The London Fish Exchange

Data / Market Insight / News

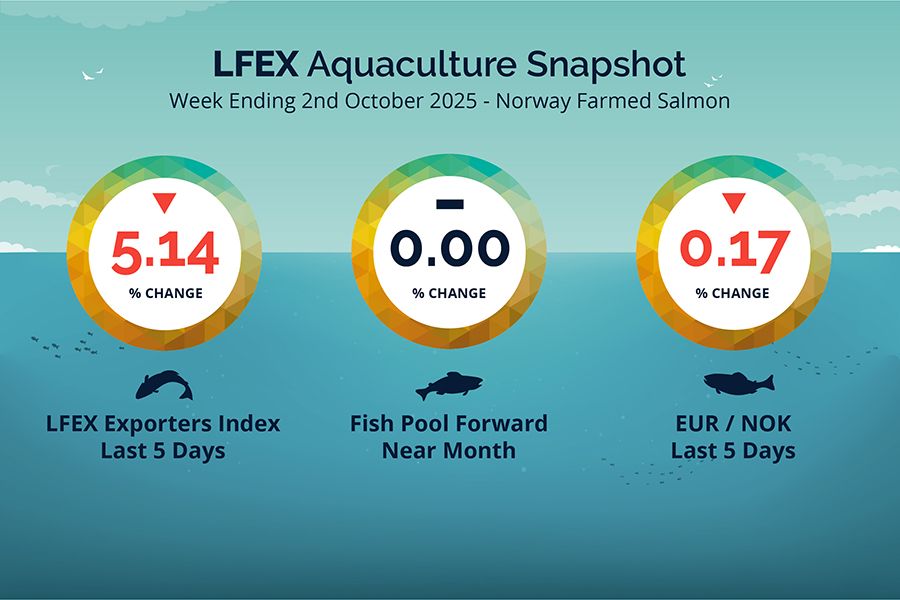

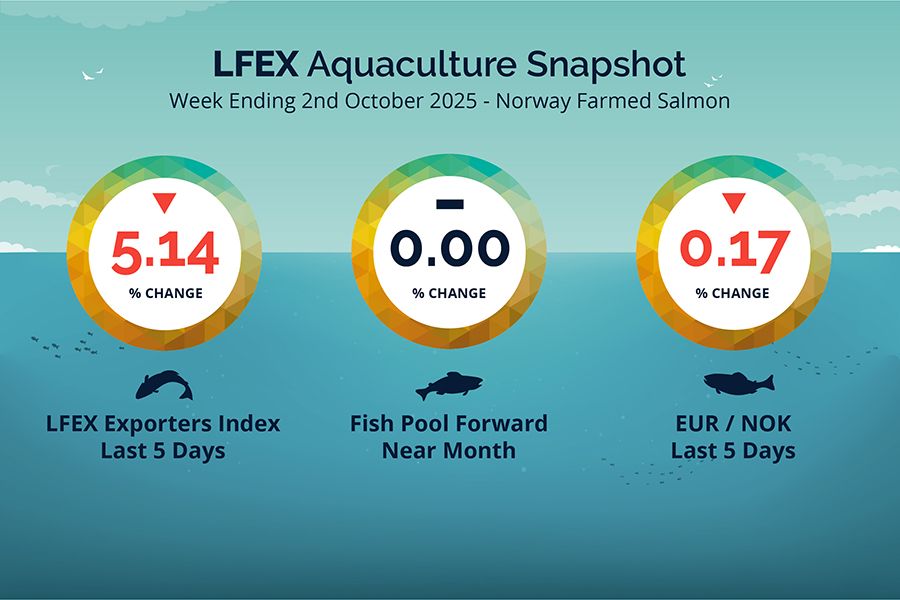

LFEX European Aquaculture Snapshot to 2nd October, 2025

|

|

Published: 3rd October 2025 This Article was Written by: John Ersser |

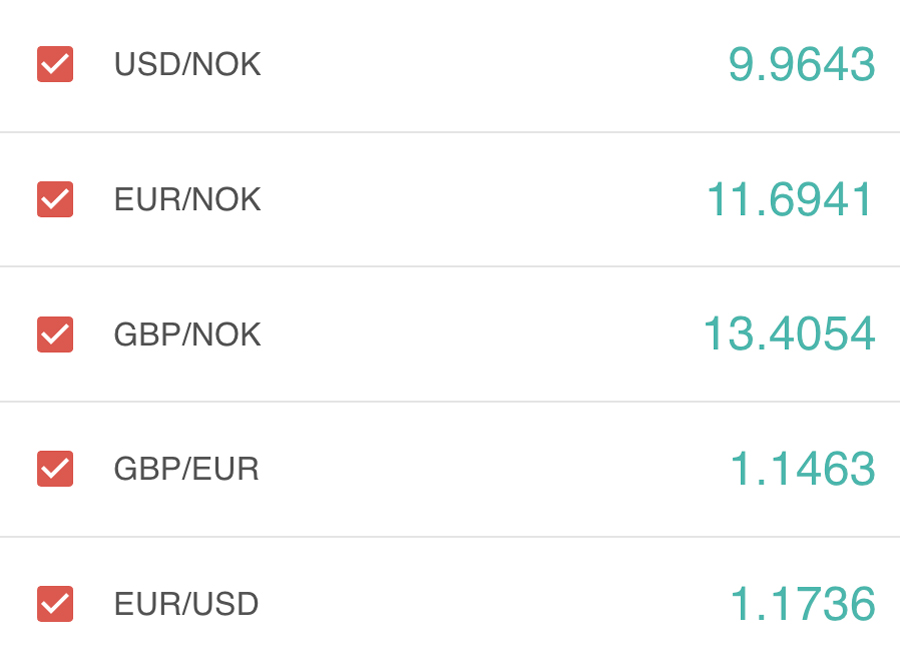

