The London Fish Exchange

Data / Market Insight / News

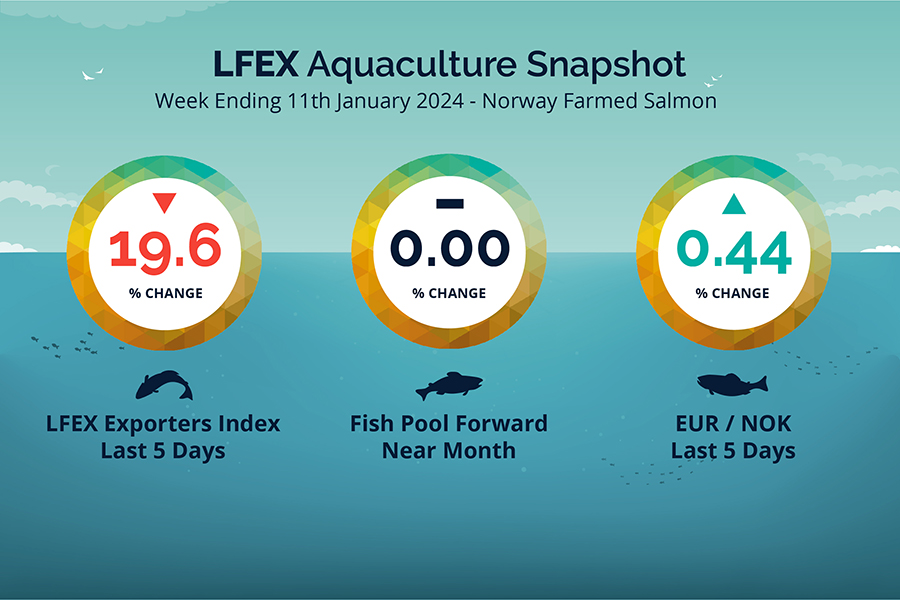

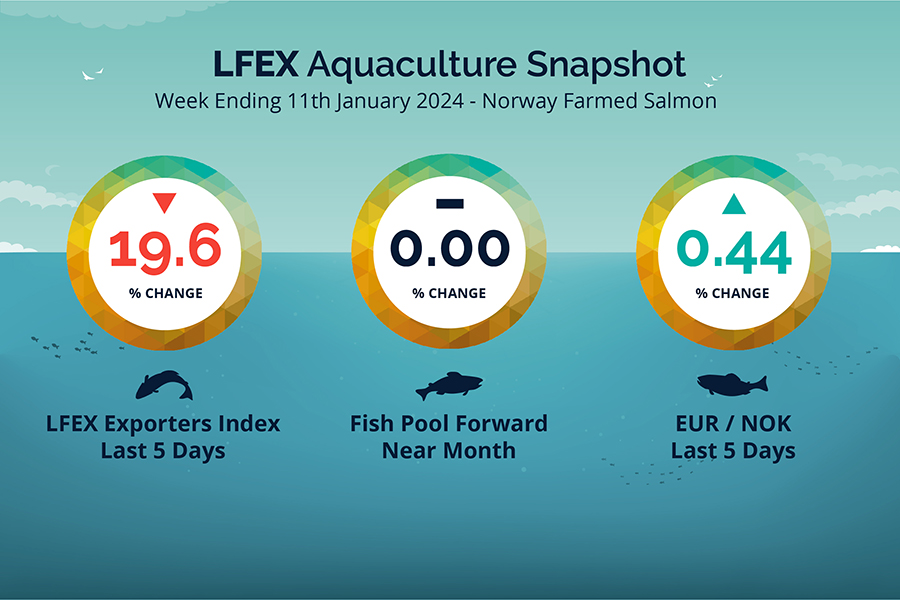

LFEX European Aquaculture Snapshot to 11th January, 2024

|

|

Published: 12th January 2024 This Article was Written by: John Ersser |

