The London Fish Exchange

Data / Market Insight / News

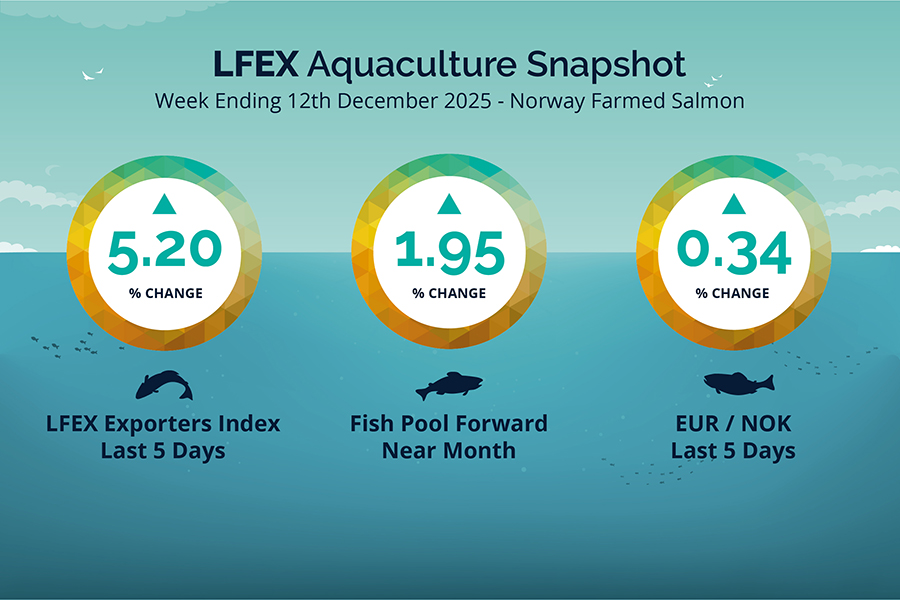

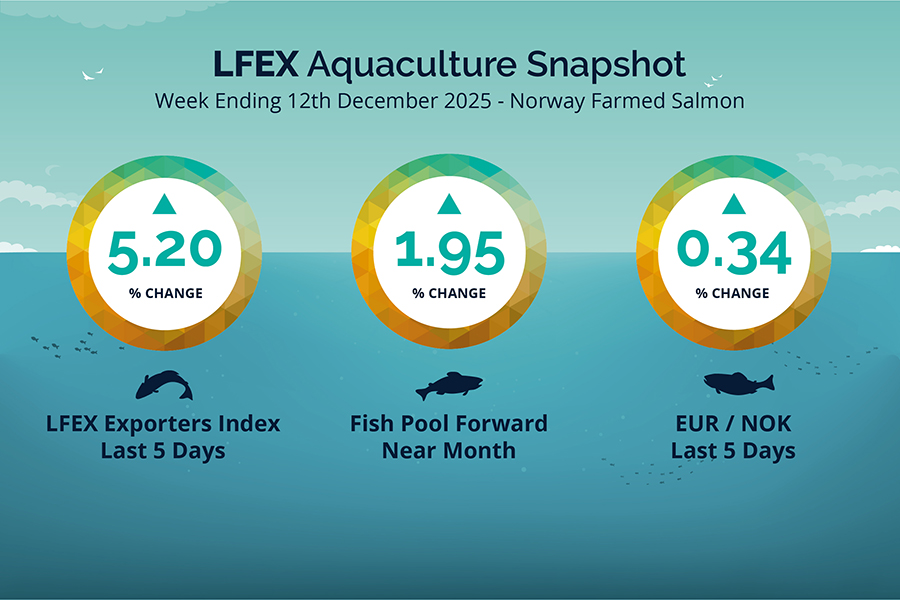

LFEX European Aquaculture Snapshot to 12th December, 2025

|

|

Published: 12th December 2025 This Article was Written by: John Ersser |

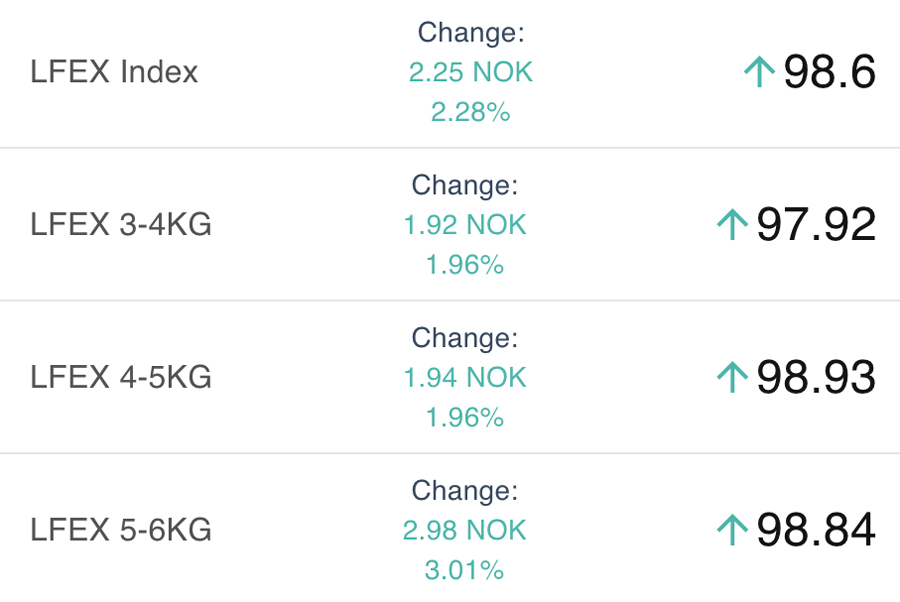

The LFEX Norwegian Exporters Index for Week 50 2025 ended the week UP + 4.87 NOK / +5.20% to stand