The London Fish Exchange

Data / Market Insight / News

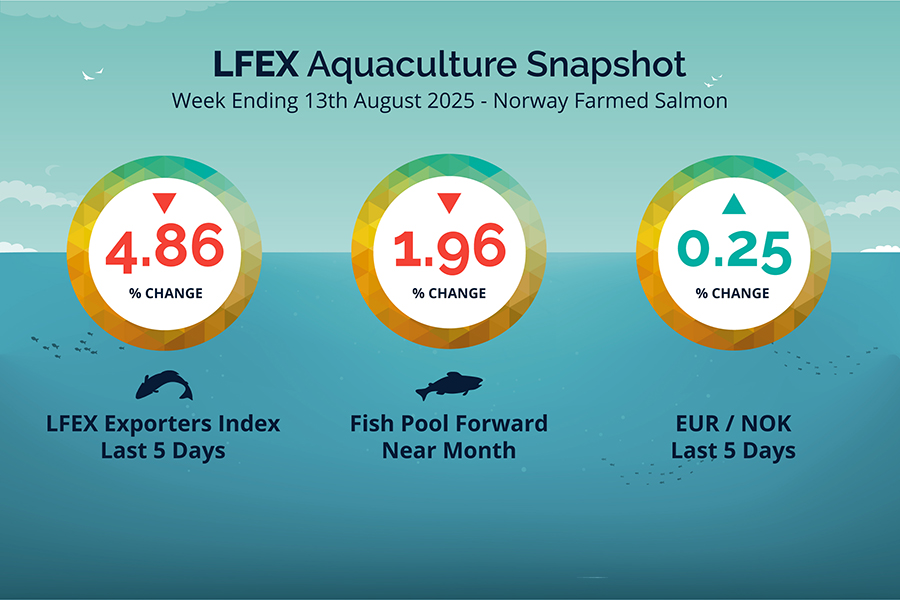

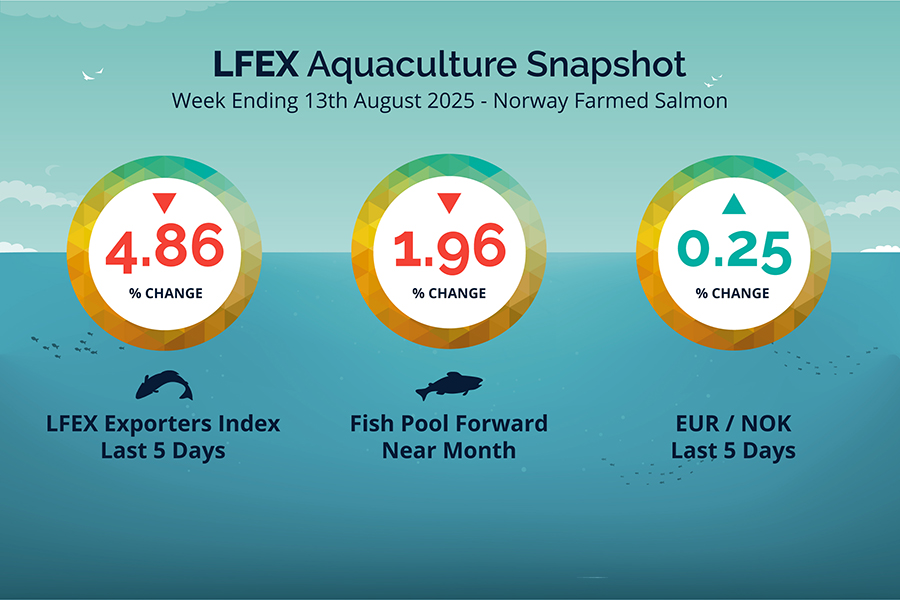

LFEX European Aquaculture Snapshot to 13th August, 2025

|

|

Published: 15th August 2025 This Article was Written by: John Ersser |

