The London Fish Exchange

Data / Market Insight / News

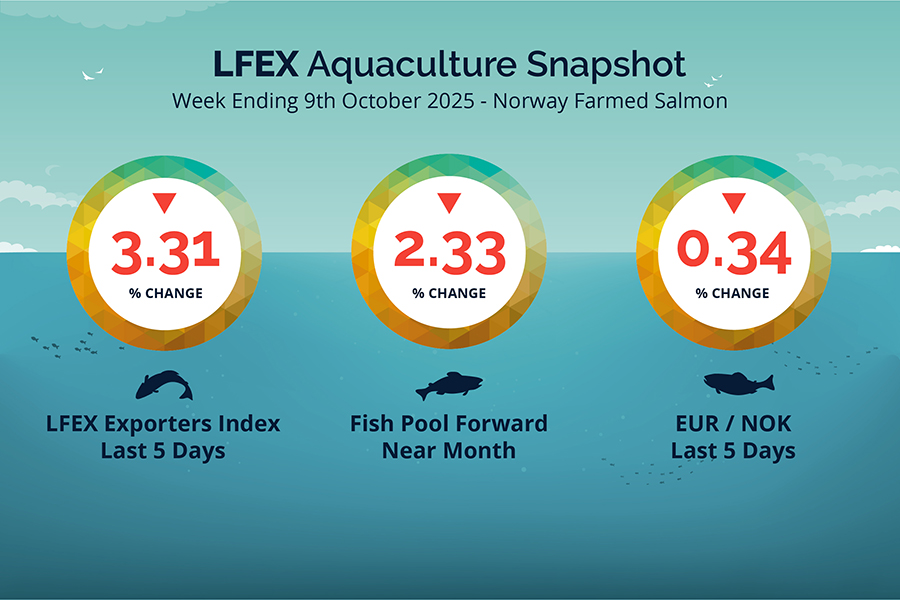

LFEX European Aquaculture Snapshot to 9th October, 2025

|

|

Published: 10th October 2025 This Article was Written by: John Ersser |

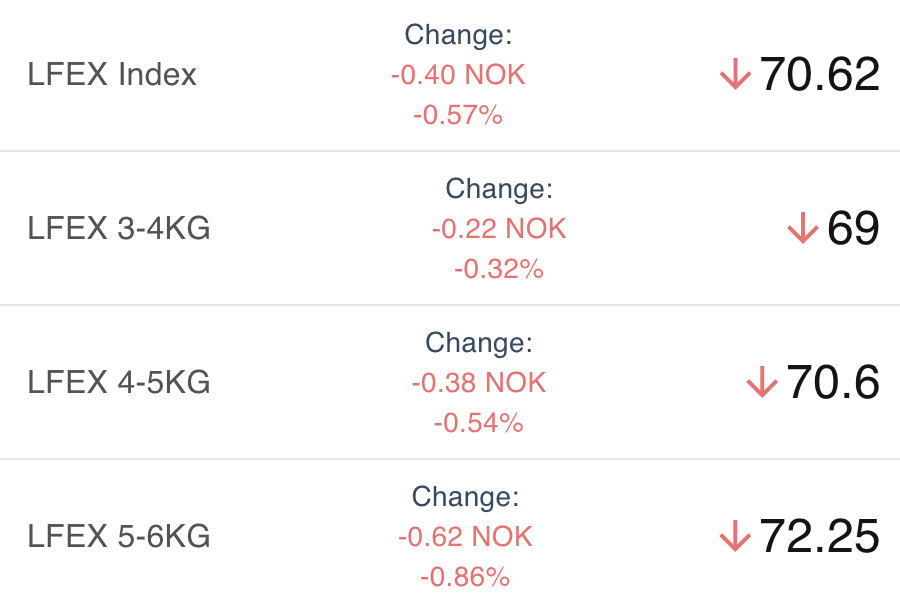

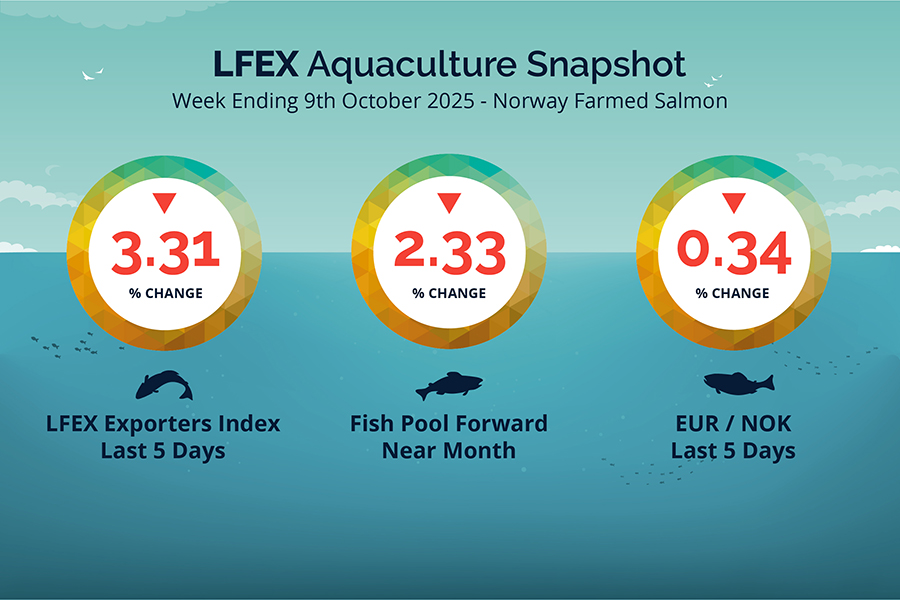

The LFEX Norwegian Exporters Index for Week 41 2025 ended the week