The London Fish Exchange

Data / Market Insight / News

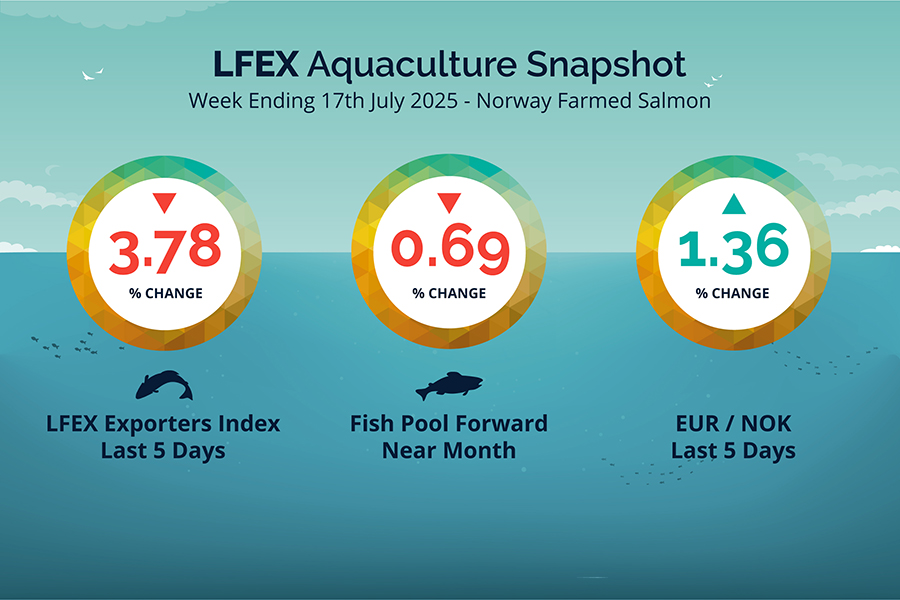

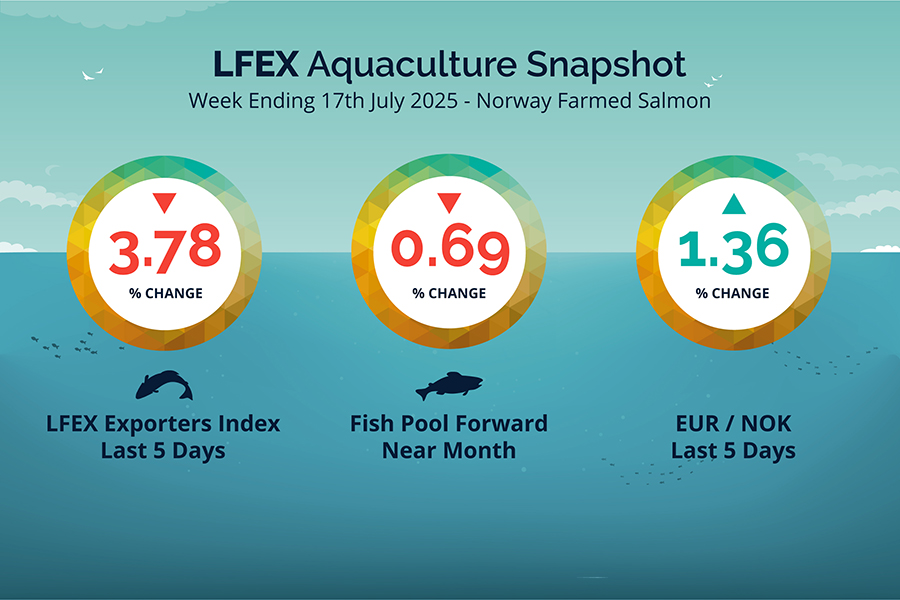

LFEX European Aquaculture Snapshot to 17th July, 2025

|

|

Published: 18th July 2025 This Article was Written by: John Ersser |

