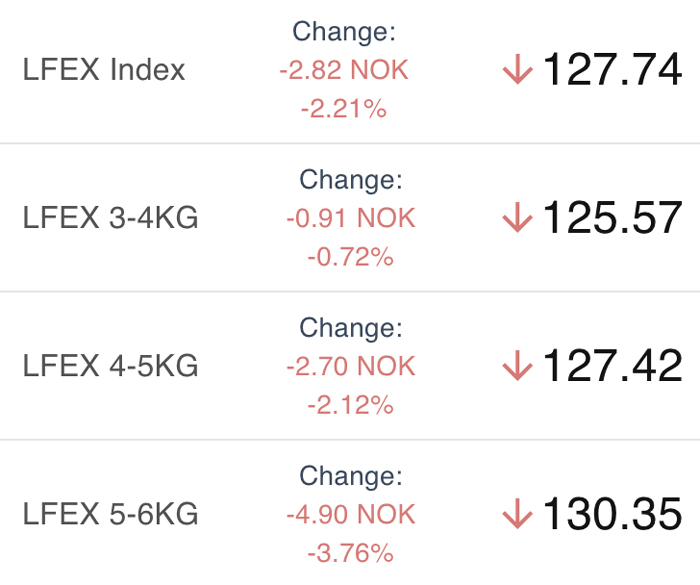

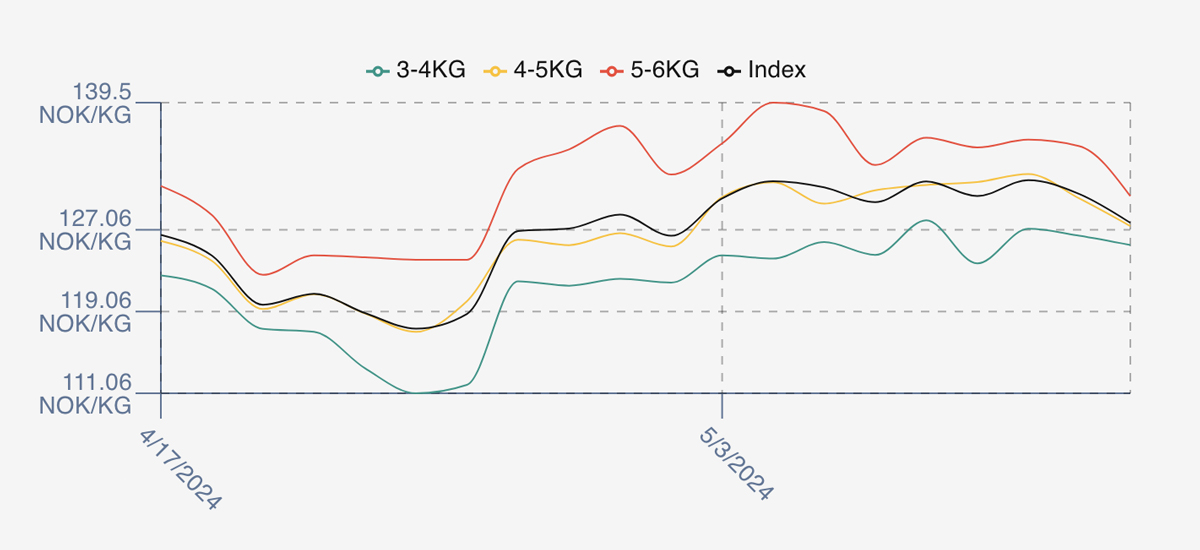

The LFEX Norwegian Exporters Index for Week 20 2024 ended the week down -1.56%, – 2.03 NOK to stand at 127.74 NOK (in EUR terms 10.98 / -0.10 / -0.89%) FCA Oslo Week ending Thursday vs previous Thursday.

