The London Fish Exchange

Data / Market Insight / News

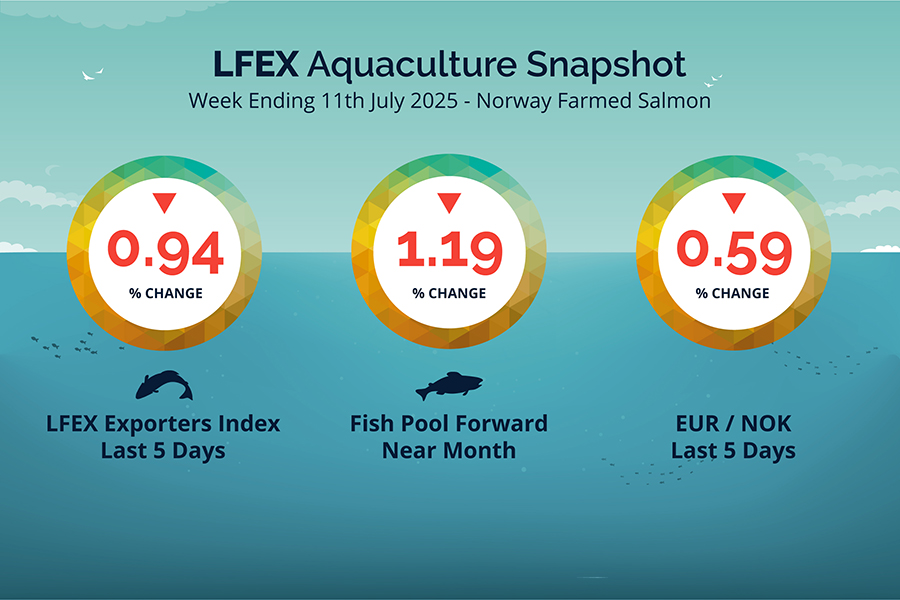

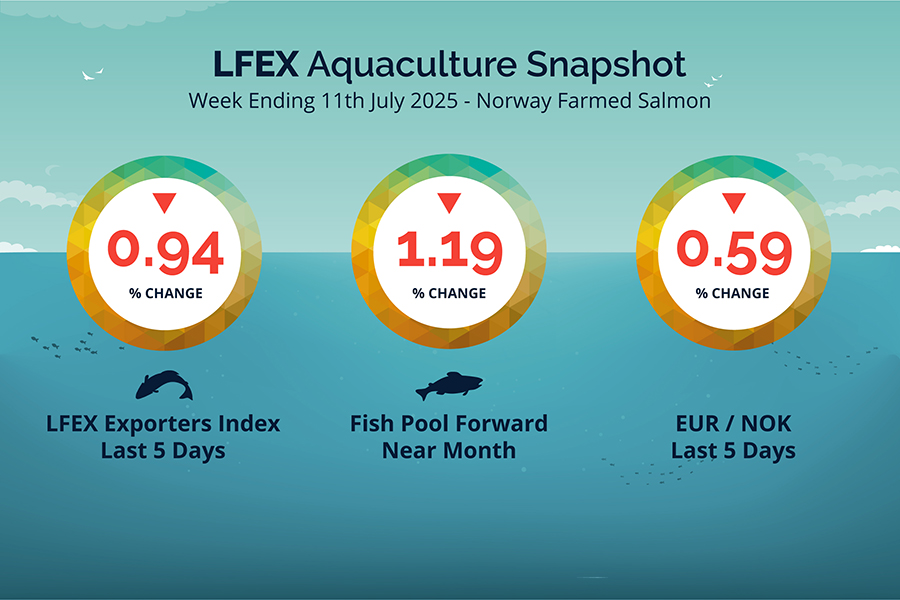

LFEX European Aquaculture Snapshot to 10th July, 2025

|

|

Published: 11th July 2025 This Article was Written by: John Ersser |