at 98.60 NOK (in EUR terms 8.34 / + 0.39 / +4.84%) FCA Oslo Week ending Thursday vs previous Thursday.

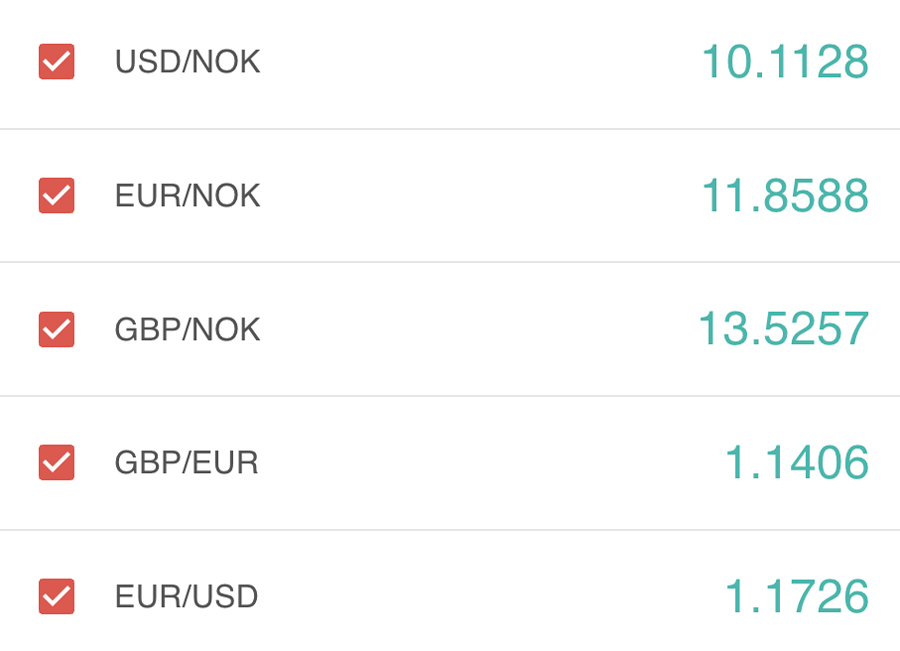

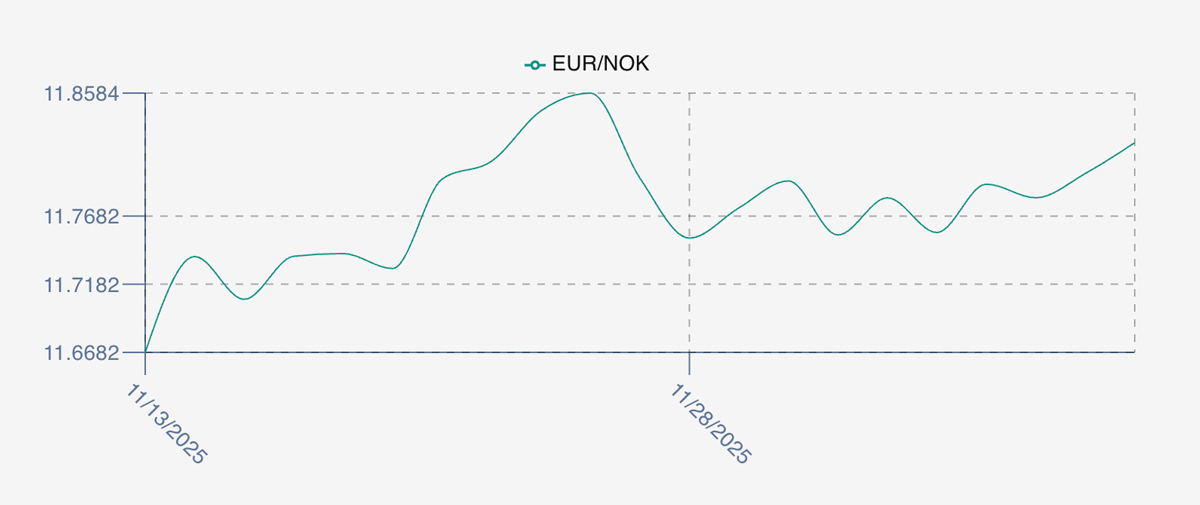

The NOK rate ended UP at 11.82 (+0.04 / +0.34%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future January was reported UP at 7.85 EUR (+0.15 / +1.95%) Thursday to Thursday, approximately 92.79 NOK. February showing 8.36.

