The London Fish Exchange

Data / Market Insight / News

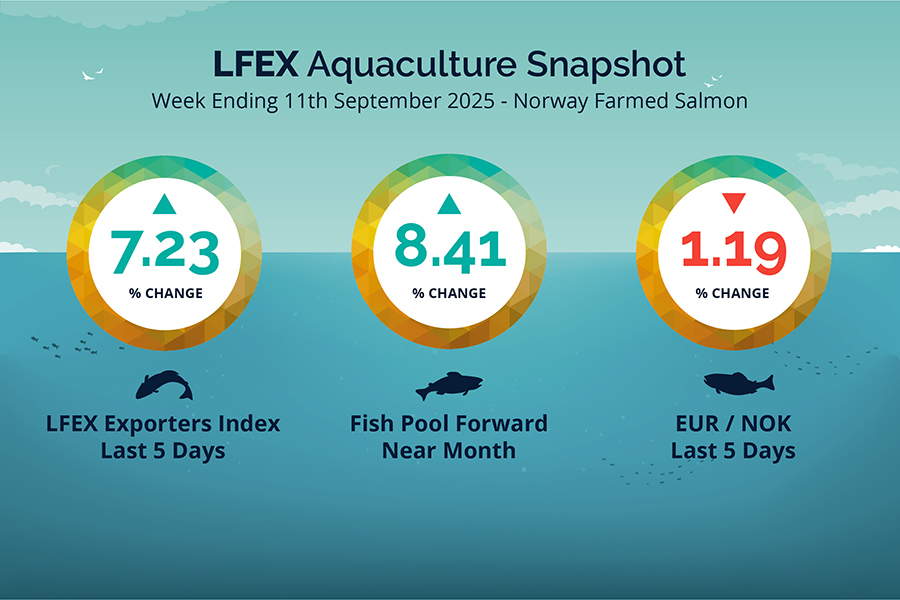

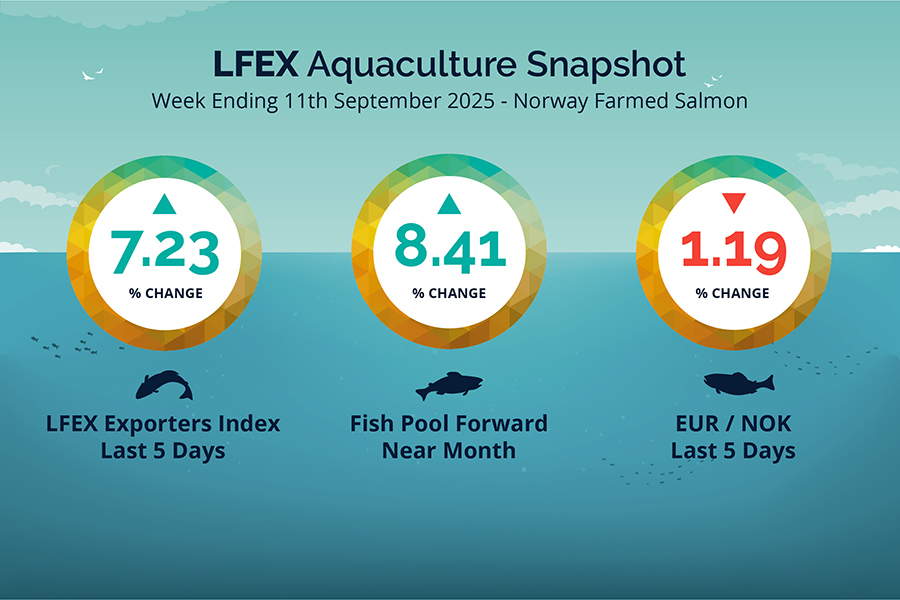

LFEX European Aquaculture Snapshot to 11th September, 2025

|

|

Published: 12th September 2025 This Article was Written by: John Ersser |

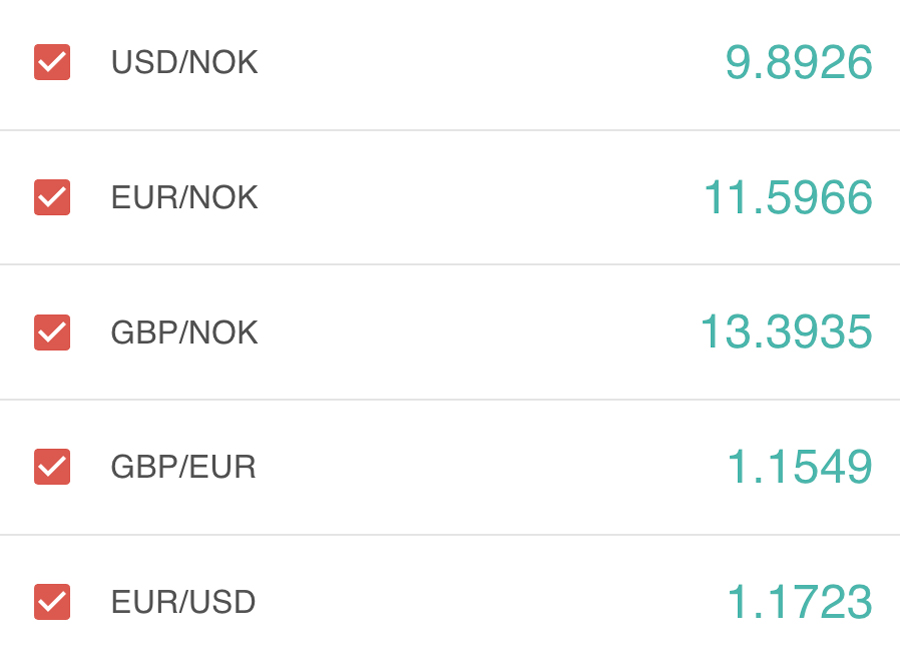