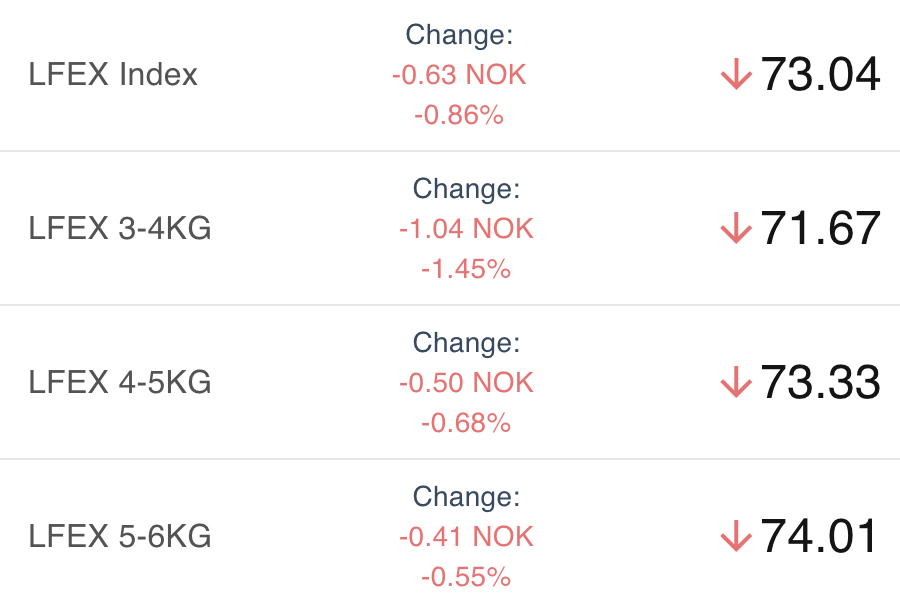

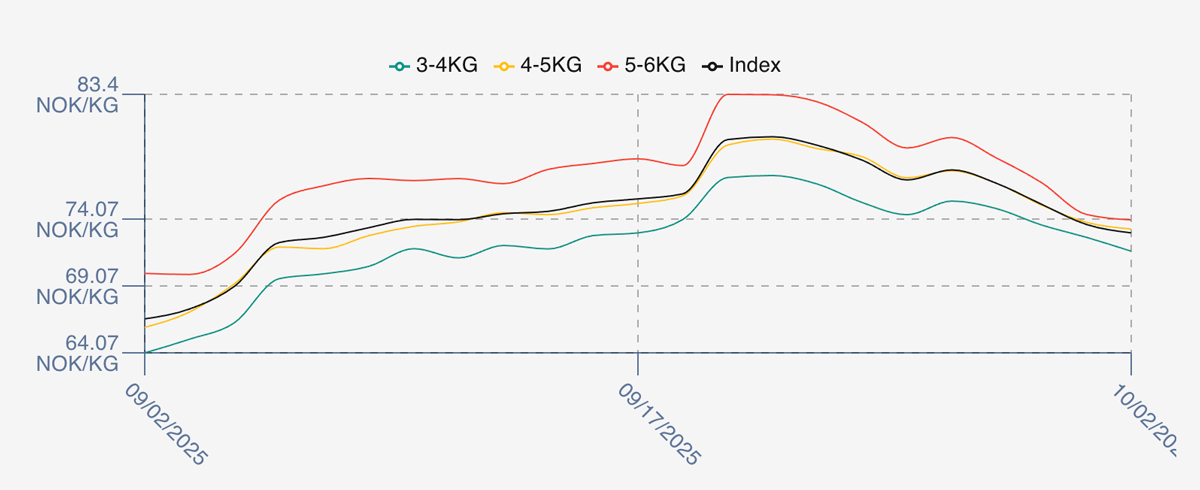

The LFEX Norwegian Exporters Index for Week 40 2025 ended the week DOWN -3.96 NOK / -5.14% to stand at 73.04 NOK (in EUR terms 6.26 / -0.33 / -4.98%) FCA Oslo Week ending Thursday vs previous Thursday.

