The London Fish Exchange

Data / Market Insight / News

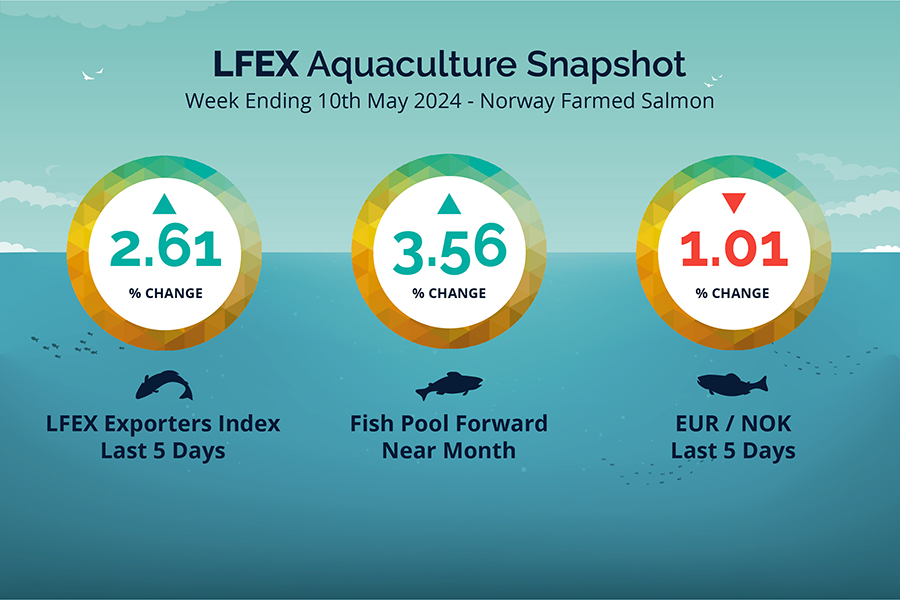

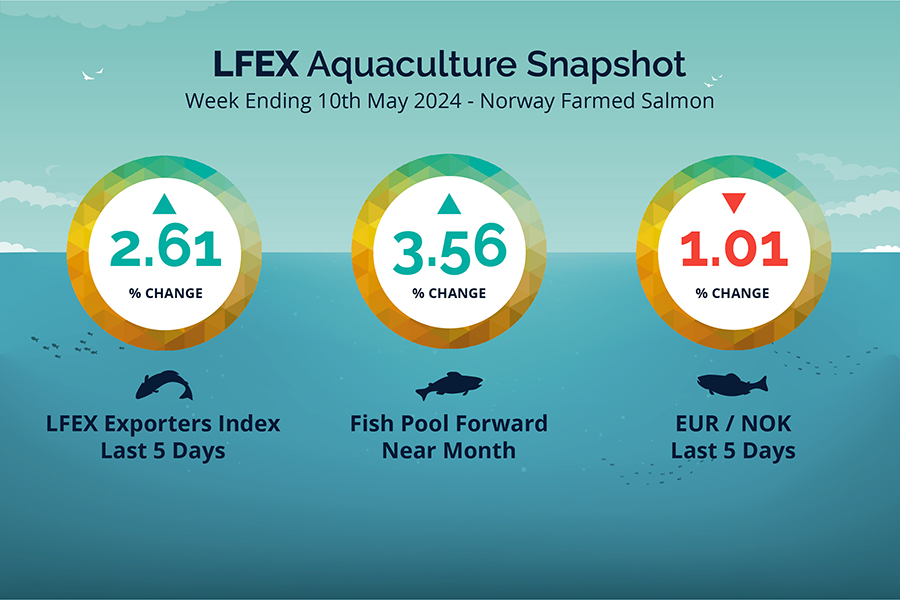

LFEX European Aquaculture Snapshot to 10th May, 2024

|

|

Published: 10th May 2024 This Article was Written by: John Ersser |

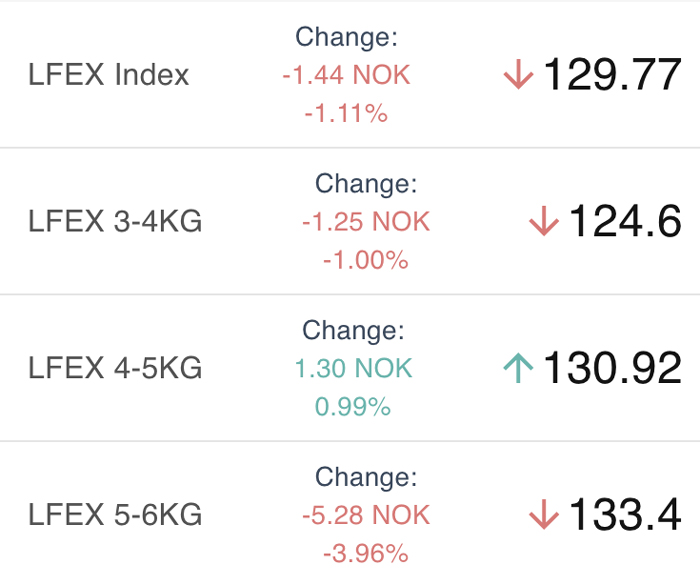

The LFEX Norwegian Exporters Index for Week 19 2024 ended the week up +2.61%, +3.30 NOK to stand at 129.77 NOK (in EUR terms 11.08 / +0.39 / +3.66%) FCA Oslo Week ending Wednesday vs previous Thursday.

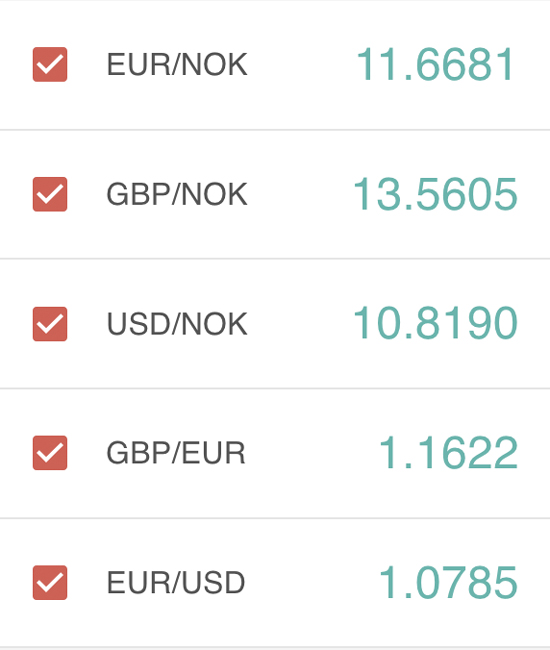

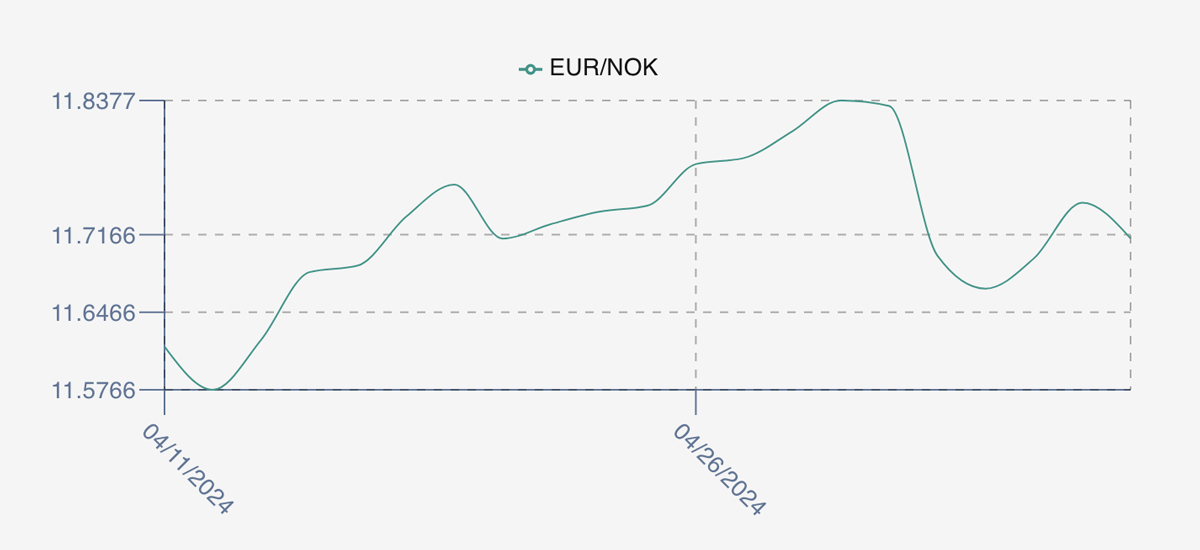

The NOK rate ended down at 11.71 to the Euro over the period Thursday to Thursday -0.12 NOK or -1.01%. The Fish Pool future May was reported up +4.25, +3.56% at 123.50 NOK.