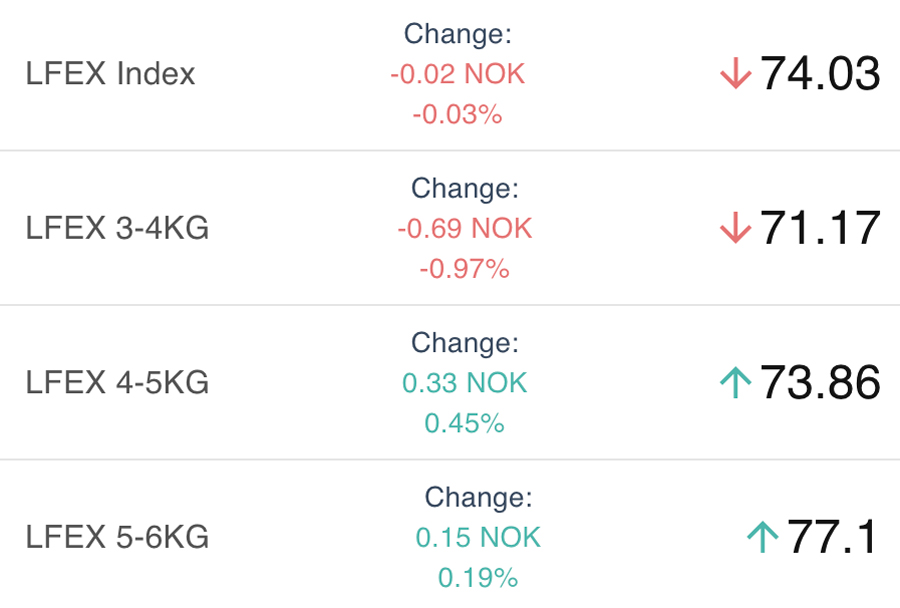

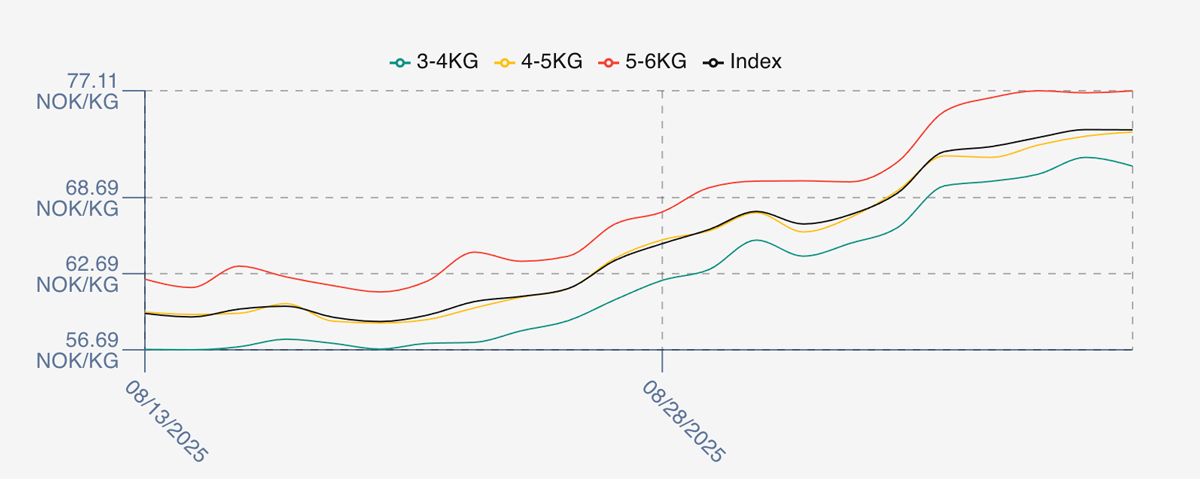

The LFEX Norwegian Exporters Index for Week 37 2025 ended the week UP +4.99 NOK / +7.23% to stand at 74.03 NOK (in EUR terms 6.38 / +0.50 / +8.52%) FCA Oslo Week ending Thursday vs previous Thursday.

