The London Fish Exchange

Data / Market Insight / News

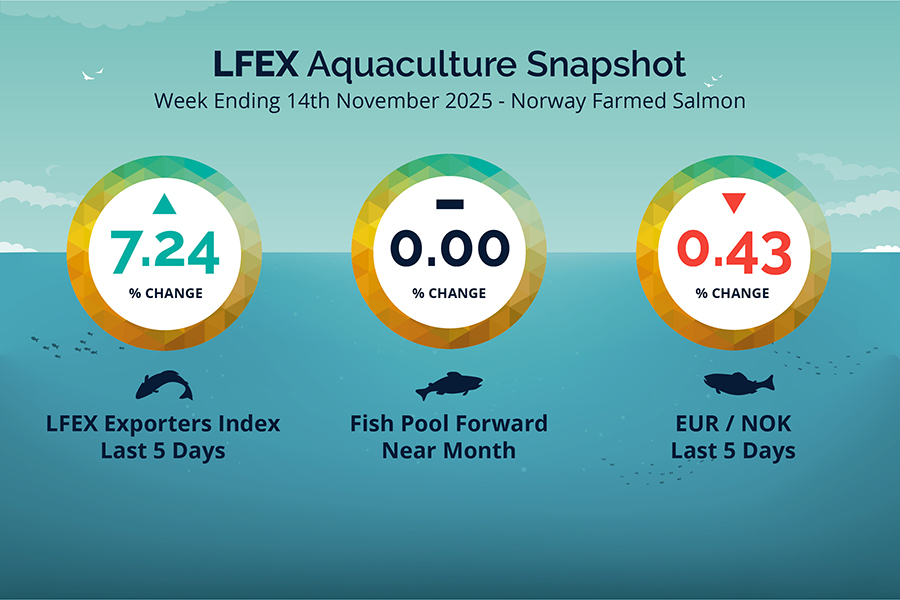

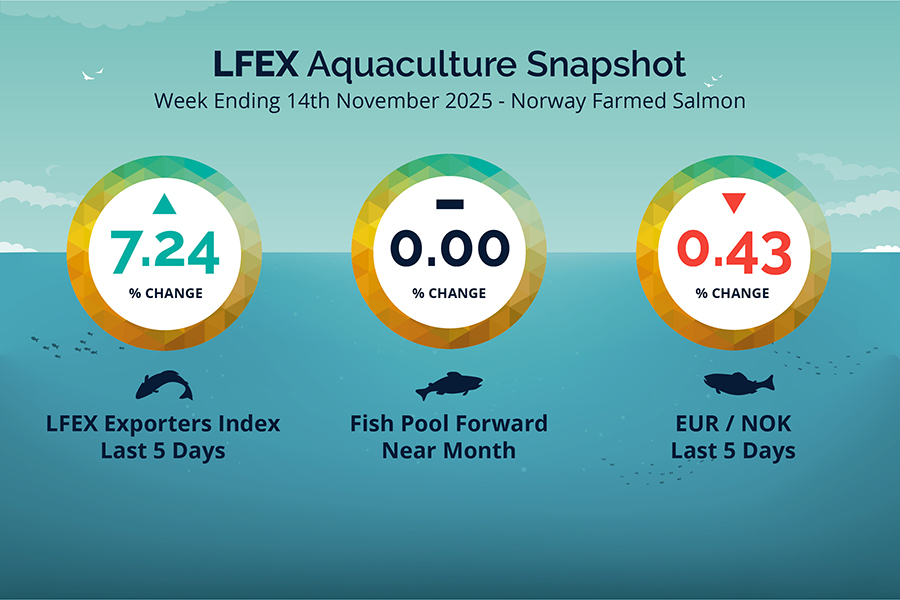

LFEX European Aquaculture Snapshot to 14th November, 2025

|

|

Published: 14th November 2025 This Article was Written by: John Ersser |