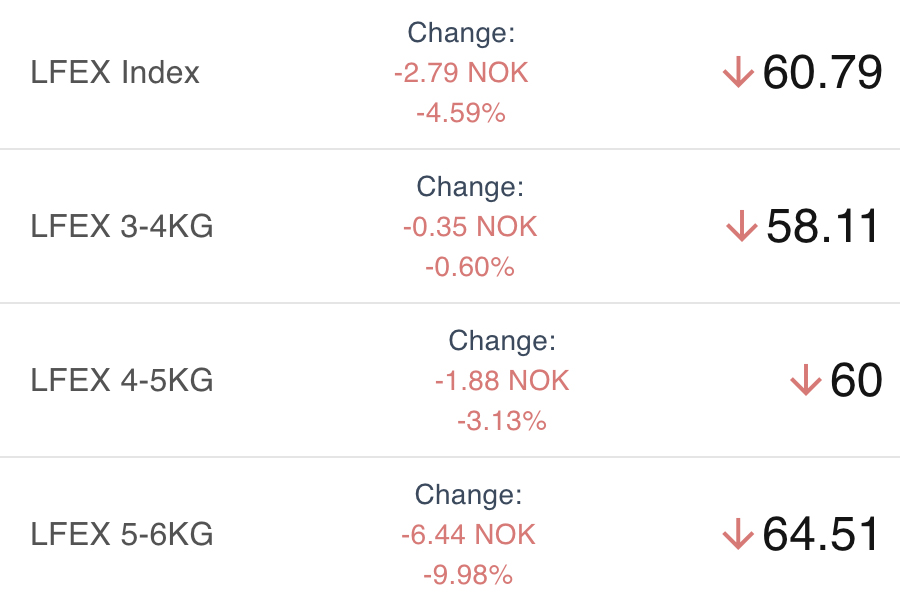

The LFEX Norwegian Exporters Index for Week 29 2025 ended the week DOWN -2.39 NOK / -3.78% to stand at 60.79 NOK (in EUR terms 5.07 / -0.27 / -5.07%) FCA Oslo Week ending Thursday vs previous Thursday.