DOWN -2.42 NOK / -3.31% to stand at 70.62 NOK (in EUR terms 6.07 / -0.19 / -2.98%) FCA Oslo Week ending Thursday vs previous Thursday.

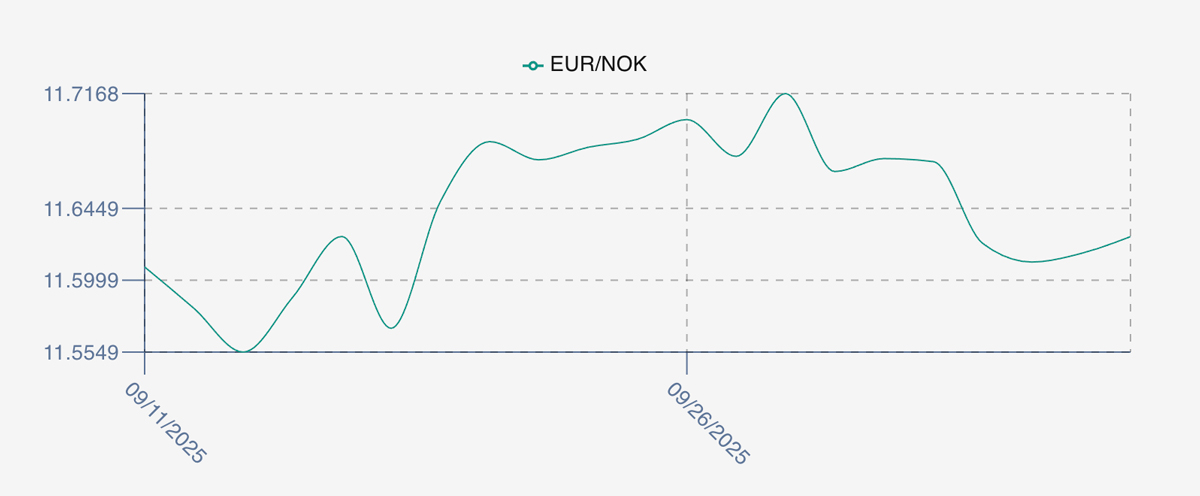

The NOK rate ended DOWN at 11.63 (-0.04 / -0.34%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future November was reported DOWN Thursday to Thursday at 6.30 EUR, (-0.15/ 2.33%) approximately 73.26 NOK.

