The London Fish Exchange

Data / Market Insight / News

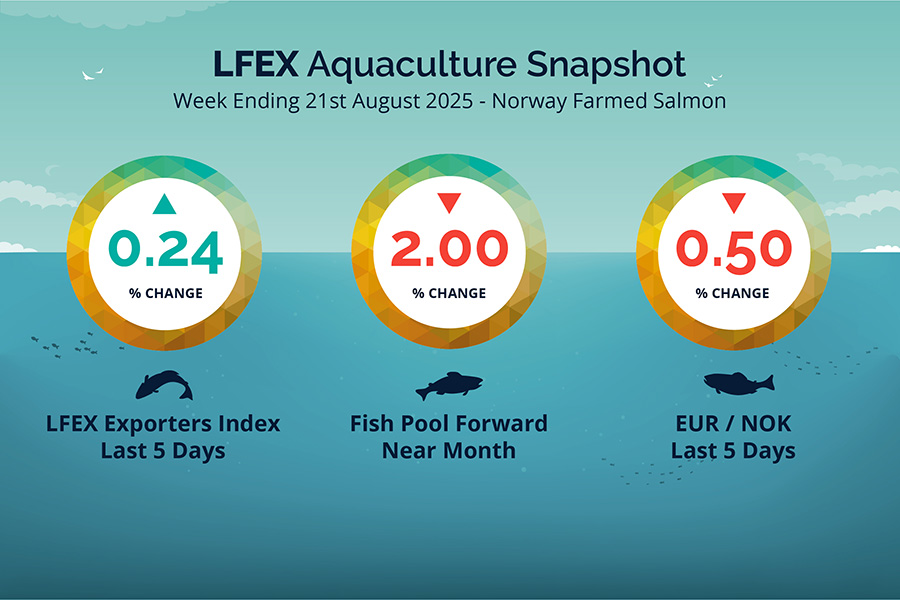

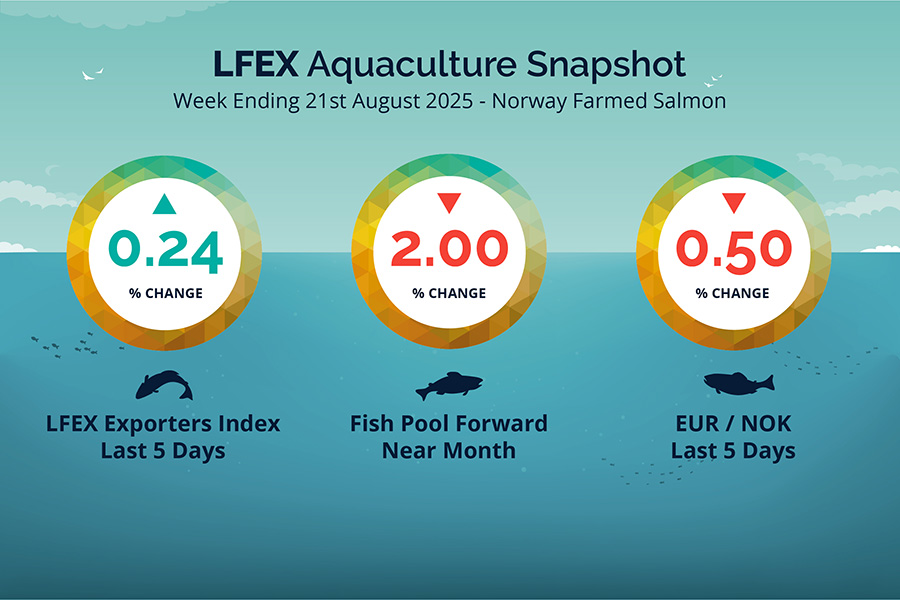

LFEX European Aquaculture Snapshot to 21st August, 2025

|

|

Published: 22nd August 2025 This Article was Written by: John Ersser |

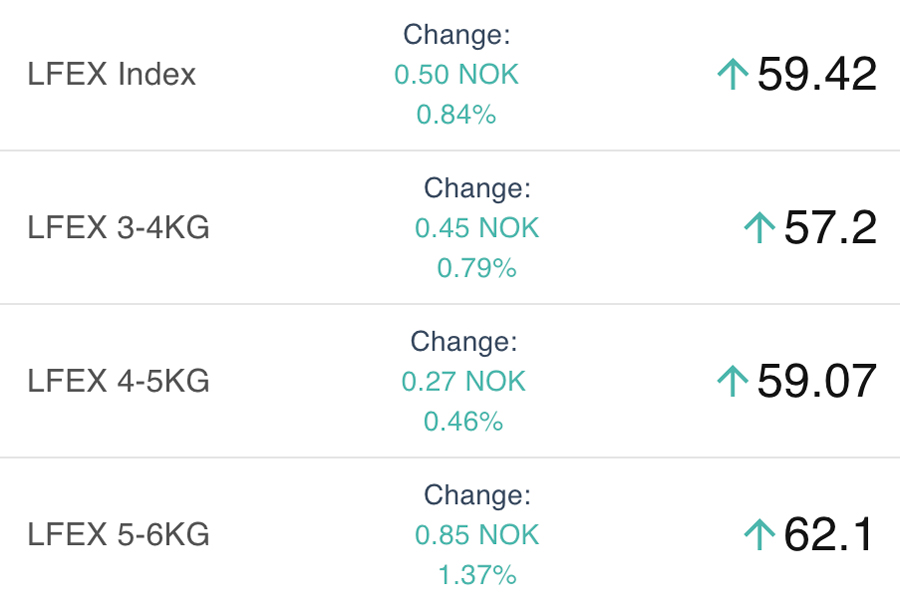

The LFEX Norwegian Exporters Index for Week 34 2025 ended the week UP +0.14 NOK / +0.24% to stand at 