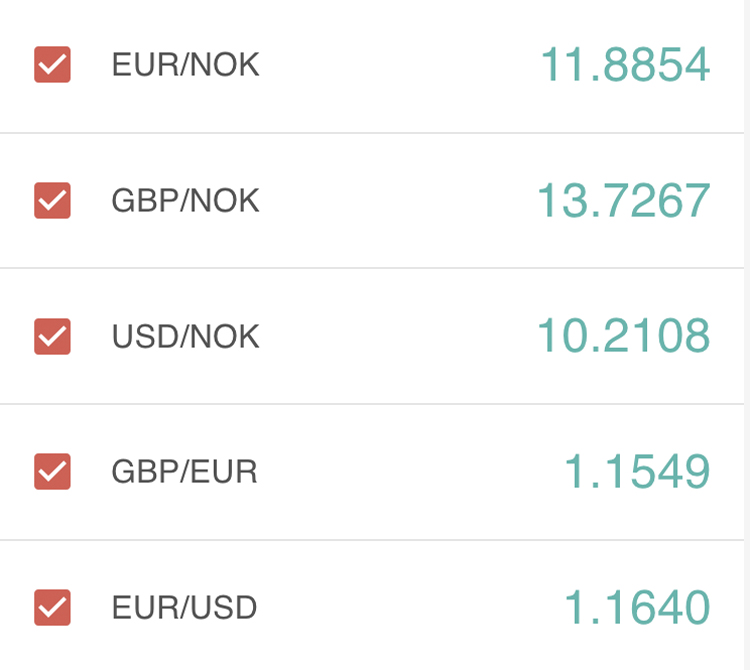

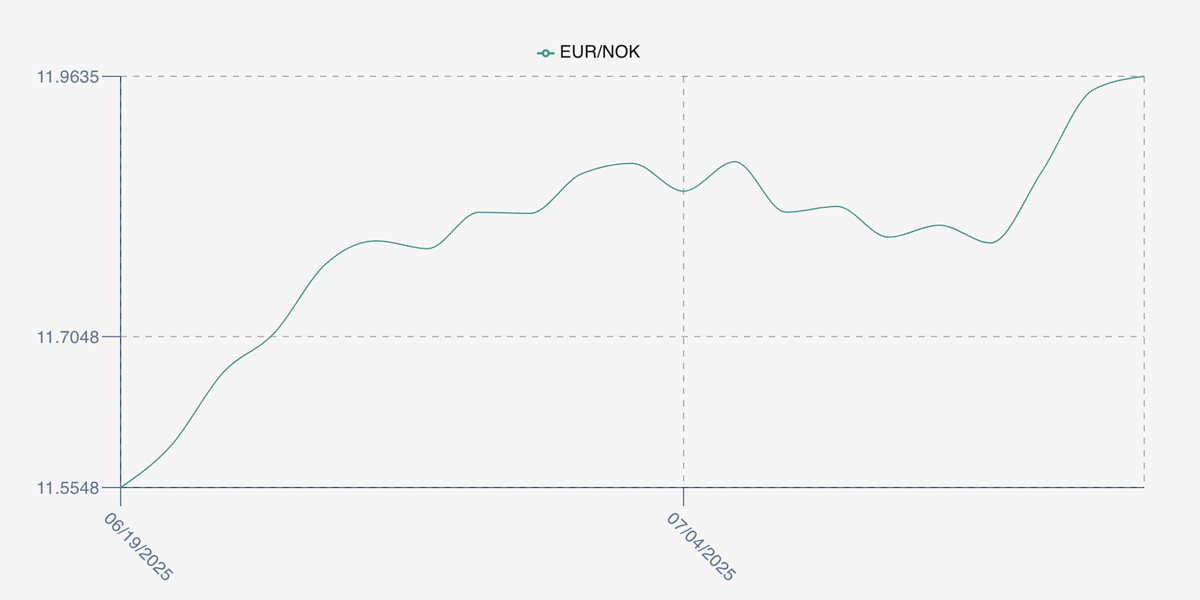

The NOK rate ended UP at 11.96 (+0.16 / +1.36%) to the Euro over the period Thursday to Thursday. The Fish Pool Euronext future August was reported DOWN Thursday to Thursday at 5.79 EUR, -0.04 / -0.69%) approximately 69.25 NOK.