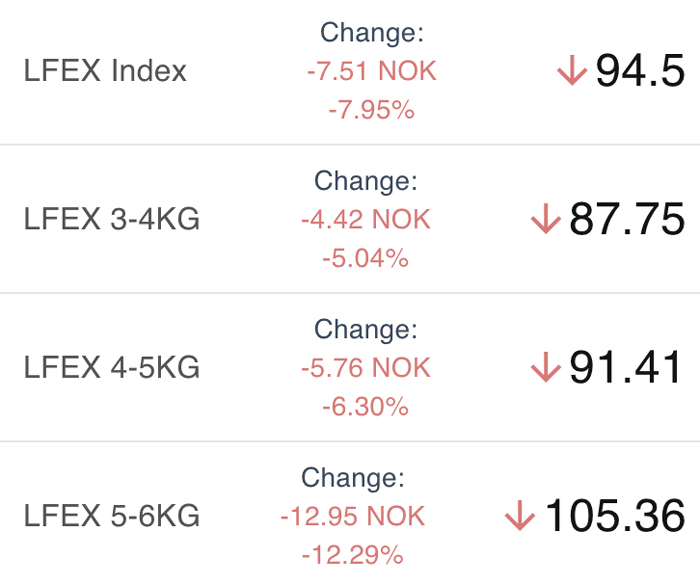

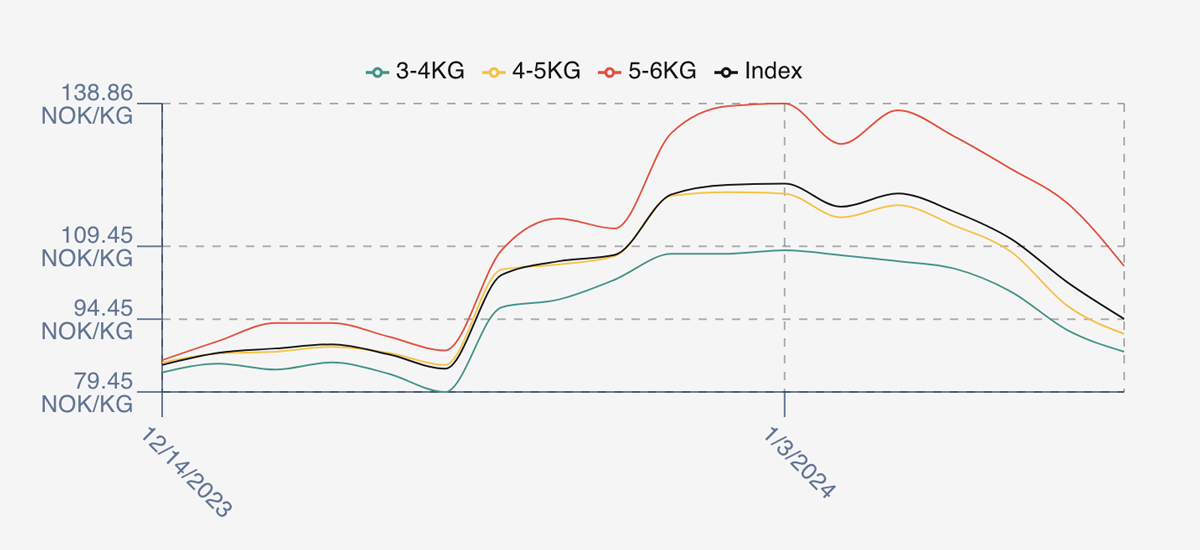

The LFEX Norwegian Exporters Index for Week 2 2024 ended the week down -19.65%, -23.11 NOK to stand at 94.50 NOK (in EUR terms 8.35 / -2.09/ -20.0%) FCA Oslo Week ending Thursday vs previous Thursday.