59.42 NOK (in EUR terms 5.01 / +0.04 / +0.74%) FCA Oslo Week ending Thursday vs previous Thursday.

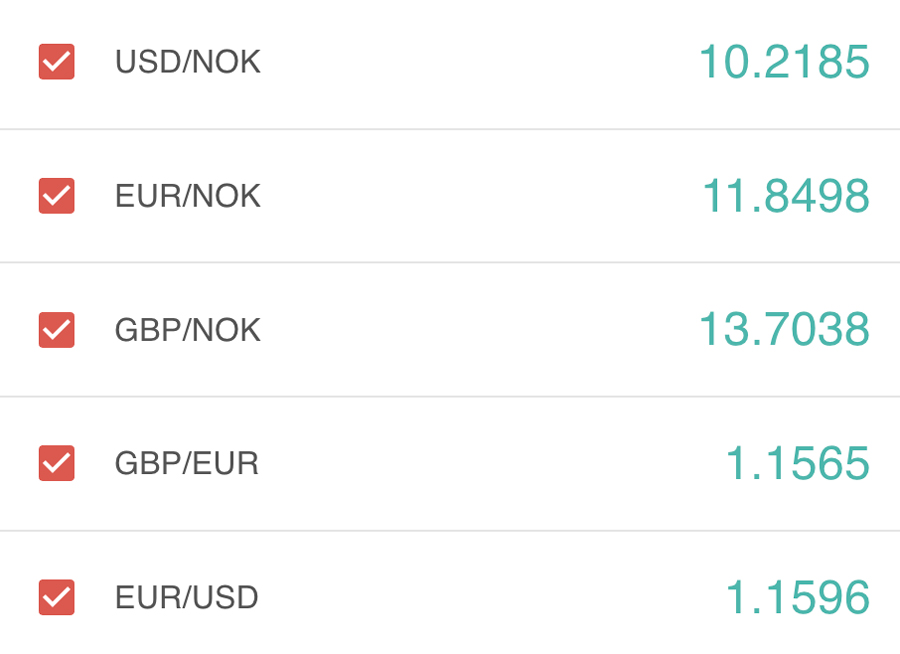

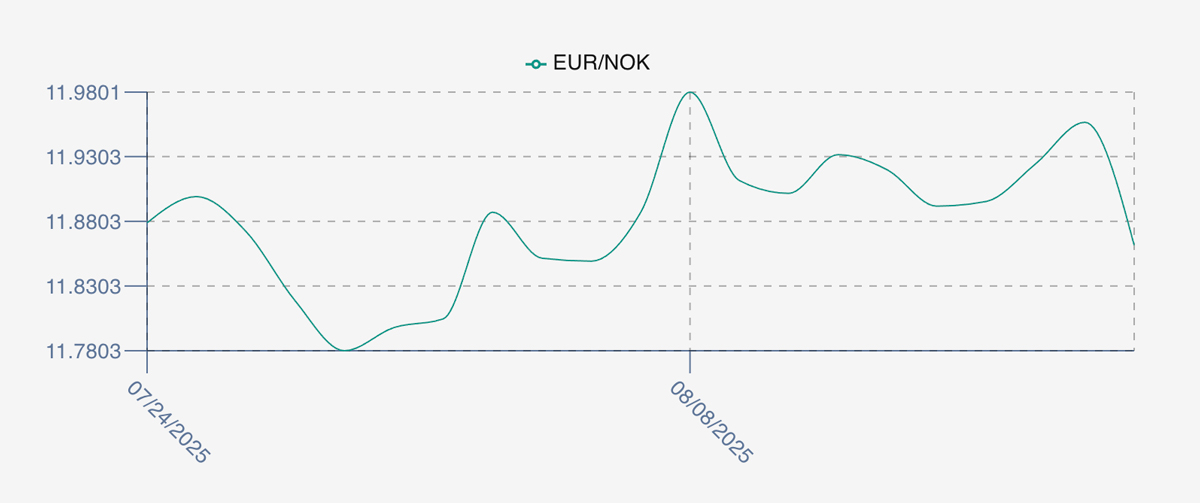

The NOK rate ended DOWN at 11.86 (-0.06 / -0.50%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future September was reported DOWN Thursday to Thursday at 4.90 EUR, (-0.10 / -2.00%) approximately 58.11 NOK with October showing 5.20.