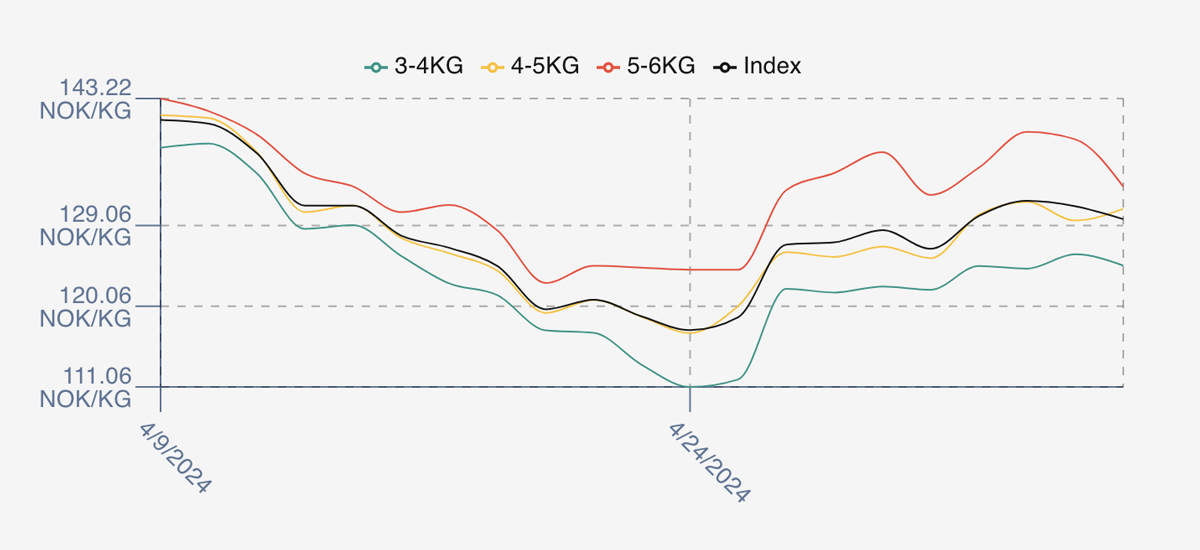

The opening last week, as indicated, was again stronger with an opening value of 130.12, up 3.65 NOK or 2.89% over the previous weeks closing value leading into the new trading week. However, despite expectations to the contrary pricing remained strong for the reduced 4 day week. Monday creeping higher to 131.81, Tuesday flat at 131.21 with Wednesday showing a small dip brought down by 5/6 prices. But not the reduction in smaller fish sizes some had expected. A stronger NOK made things 1% more expensive for Euro buyers.

Going into next week. Another 4 day week (Friday holiday), another week of reduced superior fish availability and another week of production fish availability for those who want it. Volumes set to remain as last week. Pricing pattern to follow last week. i.e. starting high on Friday with the possibility of price reductions during the week depending on availability and a dip for left over fish. Current indications for the index on Friday is starting around 131 / 132 NOK.

Volume figures for week 18 were down on the prior week at 11,511 vs 12,923, and week 18 2023 reported 13,735 tons by comparison.

A year ago, Week 20 2023 prices ended higher at 113.64 experiencing a significant bounce of 12 NOK / 12% on the week after the prior week’s steep falls, and prices then plateaued into week 21. Volumes for this week were down at 11,512 tons. The EURONOK rate also strengthened to 11.71.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 10th May, 2024 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The LFEX RFQ allows users to make offers and requests for forward orders not just the current week?

If a customer has a specific need for inventory at a specific day / week in the near future this request can be put up – for example a short-term campaign. Likewise, if a seller wants to secure some early sales (especially in a falling market) they can put up offers for that date / following week. The system also offers contracts trading for multi-leg orders.

FAQ’s

Q. Where can I get information on where prices might be in the next quarter or so?

A. If anyone had the exact answer to this it would be worth a lot of money. We can’t speculate on where prices might be, and a lot of analysis goes into this by researchers and banks. For reference and interest only, last week David Nye provided a trajectory of pricing lows based on his charting. This had LFEX index pricing lows into the quarter around 85 NOK. DNB put out research at Barcelona with price estimates around 78 Q3 and 82 Q4 and the current Fish Pool forward Q3 2024 is showing 89.27 NOK.