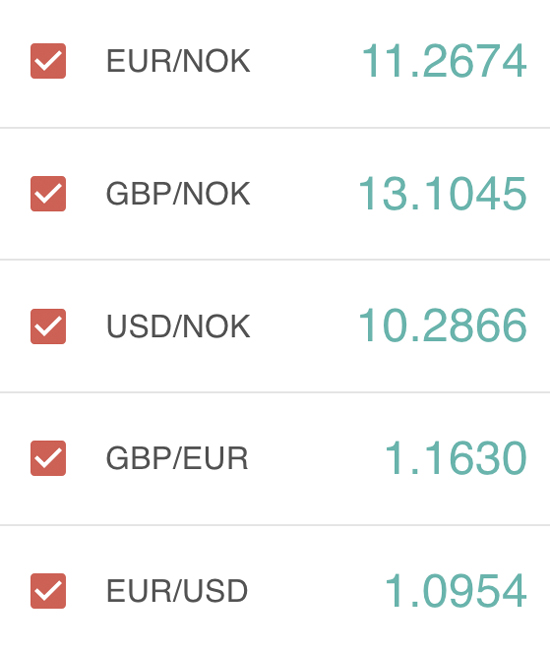

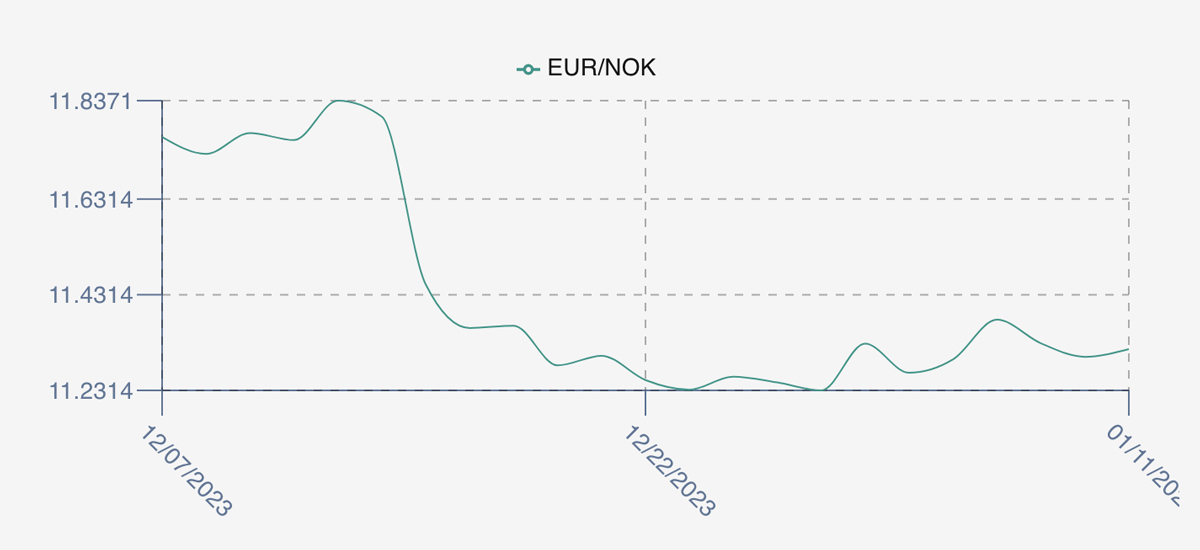

The NOK rate ended up small at 11.32 to the Euro over the period Thursday to Thursday +0.05 NOK or +0.44%. The Fish Pool future January was reported no change at 107.0 NOK.

What comes up must come down. The market kicked off with continued strength up another 2% on Friday for week 2 fish to 120.33 and the peak. It was down-hill pricing from there as Monday pitched in at 116.57, Tuesday softer at 111 and capitulation as prices tumbled to 102.1 on Wednesday and a low of 94.5 on Thursday. Top to bottom a 21.5% intraweek volatility.

What happened…the higher prices in the last few weeks have stalled the market. Buyers couldn’t sell at these levels and therefore couldn’t pay and didn’t buy. Production was a little higher with the expectation of demand based on previous lower volumes which didn’t materialise and didn’t help. A transport strike in Germany only added to the situation.

Volumes for week 1 were down at 12,105 vs 14,932 helping illustrate the reduction in harvest that pushed up prices.

Next week pricing is chaotic. There is unsold fish from the week which will put pressure on, but sellers are trying to push up from these levels. A big spread and tough for anyone to get a real idea of pricing. A sense of pricing around 95.5 with a premium of the bigger fish of +12 and smaller of -8, but really difficult to call.

Week 3 last year saw the price end of week close at 84.19 as the Chinese New Year purchasing finished and an average for week around 88.5 and the FP future for January 23 was showing 91.5.

David Nye’s technical analysis report will be published later next week.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 11th January, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

Provenance and specifications documentation are supported order by order.

As provenance and certifications become more important to buyers, it is imperative that the supporting documentation can be made available down to the individual order/trade level. The system supports Fish CV’s, certification documentation and detailed product specifications to ensure that you have all the required documentation and can evidence these materials for counterparty auditing, internal reporting and third-party auditing – all instantly available within your organisation.

FAQ’s

Q. How can I track intra week pricing with this volatility?

A. The LFEX publishes on its platform its composite index everyday allowing users the visibility to track market movement and intra week trends. Volatility is hard to manage and any visibility and insights into prices and pricing trends very valuable especially if you aren’t so connected to the market. Weekly composite historical traded prices can be helpful after the event, but don’t track market movement, and won’t capture what actually happens in the trading week.