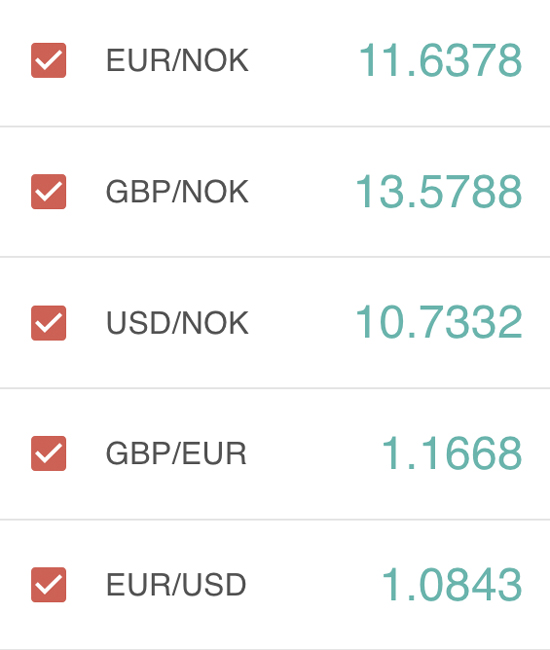

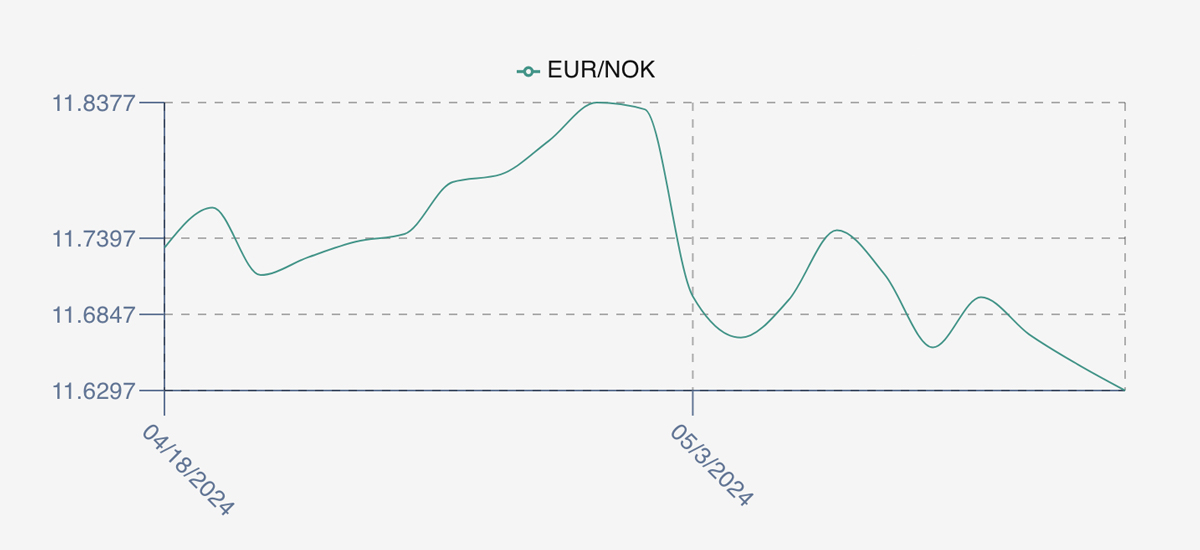

The NOK rate ended down at 11.63 to the Euro over the period Thursday to Thursday -0.08 NOK or -0.68%. The Fish Pool future May was reported up +3.00, +2.43% at 126.50 NOK.

The market has settled into a familiar routine it would seem. High overall pricing levels, starting high, remaining high and a small drop off at the end of the week. This week was no exception. Opening levels were up 2.03 NOK on the previous close, opening last week at 131.80 +1.56%. And there levels pretty much stayed at 130 and 131 for the week. Thursday saw the usual drop off giving up approximately 3 NOK to land at 127.74 and the lead into the long end of May weekend. Not much to interpret on the pricing, the weekly levels were the same, if the end was slightly lower this week which may (?) indicate a slight softening. However, this will all be volume and timing related. A further NOK strengthening 0.9% made things a little more expensive for Euro buyers relatively.

Next week (w21) will be the last ‘short’ week for Norway with Monday closed. Volumes tend to start picking up at the end of May and pricing responds accordingly. Some people look to week 23 to see the start of this trend, but there is no guarantee. For next week, week 21, pricing is thin. However, the trend is expected to continue, with a higher open and fall off towards the end of the week which would put pricing around the 129 / 130 levels. Available volumes will of course decide the trajectory next week, but initial indications are for volumes to remain tight.

Volume figures for week 19 were down on the prior week at 10,617 vs 11,511. Volumes on week 21 2023 were 15,492 to give some comparison guidance.

A year ago, Week 21 2023 prices ended lower at 112 NOK and a slight fall of 1.5% over the week. The EURNOK rate was flat at 11.73.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 17th May, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The LFEX platform helps sellers manage and distribute multiple prices to different customers in real-time on the system.

Customers are different and have different demands, whether it is sizes, classifications, certifications, currencies or INCO terms. The platform allows sellers to manage this process, getting bespoke pricing out to a universe of customers quickly and easily allowing buyers more immediate access to offers to see and react to.

FAQ’s

Q. How does your weekly pricing change work?

A. The index is a useful tool for overall pricing as well as tracking intra week volatility and we calculate and publish the index every day. We report the weekly change based on the change from the previous Friday (which captures pricing for the following week) to the Thursday of that following week. This gives an accurate measure of the actual change week on week. The index will show how it changed during that week, capturing the opening levels as prices and sales are pushed at the start of the week and where it ends up.