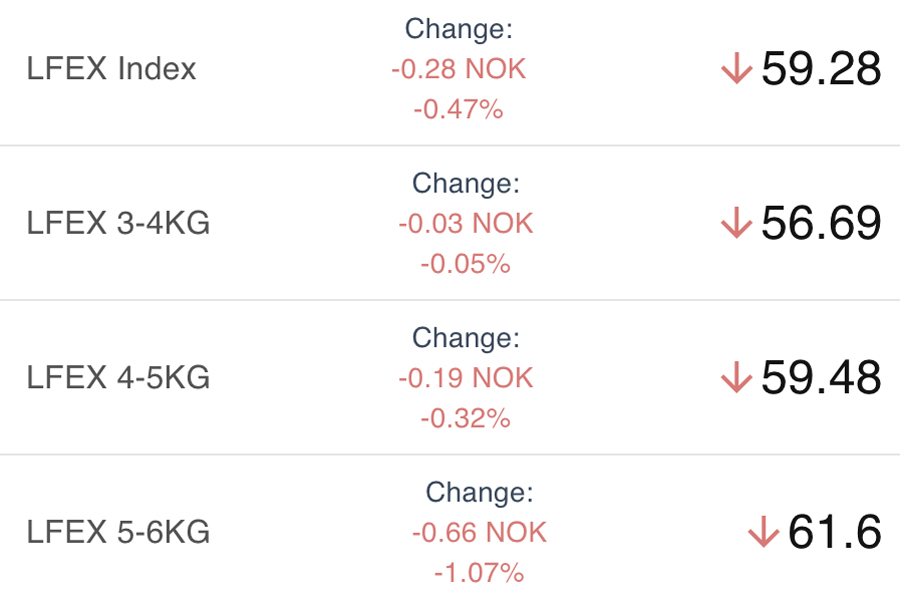

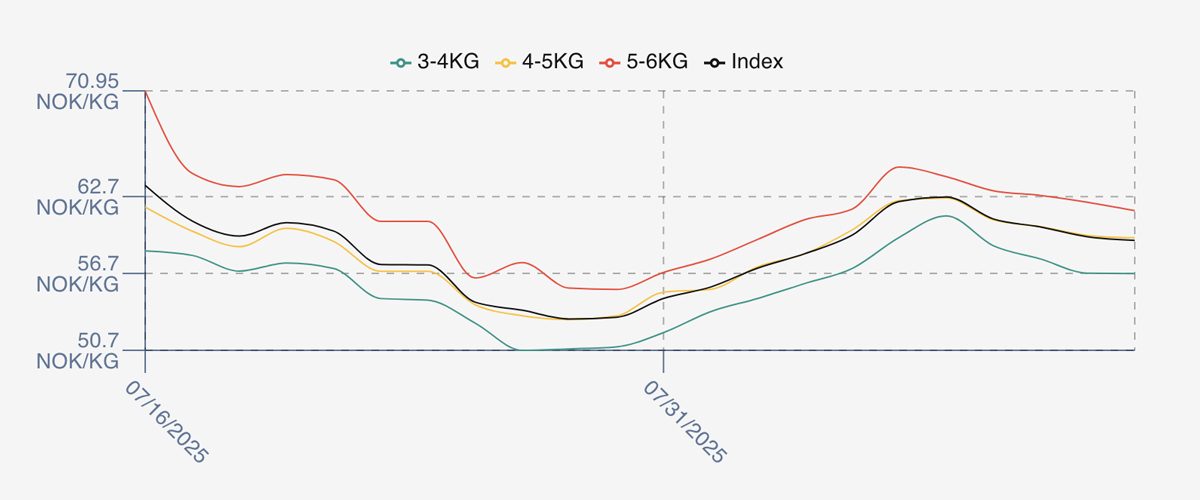

The LFEX Norwegian Exporters Index for Week 33 2025 ended the week DOWN -3.03 NOK / -4.86% to stand at 59.28 NOK (in EUR terms 4.97 / -0.27 / -5.10%) FCA Oslo Week ending Thursday vs previous Thursday.