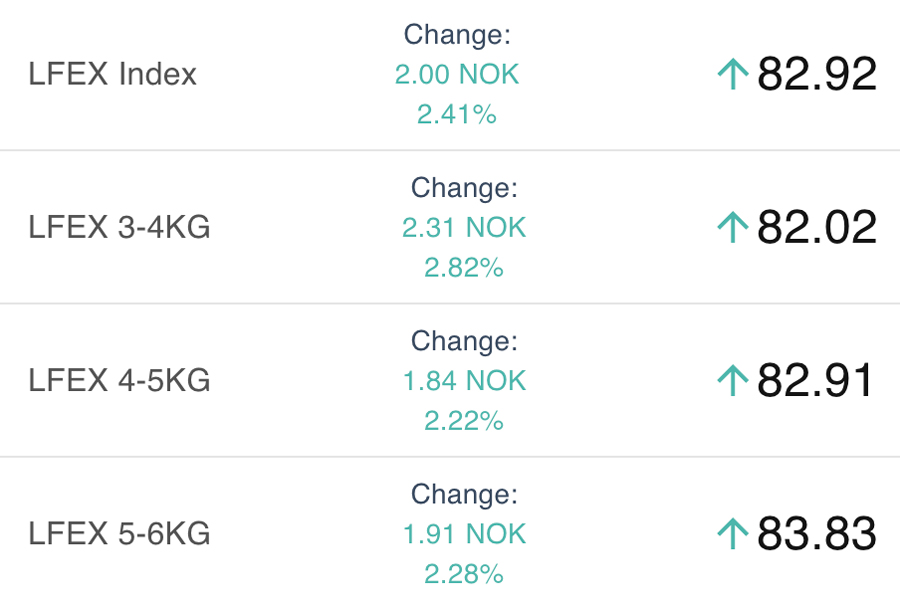

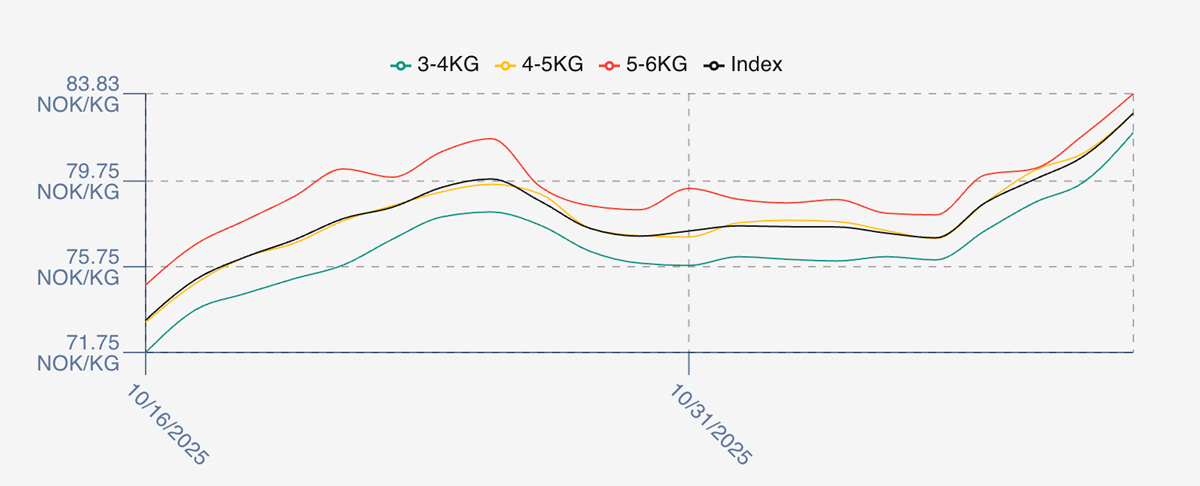

The LFEX Norwegian Exporters Index for Week 46 2025 ended the week UP +5.6 NOK / +7.24% to stand at 82.92 NOK (in EUR terms 7.11 / +0.51 / +7.70%) FCA Oslo Week ending Thursday vs previous Thursday.