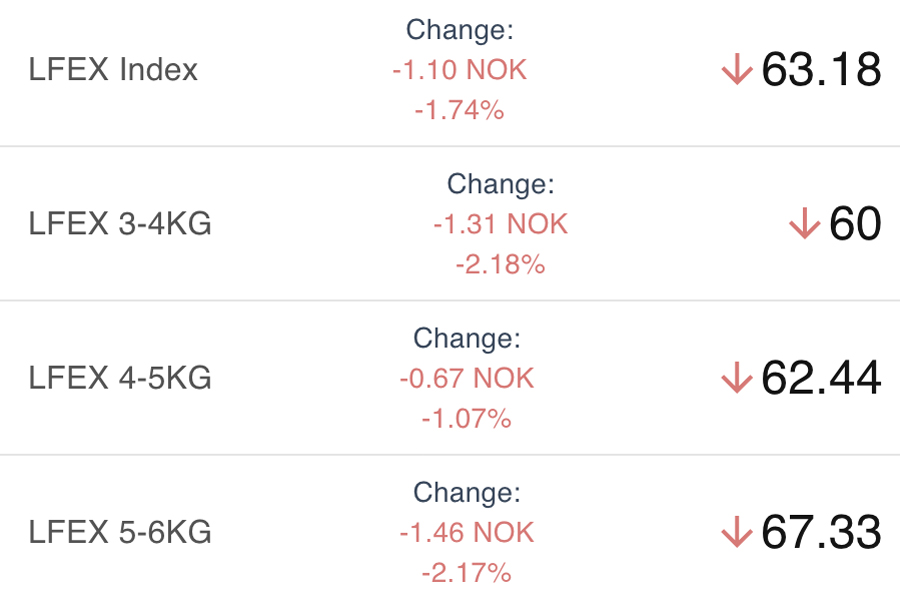

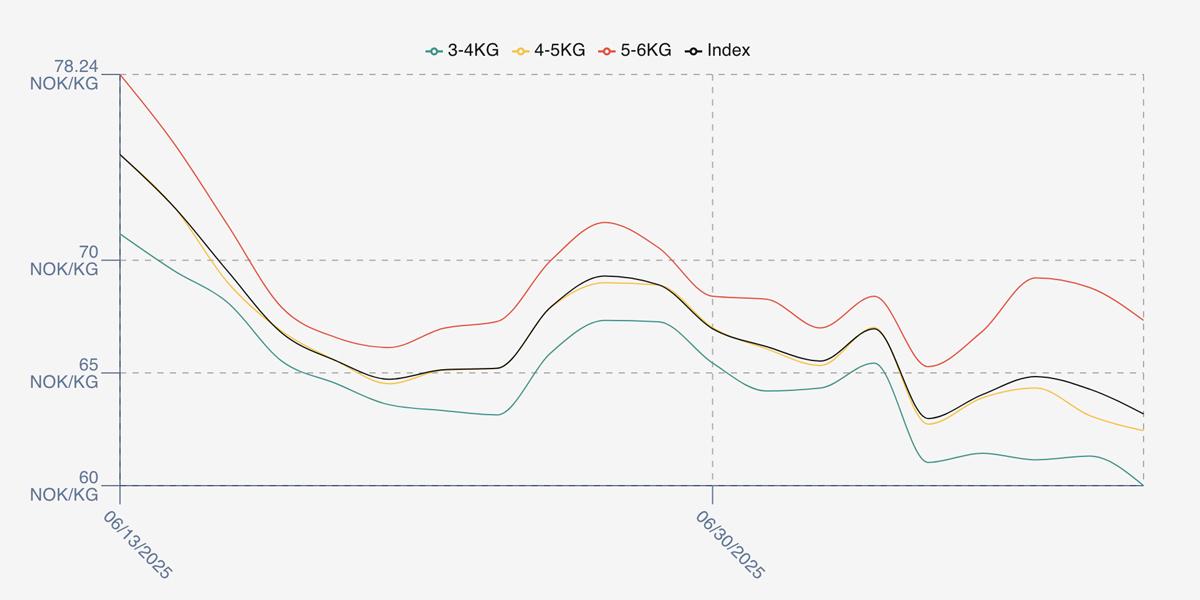

The LFEX Norwegian Exporters Index for Week 28 2025 ended the week DOWN -0.60 NOK / -0.94% to stand at 63.18 NOK (in EUR terms 5.35 / -0.02 / -0.35%) FCA Oslo Week ending Thursday vs previous Thursday.