The Last Week

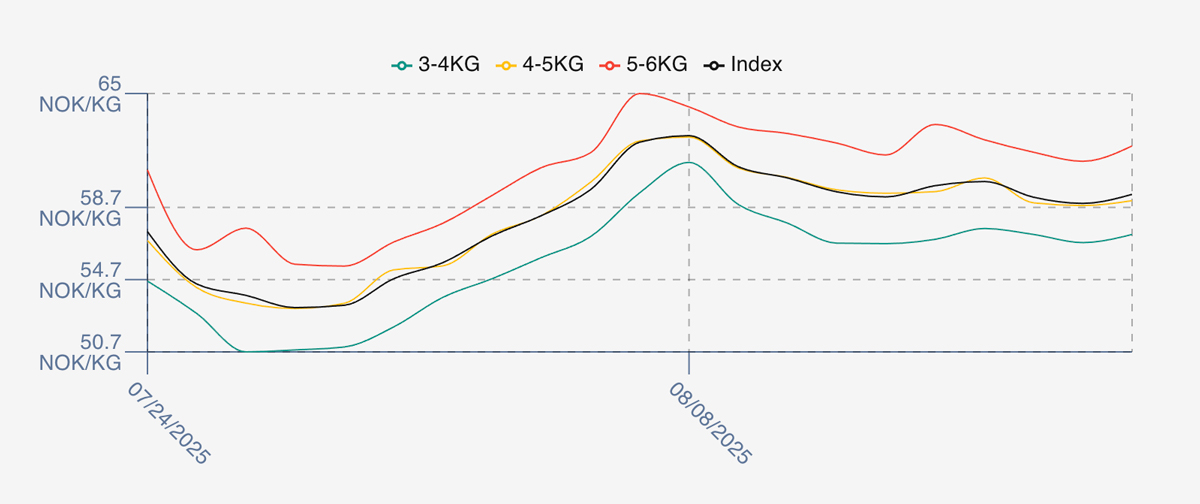

A pretty flat week as pricing remained calm with large volumes. The week opened edging up marginally from the prior Thursday (a more usual pattern) +0.62 NOK or 1%, and continued around this level at 60.13 on Monday, the high for the week. Tuesday gave the NOK back, bottomed Wednesday at 58.92 before closing up half a NOK. All benign movements as pricing traced sideways for the week.

FX rate opened at 11.89 on the Friday a fall as we entered the week, followed by jump to 11.95 Wednesday peak and a sharp drop off Thursday at 11.86.

Spreads on the index have averaged 5 NOK over the week 5-6s slightly higher.

Next Week

Indications this week see the index up small from where we left off last week with the week opening indicative offered around the 60 – 60.50 NOK level Oslo FCA. Pricing is varied with bigger producers pushing prices especially for bigger sizes. Volumes continue to be large as compared to last year. Asian premium for larger fish.

Spreads between 3/4s to 5/6s have increased to sit around 7 NOK with larger 5/6s increasing.

EUR NOK FX rate has fallen off this afternoon with rates around 11.81. This would give an indicative Euro index price around 5.12 on offered levels later Friday.

Volumes – Fresh Export

Volume figure for week 33 (2025) was 27,320 tons up 5,953 as compared to 21,367 in 2024 some 28% higher. Volumes for week 34 and week 35 (2024) were 24,242 and 25,506 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 35 2024 ended the week down -1.16 NOK / -1.61% to stand at 71.00 NOK (in EUR terms 6.10 / – 0.04 / -0.59%) FCA Oslo. The NOK rate ended lower at 11.63. The Fish Pool future August was reported flat at 72.00 NOK with September showing 71.50 down 1.00 NOK.

David Nye’s technical analysis report will be published on Tuesday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 21st August, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

After you have executed transactions on the platform you can access documentation from this order?

By executing on the platform, you have a confirmed transaction between you and your counterparty – a fully electronically documented record of your transaction with all associated details contained in this. These details are immediately available in real-time to both parties and can be accessed whenever required. All history is maintained within the system. Further, a full suite of documentation can then be attached to these records whether it is invoices, specifications, logistics etc making all relevant trade documentation available to both parties the instant they are uploaded / updated.

FAQ’s

Q. I am concerned about beginning the transition from manual to electronic transacting. Is it acceptable to do both?

A. The short answer is of course yes. In fact, we recommend that this is how people start. By dipping your toes you learn about the system, what you see and what to expect. You can then build confidence and proactively use the system to get the maximum benefit from it. You can download the orders from the system if you need to into a CSV file, or input data into your existing system in the same way you do a manual trade. For more advanced users we can connect via the LFEX API.