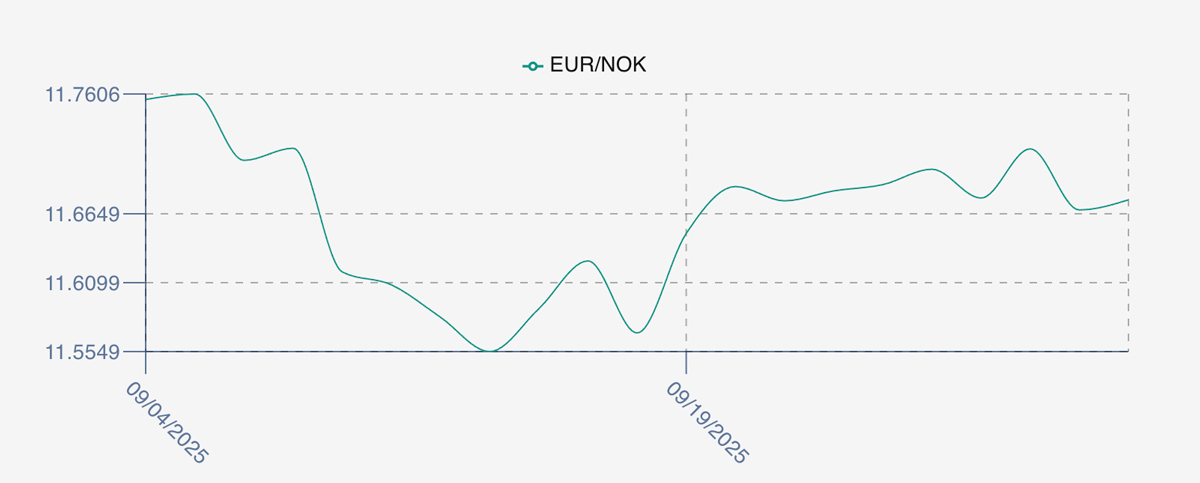

The NOK rate ended DOWN at 11.67 (-0.02 / -0.17%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future November was reported flat Thursday to Thursday at 6.45 EUR, (+0.00/ 0.00%) approximately 75.27 NOK.

The Last Week

A further reduction in prices. Friday saw a small increase in indicative offered prices (+0.75 NOK / 0.97%) over the prior week close, generally as exporters marked prices at the beginning of the week higher. However, the overall trend since the recent peak on 22nd September has been down. This continues in week 40 with prices softening gently across the week. Monday saw a 1 NOK prices, Tuesday around 1.5 NOK off to 75.18, Wednesday another 1.5 NOK with the offered index closing out at 73.04. Prices seem to have got away from themselves especially for this time of year and this was an expected reaction.

FX rate was benign this week – opening at 11.70 on the Friday, up from 11.69 as we entered the week, and traded fairly evenly ending back at 11.67 for the end of the week.

Spreads on the index have come in this week to around 2.75 NOK between 3-4 and 5-6. While everything has come down in unison the larger fish have dropped off most closing the spread.

Next Week

It is a difficult week to separate rumour and fact and find a consensus and people are struggling as a consequence. Current indications this week see the that indicative prices are pretty flat going into week 41 with the index showing around 73 NOK offered level. Rumours of a large producer having a lot of fish and generally weaker pricing hasn’t been reflected in the offered index despite talk of lower prices. The potential of storm disruption next week may also be providing some underlying pricing support. We’ll see how the week progresses.

Spreads between 3/4s to 5/6s are sitting at around the 3 NOK level currently.

EUR NOK FX rate is flat this afternoon with rates around 11.67. This would give an indicative Euro index price around 6.27 on offered levels later Friday.

Volumes – Fresh Export

Volume figure for week 39 (2025) was 23,396 tons DOWN 5,842 as compared to 29,238 in 2024 some 20 % LOWER which would explain the price increases in week 39. Volumes for week 40 and week 41 (2024) were 26,543 and 25,180 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 41 2024 ended the week up +5.41NOK / +7.81% to stand at 74.72 NOK (in EUR terms 6.33 / + 0.42 / +7.07%) FCA Oslo. The NOK rate ended higher at 11.80. The Fish Pool future October was reported +0.30 NOK / +0.43% at 70.5 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 2nd October, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

You can communicate in a different language on the platform?

The chat service supports multilanguage / characters meaning as long as users have the necessary input keyboard, they can communicate in any language they chose – including helpful emojis. We will also have the ability to offer the platform in multiple languages.

FAQ’s

Q. How can I better draw attention to my orders entered on LFEX?

A. An old trading adage says “size opens your eyes”. Yes, a good price is nice at getting attention, but if you are willing and able to move a good volume of product it will capture attention and may help in getting the trade/s completedo.