The Last Week

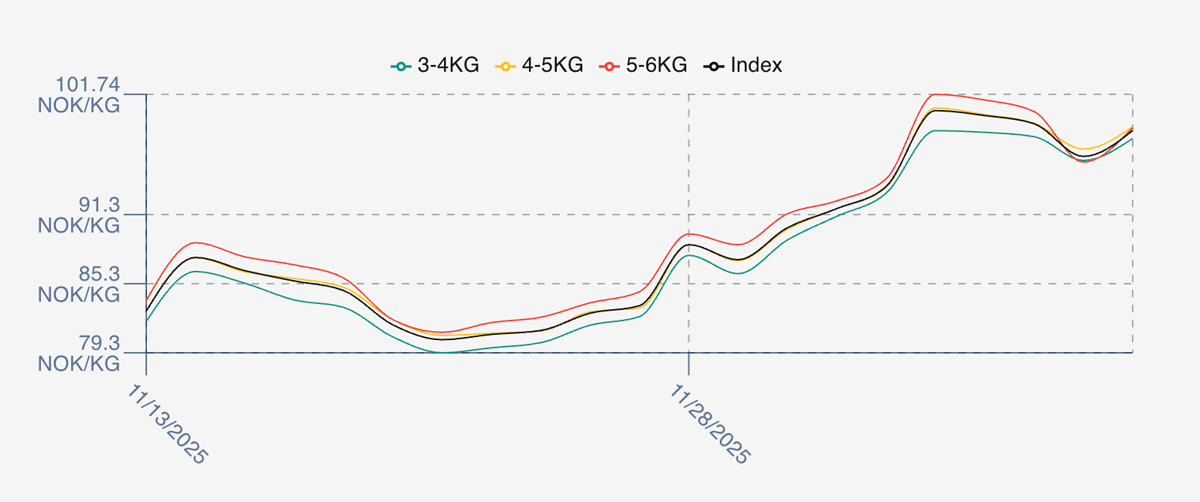

A week of higher prices. The week gapped up on Friday last week as prices were pushed pre-Christmas, seeing a rise of 6.6 NOK over the prior week close, and the index average breaching the 100 NOK level. This was the high of the week and prices settled below the 100 mark – just – on Monday at 99.9 and a 99.19 on Tuesday. Wednesday gave back a little to 96.35 as the market gauged where the balance should be and concluded that 5/6s were too high which pushed the index lower – with larger fish cheaper than the smaller sizes. We finished at 98.60 and the end of the trading week as people adjusted their positions, bigger fish remained in good supply and therefore cheaper and a closing level equivalent to 8.34 Euro.

FX rate saw overall increase as it tracked north from an opening level of 11.75 to trend higher to 11.82. Not volatile but a clear trend over the week.

Spreads on the index finished at less than 1 NOK, but more interestingly the larger size 5/6 was indicated a less than the 4/5s.

Next Week

Early indications showing steep falls in prices compared to last week. Friday price discovery is always tough, and week 51 is often brutal. The indicative prices index is off over 10 NOK since this time last week at around 90 NOK but seems to be heading lower. There is a wide range of prices. Too many large fish, too many fish, and buyers seeming to be holding back where they can in the expectation of lower prices as we move into the last full week before Christmas.

Spreads between 3/4s to 5/6s remain compressed at less than 1 NOK, and little to no premium for the 5/6’s. 6+ fish is good supply.

The EUR NOK FX rate is this afternoon around the 11.91 level up 0.09 since yesterday. This would give an indicative Euro index price around 7.57 EURO on offered levels Friday.

Volumes – Fresh Export

Volume figure for week 49 (2025) was 23,754 tons DOWN 1,988 tons as compared to 25,742 in 2024 some 7.72 % LOWER. Volumes for week 50 and week 51 (2024) were 25,658 and 22,450 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 50 2024 ended the week up +5.48 NOK / +6.43% to stand at 90.68 NOK (in EUR terms 7.78 / +0.47 / +6.43%) FCA Oslo. The NOK rate ended up where it started the week at 11.66. The Fish Pool future December was reported at 87.50 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 12th December, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

We provide commentary and technical analysis on the index price movements from our highly experienced analyst.

We reported in August that the season price lows were probably in and if we were trading the Oslo FoB Index what would have happened? In August, the first higher price low came in around 59 NOK. Today, the current price is 100.33 NOK (5/12), a 70% return. In early October, our analyst suggested that this would be a good spot to enter the Oslo FoB Index. The Oslo FoB Index held support at 71.91 NOK and was displaying bullish divergence. The return from 71.91 NOK to 100.33 NOK is 39.50%. Most investors would love to get 10% returns per year. This provides a very interesting picture of the dynamics of pricing and how to pick entry points based on the analysis.

FAQ’s

Q. Who can see my prices?

A. The answer is you can choose, it’s 100% in your control. Although you can connect to different counterparties simultaneously, the system maintains a 1-2-1 relationship between you and the seller / buyer you connected with. It securely brings your relationships onto the platform and you decide who can see your prices and offers / requests and all actions and activity are secure and private.