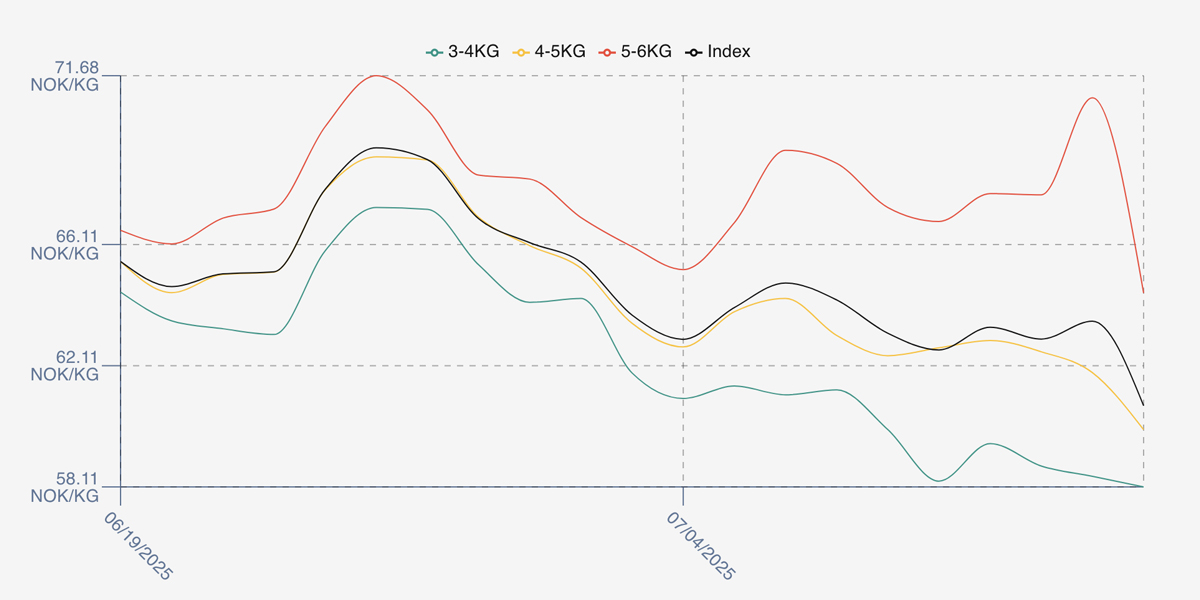

The Last Week

Friday sentiment was mixed as we saw a big disconnect between smaller and larger sizes. The index opened 0.5 NOK off the Thursday close as all sizes shuffled a little lower. Monday saw a small pick-up across the board as maybe pricing was not as weak as thought, and the index found a level around 63 for the week. This didn’t tell the whole story as 3-4s continued to slide, 4-5s held and 5-6s improved, gaining a life of their own on Wednesday up sharply offered at over 70 while the smaller fish were at 58 offered. Thursday saw a reckoning as 5-6s tanked 6/7 NOK, 4-5s fell and 3-4s continued lower to close the week at 60.79. Lots of pricing volatility.

FX rate opened at 11.80 and saw one way traffic to peak at 11.96, good news for Euro buyers.

Spreads have compressed after this week’s volatility, extending around 6.5 NOK.

Next Week

Indications this week see the index opening around the 60 – 60.5 NOK level which is down around 0.5 of a NOK from the low Thursday closing levels. European demand is softening because of holidays and the heat wave, and volumes remain robust.

Spreads between 3/4s to 5/6s around 6.5 NOK.

EUR NOK FX rate is down from yesterday at 11.83 this afternoon. This would give an indicative Euro index price around 5.07 on offered levels later Friday.

Volumes – Fresh Export

Volume figure for week 28 (2025) was 24,500 tons up 6,079 as compared to 18,421 in 2024. Volumes for week 29 and week 30 (2024) were 18,177 and 21,986 respectively for comparison.

Historical Price Guidance for Next Week

The LFEX Norwegian Exporters Index for Week 30 2024 ended the week down -1.97%, -1.59 NOK to stand at 79.25 NOK (in EUR terms 6.56 / – 0.31 / -4.48%) FCA Oslo. The NOK rate was 12.08 to the Euro. The Fish Pool future July was reported down – 0.45, -0.58% at 76.70 NOK.

David Nye’s technical analysis report will be published on Monday.

Market Data (Click Each to Expand)

| LFEX Prices | FX Rates | LFEX Indicative Exporter Prices (4 Week) | EUR / NOK FX Rate (4 Week) |

|

Prices Ending 17th July, 2025 For Friday's Price For Next Week, Offers & Trading Please Register |

Did You Know?

The LFEX system provides secure and private electronic chat services between you and your counterparties and provides a record of truth of your discussions and negotiations that can be accessed later.

It is also used internally within businesses to communicate. In the US regulated financial firms have been fined over USD$1 billion for the use of non-approved / unsecure public communications facilities, illustrating the concerns around third party messaging apps.

FAQ’s

Q. I would like to be part of the price conversation, can I do this as a buyer?

A. The service is unique in its capabilities of allowing both sides of a trade / market to be driven and managed. What this means is buyers are not just prices takers but can make specific requests based on their own requirements, they can also include prices that they are prepared to buy at. Sellers can accept this price and trade with you, or counter with their own price(s). Buyers can amend their prices at any time or withdraw them at any time. They are in complete control of the prices they want to show and to whom and when they want to show them.

This is a great way of building an understanding of a market where there are both sellers prices and buyers prices visible.