The London Fish Exchange

Data / Market Insight / News

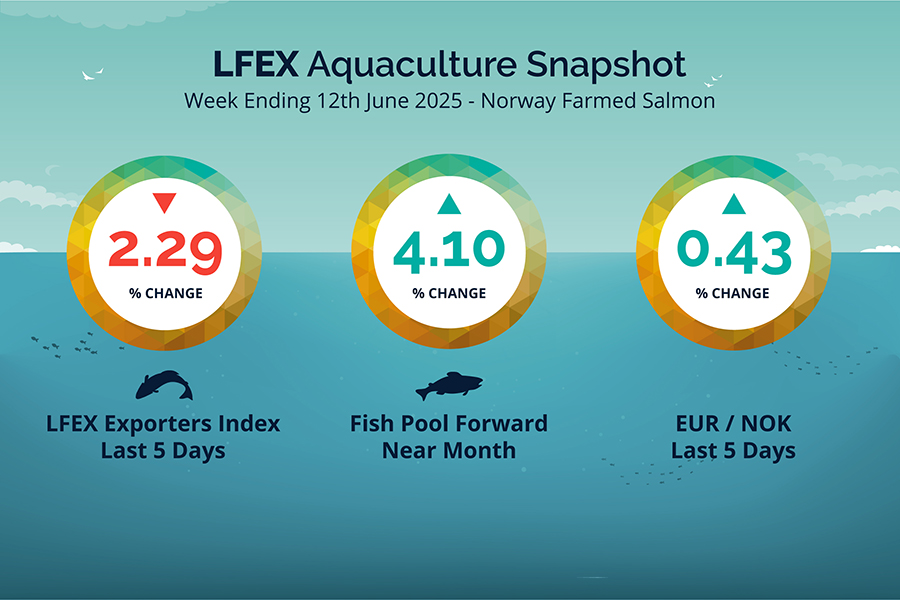

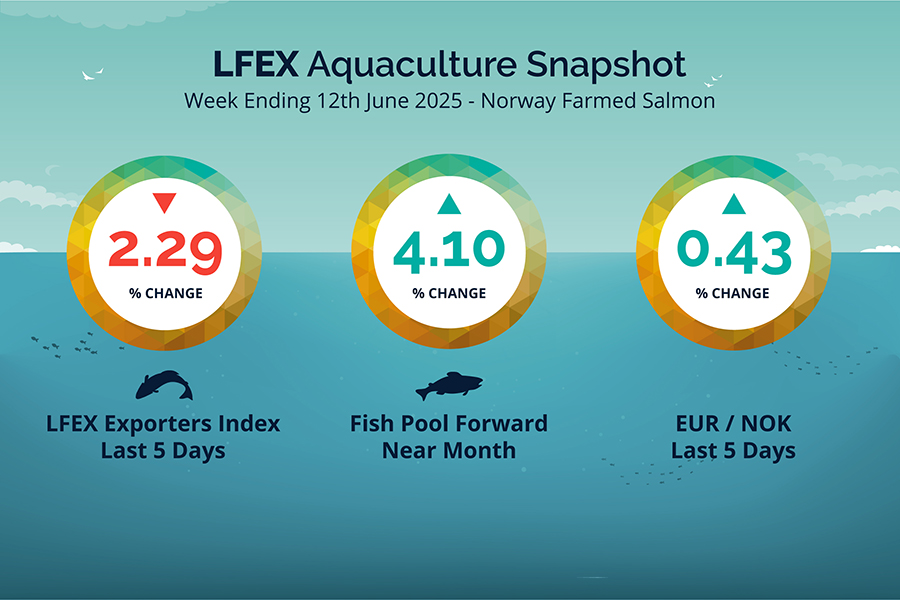

LFEX European Aquaculture Snapshot to 12th June, 2025

|

|

Published: 13th June 2025 This Article was Written by: John Ersser |

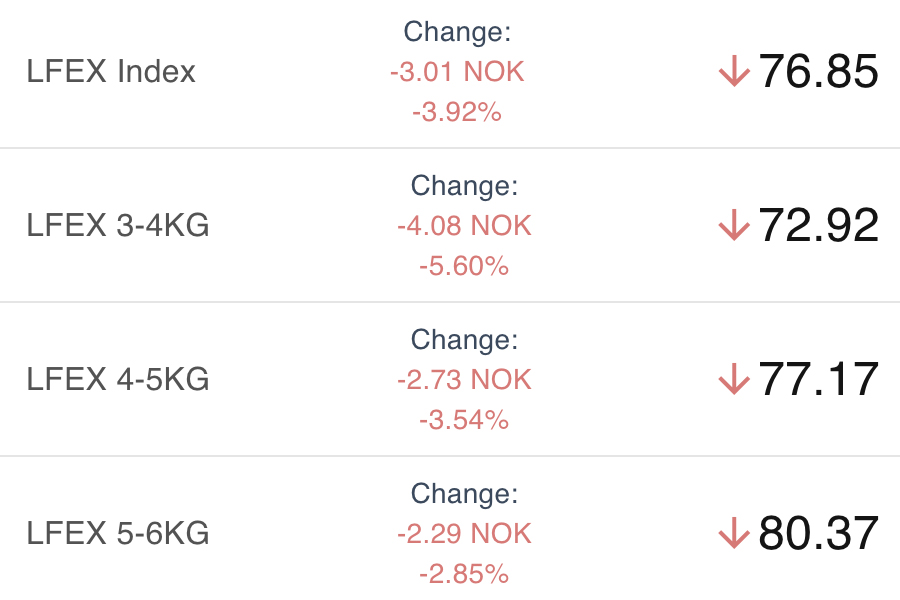

The LFEX Norwegian Exporters Index for Week 24 2025 ended the week DOWN -1.80 NOK / -2.29% to stand at 76.85 NOK (in EUR terms 6.65 / -0.19 / -2.71%) FCA Oslo Week ending Thursday vs previous Thursday.

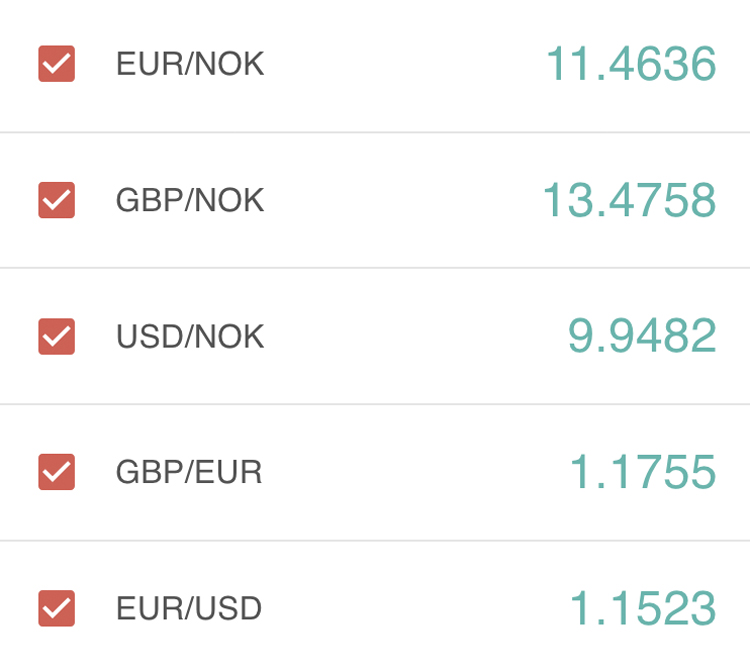

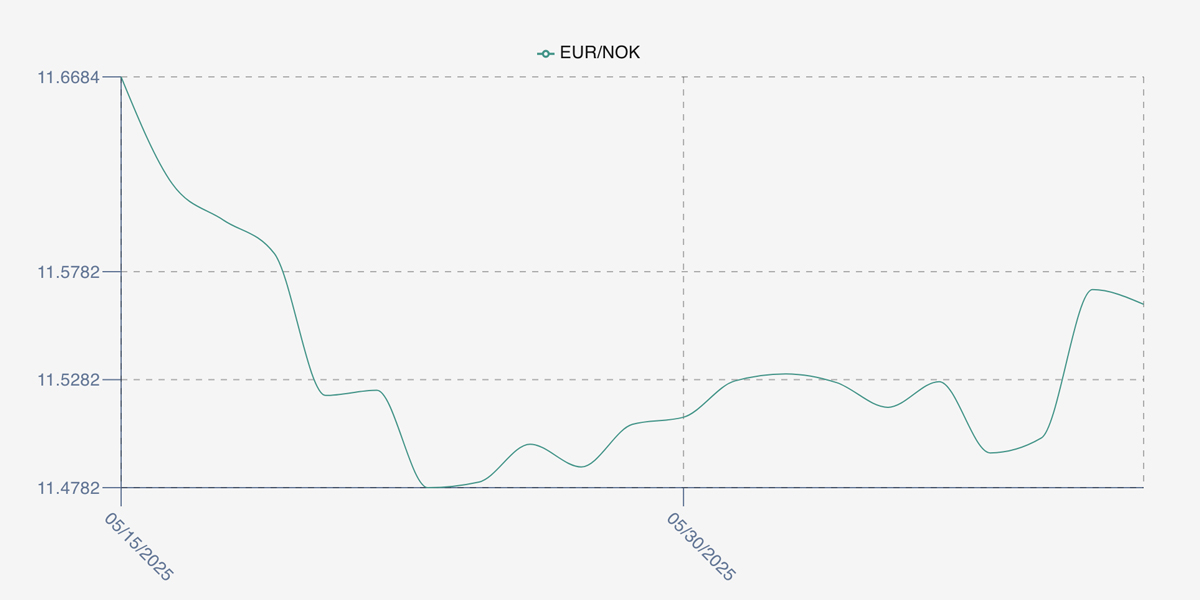

The NOK rate ended UP at 11.56 (+0.05 / +0.43%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future July was reported UP Thursday to Thursday +0.25 / +4.10% at 6.35 EUR, approximately 73.40 NOK.