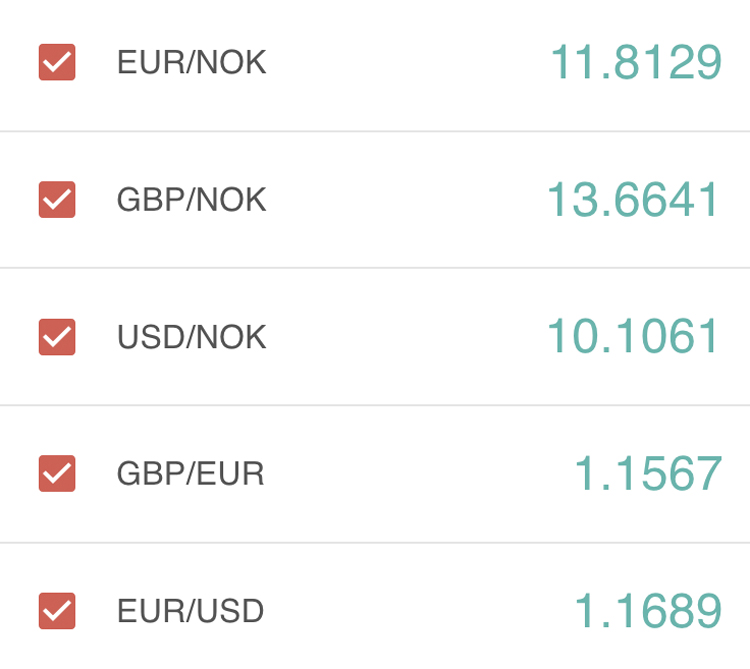

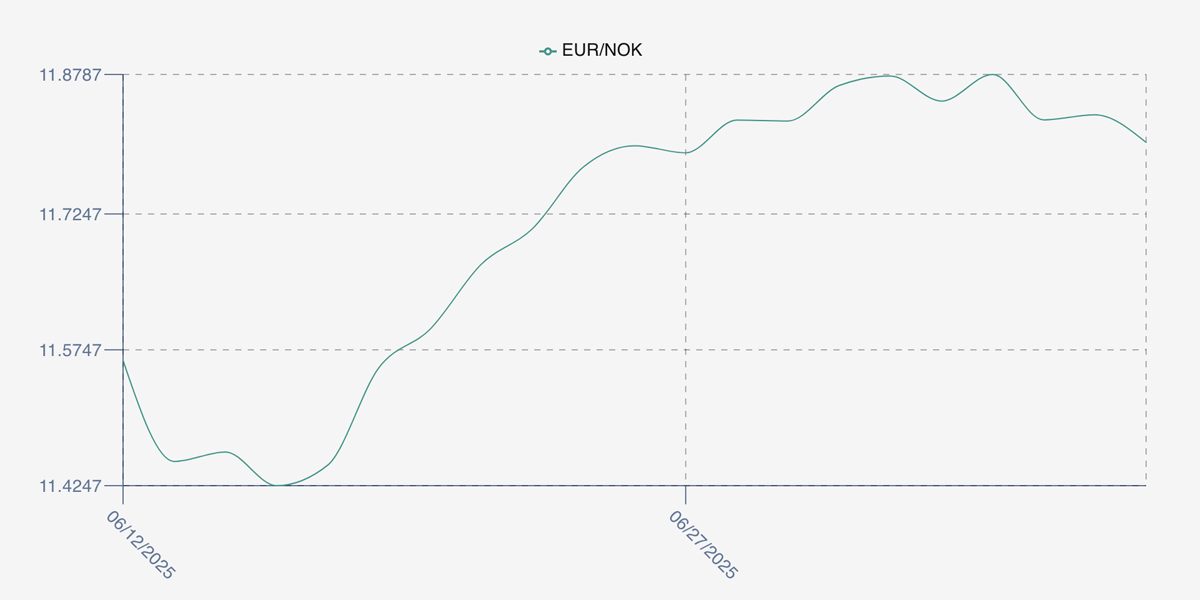

The NOK rate ended DOWN at 11.80 (-0.07 / -0.59%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future August was reported DOWN Thursday to Thursday at 5.83 EUR, -0.07 / -1.19%) approximately 68.80 NOK.

The Last Week

This week and size mattered. Friday sentiment was not strong for pricing and this was reflected in the continued price weakness, down a further 0.8 NOK / 1.25% at 62.98. A lot more smaller fish saw the spread 3-4s to 5-6s increase to 5 NOK. Monday saw the index level pop up a NOK, small fish were flat and larger sizes dragged the index up. Tuesday saw 64.84, the peak for the week, and smaller sizes remained flat while the 5/6s continued to increase with an 8 NOK spread opening up. Wednesday smaller sizes flat again, while 5/6 just off a little reflected in the overall 64.28 level. The index level for week ended over all down at 63.18 as all sizes fell.

FX rate opened up at 11.85, peaked at 11.88 0n Monday and gently back to close the week at 11.80. Spreads remained extended at around 7.5 NOK.

Next Week

Indications this week see the index opening around the 62.5 NOK level which is down around 0.75 of a NOK from Thursday closing levels. Again, a lot of small fish available and European demand seems there or there abouts on Friday. Bigger sizes bigger prices again. Spreads between 3/4s to 5/6s around 8.5 NOK.

EUR NOK FX rate is flat from yesterday at 11.83 this afternoon. This would give an indicative Euro index price around 5.28 on offered levels later Friday.

Volumes – Fresh Export

Volume figure for week 27 (2025) was 22,602 tons up 3,401 as compared to 19,201 in 2024. Volumes for week 28 and week 29 (2024) were 18,421 and 18.177 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 29 2024 ended the week up +4.12%, +3.20 NOK to stand at 80.84 NOK (in EUR terms) FCA Oslo. The NOK rate ended up, at 11.77. The Fish Pool future July was reported down – 0.75, -0.96% at 77.15 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 10th July, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

You can track the business you do with each specific counterparty?

The system saves all of your, and your counterparties, activity on the system. We give you the tools to then sort and manage this data yourself. If you want to find trades with just one counterparty this is easily achieved, as well as any pricing/data, or documentation against these trades. It’s a super flexible real-time system to get you the information and data you need, when you need it.

FAQ’s

Q. Can multiple people from my company use the platform and see the same information?

A. The answer is yes, we can set the system up to be able to see all offers or trades going through the system and allow multiple users access to this information in real-time. This helps build a picture of sales/ purchases and pricing across the business and facilitates teams work and optimisation of the selling / buying process.