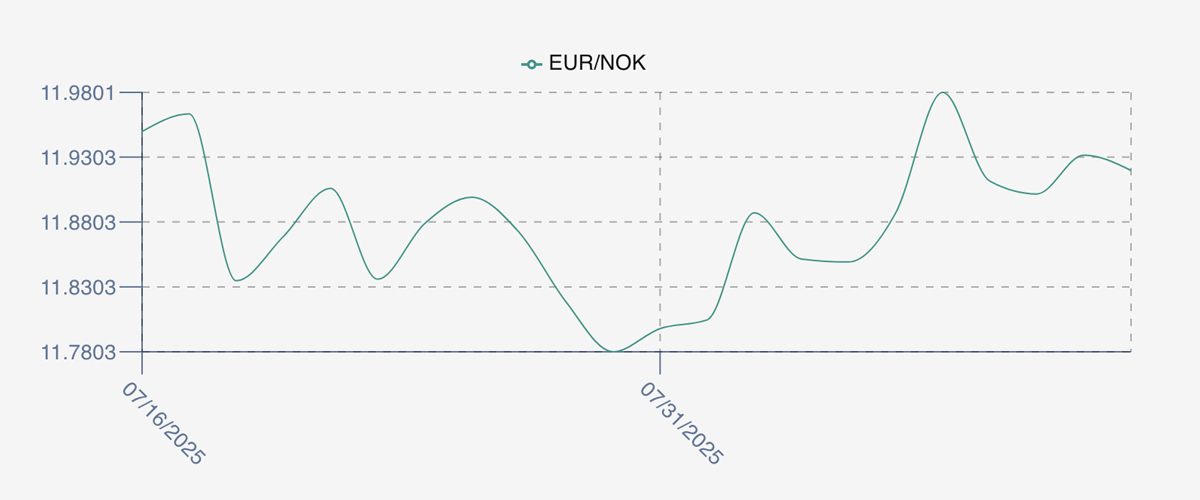

The NOK rate ended UP at 11.92 (+0.03 / +0.76%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future September was reported DOWN Thursday to Thursday at 5.00 EUR, (-0.10 / -1.96%) approximately 59.60 NOK.

The Last Week

A trending week. After the prior week’s pull up in prices, traders were uncertain of where the next move would be. Early indications on Friday had the index at 62.67 and a continuation of the upward movement from the prior week, although momentum had already been lost. And so it was, with Monday slipping back a couple of NOKs to 60.95. This led to a gentle tail-off of pricing of the index around 0.75 NOK per day Tuesday and Wednesday. The index closed out sub-60 NOK at 59.28, and an overall fall intraweek fall of 3.39 NOK / -5.5%, a reasonably large overall movement but not the volatility seen recently.

FX rate opened at 11.98 on the Friday, the peak of the week, a correction Monday and over all saw a small reduction to 11.92 closing levels.

Spreads on the index have averaged 5 NOK over the week evenly spread (3-6s).

Next Week

Indications this week see the index flat or tiny increase from where we left off last week with the week opening indicative offered around the 59.9 NOK level Oslo FCA. Pricing seems to have stability despite the large volumes going through.

Spreads between 3/4s to 5/6s compressed to sit around 6 NOK with 5/6s increasing.

EUR NOK FX rate is flat this afternoon with rates around 11.91. This would give an indicative Euro index price around 5.02 on offered levels later Friday.

Volumes – Fresh Export

Volume figure for week 32 (2025) was 25,796 tons up 5,127 as compared to 20,669 in 2024. Volumes for week 33 and week 34 (2024) were 21,367 and 24,242 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 34 2024 ended the week down -0.35 NOK / 0.48% to stand at 72.16 NOK (in EUR terms 6.14 / – 0.02 / -0.40%) FCA Oslo. The NOK rate at 11.75 to the Euro. The Fish Pool future August was reported down – 1.75, -2.37% at 72.00 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 13th August, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

If you have a certain amount of inventory and want to sell at a target price you can manage this on the system.

If you know how much you want to move, at what price and which potential customers you want to sell it to – you can configure this in seconds on the system. You can then manage this in real-time, chip away at the orders but always in control of where you are at. You can use the chat facility to engage with and encourage customers around your offer.

FAQ’s

Q. In my job I need information quickly – can the system help me?

A. The LFEX platform has been designed to allow you to manage your business in real-time from a single application. It means not only is key information available at your fingertips to allow you to make the trading decisions you need to make, it allows you to act on those decisions effectively and efficiently. As a tool it matches systems found in financial markets where time and money are critical. You want technology on your side to help make trading as efficient as possible.