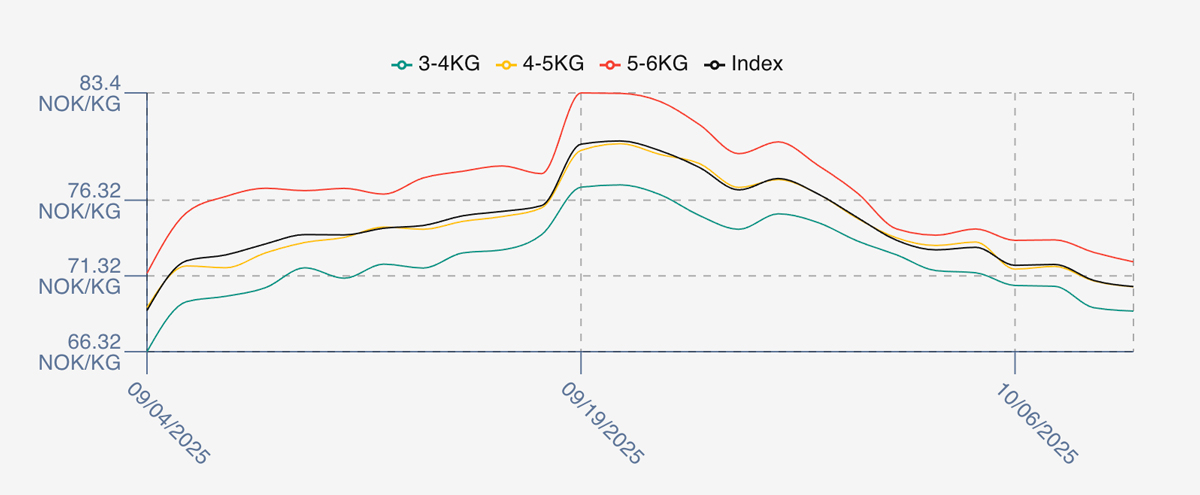

The Last Week

Prices continued to soften. Friday saw the usual trend in a normal market of a small increase in indicative offered prices (+0.17 NOK / 0.23%) over the prior week close, generally as exporters marked prices at the beginning of the week higher. This marked the high of the week, and Monday gave back a NOK or so to 72.02 and Tuesday was flat. Wednesday took a further NOK out of pricing to 71.02 and a near half a NOK lower closed the week out at 70.62 indicative offered rate. A pretty benign week for pricing although overall weakness was the trend. Exporters were struggling last Friday to get a read on pricing, in the end it was a gently trending down week.

FX rate was also benign this week – opening at 11.67 on the Friday and softened to 11.615 during the week and closed out at 11.63 level Thursday.

Spreads on the index have remain narrowed at the 2.75 NOK between 3-4 and 5-6 evenly spread.

Next Week

Pricing for next week is looking stable from last weeks close. Early indications around the 71 NOK level for the index which makes us pretty flat or a nudge up – which may be a reflection because it is Friday pricing. Volumes in recent weeks have been lower than the previous year after the enormous volumes going through earlier, although this gap is closing.

Spreads between 3/4s to 5/6s are sitting at around the 3 NOK level currently.

EUR NOK FX rate is rising this afternoon with rates around 11.72, up 0.05. This would give an indicative Euro index price around 6.08 on offered levels later Friday.

Volumes – Fresh Export

Volume figure for week 40 (2025) was 24,009 tons DOWN 2,534 as compared to 26,543 in 2024 some 9.55 % LOWER. Volumes for week 41 and week 42 (2024) were 25,180 and 25,561 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 42 2024 ended the week up +0.24 NOK / +0.32% to stand at 74.96 NOK (in EUR terms 6.31 / – 0.02 / -0.31%) FCA Oslo. The NOK rate ended higher at 11.875 to the Euro. The Fish Pool future October was reported +1.50 NOK / +2.13% at 72.0 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 9th October, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The LFEX stores all your previous orders and transactions for immediate access to all your activity on the platform.

It also saves previous orders so that you can quickly and accurately input new orders / RFQ’s without having to constantly key in new order information and allows constant updating of these orders (price / volume etc) as the market develops, until you trade or end the RFQ.

FAQ’s

Q. With pricing volatility I am concerned about getting caught selling too much at the wrong level – how can you help?

A. There are a number of ways we enable business to protect their offers / orders to give users comfort that they won’t be exposed. Primarily a specific amount of inventory can be offered to a group of buyers – the system won’t let you over trade. You can change available volumes and pricing instantly, as well as suspending pricing or cancelling offered prices or cancelling the offer completely as examples of some of the protection functionality we offer.