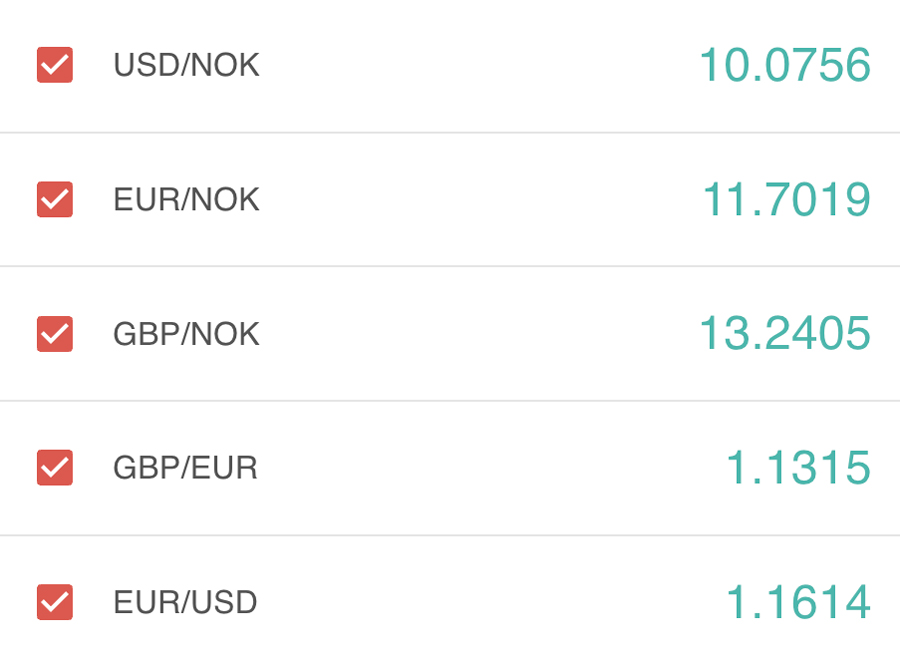

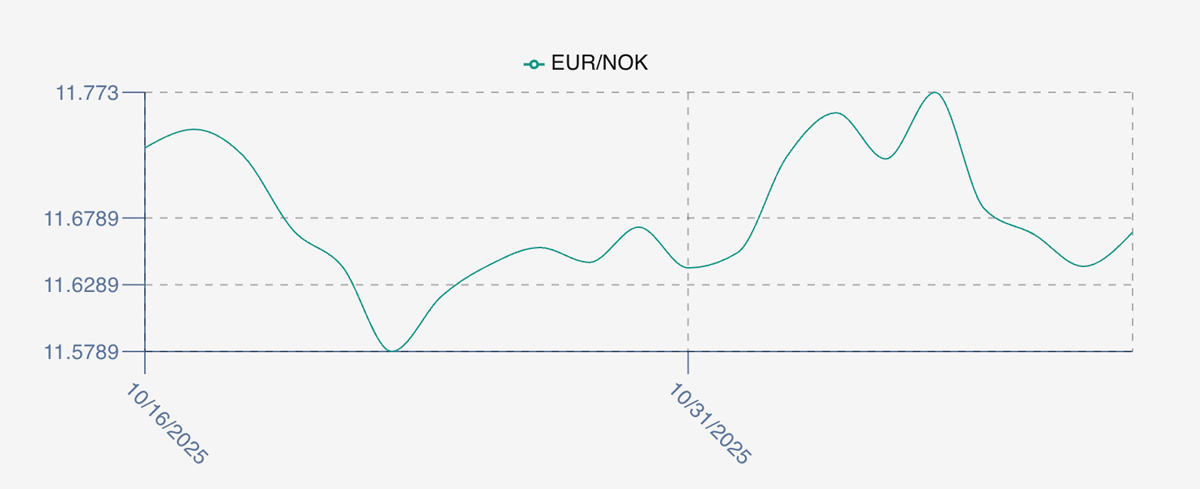

The NOK rate ended DOWN at 11.67 (-0.05 / -0.43%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future December was reported FLAT again Thursday to Thursday at 6.87 EUR, (0.00 / +0.00%) for the fourth week running, approximately 79.69 NOK. January showing 7.65.

The Last Week

Upwards price momentum this week. Pricing remained stable for the beginning of the week, in fact showing a small decline on open at 77.10 off around 0.28% on what was a pretty flat prior week. This transpired to be the low of the week and anyone buying early doors would have done well. The flat sentiment didn’t last and prices picked up, over 1.5NOK on Monday to 78.74, 1.2 NOK stronger on Tuesday as prices increased and 4/5s gapping up to near the 5/6s. Wednesday saw a NOK more on the index level as prices became more normally spread, and Thursday end of the week ran out a further 2 NOK and the biggest 1 day jump in the week. Big fish 6+ where plentiful while 3-6s came up a short with lack of fish pushing up pricing.

FX rate saw more movement as the EURNOK rate picked up from the 11.72 close out levels to 11.77 on last Friday. It was downhill for the rate most of the week, bottoming at 11.64 on Wednesday and finishing the week at 11.67, 1 % range during the week.

Spreads on the index were around 2.5 at the end of the week with some volatility mid-week.

Next Week

Early indications around the offered indicative level of 87.5 NOK for the index which would put it significantly ahead of last week close of just under 83. Prices have continued to jump this Friday in the indicative offered rates (in 3-6s) as inventory seems in shorter supply this week.

Spreads between 3/4s to 5/6s have remained around the 2.5 NOK the same as last week’s closing spread.

After falling to 11.65 first thing the EUR NOK FX rate is this afternoon around the 11.725 level. This would give an indicative Euro index price around 7.46 EURO on offered levels later Friday – an increase of 0.91 Euro versus this time last week.

Volumes – Fresh Export

Volume figure for week 45 (2025) was 24,111 tons UP 240 tons as compared to 23,871 in 2024 some 1.04 % HIGHER. Volumes for week 46 and week 47 (2024) were 22,825 and 23,333 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 47 2024 ended the week up +5.84 NOK / +7.17% to stand at 87.28 NOK (in EUR terms 7.52 / + 0.60 / +8.65%) FCA Oslo. The NOK rate ended down at 11.60 to the Euro. The Fish Pool future November was reported up Thursday to Thursday 3.00 NOK / +3.90% at 80.0 NOK with Dec showing 84.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 14th November, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

As a manager you can get a snapshot in moments of the activity in your business.

You can see all order histories with ease on the platform. You can sort and search and see who are your biggest counterparties, discover who is buying / selling at optimal prices, and identify those companies to focus more on and reduce supply shock exposure by evaluating history. It’s all at your fingertips.

FAQ’s

Q. How flexible is the system if my specifications are complex?

A. This is a great question, and the answer is ultimately infinitely flexible. Every week we get feedback from users and we can add new features or parameters to the system to ensure that users demands are met. Data capture and communication are key. The system also offers multiple ways of communicating in addition to the core order/trading functions, including order commentary and chat to ensure that you can always communicate clearly with counterparties.