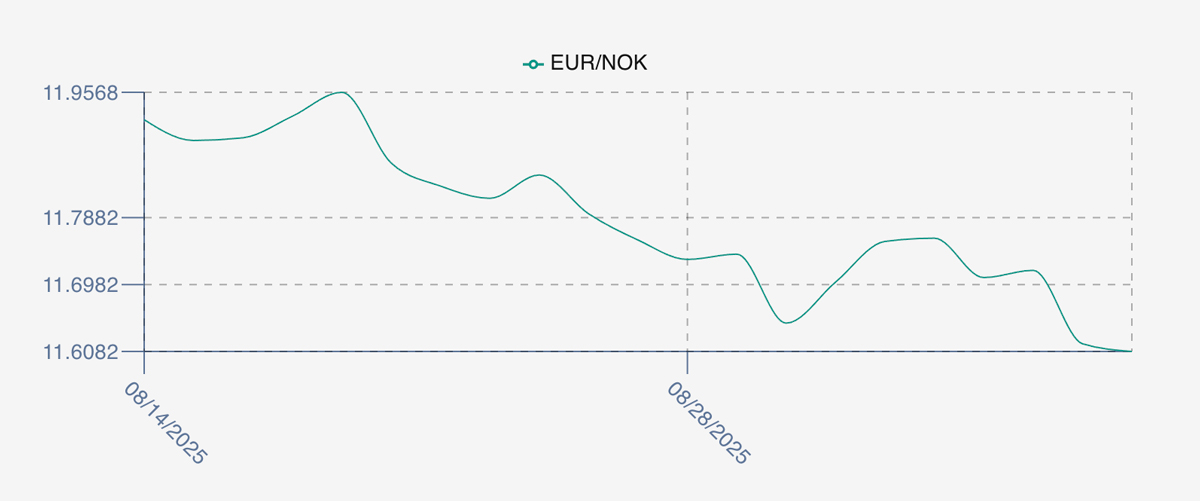

The NOK rate ended DOWN at 11.61 (-0.14 / -1.19%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future October was reported UP Thursday to Thursday at 5.80 EUR, (+0.45 / 8.41%) approximately 67.34 NOK.

The Last Week

Consistent week with stronger prices. This week’s trading pattern resembled a more typically strengthening market scenario. On Friday we saw the index pushed up from the open at 72.32 NOK levels 3+ NOK / 4.75% increase on the prior week close. Expectations generally run that prices are pushed at the beginning of the trading week. Monday inched up as the gains were held, and the same story for Tuesday at 73.43 and Wednesday at 74.05. There was some consideration that prices wouldn’t hold at the close, but we saw a flat finish at 74.03 as smaller fish brought the level down and larger up small.

FX rate opened at 11.76 on the Friday, so pretty flat (vs 11.75) as we entered the week, dropped to 11.61 by the end of the week and a 1.19% fall in the rate and one way traffic for the week meaning fish were more expensive in Euros.

Spreads on the index again have averaged 6 NOK over the week evenly spread.

Next Week

Indications this week see the index flat / edging up further to a level of 74.4NOK on last weeks close (74.03). Feelings seem to be that prices may be peaking after the recent run-up. There were left over fish this week and buyers more subdued today. Logistics issues from the North have had some impact on availability and therefore pricing.

Spreads between 3/4s to 5/6s have come in slightly to sit around 5 NOK weighted in favour of the larger 4/5s -5/6s.

EUR NOK FX rate is lower this afternoon with rates around 11.57 vs 11.61 yesterday. This would give an indicative Euro index price around 6.43 on offered levels later Friday.

Volumes – Fresh Export

Volume figure for week 36 (2025) was 26,744 tons up 1,221 as compared to 25,523 in 2024 some 4.78% higher. Volumes for week 37 and week 38 (2024) were 28,799 and 28,673 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 38 2024 ended the week down -2.08 NOK / -2.83% to stand at 71.53 NOK (in EUR terms 6.12 / – 0.05 / -0.83%) FCA Oslo. The NOK rate ended lower at 11.69 to the Euro. The Fish Pool future September was reported up +0.05 NOK / +0.07% at 71.75 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 11th September, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

You can amend or add to orders transacting on LFEX?

The system allows you to very quickly put up offers / orders within the RFQ service and manage pricing in real-time. The system not only lets you manage order parameters during the sale/purchase process but by single or multiple counterparties. It has been built to replicate your business workflows, is highly flexible and captures your business activity / management perfectly.

FAQ’s

Q. How can I optimise my sales in weeks where there may be more volume coming through?

A. Active engagement with as many counterparties as possible will help with distribution. Widening global reach would also help with this, especially if the softness is within a particular market, and funnel volume elsewhere. Proactive updating of pricing and offers will create a sense of movement in the market and spur activity, as well as targeted pricing by clients or geography. Encourage engagement with dialogue on chat and market updates and even get buyers to put up bids to you help build a better market picture.