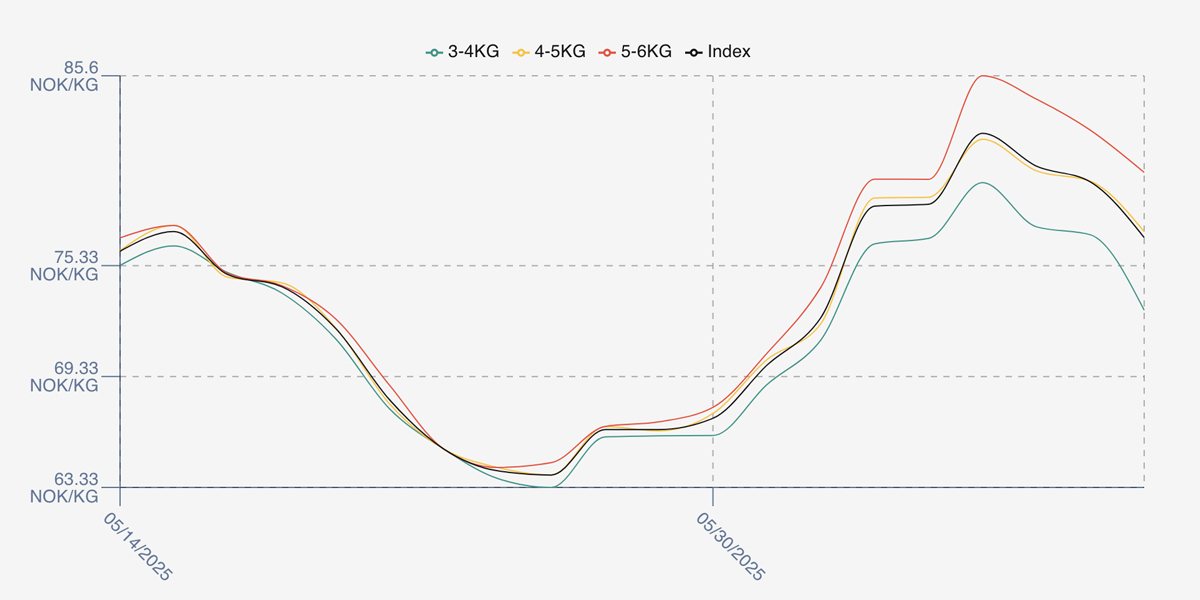

The Last Week

A short trading week with the Monday off because of Whitsun. Traders managed their books prior to the holiday with prices pushed up on Friday to account for the reduction in harvesting / trading days. The week opened up offered at 82.49, up nearly 4 NOK from the prior week Thursday close. Significant concern was voiced about how long prices could stay at this offered level, and Tuesday gave us 80.71 offered, still a considerable jump in prices. Wednesday was relatively flat at 79.86 but by Thursday the market had given back, and was in fact under water for the week, closing out at 76.85.

Spreads are back, 7 NOK between 3-6 with 3/4s showing 72.92 NOK.

Next Week

Indications this week see the index opening around the 74.5 NOK level as offered prices continue their fall from last week. Pricing is difficult again this week with a lot of volatility and a few moving parts to contend with. Volumes are good, which will apply pressure, Poland is off for a day next week which will reduce some demand and it’s a full harvesting week in Norway. Potential logistics issues from the middle east add to the mix and a drop in FX rates.

EUR NOK FX rate is 0.10 lower at 11.46 this afternoon, this would give an indicative Euro index price around 6.50 on offered levels later Friday.

Volumes – Fresh Export

Volume figure for week 23 (2025) was 19,164 tons up 2,559 as compared to 16,605 in 2024. Volumes for week 24 and week 25 (2024) were 16,797 and 18,125 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 25 2024 ended the week down -3.33%, -2.71 NOK to stand at 78.71 NOK (in EUR terms 6.97) FCA Oslo. The NOK rate ended down at 11.30. The Fish Pool future June was reported down – 1.50, -1.79% at 82.5 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 12th June, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The best way to follow price changes during the week?

We track intra- week pricing on the index and publish this early afternoon Monday to Thursday and later on a Friday to capture the following weeks pricing. It is the ideal way to get a handle on intra-week volatility and provides users with a trusted and much better picture of the market movement and sentiment, particularly in weeks like we have just seen.

FAQ’s

Q. What is the purpose of the platform?

A. Bring together the buying and selling communities on a single platform. Delivering a tool for users to connect, communicate, discover inventory and pricing, and trading in a secure, modern and transparent environment, 24 x 7 globally. To provide the benefits enjoyed by other financial and commodity markets, as well as a single source for post sales activity, documentation and market data. Delivering efficiency, opportunity and knowledge.